In-depth explainer on energy storage revenue and

These varying uses of storage, along with differences in regional energy markets and regulations, create a range of revenue streams for

Get a quote

How Can You Increase Profits in Your Energy Storage Business?

Discover proven strategies to enhance your energy storage profit margins. Learn how to optimize operations and increase revenue.

Get a quote

A Brief Review of Energy Storage Business Models

All energy storage projects hinge on a successful business model - and there are a growing number of them, as energy storage can provide value in different ways to different market

Get a quote

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get a quote

Project Developers Are Bullish On The Thermal Energy Storage

2 days ago· The emergence of thermal energy storage project developers affirms our expectations for growth in the TES industry. The main driver for manufacturers is cost savings.

Get a quote

How is the California energy storage market profitable?

1. The California energy storage market is profitable due to enhanced grid reliability, increased renewable integration, robust policy

Get a quote

National Lab Analyses Help Hydropower Operators

Analyses from Argonne National Laboratory and Pacific Northwest Laboratory help hydropower operators and developers better understand how

Get a quote

How is Energy Storage Profitable? Unlocking the Billion-Dollar

Why Energy Storage Isn''t Just for Sci-Fi Anymore Let''s face it: When you hear "energy storage," you might picture Tony Stark''s arc reactor or Doc Brown''s flux capacitor. But

Get a quote

Maximizing Revenue Streams for Storage Projects During the Energy

Some key attributes that can make a storage project more appealing include a late-stage queue position, a site in an energy community area, interconnection to a highly

Get a quote

Deep-learning

A profitable operation strategy of an energy storage system (ESS) could play a pivotal role in the smart grid, balancing electricity supply with demand. Here, we propose an AI

Get a quote

How to Make Energy Storage Projects Profitable: A No-Nonsense

With global battery storage capacity expected to hit 1,200 GW by 2040 (BloombergNEF), the stakes are high. Whether you''re a project developer, investor, or a utility

Get a quote

How Storage Makes Money

There are three main ways that grid-scale energy storage resources (ESR''s) can make money: energy price arbitrage, ancillary grid services, and resource adequacy.

Get a quote

China Sees Energy Storage Boom, Battle to Ease Grid Bottlenecks

Built by Lijin County Jinhui New Energy Co, the project is part of an explosion in development of energy storage in China, which has called for even more investment in the

Get a quote

A Brief Review of Energy Storage Business Models

All energy storage projects hinge on a successful business model - and there are a growing number of them, as energy storage can provide value in different

Get a quote

How about grid-side energy storage? | NenPower

Grid-side energy storage acts as an essential component of modern energy systems, enabling better utilization of various energy sources and enhancing reliability during

Get a quote

Maximizing Revenue Streams for Storage Projects

Some key attributes that can make a storage project more appealing include a late-stage queue position, a site in an energy community

Get a quote

How does battery siting affect the profitability of utility-scale

2. Value Stacking Siting a battery storage project in a location where it can provide multiple services (such as energy arbitrage, frequency regulation, and grid stability) allows for

Get a quote

How do energy storage projects make money? | NenPower

Participation in capacity markets allows energy storage projects to earn money by ensuring grid reliability during peak demands. Notably, energy storage systems offer flexibility,

Get a quote

Can Shared Energy Storage Be Profitable? The $100 Billion

Why Shared Energy Storage Isn''t Just Another Green Energy Fad Let''s cut to the chase: shared energy storage is turning heads faster than a Tesla Plaid at a drag race. But

Get a quote

Research on Capacity Allocation of Grid Side Energy Storage

Power system with high penetration of renewable energy resources like wind and photovoltaic units are confronted with difficulties of stable power supply and peak regulation ability. Grid

Get a quote

In-depth explainer on energy storage revenue and effects on

These varying uses of storage, along with differences in regional energy markets and regulations, create a range of revenue streams for storage projects.

Get a quote

Optimized scheduling study of user side energy storage in

Among them, user-side small energy storage devices have the advantages of small size, flexible use and convenient application, but present decentralized characteristics in space.

Get a quote

Is Grid Energy Storage Profitable? Exploring the Economics

Why Grid Energy Storage Is Suddenly Making Headlines (and Dollars) Let''s cut to the chase – grid energy storage isn''t just about saving the planet anymore. With companies

Get a quote

Will the Energy Transition Make Storage Batteries a Profitable

The battery storage sector still faces challenges. Other types of batteries that might potentially store energy for longer could make some projects relying on today''s lithium-ion

Get a quote

How to create revenue with a BESS project

Each of the three main ways that BESS generates revenue offers distinct opportunities to monetize investments. The primary revenue stream for BESS projects comes

Get a quote

Anyone have any good financial models, or like resources for

Anyone have any good financial models, or like resources for projecting out costs and revenues for BESS projects? I have spotted a lot of sites but need to be able to put together projections

Get a quote

Battery technologies for grid-scale energy storage

Energy-storage technologies are needed to support electrical grids as the penetration of renewables increases. This Review discusses the application and development

Get a quote

6 FAQs about [How to make grid-side energy storage projects profitable]

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

Should a storage project be paired with a solar or wind power project?

Pairing a storage project with a solar or wind power generation project can be beneficial. It allows projects to charge the storage system rather than deliver power to the grid when market prices for electricity are low (or negative) or when electricity would otherwise be curtailed.

