Sunwoda smashed tens of billions of dollars to build a factory in

These cases show that China''s lithium battery manufacturers are collectively optimistic about Southeast Asia, and like photovoltaics, new energy vehicles and other fields, the head

Get a quote

ENERGY TRANSITION IN SOUTHEAST ASIA: SOLVING

Opportunities still exist for investors in Southeast Asia, particularly in the co-location of renewables projects with energy storage and Singapore''s ongoing procurement of low-carbon

Get a quote

Sunwoda smashed tens of billions of dollars to build a factory in

In July 2024, EVE Lithium Energy (SZ: 300014) announced that it plans to invest in the construction of energy storage battery and consumer battery manufacturing projects in

Get a quote

Many Lithium Battery Companies Announce Plans to Build Factories

On August 5, according to the news of the Federation of Industry and Innovation, several Chinese lithium battery companies announced their plans to establish factories in

Get a quote

Energy storage and power battery development in Southeast Asia

This article introduces the energy storage and battery development status in Southeast Asia, also why it''s developed and Chinese manufacturers in there.

Get a quote

Southeast Asia Seen Attracting $70 Billion on Hydro

(Bloomberg) -- Southeast Asia is expected to attract as much as $70 billion of investment over the next decade in hydro energy storage

Get a quote

battery energy storage system Archives

A battery energy storage system (BESS) project in Vietnam has received a grant of approximately USD3 million from the United States Embassy in Ho Chi Minh City.

Get a quote

Challenges Faced by Chinese Battery Companies in Overseas

Challenges Faced by Chinese Battery Companies in Overseas ExpansionIn the context of the global green and low-carbon transition, Chinese companies in the new energy

Get a quote

Fast-Growing Rack Battery Startups in Southeast Asia

Fast-growing rack battery startups in Southeast Asia are primarily driven by Chinese lithium industry leaders expanding production capacities and establishing integrated

Get a quote

ETN News | Energy Storage News | Renewable

ETN news is the leading magazine which covers latest energy storage news, renewable energy news, latest hydrogen news and much more. This

Get a quote

Battery energy storage systems: Southeast Asia''s key to

With 80% of the energy mix still reliant on finite resources, Southeast Asia faces a critical challenge: securing energy reliability while addressing climate change.

Get a quote

Battery energy storage systems: South-east Asia''s key to

Key economies such as the United States, China and Japan rely on fossil fuels for more than half of their energy supply. The situation is even more dire in South-east Asia, with

Get a quote

China, South Korea, and Japan looking into ASEAN''s

The ASEAN power grid allows countries in Southeast Asia to trade electricity freely to meet rising demand, among other benefits. Southeast

Get a quote

ASEAN Energy Storage Market Size & Share Analysis

The Battery Energy Storage Systems (BESS) segment is experiencing rapid growth in the ASEAN energy storage market, driven by declining battery costs and increasing

Get a quote

Battery energy storage systems: South-east Asia''s

Key economies such as the United States, China and Japan rely on fossil fuels for more than half of their energy supply. The situation is even

Get a quote

Southeast Asia Seen Attracting $70 Billion on Hydro Battery

(Bloomberg) -- Southeast Asia is expected to attract as much as $70 billion of investment over the next decade in hydro energy storage systems in order to manage an

Get a quote

Tracking the EV battery factory construction boom

Battery factories are popping up across North America. Here''s where they are and how the Inflation Reduction Act influenced the boom.

Get a quote

Southeast Asia Battery Industry Trends: Examining Market

Battery demand in Southeast Asia primarily stems from two key segments: electric vehicle (EV) batteries and battery energy storage systems (BESS). In certain nations such as

Get a quote

Chinese Battery Companies Accelerate Production

This trend highlights the growing push by Chinese battery manufacturers to establish a stronger presence in the region amid rising

Get a quote

Southeast Asia Battery Storage Market 2030: Trends, Policy, and

Southeast Asia''s battery storage market is set to hit USD 5 Bn by 2030, driven by policy, tech shifts, and energy demands in Vietnam, Philippines & Thailand.

Get a quote

Many Lithium Battery Companies Announce Plans to Build

On August 5, according to the news of the Federation of Industry and Innovation, several Chinese lithium battery companies announced their plans to establish factories in

Get a quote

Sodium-ion: PV-integrated C&I solution launched in Southeast Asia

Unigrid and Blue Whale Energy claim the combined solar-plus-storage solution unlocks the potential of C&I rooftop solar PV. Image: Blue Whale Energy. A new partnership

Get a quote

Analysis: Why Southeast Asia is Becoming a Manufacturing Hub

By Li Rongqian and Denise Jia Southeast Asia is becoming a magnet for Chinese companies wanting to relocate their mid-to-upstream supply chain to avoid the United States''

Get a quote

Tesla to Invest in Indonesian Battery Manufacturing,

Jokowi said that Indonesia was also open to Musk investing in the EV battery manufacturing sector, which has already seen investments from

Get a quote

6 FAQs about [Southeast Asia invests billions in energy storage battery factories]

What is the fastest growing segment in Southeast Asia lithium-ion battery market?

