Inverter Market Report 2025

What Is Covered Under Inverter Market? Inverters refer to a circuit that converts direct current (DC) current from sources such as batteries or fuel cells into

Get a quote

Leading Solar Inverter Suppliers in 2022: Sungrow,

Central Inverters FIMER India (ABB), Sineng Electric, Sungrow, and TMEIC were the top solar central inverter suppliers for 2022. FIMER India

Get a quote

Central PV Inverter Market Size, Growth Opportunity

The central PV inverter market size exceeded USD 11 billion in 2023 and is likely to register 10.2% CAGR from 2024 to 2032, driven by the rising innovations in

Get a quote

Inverter Market Report 2025

The inverter market research report is one of a series of new reports from The Business Research Company that provides inverter market statistics, including inverter industry global market size,

Get a quote

Solar Inverter Market Size, Share, Trends Report

The solar inverter market segmentation, based on fusion type, includes Central Inverter, Micro Inverter, and String Inverter. The Central Inverter segment held

Get a quote

Sungrow, TBEA, FIMER Dominate Solar Inverter Rankings in

Sungrow India, TBEA Energy India, FIMER India, Sineng Electric, and Ginlong (Solis) Technologies were the leading solar inverter suppliers in India in the first half (1H) of

Get a quote

Solar PV Inverter Market Size, Growth & Industry

Solar PV Inverter Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030) The Solar PV Inverter Market Report is Segmented

Get a quote

Who are the world''s top 10 solar inverter makers and where are

The world''s top 10 solar PV inverter manufacturers accounted for 86% of the total market share in 2022, according to new figures from energy analysts Wood Mackenzie, as

Get a quote

Inverter Market Size To Reach Around USD 98.21 Bn By 2034

In North America, the US and Canada are the major markets for inverters. By Product, the central inverter segment generated more than 49% of the revenue share in 2023.

Get a quote

India Power Inverter Market Size, Share & YoY

The India power inverter market to grow from USD 5.52 Billion in 2024 to USD 22.33 Billion by 2034 at 15.00% CAGR, driven by rising power backup demand.

Get a quote

Top 5 inverter companies dominate 85% of Q1 2024 bids

String inverters dominated the market, accounting for 80% of total bids, with large-capacity inverters with over 300kW making up 84% of this

Get a quote

Inverter Market Recent Size, Share and Industry Analysis to 2031

Huawei Technologies Co. Ltd. leads the global Inverter Market with a dominant 21.20% market share, driven by its robust portfolio of smart solar inverters and deep

Get a quote

Top 10 solar PV inverter vendors account for 86% of global market share

The top 10 global solar photovoltaic (PV) inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year since 2021, according to latest

Get a quote

Inverter Market Size To Reach Around USD 98.21 Bn

In North America, the US and Canada are the major markets for inverters. By Product, the central inverter segment generated more than 49%

Get a quote

Solar Inverter Market Size, Share & Trends Report, 2024-2033

The global solar inverter market size was exhibited at USD 10.34 billion in 2023 and is projected to hit around USD 22.95 billion by 2033, growing at a CAGR of 8.3% during the forecast period

Get a quote

Who are the world''s top 10 solar inverter makers and

The world''s top 10 solar PV inverter manufacturers accounted for 86% of the total market share in 2022, according to new figures from energy

Get a quote

Solar PV Inverter Market Size, Growth & Industry

By inverter type, central systems commanded 55% revenue share in 2024, while microinverters are projected to register the fastest 8.1% CAGR by

Get a quote

Inverter Market Report 2025

What Is Covered Under Inverter Market? Inverters refer to a circuit that converts direct current (DC) current from sources such as batteries or fuel cells into alternating current (AC) current

Get a quote

Inverter Market Recent Size, Share and Industry Analysis to 2031

Inverter manufacturers see an opportunity in growing demand from renewable energy, grid modernization, and energy storage, while focusing on industrial strategy.

Get a quote

Top 20 Solar Inverter Manufacturers: A Global Overview of the

In this era of green energy, solar inverters, as the "heart" of the solar power system, are silently transforming nature''s gifts and contributing to the future of the earth. An

Get a quote

Australia''s top 10 solar panel, inverter manufacturers

Likewise, the market share of other inverter brands stayed pretty much flat throughout 2022. In alphabetical order, Australia''s top 10 inverter

Get a quote

Top 10 solar PV inverter vendors account for 86% of

The top 10 global solar photovoltaic (PV) inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year

Get a quote

Top 8 Solar Inverter Manufacturers in Europe: 2025

China has established itself as the world''s leading producer of solar inverters, commanding a significant share of the global market. In 2023, the global

Get a quote

Which are the Top Manufacturing Companies of Inverter Market?

