The One Big Beautiful Bill Modifies Renewable Energy

For a description of the renewable energy and energy storage-related changes made in the Inflation Reduction Act, see our prior alert.

Get a quote

What Nonprofits Need to Know about the Investment Tax Credit

In the July 2025 "One Big Beautiful Bill Act," Congress terminated key aspects of the Investment Tax Credit (ITC) for solar and wind projects and created barriers for projects

Get a quote

Incentives and credits tax provisions in "One Big Beautiful Bill

The Senate bill treats an entity as a foreign-influenced entity if the payments to the specified foreign entities are pursuant to an agreement that entitles the specified foreign entity

Get a quote

Battery Energy Storage Financing Structures and Revenue

This Practice Note discusses changes to financing structures for battery storage projects after the enactment of the Inflation Reduction Act. This Note also discusses the fixed and variable

Get a quote

Can energy storage tax credits be sold or transferred to other entities

Yes, energy storage tax credits can be sold or transferred to other entities. The Inflation Reduction Act of 2022 allows certain clean energy tax credits, including those for

Get a quote

Clean Energy Tax Changes Cut Timelines, Add Red Tape | Balch

Stand-alone storage projects, or storage projects installed with a wind or solar facility, that begin construction by the end of 2033 will retain full eligibility for the Section 48E

Get a quote

One Big Beautiful Bill Act Cuts the Power: Phase‑Outs, Foreign‑Entity

One Big Beautiful Bill Act Cuts the Power: Phase‑Outs, Foreign‑Entity Restrictions, and Domestic Content in Clean‑Energy Credits Blog Tax Law Defined® Blog

Get a quote

The One Big Beautiful Bill Act: Changing the

No changes in other areas of clean energy — The tax credits for other clean energy technologies — such as battery storage, geothermal, and

Get a quote

Client Alert: Reconciliation Bill Passes House: Detailed Analysis

Introduction The House of Representatives has passed a sweeping tax reconciliation bill that makes significant changes to the U.S. energy tax credit regime. The bill, as originally reported

Get a quote

One Big Beautiful Bill New Law Disrupts Clean Energy Investment

In contrast, the OBBB largely preserves tax credits into the next decade for newer clean energy technologies, like battery storage and carbon capture. However, all new clean

Get a quote

"Prohibited Foreign Entity" Restrictions In The OBBBA Restrict

The prohibition on "material assistance" by Prohibited Foreign Entities for most projects that begin construction after 2025 imposes complex due diligence requirements on

Get a quote

One Big Beautiful Bill New Law Disrupts Clean Energy

In contrast, the OBBB largely preserves tax credits into the next decade for newer clean energy technologies, like battery storage and carbon

Get a quote

Qualifying Advanced Energy Project Credit (48C) Frequently

A taxpayer can determine whether its project is located within a § 48C(e)(e) Energy Communities Census Tract by referring to the list of Section 48C(e)(e) Energy Communities

Get a quote

What the budget bill means for energy storage tax credit eligibility

Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an ITC of up to 50% under 48E if domestic

Get a quote

Clean Energy Infrastructure Funding for Projects and Programs

Energy storage projects will improve the reliability of transmission and distribution systems, especially in traditionally high-energy cost rural areas; more efficiently supply energy at peak

Get a quote

The One Big Beautiful Bill Modifies Renewable Energy Tax Credits

For a description of the renewable energy and energy storage-related changes made in the Inflation Reduction Act, see our prior alert. Following is a summary of some of the more

Get a quote

House Passes Major Cuts to IRA Clean Energy Tax Credit

FEOC RULES: The Bill contains new Prohibited Foreign Entity ("PFE") rules that are applicable to the Clean Electricity Investment Tax Credit ("ITC") (§ 48E); the Clean

Get a quote

How do tax equity investors benefit from standalone energy storage projects

Energy storage projects offer depreciation benefits, which can significantly enhance the return on investment for tax equity investors. Depreciation can add 10-20% to the project

Get a quote

Foreign entity rules to transform clean energy tax credits

The landscape of clean energy tax credits is undergoing significant changes due to new restrictions on foreign entities. As outlined in the recent

Get a quote

Publication 6045 (Rev. 2-2025)

Tax-exempt and governmental entities, such as state and local governments, Tribes, religious organizations, and non-profits may install energy-generation and storage property to meet

Get a quote

What the budget bill means for energy storage tax

Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an

Get a quote

House Passes One Big Beautiful Bill: Implications for Clean

KEY CHANGES TO CLEAN ENERGY TAX CREDITS The Bill substantially pares back the existing clean energy tax credit regime by accelerating the termination of a number of credits,

Get a quote

"Prohibited Foreign Entity" restrictions in the OBBBA restrict tax

"Prohibited Foreign Entity" restrictions in the OBBBA restrict tax credits in connection with Chinese investment in US-based energy storage projects

Get a quote

Energy sector tax provisions in "One Big Beautiful Bill"

This document serves as a quick guide to the provisions in the legislation affecting the energy sector. The focus is particularly on clean energy initiatives, emphasizing the important

Get a quote

Tax-exempt investment in partnerships holding energy properties

If tax – exempt entities invest in energy projects through partnerships, careful consideration should be given to allocations under the respective partnership arrangements to

Get a quote

Can energy storage tax credits be sold or transferred

Yes, energy storage tax credits can be sold or transferred to other entities. The Inflation Reduction Act of 2022 allows certain clean energy tax

Get a quote

48E Tax Credit: Claiming the Clean Electricity ITC

With a long-term policy signal available for investment into a wider range of clean technologies and systems, more industries could follow a

Get a quote

6 FAQs about [Change of investment entity energy storage project]

Who can install energy-generation & storage property?

