The expansion of peak-to-valley electricity price difference results

The widening of the peak-to-valley price gap has laid the foundation for the large-scale development of user-side energy storage. When the peak-to-valley spread reaches 7

Get a quote

haiti energy storage peak shaving

A novel peak shaving algorithm for islanded microgrid using battery energy storage The most attractive potential strategy of peak-load shaving is the application of the battery energy

Get a quote

Germany Microgrid Energy System: 4.8MW/9.6MWh

Discover the Germany Microgrid Energy System, a 4.8MW/9.6MWh battery energy storage solution designed for peak-valley arbitrage and reliable

Get a quote

Peak-Valley Arbitrage

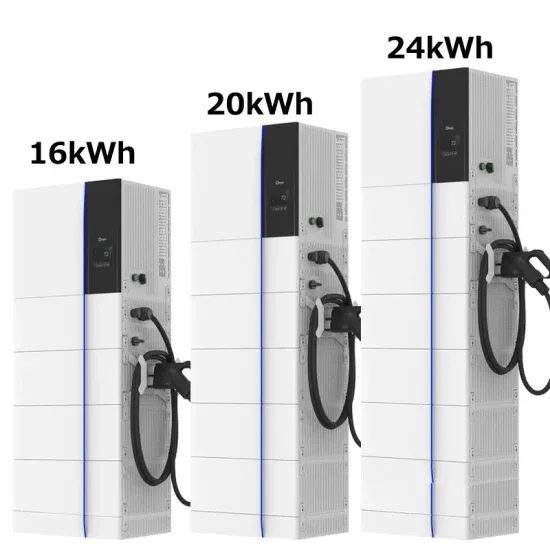

This scalable solution, ranging from 233 kWh to 7 MWh, is ideal for small to medium-sized businesses and industrial users implementing peak-valley arbitrage strategies.

Get a quote

How does energy arbitrage work with energy storage

How Energy Arbitrage Works with Energy Storage Systems Price Analysis: Analyze market prices to identify opportunities where there are

Get a quote

fenrg-2022-1029479 1..8

At present, the peak-valley arbitrage of energy storage is mostly the peak-valley price arbitrage, and the peak price is about four times that of the valley price.

Get a quote

Peak/Off Peak Arbitrage: | C&I Energy Storage System

Pyongyang Peak-Valley Off-Grid Energy Storage: Powering the Future Ever wondered how Pyongyang peak-valley off-grid energy storage systems tackle North Korea''s erratic power

Get a quote

Energy Storage Arbitrage Under Price Uncertainty: Market

Abstract—We investigate the profitability and risk of energy storage arbitrage in electricity markets under price uncertainty, exploring both robust and chance-constrained optimization ap-proaches.

Get a quote

A Joint Optimization Strategy for Demand Management and Peak-Valley

Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

Get a quote

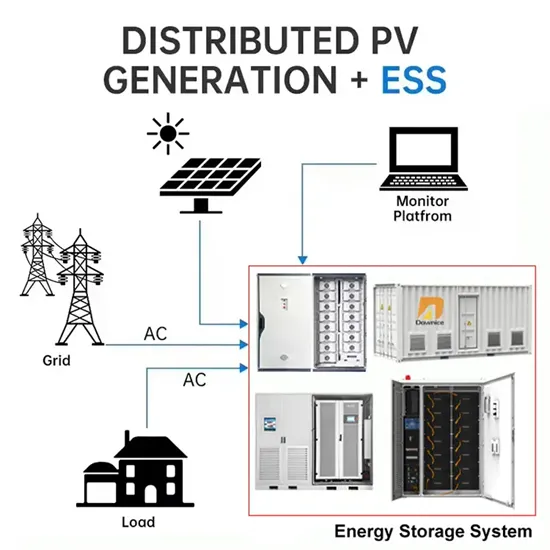

Optimized Economic Operation Strategy for Distributed Energy Storage

In order to further improve the return rate on the investment of distributed energy storage, this paper proposes an optimized economic operation strategy of distributed energy

Get a quote

Demand response-based commercial mode and operation strategy

The energy storage device is an elastic resource, and it can be used to participate into the demand-side management aiming to increasing adjustable margin of power system

Get a quote

Optimization analysis of energy storage application based on

BESS couple with RE can balance the generation and load, and provide auxiliary services. Thus, the technical and economic performance of this coupling system was

Get a quote

The expansion of peak-to-valley electricity price

The widening of the peak-to-valley price gap has laid the foundation for the large-scale development of user-side energy storage. When

Get a quote

EcoWatt-Technologies

In Latvia, by connecting to the day-ahead electricity price interface and forecasting user load, peak-valley arbitrage is achieved based on day-ahead market prices through algorithms.