The automotive segment is emerging as the fastest-growing segment in the Southeast Asia lithium-ion battery market, with an expected growth rate of approximately 32% during 2024-2029.

What drives the Southeast Asia lithium-ion battery market landscape?

The consumer electronics and other applications segments continue to play vital roles in shaping the Southeast Asia lithium-ion battery market landscape. The consumer electronics segment is driven by the region's growing middle class, increasing smartphone penetration, and rising demand for portable battery electronic devices.

Is Vietnam a leader in Southeast Asia's lithium-ion battery market?

Vietnam has established itself as the dominant force in Southeast Asia's lithium-ion battery market, commanding approximately 64% of the regional market share in 2024. The country's strategic advantage stems from its abundant high-quality nickel reserves, which have become increasingly attractive to international mining companies.

Which countries are adopting battery energy storage systems technology?

Countries like Singapore, the Philippines, and Thailand are leading the adoption of battery energy storage systems technology, with numerous projects under development. The technology's versatility in applications ranging from grid services to behind-the-meter installations for commercial and residential use is driving its adoption.

Why does Southeast Asia need flexible energy storage solutions?

Southeast Asia's exponential growth in electricity demand, averaging over 6% annually over the past two decades, has created an urgent need for reliable and flexible energy storage solutions. This surge in demand is primarily driven by increasing ownership of household appliances and rising consumption of goods and services across the region.

Why is the Philippines a leader in battery energy storage?

The country's leadership position is driven by its progressive energy policies and ambitious renewable energy integration goals. The Philippines has established itself as a pioneer in battery energy storage system (BESS) deployment, with multiple large-scale projects under development across its various islands.

Guess what you want to know

-

Southeast Asia Energy Storage Battery Brand Ranking

Southeast Asia Energy Storage Battery Brand Ranking

-

Southeast Asian outdoor energy storage battery exports

Southeast Asian outdoor energy storage battery exports

-

Central Asia Home System Energy Storage Battery

Central Asia Home System Energy Storage Battery

-

East Asia Energy Storage Battery Quote

East Asia Energy Storage Battery Quote

-

Central Asia Household Energy Storage Battery

Central Asia Household Energy Storage Battery

-

West Asia 5kW home energy storage battery

West Asia 5kW home energy storage battery

-

Southeast Asia outdoor energy storage power supply custom factory

Southeast Asia outdoor energy storage power supply custom factory

-

Southeast Asia Outdoor Energy Storage

Southeast Asia Outdoor Energy Storage

-

North Asia Energy Storage Battery

North Asia Energy Storage Battery

-

East Asia Energy Storage Battery Specifications

East Asia Energy Storage Battery Specifications

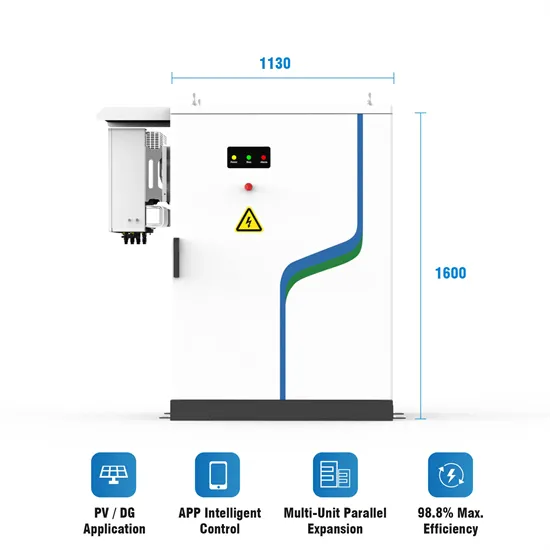

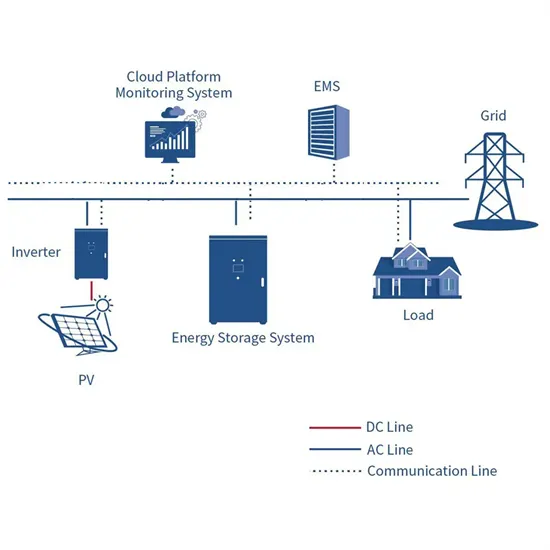

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.