Sungrow awarded 600MWh BESS contract for Saudi

The project aims to transform stretches of desert near the Red Sea coast into a sustainable business, tourism and residential development.

Get a quote

ASIA SUSTAINABLE ENERGY WEEK

ASIA Sustainable Energy Week 2026 (ASEW) returns as the region''s most influential platform driving clean energy transformation. Bringing together innovators, policymakers, and industry

Get a quote

Market attractiveness analysis of battery energy

Battery energy storage systems (BESS) have emerged as a solution for mitigating the intermittent nature of solar and wind power with the

Get a quote

Scaling Energy Storage in the MENA Region Amidst Renewables

With renewable energy projects expanding across the region, energy storage has started gaining traction. Unlike Europe, North America, and Asia, where renewable energy and

Get a quote

ASEAN Energy Storage Market 6.78 CAGR Growth Outlook 2025

Key market insights indicate a growing preference for battery storage systems in ASEAN countries. This shift is largely due to the increasing adoption of renewable energy

Get a quote

Wärtsilä Energy Storage

We have deployed or contracted over 18 GWh of energy storage across more than 130 sites worldwide. Backed by Wärtsilä''s reputation as a bankable and

Get a quote

Largest Energy Storage System in South-East Asia to

EMA appointed Sembcorp Industries to build, own and operate Energy Storage Systems (ESS) to enhance the resilience of our energy

Get a quote

Opportunities for Battery Storage in Asia and Australia

Energy storage deployment started in the US, Japan, Korea and Europe –countries developing storage technologies –while Australia has come on strong 5 Source: DOE Global Energy

Get a quote

Bid for east asia energy storage project

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries. Several

Get a quote

East Asia Battery Market Analysis

The East Asia battery market refers to the market for batteries, which are energy storage devices used to store and release electrical energy. Batteries are composed of one or more

Get a quote

Southeast Asia Battery Storage Market 2030: Trends, Policy, and

Southeast Asia''s battery storage market is set to hit USD 5 Bn by 2030, driven by policy, tech shifts, and energy demands in Vietnam, Philippines & Thailand.

Get a quote

ASEAN Energy Storage Market Size & Share Analysis

The Battery Energy Storage Systems (BESS) segment is experiencing rapid growth in the ASEAN energy storage market, driven by declining battery costs and increasing

Get a quote

Asia Pacific Energy Storage Systems Market Size,

In April 2025, Panasonic announced a strategic shift in its battery production, focusing more on lithium iron phosphate (LFP) batteries to align with the

Get a quote

Southeast Asia''s emerging energy storage opportuniti

Southeast Asia''s emerging energy storage opportunities Southeast Asia''s emerging energy storage opportunities Southeast Asia | There has been an uptick in energy storage investment

Get a quote

Southeast Asia Battery Energy Storage System Market Size

Discover the Southeast Asia Battery Energy Storage System market growth trends, size, demand, and key companies driving innovation and value in the industry.

Get a quote

Largest Energy Storage & Batteries companies in Asia by Market

This ranking features the largest 592 Energy Storage & Batteries companies in Asia ranked by Market Capitalization, totaling a Market Capitalization of USD 1.47 T, for July 24, 2025.

Get a quote

Asia-Pacific Energy Storage System Price Trends: What You

Let''s face it – the Asia-Pacific energy storage system price trends are hotter than a lithium battery on a summer day. From solar farms in Australia to EV factories in China, everyone''s asking:

Get a quote

North asia energy storage machine quote

The Energy Storage Market size is expected to reach USD 51.10 billion in 2024 and grow at a CAGR of 14.31% to reach USD 99.72 billion by 2029. battery storage deployment has been

Get a quote

Asia is building the backbone of its renewable future with energy

From Southeast Asia to India and Australia, landmark policies, first-of-their-kind projects and bold investment decisions show that energy storage is no longer a niche

Get a quote

ASEAN Energy Storage Market 6.78 CAGR Growth

Key market insights indicate a growing preference for battery storage systems in ASEAN countries. This shift is largely due to the increasing

Get a quote

ASEAN Energy Storage Market 6.78 CAGR Growth

The size of the ASEAN Energy Storage Market was valued at USD 3.32 Million in 2023 and is projected to reach USD 5.25 Million by 2032, with

Get a quote

Asia Pacific Energy Storage Systems Market Size, Share

In April 2025, Panasonic announced a strategic shift in its battery production, focusing more on lithium iron phosphate (LFP) batteries to align with the growing demand for cost-effective and

Get a quote

East asia energy storage battery container

Will Singapore expand its biggest battery storage plant? Singapore''s government and Energy Market Authority have announced power sector and grid enhancements,including a possible

Get a quote

Asia is building the backbone of its renewable future with energy storage

From Southeast Asia to India and Australia, landmark policies, first-of-their-kind projects and bold investment decisions show that energy storage is no longer a niche

Get a quote

Wärtsilä Energy Storage

We have deployed or contracted over 18 GWh of energy storage across more than 130 sites worldwide. Backed by Wärtsilä''s reputation as a bankable and reliable partner, our

Get a quote

3 FAQs about [East Asia Energy Storage Battery Quote]

Does ASEAN need energy storage?

The ASEAN energy storage landscape is undergoing a significant transformation driven by the region's ambitious renewable energy goals and growing energy demands. The ASEAN Centre for Energy (ACE) projects the region's total final energy consumption to increase by 146% by 2040, highlighting the urgent need for robust energy storage systems.

Why does Southeast Asia need flexible energy storage solutions?

