Energy storage systems in Southeast Asia: Four Real-World Projects

Four original case studies of solar power inverter systems with lithium batteries deployed in Southeast Asia—design choices, performance insights, and how storage cuts

Get a quote

Southeast Asia to reach 18 GW of pumped storage hydro by 2033

Pumped-storage hydropower in southeast Asia is projected to surge from 2.3 GW today to 18 GW by 2033, according to research by Rystad Energy. This growth represents a

Get a quote

Top 10 Energy Storage Developers in Asia | PF Nexus

Discover the current state of energy storage developers in Asia, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

Energy storage systems in Southeast Asia: Four Real-World

Four original case studies of solar power inverter systems with lithium batteries deployed in Southeast Asia—design choices, performance insights, and how storage cuts

Get a quote

ASEAN Energy Storage Market 6.78 CAGR Growth

Indonesia and Thailand are anticipated to dominate the ASEAN Energy Storage Market, driven by their significant investment in renewable

Get a quote

Sungrow is supplier to Thai solar-plus-storage project

What is thought to be Southeast Asia''s single largest battery energy storage system (BESS) to date will be supplied to a solar PV-plus

Get a quote

Southeast Asia residential energy storage market analysis:

We found: Extreme weather + preferential policies drive the development of Southeast Asian household energy storage market. Firstly, climate change affects the supply

Get a quote

Largest Energy Storage System in South-East Asia to

EMA appointed Sembcorp Industries to build, own and operate Energy Storage Systems (ESS) to enhance the resilience of our energy

Get a quote

Southeast Asia''s emerging energy storage opportuniti

Almost all Southeast Asian countries have experienced a doubling of their GDP since the turn of the millennium and seen their energy demand increase by around 3% every year in that time,

Get a quote

Energy storage 2022: biggest projects, financing and offtake deals

A roundup of the biggest projects, financing and offtake deals in the sector that Energy-Storage.news has reported on this year.

Get a quote

Southeast Asia residential energy storage market

We found: Extreme weather + preferential policies drive the development of Southeast Asian household energy storage market. Firstly,

Get a quote

Storage in the energy transition in Asia-Pacific | PFI

As Asia gears up for a shift to renewable energy, energy storage has come to the fore. But the transition to cleaner power can be a bumpy ride. To navigate the uncertain

Get a quote

A Race to the Top: Southeast Asia 2024

A Race to the Top 2024: Southeast Asia Operating solar and wind capacity in Southeast Asia grows by a fifth since last year, but only 3% of prospective projects are in construction

Get a quote

Improving battery storage in Southeast Asia

Southeast Asia is expected to become a major market for isolated grids which would only improve demand for energy storage systems. Governments in the region are now

Get a quote

Southeast Asia''s Energy Transition: Policy and

Touted to be Southeast Asia''s largest hydroelectric project, the project aims to generate up to 9 GW of electricity which would support

Get a quote

ENERGY TRANSITION IN SOUTHEAST ASIA: SOLVING

The first non-recourse project finance of a large-scale merchant BESS project was announced by MUFG on 7 May 2025, with revenue streams coming from energy arbitrage via the JEPX spot

Get a quote

Southeast Asia Battery Storage Market 2030: Trends, Policy, and

Southeast Asia''s battery storage market is set to hit USD 5 Bn by 2030, driven by policy, tech shifts, and energy demands in Vietnam, Philippines & Thailand.

Get a quote

ASEAN Energy Storage Market Size & Share Analysis

The ASEAN Energy Storage Market is expected to reach USD 3.55 billion in 2025 and grow at a CAGR of 6.78% to reach USD 4.92 billion by 2030. GS Yuasa Corporation,

Get a quote

Southeast Asia''s renewable investment to top $76 billion

Learn more with Rystad Energy''s Service Market Solution. Independent Power Producers (IPPs) lead green growth in Southeast Asia Pertamina Geothermal Energy (PGE),

Get a quote

Southeast Asia: Emerging energy storage opportunities

There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high growth in population and energy

Get a quote

Energy storage battery sales in southeast asia

Last October, the company announced the completion of Singapore''''s first-ever grid-scale energy storage project and said that it had received a further 90MW / 90MWh order for battery storage

Get a quote

ASEAN Energy Storage Market 6.78 CAGR Growth Outlook 2025

Indonesia and Thailand are anticipated to dominate the ASEAN Energy Storage Market, driven by their significant investment in renewable energy projects and supportive

Get a quote

Southeast Asia: Emerging energy storage opportunities

There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high

Get a quote

4 FAQs about [Independent energy storage project revenue in Southeast Asia]

Why does Southeast Asia need flexible energy storage solutions?

Southeast Asia's exponential growth in electricity demand, averaging over 6% annually over the past two decades, has created an urgent need for reliable and flexible energy storage solutions. This surge in demand is primarily driven by increasing ownership of household appliances and rising consumption of goods and services across the region.

Is Southeast Asia a good place to invest in energy storage?

Image: ACEN. There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high growth in population and energy demand. Andy Colthorpe speaks with companies working to establish a framework of opportunities in the region.

Can energy storage solutions be integrated into a power infrastructure?

Despite their different development stages, these markets share common challenges and opportunities in integrating energy storage solutions into their existing power infrastructure.

Which countries are adopting battery energy storage systems technology?

Countries like Singapore, the Philippines, and Thailand are leading the adoption of battery energy storage systems technology, with numerous projects under development. The technology's versatility in applications ranging from grid services to behind-the-meter installations for commercial and residential use is driving its adoption.