What is a battery energy storage project?

A battery energy storage project is a system that serves a variety of purposes for utilities and other consumers of electricity, including backup power, frequency regulation, and balancing electricity supply with demand.

Guess what you want to know

-

How to make energy storage equipment profitable

How to make energy storage equipment profitable

-

How many billions has Huawei invested in energy storage projects

How many billions has Huawei invested in energy storage projects

-

How many energy storage power station projects are there in Laos

How many energy storage power station projects are there in Laos

-

How long is the warranty period for photovoltaic energy storage projects

How long is the warranty period for photovoltaic energy storage projects

-

How many cells are there in an energy storage battery module

How many cells are there in an energy storage battery module

-

Energy Storage Service Projects

Energy Storage Service Projects

-

How much does it cost to buy an energy storage cabinet in Azerbaijan

How much does it cost to buy an energy storage cabinet in Azerbaijan

-

How many amps are portable energy storage devices usually

How many amps are portable energy storage devices usually

-

How much does lithium energy storage power cost in Costa Rica

How much does lithium energy storage power cost in Costa Rica

-

Subsidies for large-scale energy storage projects in Egypt

Subsidies for large-scale energy storage projects in Egypt

Industrial & Commercial Energy Storage Market Growth

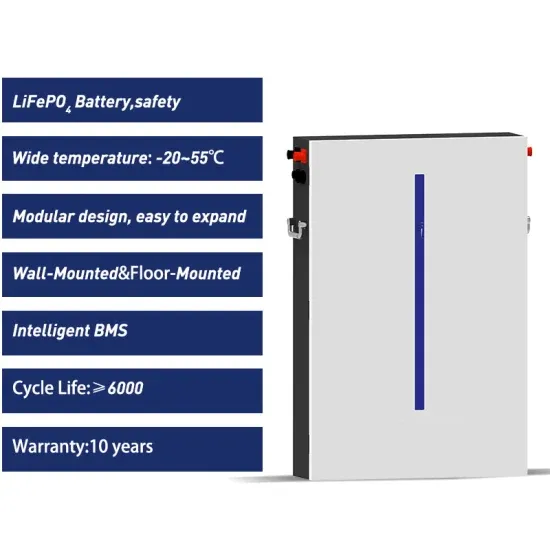

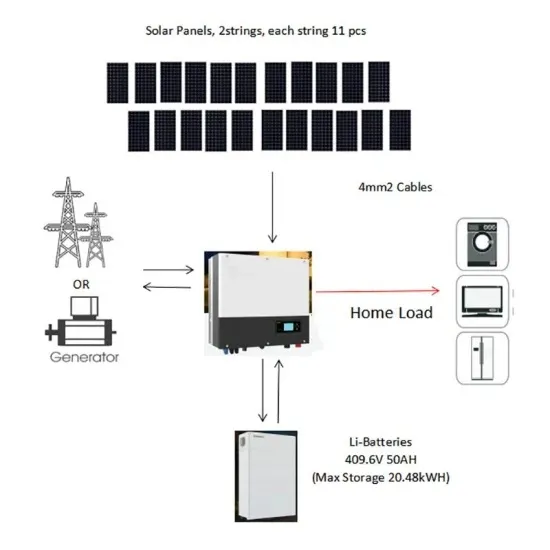

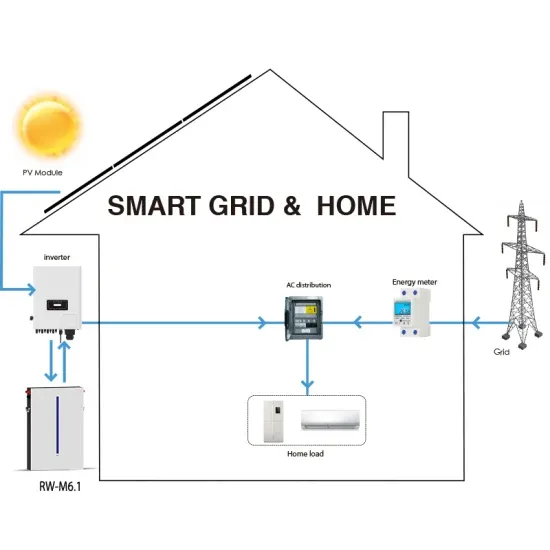

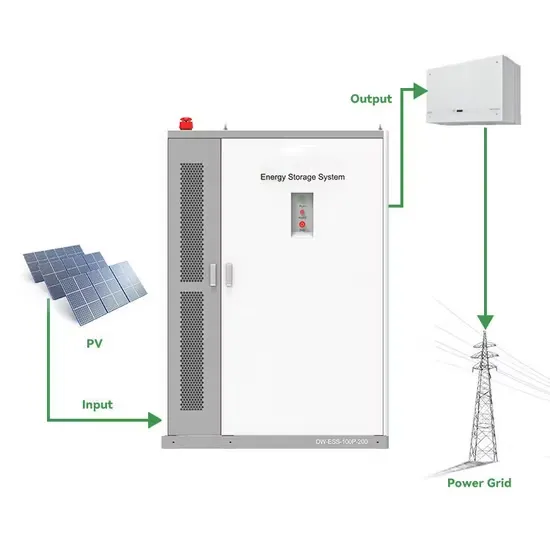

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.