6 Emerging Revenue Models for BESS: A 2025 Profitability Guide

Explore 6 practical revenue streams for C&I BESS, including peak shaving, demand response, and carbon credit strategies. Optimize your energy storage ROI now.

Get a quote

Optimization Planning and Cost-Benefit Analysis of Energy Storage

In the context of the electricity market and a low-carbon environment, energy storage not only smooths energy fluctuations but also provides value-added services. This

Get a quote

Combined Source-Storage-Transmission Planning Considering

In this study, a source-storage-transmission joint planning method is proposed considering the comprehensive incomes of energy storage. The comprehensive income of the

Get a quote

is there a future for peak-to-valley arbitrage in energy storage

Peak-valley arbitrage is one of the important ways for energy storage systems to make profits. Traditional optimization methods have shortcomings such as long solution time, poor

Get a quote

What Is Energy Arbitrage and How Does It Work?

Energy arbitrage optimizes EV charging costs by storing electricity during low-demand periods and using it during peak demand. Click here to learn more!

Get a quote

A Joint Optimization Strategy for Demand Management and Peak-Valley

Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

Get a quote

"peak valley arbitrage" | C&I Energy Storage System

Ever wondered why CCTV keeps buzzing about industrial and commercial energy storage lately? a factory owner in Zhejiang who slashed his electricity bills by 40% simply by installing an

Get a quote

Exploring Peak Valley Arbitrage in the Electricity Market

Industrial and Commercial Energy Storage: Peak valley arbitrage is a common profit strategy, especially where substantial price differences exist, making electrochemical

Get a quote

is there a future for peak-to-valley arbitrage in energy storage

The expansion of peak-to-valley electricity price difference results in a new business model (1): peak-to-valley energy storage arbitrage Using peak-to-valley spread arbitrage is currently the

Get a quote

Peak valley arbitrage | C&I Energy Storage System

The Article about Peak valley arbitrageBangladesh Huijue Energy Storage Construction: Powering a Sustainable Future A monsoon storm knocks out power lines across Dhaka, but hospitals

Get a quote

Energy Storage Arbitrage Under Price Uncertainty: Market Risks

We investigate the profitability and risk of energy storage arbitrage in electricity markets under price uncertainty, exploring both robust and chance-constrained optimization

Get a quote

Multi-objective optimization of capacity and technology selection

To support long-term energy storage capacity planning, this study proposes a non-linear multi-objective planning model for provincial energy storage capacity (ESC) and

Get a quote

How much is the peak-to-valley price difference for energy

To commercialize peak-to-valley price differences effectively, energy storage systems strategically purchase electricity during off-peak periods when prices are low and

Get a quote

Exploring Peak Valley Arbitrage in the Electricity Market

Industrial and Commercial Energy Storage: Peak valley arbitrage is a common profit strategy, especially where substantial price differences

Get a quote

Energy storage peak-valley arbitrage case study

Energy Storage Systems Cost Update : a Study for the DOE Energy Storage Systems Program. Sandia Peak-valley arbitrage revenue: The third type of user has a moderate energy

Get a quote

Price Differences in Different Countries And Their Impact On Energy

In different European countries, the peak-valley price difference varies, and the impact on energy storage projects is also different. In the UK, the main revenue of its energy

Get a quote

Peak-Valley Arbitrage

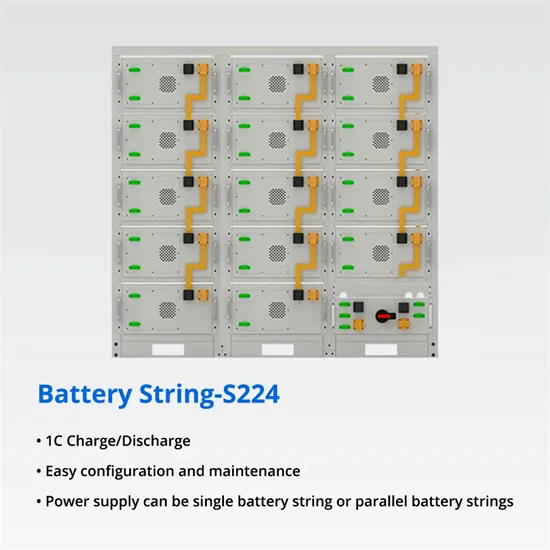

This scalable solution, ranging from 233 kWh to 7 MWh, is ideal for small to medium-sized businesses and industrial users implementing peak-valley arbitrage strategies.

