Australian battery storage sector

A key solution is utilising energy storage systems, specifically, battery energy storage systems (BESS). While other energy storage technologies, such as pumped hydro, are an important

Get a quote

Gigantic Energy Storage Project Taking Shape In Kentucky

Pumped hydropower is the basis for 96% of utility-scale energy storage capacity in the US, and it is ripe with potential for expansion.

Get a quote

Blueprint 3A How-To Guide: Solar + Storage Power

Decide whether to include solar + storage projects in a procurement based on storage benefits for addressing energy cost savings and/or resilience use cases at specific sites.

Get a quote

What are the investment models for energy storage projects?

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through different financial mechanisms,

Get a quote

Next step in China''s energy transition: energy storage deployment

China''s industrial and commercial energy storage is poised for robust growth after showing great market potential in 2023, yet critical challenges remain.

Get a quote

Energy Storage Financing: Project and Portfolio Valuation

This study investigates the issues and challenges surrounding energy storage project and portfolio valuation and provide insights into improving visibility into the process for developers,

Get a quote

Energy Storage Power Station Investment Insights: Breaking

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get a quote

The Art of Financing Battery Energy Storage Systems

Author: Elgar Middleton The Art of Financing Battery Energy Storage Systems (BESS) Elgar Middleton has extensive debt and equity

Get a quote

Energy Storage Investments – Publications

Generally, energy storage targets can be broken down into two categories: (1) development-stage, pre-operational projects and (2) operational projects.

Get a quote

127135|123800

The financing mechanisms for onsite renewable generation, energy storage, and energy eficiency projects include a spectrum of options ranging from traditional to specialized.

Get a quote

Battery Energy Storage Financing Structures and Revenue

This Practice Note discusses changes to financing structures for battery storage projects after the enactment of the Inflation Reduction Act. This Note also discusses the fixed and variable

Get a quote

Energy storage project structure analysis

The majority of new energy storage installations over the last decade have been in front-of-the-meter, utility-scale energy storage projects that will be developed and constructed pursuant to

Get a quote

Fidra Energy secures £445m financing for Thorpe Marsh BESS project

23 hours ago· Fidra Energy has received up to £445m ($601.1m) in equity investment from EIG and the National Wealth Fund (NWF) for the Thorpe Marsh battery energy storage system

Get a quote

Financing energy storage projects: assessing risks

In part one of this article, we discussed the types of energy storage and the incentives that are supporting its development. Now let''s look at the financing issues and the project risks

Get a quote

Demystifying Energy Storage Project Investment Structure: A

Think of energy storage projects like your morning coffee ritual: you need the right ingredients (batteries), proper brewing time (project timelines), and a sturdy mug (investment structure) to

Get a quote

World Bank Document

However, these projects have mostly been commissioned in developed countries, despite it being clear that batteries can deliver substantial benefits in less developed countries. As shown in

Get a quote

What are the investment models for energy storage

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through

Get a quote

Energy Storage in the UK

The aim of this report is to increase knowledge of the industry among various stakeholders. This report encompasses an updated summary of the current technologies; support available

Get a quote

Structuring a bankable project: energy storage

It looks at common types of energy storage projects, the typical financing structures and the principal requirements for obtaining financing. It also highlights the key points that parties

Get a quote

Energy Storage Financing for Social Equity

Abstract Energy storage technologies are uniquely qualified to help energy projects with a social equity component achieve better financing options while providing the needed benefits for the

Get a quote

Navigating energy storage financing amidst rising interest rates

The path forward will require creativity, coordination, and continued investment—but the rewards are clear: a more resilient, reliable, and decarbonized grid.

Get a quote

Q&A: Innovative Capital Structures to Finance Clean

Growing demand for renewable energy and decarbonization methods makes it critical for organizations to tap into innovative investment

Get a quote

6 FAQs about [Energy storage project investment structure]

Are energy storage projects different than power industry project finance?

Most groups involved with project development usually agree that energy storage projects are not necessarily different than a typical power industry project finance transaction, especially with regards to risk allocation.

Are energy storage systems a good investment?

