Battery Energy Storage Financing Structures and Revenue

Battery Energy Storage Revenue Streams The varying uses of storage, along with differences in regional energy markets and regulations, create a range of revenue streams for battery energy

Get a quote

Energy Storage Payback Period: When Will Your Battery System

It''s the time needed for your energy storage system''s savings to equal its initial cost. But here''s the kicker: not all payback periods are created equal. We''ve got: Let''s get nerdy for a second.

Get a quote

How long until solar panels pay for themselves?

So, how long does it take for solar panels to pay for themselves? It''s difficult to say, but the answer depends on how much you pay for the panels, how much your electricity would

Get a quote

In-depth explainer on energy storage revenue and

Battery energy storage projects serve a variety of purposes for utilities and other consumers of electricity, including backup power, frequency

Get a quote

How to Calculate the Payback Period for Your Energy Storage

Divide the total cost of the system by the annual energy savings to arrive at the payback period. In our scenario, the payback period would be $10,000 / $1,500 = 6.67 years.

Get a quote

Misconceptions About Self Storage Development

So how long does it take to fill a self-storage facility? Based on my experience, I advise self-storage developers to financially prepare for the

Get a quote

What''s The Average Solar Panel Payback Period? –

Switching to solar energy is a major financial commitment and, if you''re like most homeowners, you''ll want to know how long it will take to

Get a quote

US grid interconnection backlog jumps 40%, with wait

The total capacity of energy projects in U.S. interconnection queues grew 40% year-over-year in 2022, with more than 1,350 GW of

Get a quote

How many years does it take for an energy storage project to pay back

In regions where renewable energy generation is dominant and energy prices are high, storage projects tend to recover costs more rapidly. Conversely, in areas with fluctuating

Get a quote

IRA sets the stage for US energy storage to thrive

The Inflation Reduction Act (IRA) signed into law in August significantly improves the economics for large-scale battery storage projects in

Get a quote

How many years does it take for an energy storage power station to pay

With its commissioning in 2017, the project has not only contributed to balancing electricity supply and demand but has also generated considerable revenue, allowing it to pay

Get a quote

How long does a wind farm take to pay for itself off?

According to a 2018 report by the Energy Information Administration (EIA), the cost of building transmission lines to connect wind

Get a quote

Battery purchase contracts: Key pitfalls

Anyone developing a battery energy storage project should be prepared to address two main issues. The first, and the topic of an earlier article, is the general contracting

Get a quote

Battery storage tax credit opportunities and

Revised February 13, 2023 Below are slides the authors prepared about tax credit opportunities and development challenges for battery storage.

Get a quote

What''s the payback on solar and batteries?

What is "payback" anyway? The idea of "payback" is simple enough – you pay for a solar and battery system upfront, so you want to know how long it will take to get your money

Get a quote

Battery Energy Storage Tax Credits in 2024 | Alsym

From homeowners looking to reduce energy bills to businesses aiming to enhance operational resilience, now is the time to explore the

Get a quote

Return on Investment (ROI) of Energy Storage Systems: How

Explore the Return on Investment (ROI) of energy storage systems for commercial and industrial applications. Learn how factors like electricity price differentials, government

Get a quote

What''s The Average Solar Panel Payback Period? – Forbes Home

Switching to solar energy is a major financial commitment and, if you''re like most homeowners, you''ll want to know how long it will take to recoup your investment. This average

Get a quote

How many years does it take for an energy storage power station

With its commissioning in 2017, the project has not only contributed to balancing electricity supply and demand but has also generated considerable revenue, allowing it to pay

Get a quote

When Does a Solar Farm Pay for Itself? | Coldwell Solar

It is essential to consider the payback period of your solar system when going solar. People must determine how and when their investment in residential solar electricity will pay for themselves.

Get a quote

Solar payback period: How soon will it pay off?

The average solar payback period for EnergySage customers is currently just over seven years. However, without the federal tax credit, that same system would take over 10

Get a quote

Return on Investment (ROI) of Energy Storage Systems: How Long

Explore the Return on Investment (ROI) of energy storage systems for commercial and industrial applications. Learn how factors like electricity price differentials, government

Get a quote

Frequently asked questions about energy efficient home

Updated FAQs were released to the public in Fact Sheet 2025-01 PDF, Jan. 17, 2025. This fact sheet contains all of the FAQs in one downloadable PDF. Q1. May a taxpayer carry forward an

Get a quote

California Solar Incentives, Tax Credits & Rebates 2025

California solar incentives like tax credits and rebates allow you to save money when you go solar - learn which incentives are available.

Get a quote

6 FAQs about [How long does it take for energy storage projects to pay back ]

How long does it take a solar system to pay off?

