Top 10 solar PV inverter vendors account for 86% of

The top 10 global solar photovoltaic (PV) inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year

Get a quote

Who are the world''s top 10 solar inverter makers and

The world''s top 10 solar PV inverter manufacturers accounted for 86% of the total market share in 2022, according to new figures from energy

Get a quote

10 Top Solar Inverter Manufacturers In The World

A high-quality inverter improves efficiency and supports energy storage and grid connection, making solar power more viable and reliable. In this guide, we will

Get a quote

Global Photovoltaic Inverter Market Research Report 2024

It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term. Chapter 2: Detailed analysis of Photovoltaic Inverter

Get a quote

Top 15 Solar Inverter Manufacturers In the World

We have compiled a list of 15 global solar inverter manufacturers in 2023. These companies offer highly competitive products, providing a range of options to choose from.

Get a quote

Solar Inverter Market Size, Share & Trends Report,

The global solar inverter market size was exhibited at USD 10.34 billion in 2023 and is projected to hit around USD 22.95 billion by 2033, growing at a CAGR

Get a quote

Solar PV Inverter Market Share | Size & Analysis

The solar PV inverter market reached USD 8.45 Billion in 2024 & expected to grow at 5.00% CAGR between 2025 and 2034, to reach USD 13.76 Billion by 2034.

Get a quote

Who are the world''s top 10 solar inverter makers and where are

The world''s top 10 solar PV inverter manufacturers accounted for 86% of the total market share in 2022, according to new figures from energy analysts Wood Mackenzie, as

Get a quote

Top 10 Solar Inverter Manufacturers in the World 2025

In-depth analysis of the market performance, technological breakthroughs and future trends of the world''s top 10 inverter manufacturers

Get a quote

Global Photovoltaic Pv Inverter Market Companies

This market report lists the top Global Photovoltaic (PV) Inverter companies based on the 2023 & 2024 market share reports. DBMR Analyst after extensive analysis have determined these

Get a quote

2025 Top 20 Global Solar Inverter Brands Revealed by PVBL

4 days ago· Finally, the top 10 PV brand rankings lists for various categories are finalised for announcement at the annual Century Photovoltaic Conference, organised by Century New

Get a quote

What is a Solar Inverter? Top 10 Solar Inverter Manufacturers

A solar inverter (solar PV inverter) is a dependable and safe power source converter. Learn more about the top 10 solar PV inverter manufacturers.

Get a quote

Top five solar inverter vendors accounted for 71% of

The top 10 global solar inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year since 2021, according

Get a quote

Australia''s top 10 solar panel and inverter

A list of Australia''s top solar panel and inverter manufacturers has been published by solar energy analyst Sunwiz, as well as details of buying

Get a quote

PV Inverter Market Size, Share & Forecast Report, 2025-2034

Companies are launching modern PV inverters, especially smart or grid-tied inverters, that offer advanced functionalities such as voltage regulation, frequency support, and remote

Get a quote

10 Best Brands and Models of Solar Panel Inverters in

Beyond these select choices, there are at least seven other candidates to make up the list of best brand of solar inverter on the market in

Get a quote

Solar PV Inverters Market Size, Trends, Growth | 2034 Report

Solar PV Inverters Market Size, Share, Growth, and Industry Analysis, By Type (Central Inverters, String Inverters, Micro Inverters), By Application (Residential, Commercial,

Get a quote

Top 10 solar PV inverter vendors account for 86% of global market share

The top 10 global solar photovoltaic (PV) inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year since 2021, according to latest

Get a quote

Global ranking of photovoltaic inverters

The top 10 global solar photovoltaic (PV) inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year since 2021, according to latest analysis by Wood

Get a quote

Huawei, Sungrow and SMA dominate global inverter market

The global solar inverter market grew 18% in 2019, according to new data from U.S.-owned analyst Wood Mackenzie. The WoodMac analysts said two trends were critical:

Get a quote

PV Inverter Market Size, Share & Forecast Report,

Companies are launching modern PV inverters, especially smart or grid-tied inverters, that offer advanced functionalities such as voltage regulation,

Get a quote

Top 10 Solar Inverter Manufacturers in 2025: Global Brands

Discover the top 10 solar inverter manufacturers in 2025, offering an in-depth review of each global brand. We also examine the global supply chain centers, major

Get a quote

Top 10 solar inverter manufacturers in 2025 in the world

Top 10 solar inverter manufacturers in 2025 in the world Chinese photovoltaic companies continue to lead the world, occupying the majority of

Get a quote

2023 World''s Top 20 Global Photovoltaic Inverter

PVTIME – Cohesion of PV brands promotes strong development of technology and services for solar energy and energy storage industry. On

Get a quote

Top 10 Solar PV Inverter Manufacturers 2024 in the

The solar industry is booming in 2024, and solar PV inverter manufacturers are key players in this growth. From residential setups to large

Get a quote

Top 10 Solar Inverter Manufacturers in 2025: Global

Discover the top 10 solar inverter manufacturers in 2025, offering an in-depth review of each global brand. We also examine the global supply

Get a quote

Top 10 Solar Inverter Manufacturers Dominating the

Discover the top solar inverter manufacturers dominating the market in 2024, with insights on innovations, global reach, and cost trends

Get a quote

6 FAQs about [PV inverter market share by brand]

What is the global PV inverter market size?

According to Wood Mackenzie forecast, the U.S. PV inverter market size will exceed $16 billion in 2025, accounting for more than 30% of the global market. In this article, we will deeply analyze the market performance and advantageous products of the world's top ten inverter manufacturers. Global Top 10 Inverter Manufacturers Overview

Who are the top 10 solar inverter manufacturers in 2025?