Guess what you want to know

-

Southeast Asia Power Supply and Energy Storage Project

Southeast Asia Power Supply and Energy Storage Project

-

Southeast Asia Industrial and Commercial Energy Storage Projects

Southeast Asia Industrial and Commercial Energy Storage Projects

-

East Asia Photovoltaic Energy Storage Project

East Asia Photovoltaic Energy Storage Project

-

South Asia Energy Storage Project

South Asia Energy Storage Project

-

Southeast Asia outdoor energy storage power supply custom factory

Southeast Asia outdoor energy storage power supply custom factory

-

Southeast Asia invests billions in energy storage battery factories

Southeast Asia invests billions in energy storage battery factories

-

West Asia Industrial and Commercial Photovoltaic Energy Storage Project

West Asia Industrial and Commercial Photovoltaic Energy Storage Project

-

Huawei Southeast Asia Photovoltaic Energy Storage Manufacturer

Huawei Southeast Asia Photovoltaic Energy Storage Manufacturer

-

Huawei Brunei Independent Energy Storage Project

Huawei Brunei Independent Energy Storage Project

-

East Asia Energy Bureau Energy Storage Project

East Asia Energy Bureau Energy Storage Project

Industrial & Commercial Energy Storage Market Growth

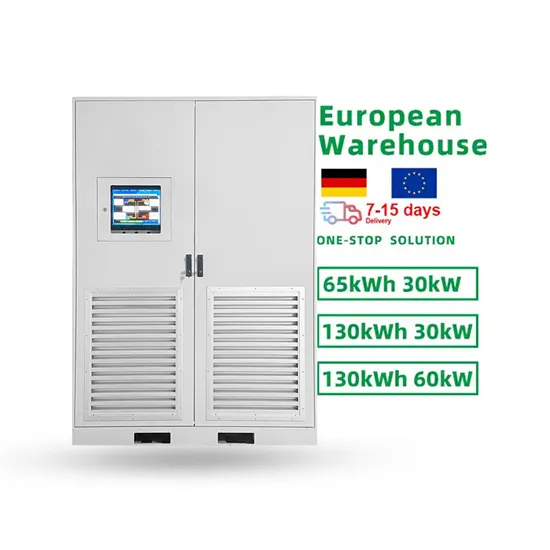

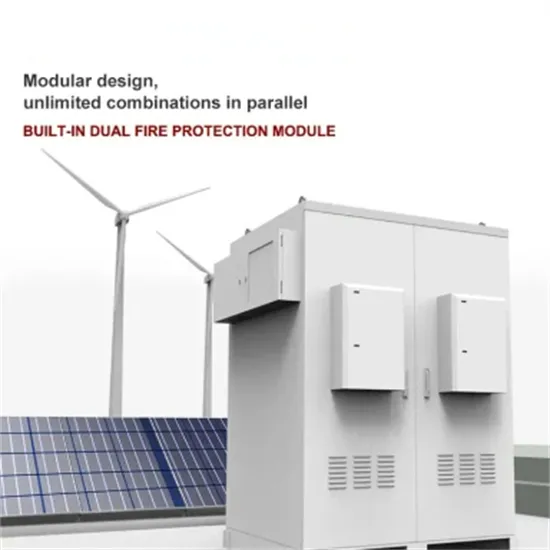

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

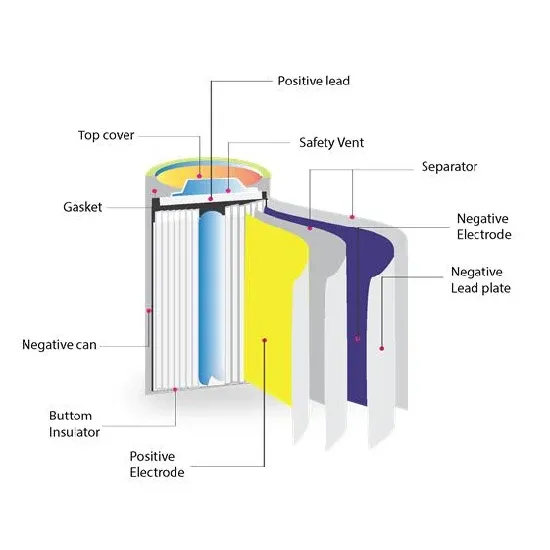

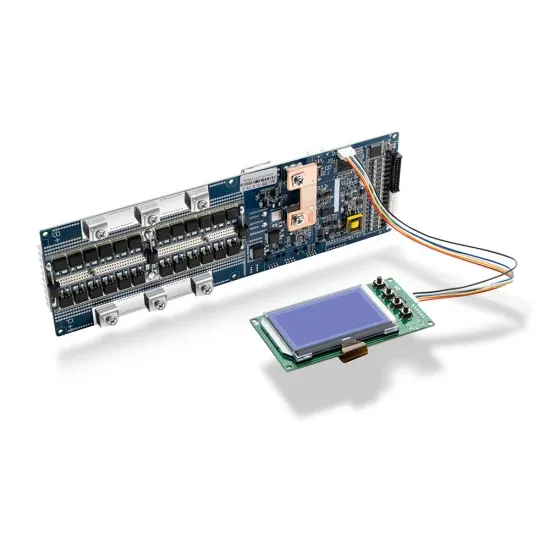

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.