Get a quote

Analysis and Comparison for The Profit Model of Energy Storage

The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power system. With the deepening of

Get a quote

Profitability analysis and sizing-arbitrage optimisation of

This paper explores the potential of using electric heaters and thermal energy storage based on molten salt heat transfer fluids to retrofit CFPPs for grid-side energy storage

Get a quote

Economic benefit evaluation model of distributed energy storage

A revenue model for distributed energy storage system to provide custom power services such as power quality management, peak-valley arbitrage, and renewable energy

Get a quote

6 Emerging Revenue Models for BESS: A 2025 Profitability Guide

Explore 6 practical revenue streams for C&I BESS, including peak shaving, demand response, and carbon credit strategies. Optimize your energy storage ROI now.

Get a quote

Optimization analysis of energy storage application based on

The coupling system generates extra revenue compared to RE-only through arbitrage considering peak-valley electricity price and ancillary services. In order to maximize

Get a quote

Peak-to-valley arbitrage partner of Palau energy storage system

What is Peak-Valley arbitrage? The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted

Get a quote

A Joint Optimization Strategy for Demand Management and Peak

Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

Get a quote

Economic benefit evaluation model of distributed energy storage system

A revenue model for distributed energy storage system to provide custom power services such as power quality management, peak-valley arbitrage, and renewable energy

Get a quote

The expansion of peak-to-valley electricity price

1. Peak and valley arbitrage Using peak-to-valley spread arbitrage is currently the most important profit method for user-side energy storage. It

Get a quote

Peak-valley tariffs and solar prosumers: Why renewable energy

To help address this literature gap, this paper takes China as a case to study a local electricity market that is driven by peer-to-peer trading. The results show that peak-valley

Get a quote

Industry Peak-Valley Arbitrage

Maximize Factory Savings with Peak and Valley Energy Arbitrage In today''s dynamic energy market, managing costs is more critical than ever for factories and industrial facilities. One of

Get a quote

Peak shaving and valley filling energy storage project

This article will introduce Grevault to design industrial and commercial energy storage peak-shaving and valley-filling projects for customers. In the power system, the energy storage

Get a quote

6 FAQs about [Peak-valley arbitrage in Haiti s energy storage system]

What is Peak-Valley arbitrage?

The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted in domestic and foreign time-of-use electricity price is mostly 3–6 times, and even reach 8–10 times in emergency cases.

How does reserve capacity affect peak-valley arbitrage income?

However, when the proportion of reserve capacity continues to increase, the increase of reactive power compensation income is not obvious and the active output of converter is limited, which reduces the income of peak-valley arbitrage and thus the overall income is decreased.

Are energy storage systems more cost-effective than batteries for Energy Arbitrage?

The retrofitted energy storage system is more cost-effective than batteries for energy arbitrage. In the context of global decarbonisation, retrofitting existing coal-fired power plants (CFPPs) is an essential pathway to achieving sustainable transition of power systems.

Is a retrofitted energy storage system profitable for Energy Arbitrage?

Optimising the initial state of charge factor improves arbitrage profitability by 16 %. The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. The retrofitted energy storage system is more cost-effective than batteries for energy arbitrage.

What is energy arbitrage?

Energy arbitrage means that ESSs charge electricity during valley hours and discharge it during peak hours, thus making profits via the peak-valley electricity tariff gap [ 14 ]. Zafirakis et al. [ 15] explored the arbitrage value of long-term ESSs in various electricity markets.

Is energy arbitrage profitability a sizing and scheduling Co-Optimisation model?

It proposes a sizing and scheduling co-optimisation model to investigate the energy arbitrage profitability of such systems. The model is solved by an efficient heuristic algorithm coupled with mathematical programming.

Guess what you want to know

-

Peak-valley arbitrage energy storage project

Peak-valley arbitrage energy storage project

-

Austria s peak-valley energy storage project goes bankrupt

Austria s peak-valley energy storage project goes bankrupt

-

Huawei Haiti Energy Storage Battery

Huawei Haiti Energy Storage Battery

-

Haiti battery energy storage cabinet bidding

Haiti battery energy storage cabinet bidding

-

New Energy Storage Peak-Valley Battery

New Energy Storage Peak-Valley Battery

-

Home peak-valley energy storage system

Home peak-valley energy storage system

-

Haiti energy storage tank equipment manufacturer

Haiti energy storage tank equipment manufacturer

-

Nanya battery energy storage box supplier

Nanya battery energy storage box supplier

-

Dutch lithium battery energy storage system design

Dutch lithium battery energy storage system design

-

What is the price of small energy storage

What is the price of small energy storage

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.