Top 10 Solar Inverter Manufacturers in 2025 1. Huawei 2. Sungrow 3. SMA Solar Technology 4. SolarEdge Technologies 5. Fronius 6. Enphase Energy 7. Growatt 8. GoodWe 9. Sineng Electric 10. TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation) Part 4. Global Supply Chain Centers for Solar Inverters Part 6.

What is the global demand for PV inverters in 2022?

The global PV demand of 201 gigawatt alternating current (GWac) in 2022 contributed to 48% growth year-over-year for PV inverters. In terms of inverter shipments, strong growth in Europe, Asia Pacific, and the United States where government support bolstered to meet clean energy goals led to a total of 333 GWac of global shipments in 2022.

How is PV inverter market segmented?

Based on phase, the PV inverter market is segmented into single phase and three phase. The three phase segment held 86% market share in 2024, owing to swift industrial development favored by commercialization throughout the emerging countries, along with considerable operational flexibility across various applications.

Which PV inverter vendors shipments grew the most in 2022?

The top five vendors – Huawei, Sungrow, Ginlong Solis, Growatt, and GoodWe – shipped more than 200 GWac and accounted for 71% of total global PV inverter shipments in 2022, growing 8% from 2021. Huawei’s shipments saw a significant increase of 83% in 2022 compared to 2021, while Sungrow’s shipments expanded 56% in the same period.

What is the global market for central inverters?

The global market for central inverters is anticipated to be over USD 30.8 billion by 2034. These inverters have been categorized as stationary inverters primarily serving across a large-scale solar farm or a utility-aided solar deployment.

Guess what you want to know

-

Western European PV Energy Storage Inverter Market

Western European PV Energy Storage Inverter Market

-

Inverter manufacturers market share

Inverter manufacturers market share

-

Photovoltaic inverter market quota

Photovoltaic inverter market quota

-

Brand new 48 volt inverter price

Brand new 48 volt inverter price

-

PV inverter autonomous derating

PV inverter autonomous derating

-

Eritrea DC Solar PV Water Pump Inverter

Eritrea DC Solar PV Water Pump Inverter

-

Top 10 PV Inverter Brands in East Africa

Top 10 PV Inverter Brands in East Africa

-

Foreign communication base station inverter grid-connected brand

Foreign communication base station inverter grid-connected brand

-

Uganda three-phase inverter brand ranking

Uganda three-phase inverter brand ranking

-

Dominic brand photovoltaic inverter 50kw

Dominic brand photovoltaic inverter 50kw

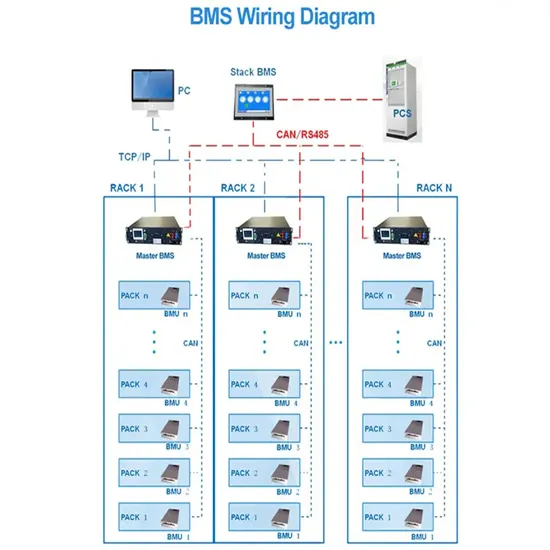

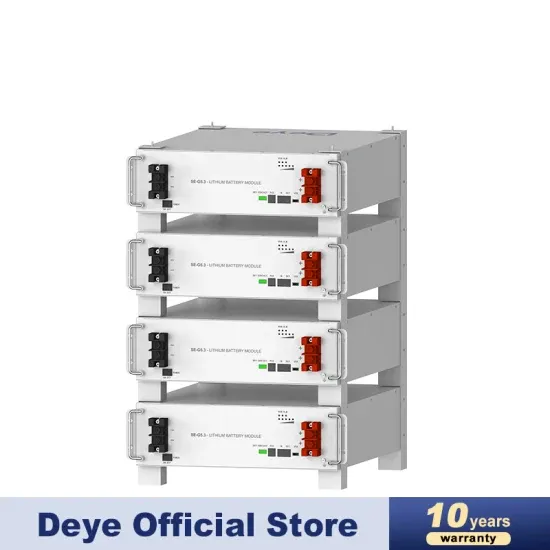

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

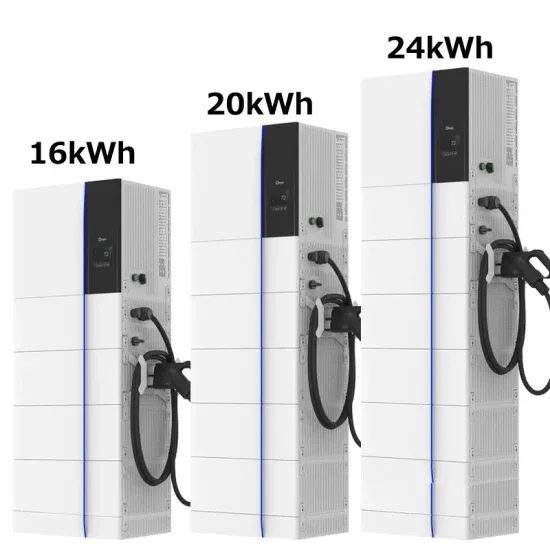

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.