Market share of top 3 suppliers of base stations to undergo slight

Not only does this number point to the impressive magnitude of the Chinese telecom market, but it has also been the key to Huawei''s leadership in the base station market

Get a quote

Base Station market Analysis

Market Overview The base station market is witnessing significant growth and advancements in recent years. A base station, also known as a cell site or cell

Get a quote

Huawei leads network base station market for 2022

The report mentions that Huawei will lead the global base station market with 29 percent of the overall market share in 2022. which is a 1 percent dip from last year. Ericson

Get a quote

Huawei and CommScope are leaders in cellular base station antenna

Despite a challenging year for the passive base station antenna market in 2020, Huawei retained its title as leader and increased its market share to 35.1%.

Get a quote

Huawei is the top mobile base station equipment

Today, TrendForce released the global market share analysis report of suppliers of base station equipment in which the top three companies

Get a quote

Huawei is the top mobile base station equipment

Today, TrendForce released the global market share analysis report of suppliers of base station equipment in which the top three companies are Huawei, Ericsson, and Nokia.

Get a quote

Huawei Photovoltaic Inverters in 2025: Leading the Global Solar

Does Huawei Still Dominate Solar Inverter Production? The 2025 Reality Check Short answer: Absolutely. Huawei remains a top-tier producer of photovoltaic inverters,

Get a quote

5g Base Station Market Size & Share Analysis

The global 5G base station market is dominated by established telecommunications equipment manufacturers, including Huawei, ZTE, Nokia, Ericsson, Samsung Electronics, and

Get a quote

Base Station Market Report | Global Forecast From

The global base station market size was valued at USD 32 billion in 2023 and is projected to reach USD 65 billion by 2032, registering a CAGR of

Get a quote

Huawei leads network base station market for 2022

The report mentions that Huawei will lead the global base station market with 29 percent of the overall market share in 2022. which is a 1

Get a quote

Shifting Tides: The Decline of Nokia, Ericsson, and Huawei''s Market

Nokia, Ericsson, and Huawei, once the titans of the telecommunications infrastructure market, are witnessing a gradual decline in their dominance. Recent market

Get a quote

Huawei Maintains the Top Position in the Global Passive Antenna Market

According to the report, Huawei continues to lead the global market for the ninth consecutive year with a market share of 38.93%, making Huawei the only equipment

Get a quote

Global mobile base station market share 2022| Statista

In 2021, Huawei accounted for ** percent of the global mobile base station market, with Ericsson ranking second occupying **** percent of the market.

Get a quote

HUAWEI Smart Solar Inverters SUN2000 Series

HUAWEI SUN Series Smart String Grid Connect Inverters are of transformerless design for the management of hybrid solar powered PV/AC mains power supply installations.

Get a quote

Market share of top 3 suppliers of base stations to

Not only does this number point to the impressive magnitude of the Chinese telecom market, but it has also been the key to Huawei''s leadership

Get a quote

String Inverters Market Size to reach USD 6,380.14 Mn by 2031

The utility segment, which includes large-scale solar farms and grid-connected power plants, accounts for a significant share of the string inverter market. Utility-scale installations require

Get a quote

5G Base Station Market Size, Share | Forecast

The global 5G base station market size was valued at USD 8.16 billion in 2020, and is projected to reach USD 190.78 billion by 2030, registering a CAGR of 37.3% from 2021 to 2030. A 5G base

Get a quote

Digital Power 2030

As this happens, data centers, communications base stations, and other types of facilities used for transmitting, computing, and mining information flow will grow in number and consume more

Get a quote

Huawei''s New Single SitePower Solution Creates

The communications industry consumes 2.5% of the world''s electricity, with base stations accounting for over 60%. Along with the rapid

Get a quote

Huawei and CommScope are the Market Leaders in ABI

The updated Cellular Base Station Antenna Market competitive ranking report from ABI Research, a global tech market advisory firm, provides insights into the competitive

Get a quote

Global mobile base station market share 2022| Statista

In 2021, Huawei accounted for ** percent of the global mobile base station market, with Ericsson ranking second occupying **** percent of the

Get a quote

5.5G Innovation Paves the Way to an Intelligent World

5.5G has also triggered research into the standardization of harmonized communication and sensing (HCS). 5.5G base stations will adopt integrated

Get a quote

Huawei and CommScope are leaders in cellular base station

Despite a challenging year for the passive base station antenna market in 2020, Huawei retained its title as leader and increased its market share to 35.1%.

Get a quote

Leading Solar Solutions for a Greener Future

HUAWEI FusionSolar advocates green power generation and reduces carbon emissions. It provides smart PV solutions for residential, commercial,

Get a quote

5G Technology Market Size | Growth Trends 2025-2037

The 5G technology market size was over USD 29.8 billion in 2024 and is set to cross USD 4.1 trillion by the end of 2037, witnessing a CAGR of over 47% during the forecast

Get a quote

China and Europe dominate base station market

Chinese and European suppliers of base station equipment are expected to maintain a global market share of more than 70% in 2021, says TrendForce. The top three

Get a quote

Huawei Maintains the Top Position in the Global Passive Antenna

According to the report, Huawei continues to lead the global market for the ninth consecutive year with a market share of 38.93%, making Huawei the only equipment

Get a quote

Huawei Ranked First for Four Consecut...

According to ABI Research, the global base station antenna market is stable, with Huawei, Kathrein, and CommScope accounting for approximately 70% of the passive antenna

Get a quote

6 FAQs about [Huawei communication base station inverter grid-connected market share]

Does Huawei have a mobile base station?

