Emerging Energy Storage Markets Analysis in

A total of 47,100 residential battery energy storage systems will be deployed, a year-on-year increase of 73.8%. According to BNEF data, in

Get a quote

Southeast Asia Battery Industry Trends: Examining

The demand for battery manufacturing output from Southeast Asia is poised to be primarily driven by exports to other regions, notably the US and

Get a quote

ABB supplies Southeast Asia''s largest battery energy storage system

Cambodia''s clean energy shift exceeds ASEAN goals The use of clean energy in Cambodia''s national grid has risen significantly, now constituting over 62% of total energy

Get a quote

Market attractiveness analysis of battery energy storage systems

By assessing BESS market attractiveness in five key Southeast Asian countries (Indonesia, Malaysia, the Philippines, Thailand, and Vietnam), this study investigates the

Get a quote

Southeast Asia Battery Energy Storage System Market Size

Discover the Southeast Asia Battery Energy Storage System market growth trends, size, demand, and key companies driving innovation and value in the industry.

Get a quote

Southeast Asia Energy Outlook 2024

The Southeast Asia Energy Outlook 2024 is the sixth edition of this special report, making Southeast Asia by far the most regularly updated regional outlook compiled by the

Get a quote

China s New Energy Enterprises Going Abroad Series:

In the future, as global demand for clean energy continues to rise and China''s new energy industry continues to gain in competitiveness, it is expected that China will export a greater

Get a quote

Renewable Energy Manufacturing

The demand for batteries in Southeast Asia is primarily driven by two segments: EV batteries and battery energy storage systems (BESS). In some countries like Indonesia, Thailand, and Viet

Get a quote

Energy storage battery market in southeast asia

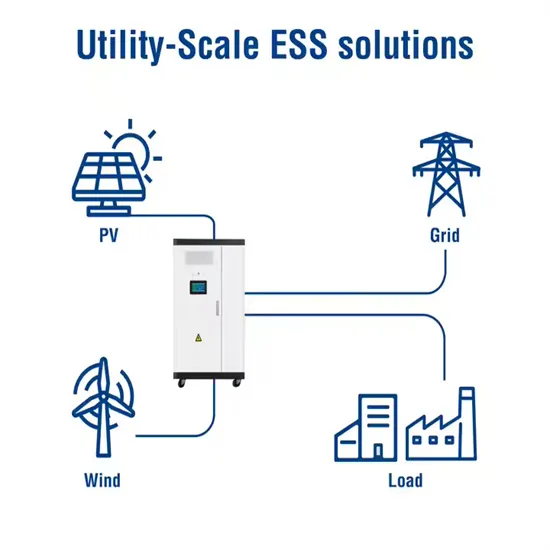

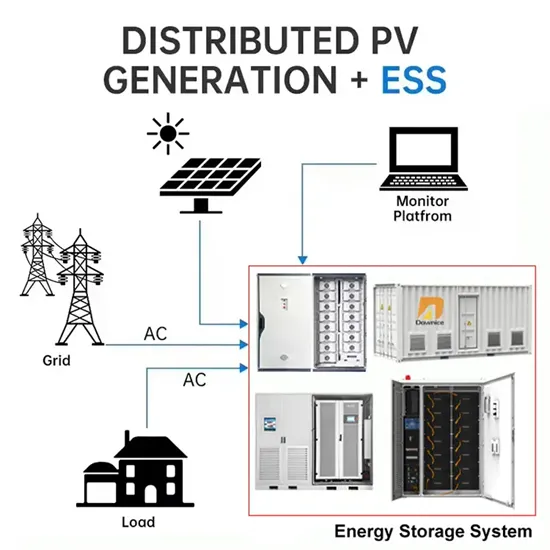

Battery energy storage systems (BESS) have emerged as a solution for mitigating the intermittent nature of solar and wind power with the rise of renewable energy. The application of BESS is

Get a quote

Battery energy storage systems: Southeast Asia''s key to

With 80% of the energy mix still reliant on finite resources, Southeast Asia faces a critical challenge: securing energy reliability while addressing climate change.

Get a quote

Emerging Energy Storage Markets Analysis in Southeast Asia,

A total of 47,100 residential battery energy storage systems will be deployed, a year-on-year increase of 73.8%. According to BNEF data, in 2022, the installed capacity of

Get a quote

BESS the Linchpin for Asia''s Renewable Energy Targets

The Asia Pacific region is predicted to account for almost 70 percent of the global battery energy storage market through 2026 BESS compound annual growth rates in Asia are

Get a quote

Market attractiveness analysis of battery energy

By assessing BESS market attractiveness in five key Southeast Asian countries (Indonesia, Malaysia, the Philippines, Thailand, and Vietnam),

Get a quote

Battery energy storage systems: South-east Asia''s key to

Key economies such as the United States, China and Japan rely on fossil fuels for more than half of their energy supply. The situation is even more dire in South-east Asia, with

Get a quote

Opportunities for Battery Storage in Asia and Australia

Energy storage deployment started in the US, Japan, Korea and Europe –countries developing storage technologies –while Australia has come on strong 5 Source: DOE Global Energy

Get a quote

ASEAN Energy Storage Market Size & Share Analysis

ASEAN Energy Storage Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030) The ASEAN energy storage market is

Get a quote

Batteries Surge in Southeast Asia Energy Storage Market

Southeast Asia''s nascent energy storage market is growing quickly, with many companies planning to deploy more capacity over the next decade. The regions'' power market regulations

Get a quote

Batteries Surge in Southeast Asia Energy Storage

Southeast Asia''s nascent energy storage market is growing quickly, with many companies planning to deploy more capacity over the next decade. The

Get a quote

ASEAN Energy Storage Market Size & Share Analysis

The Battery Energy Storage Systems (BESS) segment is experiencing rapid growth in the ASEAN energy storage market, driven by declining battery costs and increasing

Get a quote

US reciprocal tariffs to reduce China''s lithium-ion battery exports

2) Global Production Network Southeast Asia: CATL''s $6 billion base in Indonesia and Gotion High Tech''s 20 GWh project in Vietnam. Middle East: BYD receives a 12.5 GWh

Get a quote

Southeast Asia Battery Storage Market 2030: Trends, Policy, and

Southeast Asia''s battery storage market is set to hit USD 5 Bn by 2030, driven by policy, tech shifts, and energy demands in Vietnam, Philippines & Thailand.