Tax-exempt and governmental entities, such as state and local governments, Tribes, religious organizations, and non-profits may install energy-generation and storage property to meet energy demands, reach clean energy transition goals, or save money on energy costs.

What are the tax benefits of investing in energy projects?

Investments in energy projects offer two primary tax benefits: the ITC and accelerated depreciation. Some developers cannot use these tax benefits themselves but can use them to incentivize tax equity investors that provide bridge financing until the projects receive cash payments.

What is the base tax credit for energy projects?

• For projects beginning construction on or after Jan. 29, 2023 or where the maximum net output is 1 MW or greater, the base tax credit is 6% of the taxpayer’s basis in the energy property or qualified facility (or energy storage technology).

What are the major energy-related changes in the Energy Act?

Some of the other significant energy-related changes in the Act include: Denial of the PTC or ITC with respect to solar or small wind energy property that qualified for the residential clean energy credit under Section 25D of the Internal Revenue Code and is subject to a lease arrangement.

Are storage projects eligible for ITC & PTC?

Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an ITC of up to 50% under 48E if domestic content and labor standards are met, though the ITC will phase out entirely by 2035.

How does the inflation Reduction Act affect energy investment?

The Inflation Reduction Act also established the technology – neutral zero greenhouse gas (GHG) emission electricity investment credit under Sec. 48E, which replaces Sec. 48 as the primary tax incentive for investment in clean – energy facilities placed in service after 2024.

Guess what you want to know

-

Four electric energy storage project investment companies in Somalia

Four electric energy storage project investment companies in Somalia

-

The largest energy storage project investment

The largest energy storage project investment

-

Energy Storage Project Investment Benefits

Energy Storage Project Investment Benefits

-

Myanmar lithium battery energy storage investment project

Myanmar lithium battery energy storage investment project

-

Island investment energy storage power station project

Island investment energy storage power station project

-

Energy storage project investment structure

Energy storage project investment structure

-

Saint Lucia Energy Storage Battery Investment Project

Saint Lucia Energy Storage Battery Investment Project

-

Small investment energy storage project

Small investment energy storage project

-

Malawi Energy Storage Power Station Investment Project

Malawi Energy Storage Power Station Investment Project

-

Mobile energy storage equipment investment project

Mobile energy storage equipment investment project

Industrial & Commercial Energy Storage Market Growth

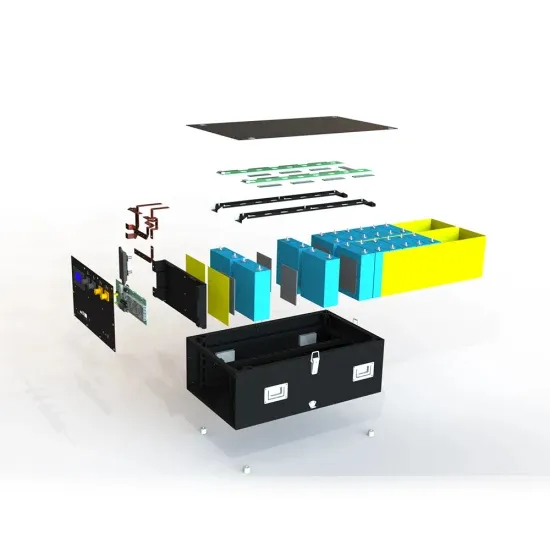

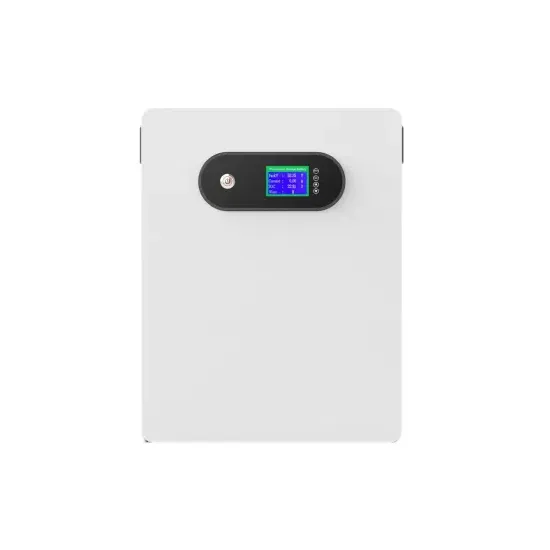

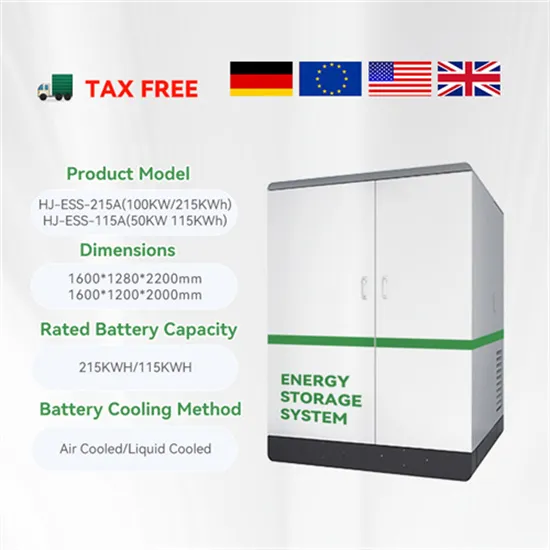

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.