Get a quote

energy storage achieves peak-valley arbitrage

Participation in reactive power compensation, renewable energy consumption and peak-valley arbitrage can bring great economic benefits to the energy storage project, which provides a

Get a quote

Economic benefit evaluation model of distributed energy storage

Usually, the energy storage is charged at night when the price is at valley stage, and discharges during the daytime when the power consumption is at peak, so as to achieve

Get a quote

A Joint Optimization Strategy for Demand Management and Peak

Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

Get a quote

How much is the peak-to-valley price difference for energy storage

To commercialize peak-to-valley price differences effectively, energy storage systems strategically purchase electricity during off-peak periods when prices are low and

Get a quote

2MW/4MWh Energy Storage Project (Manufacturing Industry) | SAV

This project is an industrial and commercial energy storage power station on the user side, which is constructed with Sav''s integrated AC/DC outdoor energy storage cabinets and outdoor grid -

Get a quote

获取多场景收益的电网侧储能容量优化配置

In view of the current grid energy storage system, application scena-rio is relatively single, we propose a grid side energy storage capacity allocation method that takes into account the

Get a quote

energy storage achieves peak-valley arbitrage

Improved Deep Q-Network for User-Side Battery Energy Storage Therefore, energy storage-based peak shaving and valley filling, and peak-valley arbitrage are used to charge the grid at

Get a quote

Commercial & Industrial Energy Storage Project

Peak-Valley Arbitrage: Charge at low-tariff off-peak hours, discharge at high-tariff peak hours to profit from price differences. Backup Power: Ensure