Get a quote

Battery energy storage systems: South-east Asia''s

Key economies such as the United States, China and Japan rely on fossil fuels for more than half of their energy supply. The situation is even

Get a quote

5 FAQs about [Southeast Asian outdoor energy storage battery exports]

Which countries are adopting battery energy storage systems technology?

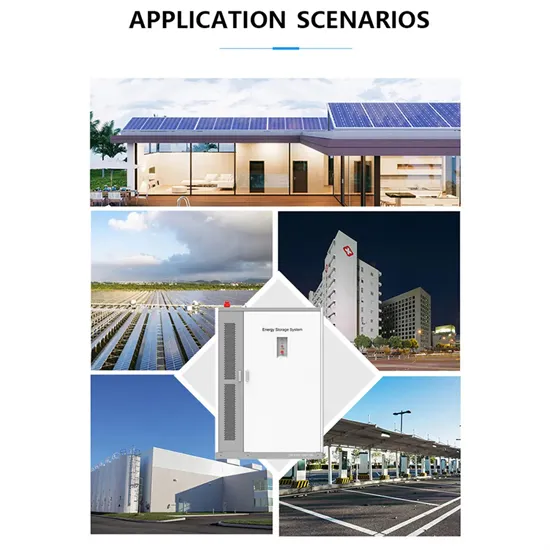

Countries like Singapore, the Philippines, and Thailand are leading the adoption of battery energy storage systems technology, with numerous projects under development. The technology's versatility in applications ranging from grid services to behind-the-meter installations for commercial and residential use is driving its adoption.

Why does Southeast Asia need flexible energy storage solutions?

Southeast Asia's exponential growth in electricity demand, averaging over 6% annually over the past two decades, has created an urgent need for reliable and flexible energy storage solutions. This surge in demand is primarily driven by increasing ownership of household appliances and rising consumption of goods and services across the region.

Is Bess facilitating the energy transition in Southeast Asia?

Despite the crucial role that BESS play in facilitating the energy transition, Southeast Asia’s BESS market remains in its early stages, marked by a lack of significant BESS policies. Implementing policies to foster a competitive market environment for BESS can attract investors and lead to widespread adoption of the BESS.

Does ASEAN need energy storage?

The ASEAN energy storage landscape is undergoing a significant transformation driven by the region's ambitious renewable energy goals and growing energy demands. The ASEAN Centre for Energy (ACE) projects the region's total final energy consumption to increase by 146% by 2040, highlighting the urgent need for robust energy storage systems.

How will Bess help Southeast Asia reshape the energy landscape?

By providing flexible, reliable, and scalable power, BESS enables Southeast Asia to overcome traditional infrastructure limitations and embrace a sustainable future. What role will BESS play in reshaping Southeast Asia’s energy landscape? Explore the insights here.

Guess what you want to know

-

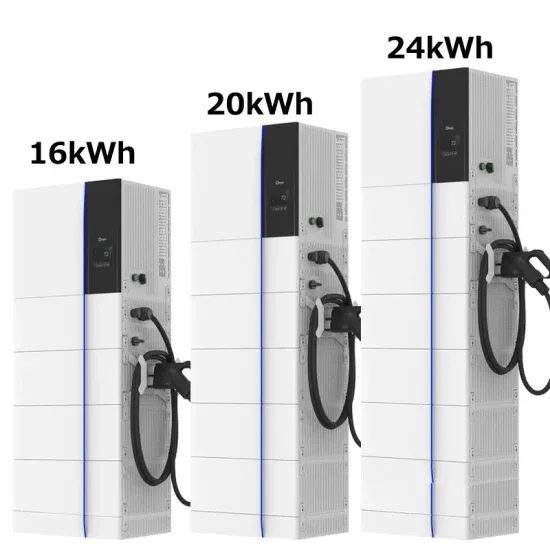

Southeast Asian large-capacity energy storage battery manufacturers

Southeast Asian large-capacity energy storage battery manufacturers

-

Egypt s outdoor energy storage battery companies

Egypt s outdoor energy storage battery companies

-

Home outdoor energy storage battery

Home outdoor energy storage battery

-

Energy storage cabinet outdoor solar power supply energy storage battery self-operated

Energy storage cabinet outdoor solar power supply energy storage battery self-operated

-

Columbia outdoor energy storage battery pack

Columbia outdoor energy storage battery pack

-

Ethiopia rechargeable energy storage battery exports

Ethiopia rechargeable energy storage battery exports

-

Outdoor energy storage battery factory

Outdoor energy storage battery factory

-

Outdoor Energy Storage Battery Solution Company

Outdoor Energy Storage Battery Solution Company

-

Generations of Energy Storage Cabinet Battery Outdoor Sites

Generations of Energy Storage Cabinet Battery Outdoor Sites

-

Outdoor cabinet battery energy storage cabinet installation

Outdoor cabinet battery energy storage cabinet installation

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.