This is understandable as energy storage technologies possess a number of inter-related cost, performance, and operating characteristics that and impart feed-back to impacts to the other project aspects. However, this complexity is the heart of the value potential for energy storage systems.

What economic inputs are included in the energy storage model?

The economic inputs into the model will include both the revenue and costs for the project. Revenue for the energy storage project will either be expressed as a contracted revenue stream from a PPA (Power Purchase Agreement), derived from merchant activity by the facility, or some combination thereof.

Should energy storage project developers develop a portfolio of assets?

12 PORTFOLIO VALUATION Developing a portfolio of assets can be seen as the inevitable evolution for energy storage project developers and private equity investors who are interested in leveraging their knowledge of the technology, expertise in project development, and access to capital.

Should energy storage projects be developed?

However, energy storage project development does bring with it a greater number of moving parts to the projects, so developers must consider storage’s unique technology, policy and regulatory mandates, and market issues—as they exist now, and as the market continues to evolve.

How do you value energy storage projects?

The central tool for valuing an energy storage project is the project valuation model. Many still use simple Excel models to evaluate projects, but to capture the opportunities in the power market, it is increasing required to utilize something with far greater granularity in time and manage multiple aspects of the hardware.

Guess what you want to know

-

Mobile energy storage equipment investment project

Mobile energy storage equipment investment project

-

Saint Lucia Energy Storage Battery Investment Project

Saint Lucia Energy Storage Battery Investment Project

-

Energy storage project investment and operating costs

Energy storage project investment and operating costs

-

Myanmar lithium battery energy storage investment project

Myanmar lithium battery energy storage investment project

-

Kenya Energy Storage Investment Project

Kenya Energy Storage Investment Project

-

Key points for energy storage project investment include

Key points for energy storage project investment include

-

Niger energy storage battery project investment

Niger energy storage battery project investment

-

Algeria Oran Steel Structure Energy Storage Project

Algeria Oran Steel Structure Energy Storage Project

-

Change of investment entity energy storage project

Change of investment entity energy storage project

-

Huawei Small Investment Energy Storage Project

Huawei Small Investment Energy Storage Project

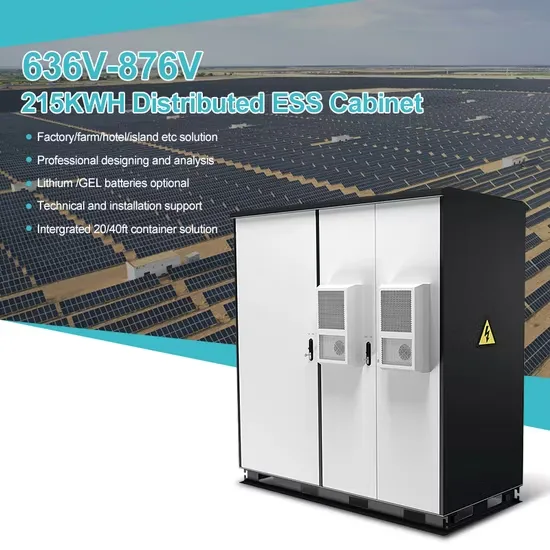

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

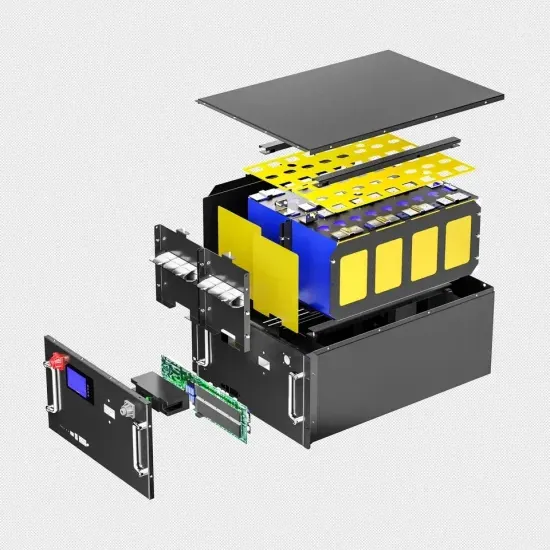

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.