Get a quote

Guess what you want to know

-

Peak-valley arbitrage in Haiti s energy storage system

Peak-valley arbitrage in Haiti s energy storage system

-

Austria s peak-valley energy storage project goes bankrupt

Austria s peak-valley energy storage project goes bankrupt

-

West Asia New Energy Storage Battery Project

West Asia New Energy Storage Battery Project

-

Independent energy storage project revenue in Southeast Asia

Independent energy storage project revenue in Southeast Asia

-

Cuba Solar Energy Storage Project

Cuba Solar Energy Storage Project

-

Namibia Energy Storage Project Related Companies

Namibia Energy Storage Project Related Companies

-

Solomon Islands Substation Energy Storage Project

Solomon Islands Substation Energy Storage Project

-

Jordan Hybrid Compression Energy Storage Project

Jordan Hybrid Compression Energy Storage Project

-

New Zealand Photovoltaic Energy Storage Battery Project

New Zealand Photovoltaic Energy Storage Battery Project

-

China Energy Storage Project

China Energy Storage Project

Industrial & Commercial Energy Storage Market Growth

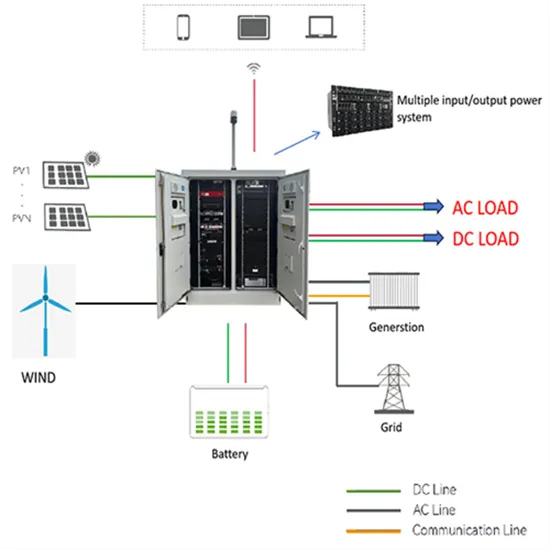

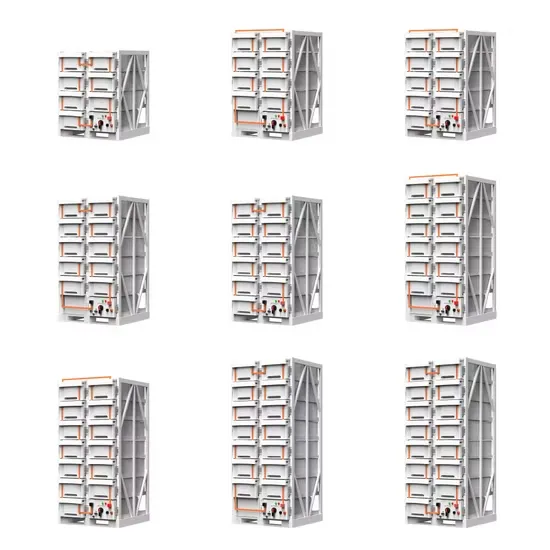

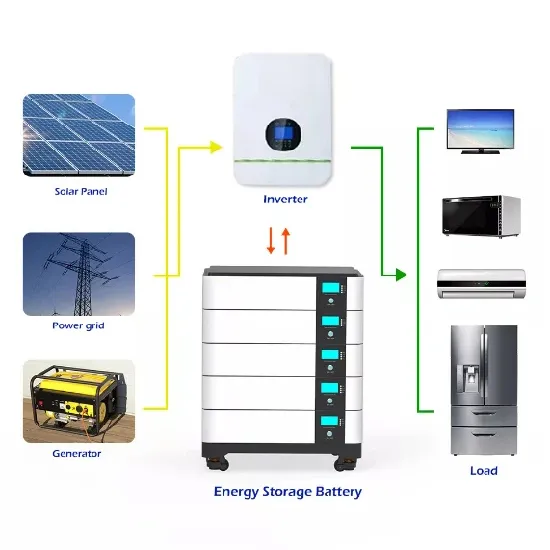

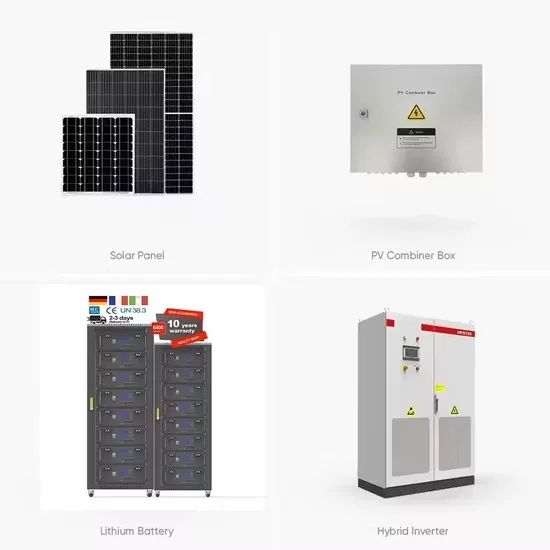

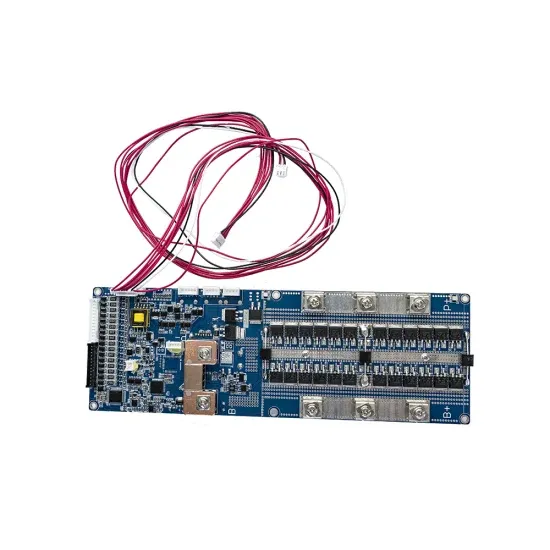

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.