US'' tax credit incentives for standalone energy

"Starting today, all US #energystorage projects can avail a 30+% investment tax credit. Excited to see the industry go to the next level," Burwen

Get a quote

Electricity storage subsidies in Germany

However, although energy storage costs have fallen sharply in recent years, for most people it''s still too expensive without subsidy programs: each kilowatt hour (kWh) of

Get a quote

State-Level Energy Storage Incentives in the US

Comparable programs considered for this report include the Connecticut Energy Storage Solutions program, the Massachusetts and Rhode Island ConnectedSolutions

Get a quote

What the budget bill means for energy storage tax credit eligibility

Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an ITC of up to 50% under 48E if domestic

Get a quote

How much government subsidies are there for developing solar energy

1. Government subsidies for developing solar energy are extensive and diverse, 2. They include tax credits, grants, and loan programs, 3. The total amount can vary significantly

Get a quote

Lithuanian Energy Grants 2025: Solar Panel, Wind Energy & Storage

As Lithuania strengthens its commitment to renewable energy and energy independence, an increasing number of government-backed subsidies and loan programs are

Get a quote

Navigating New Energy Storage Project Subsidy Schemes: A

Ever wondered how countries are achieving record-breaking renewable energy adoption? The secret sauce often lies in new energy storage project subsidy schemes. In

Get a quote

How much is the energy storage subsidy in Barbados

Energy-Storage.news'''' publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together

Get a quote

US'' tax credit incentives for standalone energy storage begin new

"Starting today, all US #energystorage projects can avail a 30+% investment tax credit. Excited to see the industry go to the next level," Burwen tweeted.

Get a quote

Federal Incentives are Supercharging Energy Storage in America

But the answers to "How much?" and "How fast?" for energy storage deployment will depend on resolving three core challenges: supply chains, interconnection and permitting,

Get a quote

German Battery Storage on a Rise: Legislative Changes

High and further increasing volatility of power prices due to the expansion of renewables on the one hand and significantly decreasing prices for battery cells in recent

Get a quote

The Role of Government Incentives: Grants, Subsidies, and Tax

They can come in various forms, such as direct payments or price supports that make renewable energy projects more competitive. Imagine entering a race where the

Get a quote

WINDExchange: Wind Energy Financial Incentives

The following provides an overview of the main federal incentives for wind energy projects. The federal government has used subsidies and incentives to stimulate deployment for all energy

Get a quote

How much government subsidies do energy storage power

The amount of government subsidies provided to energy storage power stations varies significantly depending on the country, region, and specific policies in place.

Get a quote

Federal Incentives for Renewable Energy and Energy

This report takes care of the confusion, identifying those pro-grams that support renewable energy and energy storage projects and diving into the specifics of each program. In total, twelve

Get a quote

Renewable energy explained Incentives

Government financial incentives Several federal government tax credits, grants, and loan programs are available for qualifying renewable energy technologies and projects.

Get a quote

What the budget bill means for energy storage tax

Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an

Get a quote

The Government of Canada Announces New Intake for Clean

SREPs was recapitalized with nearly $2.9 billion in Budget 2023 and supports clean electricity infrastructure — such as renewable energy technologies, energy storage and

Get a quote

New Federal Funding for Energy Storage: What''s Available and

The US Department of Energy has several new, large funding budgets for energy storage projects, research and development. Within the Infrastructure Investment and Jobs

Get a quote

How much government subsidies do energy storage projects

With the growing emphasis on renewable energy, many governments see energy storage as pivotal in achieving sustainability targets, thus promoting a wide range of

Get a quote

GOVERNMENT SUBSIDIES FOR ENERGY STORAGE

How much money does the federal government spend on carbon removal & storage? The increased subsidies all come on top of roughly $12 billionin federal support for carbon

Get a quote

Hydroelectric Incentives Guide

The Hydroelectric Incentives program oversees an investment of more than $750 million to support the continued operation of the U.S. hydropower fleet to meet

Get a quote

The Budgetary Cost of the Inflation Reduction Act''s Energy Subsidies

The Inflation Reduction Act (IRA) became law on August 16, 2022. Despite its name, the act was mostly designed to decarbonize the US economy by providing subsidies to

Get a quote

Federal Incentives are Supercharging Energy Storage

But the answers to "How much?" and "How fast?" for energy storage deployment will depend on resolving three core challenges: supply

Get a quote

Clean Energy Infrastructure Funding for Projects and Programs

It includes more than 60 actions both the federal government and Congress can take to help the US capture the economic opportunity inherent in the energy sector transition. DOE is working

Get a quote

6 FAQs about [How much government subsidies are there for energy storage projects ]

What are the different types of energy storage incentives?

In addition, there are other types of energy storage incentives that have been tried. For example, storage may be added to existing renewable programs, such as solar incentive programs, or be made eligible for market-based programs such as utility renewable portfolio standards (RPS).

How do state energy storage incentive programs differ?

• State energy storage incentive programs vary greatly in both program structures and incentive rates. The differences in structure—for example, rebates vs performance payments —make it very difficult to make apples-to-apples comparisons from state to state. • It is difficult to establish consistent parallels between rates and outcomes.

Are incentive rates good for energy storage?

For example, New York offers relatively low per-kWh incentive rates, but its programs are nearly fully subscribed. By contrast, Connecticut offers relatively high incentive rates but its residential program has been under-subscribed. • Incentive rates alone do not convey a comprehensive economic story for energy storage in a state.

Are state incentives necessary to increase distributed storage deployment?

• Despite all these variables, numerous studies as well as experience have shown that until energy markets mature, battery prices fall, and currently non-monetizable energy storage services become monetizable, state incentives are a necessary and critical key to increasing distributed storage deployment.