Southeast Asia's exponential growth in electricity demand, averaging over 6% annually over the past two decades, has created an urgent need for reliable and flexible energy storage solutions. This surge in demand is primarily driven by increasing ownership of household appliances and rising consumption of goods and services across the region.

Which countries are adopting battery energy storage systems technology?

Countries like Singapore, the Philippines, and Thailand are leading the adoption of battery energy storage systems technology, with numerous projects under development. The technology's versatility in applications ranging from grid services to behind-the-meter installations for commercial and residential use is driving its adoption.

Guess what you want to know

-

East Asia Energy Storage Battery Specifications

East Asia Energy Storage Battery Specifications

-

North Asia Large Energy Storage Battery Life

North Asia Large Energy Storage Battery Life

-

East Asia Industrial and Commercial Energy Storage Cabinet

East Asia Industrial and Commercial Energy Storage Cabinet

-

East Asia Valley Energy Storage Device

East Asia Valley Energy Storage Device

-

Central Asia Home System Energy Storage Battery

Central Asia Home System Energy Storage Battery

-

East Asia Energy Storage System Integration

East Asia Energy Storage System Integration

-

North Asia Energy Storage Lithium Battery Manufacturer

North Asia Energy Storage Lithium Battery Manufacturer

-

Huawei Middle East energy storage battery customization

Huawei Middle East energy storage battery customization

-

East Asia s new energy storage industry

East Asia s new energy storage industry

-

East Asia Energy Storage Power Supply Customization

East Asia Energy Storage Power Supply Customization

Industrial & Commercial Energy Storage Market Growth

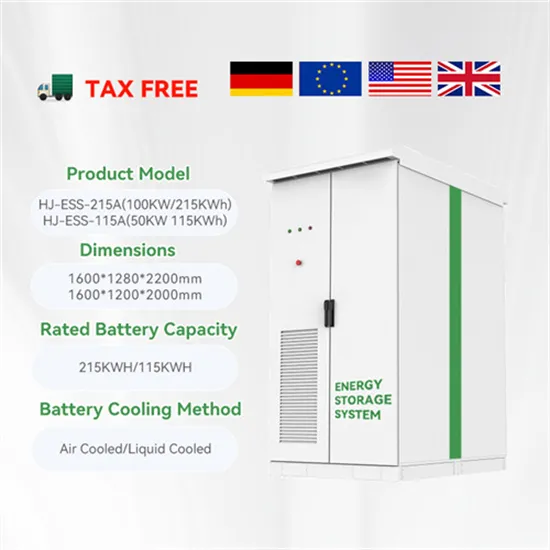

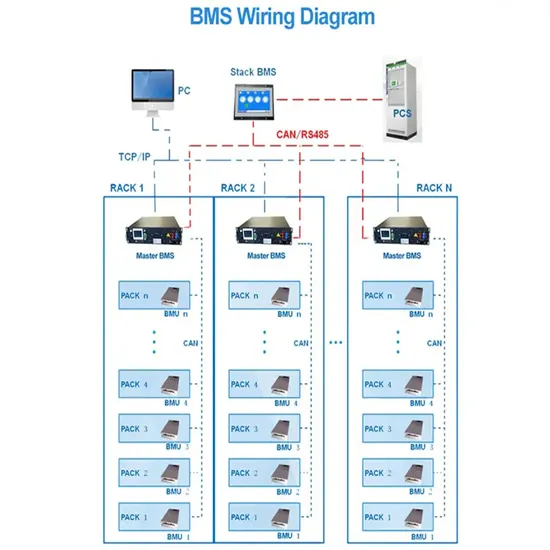

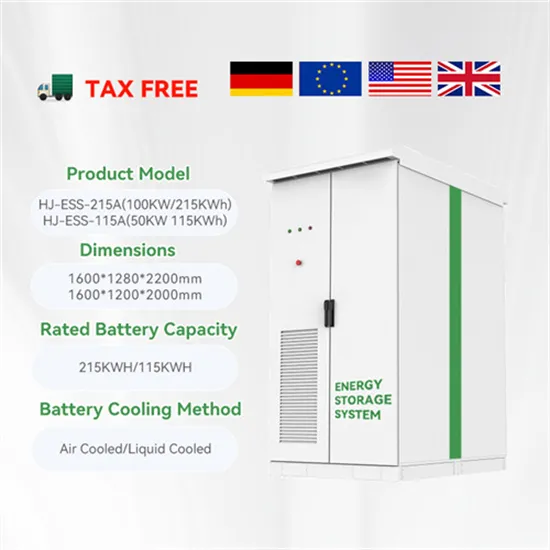

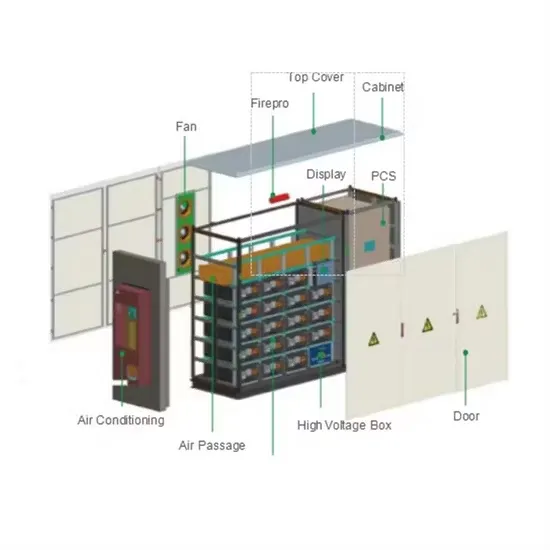

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.