The average solar payback period for EnergySage customers is currently just over seven years. However, without the federal tax credit, that same system would take over 10 years to pay for itself. Here's what you need to know about how long it's likely to take you to break even on your solar energy investment—and why timing matters.

How long does it take for solar panels to pay back?

So, if it takes 10 years to recover the cost of your solar panels, you can still expect savings on your electric bills for another 15 years, which is an excellent investment. Solar companies can provide you with an estimate of your payback period.

How long does it take to recoup solar energy?

Switching to solar energy is a major financial commitment and, if you’re like most homeowners, you’ll want to know how long it will take to recoup your investment. This average recovery time, called the solar panel payback period, typically ranges from six to 10 years, depending on a handful of factors.

How long is a solar panel payback period?

The solar panel payback period typically ranges from six to 10 years, varying based on system size, location and incentives. Federal and local rebates, including a 30% federal tax credit, significantly lower initial solar installation costs.

How long do solar panels last on EnergySage?

That's the average payback period on EnergySage. At the end of those 7.1 years, your solar panels will have saved you enough money on your electric bill to cover the upfront cost of your system. Year eight in the example is when you technically start saving money, having finally broken even on your investment.

How do I calculate my solar payback period?

To calculate your solar payback period, divide your combined costs by your annual savings. With tax credit: Combined costs ($18,552) ÷ annual savings ($2,613) = solar payback period (7.1 years) Without tax credit: Combined costs ($27,360) ÷ annual savings ($2,613) = solar payback period (10.5 years)

Guess what you want to know

-

How long does it take for home photovoltaic energy storage to pay back

How long does it take for home photovoltaic energy storage to pay back

-

How long is the warranty period for photovoltaic energy storage projects

How long is the warranty period for photovoltaic energy storage projects

-

How long can photovoltaic energy storage last

How long can photovoltaic energy storage last

-

How long is the service life of a commercial energy storage cabinet

How long is the service life of a commercial energy storage cabinet

-

How many categories are there for energy storage projects

How many categories are there for energy storage projects

-

How long can lithium battery energy storage containers be used

How long can lithium battery energy storage containers be used

-

How much is the subsidy for energy storage projects in Tanzania

How much is the subsidy for energy storage projects in Tanzania

-

How much government subsidies are there for energy storage projects

How much government subsidies are there for energy storage projects

-

How long does it take for the energy storage battery to be fully discharged

How long does it take for the energy storage battery to be fully discharged

-

How many billions has Huawei invested in energy storage projects

How many billions has Huawei invested in energy storage projects

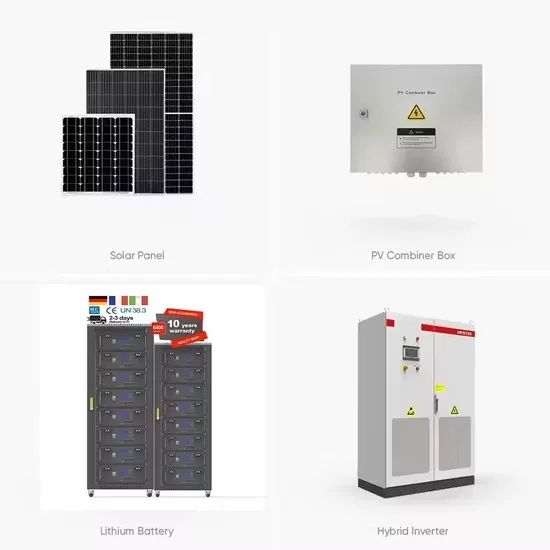

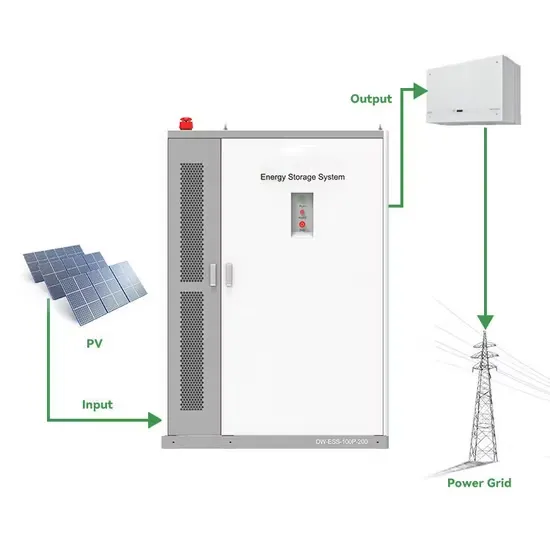

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.