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access. In 2021, Huawei accounted for 30 percent of the global mobile base station market, with Ericsson ranking second occupying 23.5 percent of the market.

Does Huawei have a strong market share?

According to the report, Huawei continues to lead the global market for the ninth consecutive year with a market share of 38.93%, making Huawei the only equipment manufacturer to maintain positive market share growth during this period.

Who will lead the base station market in 2022?

The report mentions that Huawei will lead the global base station market with 29 percent of the overall market share in 2022. which is a 1 percent dip from last year. Ericson comes second with 24 percent market share, third is Nokia with 21.5 percent market share, up from 20 percent last year.

What is the market share of base station equipment suppliers?

A world-leading market intelligence provider – TrendForce released the global market share analysis report of suppliers of base station equipment. The report discloses that more than 70% of the market is covered by Chinese and European suppliers.

Who owns the base station equipment market?

The report discloses that more than 70% of the market is covered by Chinese and European suppliers. The top three base station equipment providers are China-based Huawei with the share accounting for 30%, Sweden-based Ericsson with 23% shared and the third one is Finland-based Nokia with 20% market shares.

Who has the most base station market share?

Ericson comes second with 24 percent market share, third is Nokia with 21.5 percent market share, up from 20 percent last year. Samsung has 4th place with 12 percent market share and ZTE comes fifth with 2.5 percent shares in the overall base stations category.

Guess what you want to know

-

Huawei photovoltaic communication base station inverter grid-connected cost price

Huawei photovoltaic communication base station inverter grid-connected cost price

-

The lifespan of the grid-connected inverter for the Djibouti communication base station

The lifespan of the grid-connected inverter for the Djibouti communication base station

-

Is there any grid-connected energy storage for the Heishan communication base station inverter

Is there any grid-connected energy storage for the Heishan communication base station inverter

-

Communication base station inverter grid-connected photovoltaic power generation

Communication base station inverter grid-connected photovoltaic power generation

-

Communication base station inverter grid-connected transfer

Communication base station inverter grid-connected transfer

-

Reasons for building a communication base station inverter grid-connected project

Reasons for building a communication base station inverter grid-connected project

-

Application scenarios of communication base station inverter grid-connected equipment

Application scenarios of communication base station inverter grid-connected equipment

-

How to eliminate the problem of small grid-connected battery in inverter of communication base station

How to eliminate the problem of small grid-connected battery in inverter of communication base station

-

Huawei communication base station inverter energy storage

Huawei communication base station inverter energy storage

-

Is the grid-connected communication base station inverter a business facility

Is the grid-connected communication base station inverter a business facility

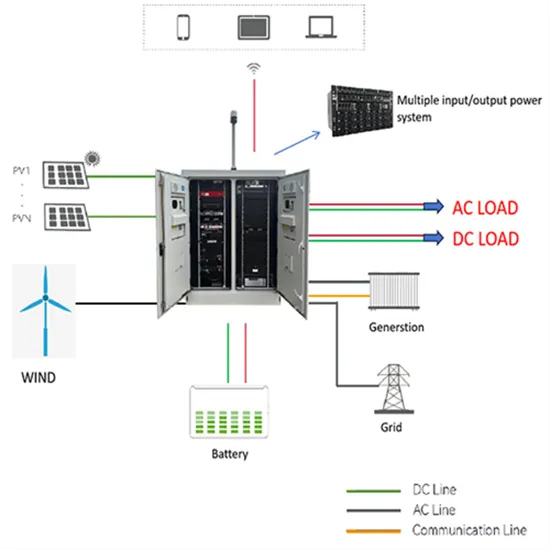

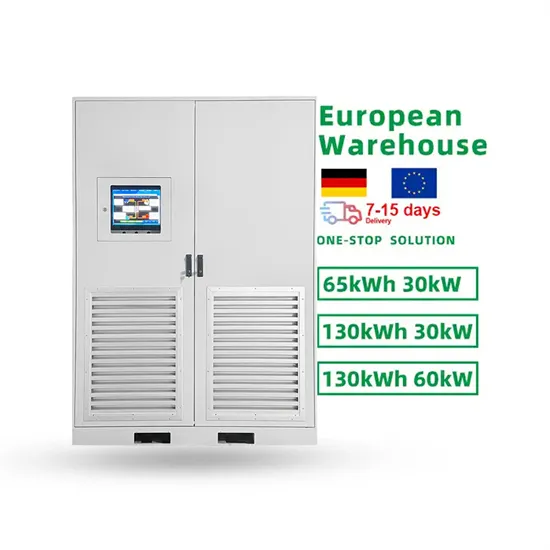

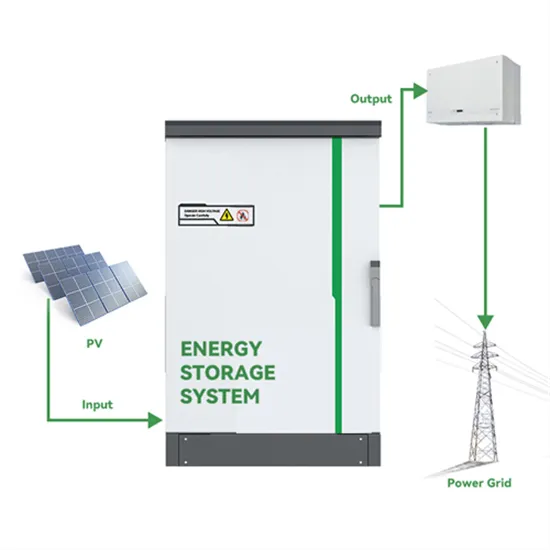

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.