National Subsidy Price for Energy Storage: 2025 Policy

Ever wondered why battery storage projects are popping up faster than mushrooms after rain? The answer lies in national subsidy prices for energy storage that make investors'' eyes sparkle

Get a quote

2025 energy trends in Asia | Herbert Smith Freehills Kramer

3. Asia will see a measured approach to low-carbon hydrogen and ammonia production schemes, as well as increased interest in CO2 mitigation projects. Driven by the

Get a quote

How much is the subsidy for Henan energy storage project?

The financial support allocated for the Henan energy storage project has undergone critical variations over the years. Significant adaptations are evident in government

Get a quote

Navigating New Energy Storage Project Subsidy Schemes: A

In 2025, global investments in energy storage hit $48 billion, with subsidy programs driving 63% of grid-scale battery deployments [3]. Let''s unpack why these financial incentives

Get a quote

WILL HUNGARIAN ENERGY STORAGE PROJECTS GET SUBSIDY

The Hungarian Ministry of Energy has announced that around 50 grid-scale energy storage projects with a cumulative capacity of 440 MW have received subsidy support through a

Get a quote

east asia energy storage power station subsidy policy document

By interacting with our online customer service, you''ll gain a deep understanding of the various east asia energy storage power station subsidy policy document featured in our extensive

Get a quote

Vietnam pv energy storage subsidy

How much power will Vietnam have by 2030? The plan also called for 300MW of battery storage deployment and 2,400MW of pumped hydro energy storage (PHES) by 2030. State-owned

Get a quote

How much is the charging subsidy for energy storage projects?

The subsidy amounts for energy storage projects are influenced by several factors, including the location of the project, the local or federal policies, technology used, and the

Get a quote

2025 north asia energy storage subsidy

At the same time, Beijing''''s Chaoyang District continued to provide 20% initial investment subsidies for energy storage projects after energy storage was incorporated into the special

Get a quote

How much is the subsidy for Foshan energy storage project?

The subsidy for the Foshan energy storage project is approximately 1.5 billion RMB (around 230 million USD), aimed at enhancing renewable energy storage systems, thereby

Get a quote

Market attractiveness analysis of battery energy storage systems

To accelerate the BESS market potential in Southeast Asia, the following policies are recommended: (i) providing subsidies and incentives for BESS deployment, (ii) including

Get a quote

India launches tender scheme to help fund 4GWh of

India''s government has approved a tender scheme to support the development and construction of BESS assets for delivery by 2030-2031.

Get a quote

SOUTHEAST ASIA''S LARGEST ENERGY STORAGE

Singapore, February 2, 2023 – Sembcorp Industries (Sembcorp) and the Energy Market Authority (EMA) today officially opened the Sembcorp Energy Storage System (ESS). The Sembcorp

Get a quote

South East Asia: The coming solar-storage revolution

Much of this investment will be ploughed into solar and energy storage facilities as they will be the resources upon which South East Asia''s clean energy revolution will be built.

Get a quote

North Asia Energy Storage Subsidy: A Comprehensive Guide for

North Asia''s energy storage subsidies aren''t one-size-fits-all. China''s "Top Runner" program offers up to 20% cost coverage for grid-scale projects, while Japan''s METI throws tax breaks at

Get a quote

How much subsidy does the country have for energy storage

The range of subsidies available for energy storage can be categorized into several key types, each tailored to meet the specific needs of energy projects while

Get a quote

How much subsidy is appropriate for energy storage power

In determining the optimal subsidy for energy storage power stations, various factors must be considered. 1. The level of investment required, 2. The expected return on

Get a quote

How much subsidy does Dongguan energy storage project receive?

The funding allocated to the Dongguan energy storage project is substantial, specifically 1. 700 million RMB earmarked for project advancement, 2. 150 million R

Get a quote

How battery storage accelerates decarbonisation in

Energy storage can enable decarbonisation around the world and Asia-Pacific is no exception, writes Hendrik Bohne of Aquila Capital.

Get a quote

How much subsidy does Shenzhen energy storage project receive?

In Shenzhen, energy storage projects benefit from substantial financial support from government initiatives aimed at promoting renewable energy and enhancing grid stability.

Get a quote

Interpretation of the charging subsidy policy for energy

Are energy storage subsidy policies uncertain? Subsidy policies for energy storage technologies are adjusted according to changes in market competition,technological progress,and other

Get a quote

27 grid-scale BESS projects secure 34.6B yen through METI''s

4 days ago· The subsidy, which covers between one and two thirds of equipment and construction costs depending on technology, was open for applications between the end of

Get a quote

27 grid-scale BESS projects secure 34.6B yen

4 days ago· The subsidy, which covers between one and two thirds of equipment and construction costs depending on technology, was open for applications

Get a quote

How much subsidy is provided for new energy storage projects?

New energy storage projects receive a range of subsidies based on regional and national policies, typically in the form of grants, tax credits, and performance-based incentives.

Get a quote

north asia energy storage national subsidy policy

There have been new energy compulsory energy storage policies implemented in multiple regions nationwide, making the 2-hour and above energy storage market a market necessity.