Will the inflation Reduction Act affect energy storage projects?

Image: President Biden via Twitter. The Inflation Reduction Act’s incentives for energy storage projects in the US came into effect on 1 January 2023. Standout among those measures is the availability of an investment tax credit (ITC) for investment in renewable energy projects being extended to include standalone energy storage facilities.

Do energy storage developers offer financing?

While many energy storage developers offer financing, it can be helpful for the state to provide public financing options that can be marketed to income-qualified customers and historically underserved communities (for example, low- or no-interest loans that do not require high credit scores to qualify).

Guess what you want to know

-

Does Belgium provide subsidies for energy storage projects

Does Belgium provide subsidies for energy storage projects

-

How high is the hybrid pressure in hybrid energy storage projects

How high is the hybrid pressure in hybrid energy storage projects

-

Are there subsidies for energy storage projects in Morocco

Are there subsidies for energy storage projects in Morocco

-

How long is the warranty period for photovoltaic energy storage projects

How long is the warranty period for photovoltaic energy storage projects

-

How long does it take for energy storage projects to pay back

How long does it take for energy storage projects to pay back

-

Subsidies for large-scale energy storage projects in Egypt

Subsidies for large-scale energy storage projects in Egypt

-

How much is the subsidy for East Asian energy storage projects

How much is the subsidy for East Asian energy storage projects

-

How much is the electricity price of the Croatian energy storage power station

How much is the electricity price of the Croatian energy storage power station

-

How much does a station-type energy storage system cost

How much does a station-type energy storage system cost

-

How much does a photovoltaic communication base station energy storage battery cost

How much does a photovoltaic communication base station energy storage battery cost

Industrial & Commercial Energy Storage Market Growth

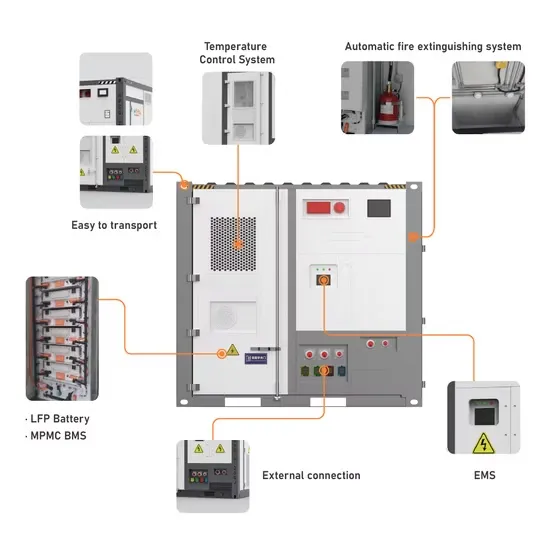

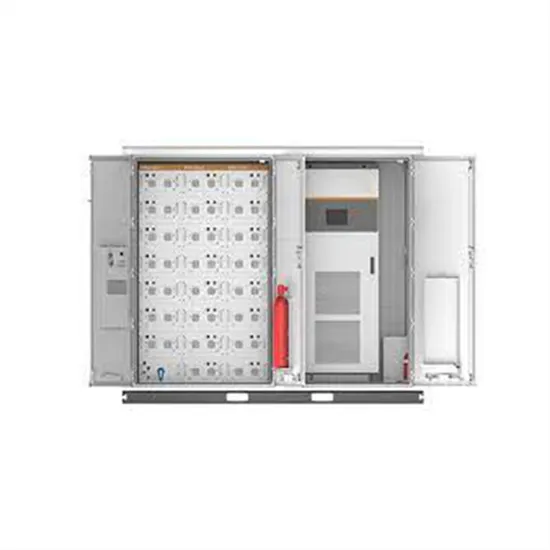

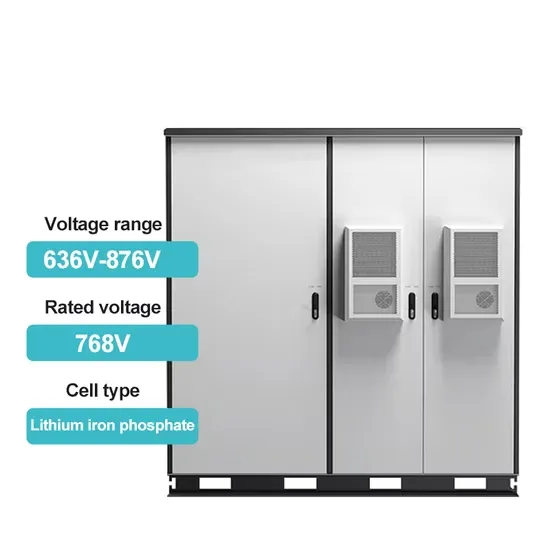

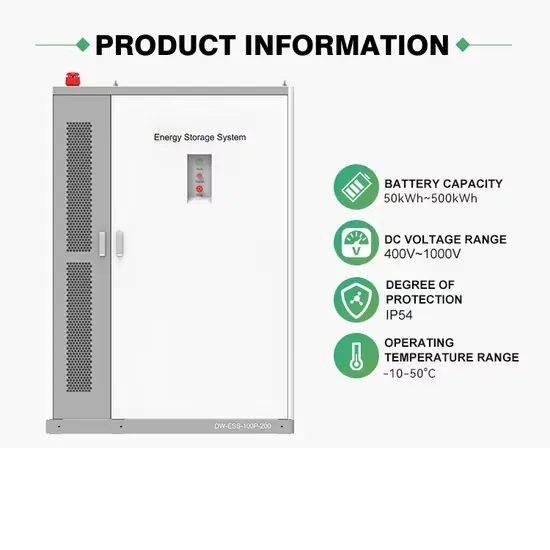

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.