Huawei Technologies Co. Ltd. leads the global Inverter Market with a dominant 21.20% market share, driven by its robust portfolio of smart solar inverters and deep

Get a quote

Inverter Market Size, Growth, Trends, Share

Based on the types of distribution channels, the global inverter market is segmented into direct sales and indirect sales. According to our

Get a quote

Top 10 solar inverter makers account for 82% global market share

Huawei''s market share stayed at a stable 23% in 2021 while Sungrow ranked a close second at about 21% growing from approximately 19% in 2020. Second runner-up Growatt

Get a quote

North America Solar PV Inverters Market to 2030

North America Solar PV Inverters Market was valued at US$ 1,357.63 million in 2023 and is projected to reach US$ 3,094.06 million by 2030 with a CAGR of

Get a quote

Inverter Market Size, Growth, Trends, Share & Insights Report, 2035

Based on the types of distribution channels, the global inverter market is segmented into direct sales and indirect sales. According to our analysis, the direct sales channel leads

Get a quote

Top 10 Solar Inverter Manufacturers In The World –

In 2022, the company''s global market share of photovoltaic inverters is 23%, ranking second in the world. The market share of energy

Get a quote

Solar PV Inverter Market Size, Growth & Industry Analysis | 2030

By inverter type, central systems commanded 55% revenue share in 2024, while microinverters are projected to register the fastest 8.1% CAGR by 2030. By application, utility

Get a quote

Solar Inverter Market Size, Share, Trends Report 2030

The solar inverter market segmentation, based on fusion type, includes Central Inverter, Micro Inverter, and String Inverter. The Central Inverter segment held the majority share in 2021

Get a quote

6 FAQs about [Inverter manufacturers market share]

What is a solar inverter market?

The solar inverter segment is the largest market in the inverter business, owing to the increasing usage of solar energy all over the world. Through 2023, the US has installed more than 200 GW of solar capacity to power more than 36 million homes, according to the Solar Energy Industries Association.

Which companies are in the solar inverter market?

Prominent companies in this market include Huawei Technologies Co., Ltd. (China), SUNGROW (China), SMA Solar Technology AG (Germany), Power Electronics S.L. (Spain), and Fimer Group (Italy). The solar inverter segment is the largest market in the inverter business, owing to the increasing usage of solar energy all over the world.

Why is the global inverter market growing?

The main drivers to the growth of the global Inverter market are an increasing number of installs of solar power systems and growing demand for energy-efficient solutions in industrial automation. Find out what an inverter is doing to convert DC power into AC and promote energy efficiency.

What is the global inverter market segment?

The global inverter market is segmented into various types of products, such as central inverters, hybrid inverters, microinverters, and string inverters. According to our analysis, central inverter segment will augment the segment's growth with the largest market share during this forecast period.

What is the global inverter market size in 2023?

The current market size of the global Inverter market is USD 18.9 billion in 2023. What are the major drivers for the Inverter market? The global Inverter market is driven by increasing investments in the renewable energy sector. Which is the fastest-growing region during the forecasted period in the Inverter market?

What is the global inverter market report?

The market report presents an in-depth analysis of the various service providers that are involved in offering inverter market, across different segments, as defined in the table below: The global inverter market is segmented into various types of products, such as central inverters, hybrid inverters, microinverters, and string inverters.

Guess what you want to know

-

PV inverter market share by brand

PV inverter market share by brand

-

Huawei communication base station inverter grid-connected market share

Huawei communication base station inverter grid-connected market share

-

Three-phase grid-connected inverter application market

Three-phase grid-connected inverter application market

-

Inverter manufacturers exported to Venezuela

Inverter manufacturers exported to Venezuela

-

Nigeria photovoltaic and wind power inverter manufacturers

Nigeria photovoltaic and wind power inverter manufacturers

-

All-vanadium redox flow battery market share

All-vanadium redox flow battery market share

-

Ecuadorian stock inverter manufacturers supply

Ecuadorian stock inverter manufacturers supply

-

Supply of single-machine inverter manufacturers

Supply of single-machine inverter manufacturers

-

EU sine wave inverter manufacturers

EU sine wave inverter manufacturers

-

Photovoltaic inverter manufacturers and their capacity

Photovoltaic inverter manufacturers and their capacity

Industrial & Commercial Energy Storage Market Growth

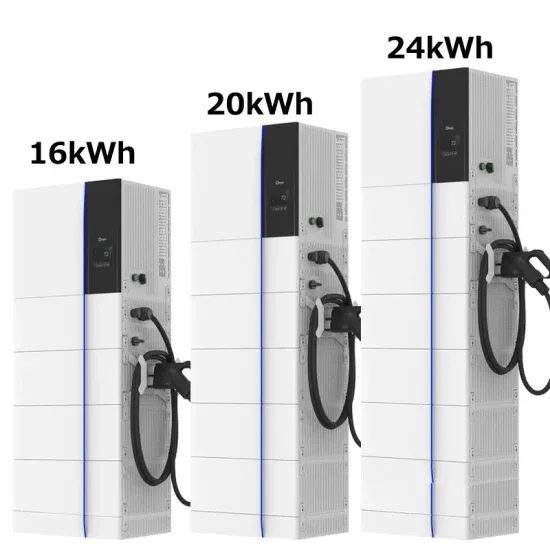

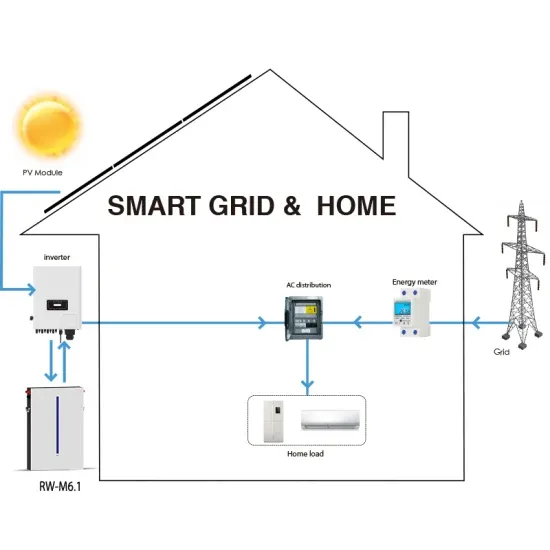

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.