Get a quote

3 FAQs about [How much is the subsidy for East Asian energy storage projects ]

How much do China's end-use energy subsidies cost?

Table 3 indicates that in 2007, China's end-use energy subsidies amount to CNY 356.73 billion — roughly equivalent to 1.43% of GDP. IEA (2008) had estimated that China's energy consumption subsidies were about CNY 300 billion in 2007.

What is a mw subsidy & how does it work?

The subsidy, which covers between one and two thirds of equipment and construction costs depending on technology, was open for applications between the end of August and the end of October 2024. Projects 1MW and larger spanning up to three fiscal years were eligible.

Which companies have been awarded energy projects in 2025?

Four companies including Q.ENEST Holdings, Banpu Japan, Mitsuuroko Green Energy, and Kurihalant were awarded two projects. Additionally, Toyota Tsusho group was awarded two projects, with Eurus Energy Holdings and Terras Energy, which are expected to be merged in April 2025, each having been awarded one.

Guess what you want to know

-

How much is the subsidy for energy storage projects in Tanzania

How much is the subsidy for energy storage projects in Tanzania

-

East Asian Energy Storage Charging Pile

East Asian Energy Storage Charging Pile

-

How to make grid-side energy storage projects profitable

How to make grid-side energy storage projects profitable

-

How high is the hybrid pressure in hybrid energy storage projects

How high is the hybrid pressure in hybrid energy storage projects

-

How much government subsidies are there for energy storage projects

How much government subsidies are there for energy storage projects

-

How much does the East African energy storage firefighting system cost

How much does the East African energy storage firefighting system cost

-

How many energy storage power station projects are there in Egypt

How many energy storage power station projects are there in Egypt

-

How long does it take for energy storage projects to pay back

How long does it take for energy storage projects to pay back

-

How much does a West Asian energy storage container power station cost

How much does a West Asian energy storage container power station cost

-

How much does energy storage battery cost in East Africa

How much does energy storage battery cost in East Africa

Industrial & Commercial Energy Storage Market Growth

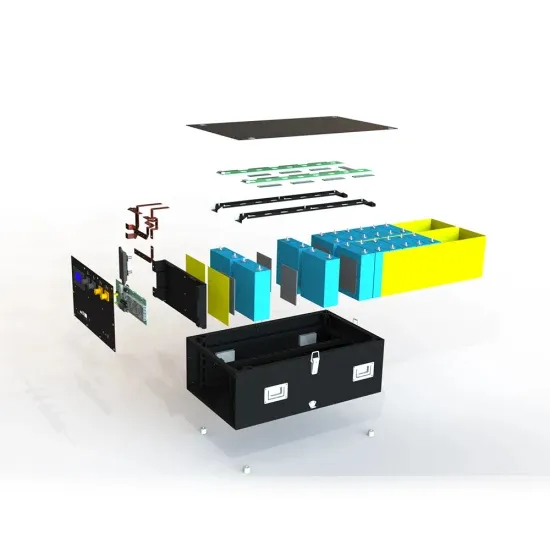

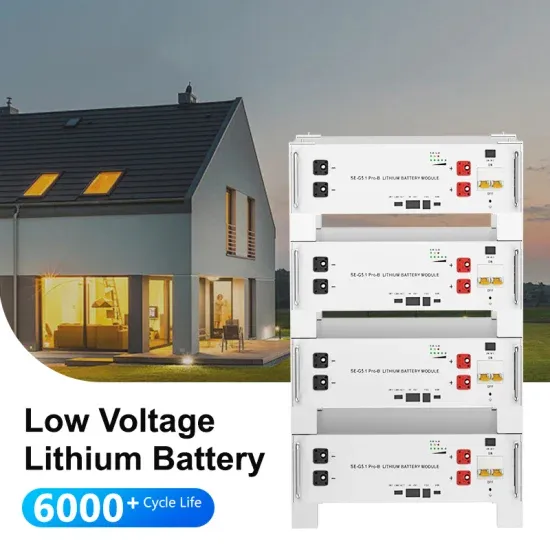

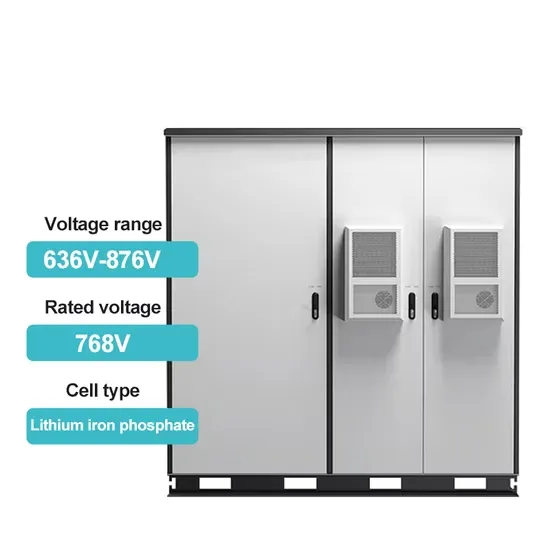

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.