Energy Storage System Investment Decision Based on Internal Rate of Return

The advantage of the internal rate of return method is that it can link the income of the project life to its total investment, point out the profit rate of the project, and compare it with

Get a quote

Return on Investment (ROI) of Energy Storage Systems: How

Explore the Return on Investment (ROI) of energy storage systems for commercial and industrial applications. Learn how factors like electricity price differentials, government

Get a quote

Energy Storage Excel Financial Model Template

Explore the Energy Storage Excel Financial Model, crafted by Oak Business Consultant, to assess project viability and optimize ROI in renewable energy

Get a quote

StoreFAST: Storage Financial Analysis Scenario Tool | Energy Storage

StoreFAST: Storage Financial Analysis Scenario Tool The Storage Financial Analysis Scenario Tool (StoreFAST) model enables techno-economic analysis of energy

Get a quote

World Energy Investment 2024

The report highlights several key aspects of the current investment landscape, including persistent cost and interest rates pressures, the new industrial strategies being adopted by major

Get a quote

BESS in North America_Whitepaper_Final Draft

Battery energy storage – a fast growing investment opportunity Cumulative battery energy storage system (BESS) capital expenditure (CAPEX) for front-of-the-meter (FTM) and behind-the

Get a quote

Energy Storage Financing: Project and Portfolio Valuation

This study investigates the issues and challenges surrounding energy storage project and portfolio valuation and provide insights into improving visibility into the process for developers,

Get a quote

Energy Storage Project Investment Income Ratio Key Insights for

Meta description: Discover how energy storage projects deliver competitive returns. Explore ROI drivers, industry trends, and real-world data to optimize your investment decisions. Learn why

Get a quote

How can I calculate the return on investment (ROI) for

To calculate the return on investment (ROI) for energy storage, consider the following key components: 1. Initial Investment Costs, 2.

Get a quote

Energy Return on Investment of Major Energy

Net energy, that is, the energy remaining after accounting for the energy "cost" of extraction and processing, is the "profit" energy used to

Get a quote

Return on Investment (ROI) of Energy Storage

Explore the Return on Investment (ROI) of energy storage systems for commercial and industrial applications. Learn how factors like electricity

Get a quote

solar.cgprotection

A common metric to quantify the net energy returns of a given energy system is the energy return on investment (EROI),defined as the ratio of the energy delivered divided by the energy

Get a quote

Solar Energy Storage: Technologies, Costs & ROI Explained

1 day ago· Learn how energy storage in solar plants works, compare technologies, and discover key cost and ROI metrics to guide investment decisions.

Get a quote

Understanding the Return of Investment (ROI) of Energy Storage

In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the

Get a quote

How can I calculate the return on investment (ROI) for energy storage

To calculate the return on investment (ROI) for energy storage, consider the following key components: 1. Initial Investment Costs, 2. Operational Savings, 3. Revenue

Get a quote

What is the return on investment for an energy

Learn how to calculate and optimize the return on investment (ROI) for energy storage projects using simple concepts and practical strategies.

Get a quote

What is the return on investment for an energy storage project?

Learn how to calculate and optimize the return on investment (ROI) for energy storage projects using simple concepts and practical strategies.

Get a quote

How AI will revolutionise energy storage investment

The expectation is that the wider use of AI to assess investment risk will make financing more accessible for energy storage developers as it will enable lenders to get a more

Get a quote

Energy Storage System Investment Decision Based on Internal

The advantage of the internal rate of return method is that it can link the income of the project life to its total investment, point out the profit rate of the project, and compare it with

Get a quote

Financial and economic modeling of large-scale gravity energy storage

This work models and assesses the financial performance of a novel energy storage system known as gravity energy storage. It also compares its performance with alternative

Get a quote

Financial and economic modeling of large-scale gravity energy

This work models and assesses the financial performance of a novel energy storage system known as gravity energy storage. It also compares its performance with alternative

Get a quote

Systemwide energy return on investment in a sustainable

This study examines the net energy performance of nine decarbonisation global energy transition scenarios until 2050 by applying a newly developed systemwide energy

Get a quote

Investment and risk appraisal in energy storage systems: A real

The increasing penetration of variable renewable energy is becoming a key challenge for the management of the electrical grid. Electrical Energy Storage Systems (ESS)

Get a quote

481237_1_En_12_Chapter 149.

And this internal rate of return is compared with the set internal rate of return of the investment to determine whether the energy storage system is worth building.

Get a quote

The case for estimating carbon return on investment (CROI) for

We posit that widespread, uniform application of a standardized ratio metric, carbon return on investment (CROI), will improve the usefulness of LCA to articulate true CO2

Get a quote

6 FAQs about [Energy storage project investment return ratio]

What factors influence the ROI of a battery energy storage system?

Several key factors influence the ROI of a BESS. In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the organization/business, and external factors that are beyond our control.

How does energy storage affect Roi?

The cost of electricity, including peak and off-peak rates, significantly impacts the ROI. Energy storage systems can store cheaper off-peak energy for use during expensive peak periods. Subsidies, tax credits, and rebates offered by governments can enhance the financial attractiveness of ESS installations.

How do I assess the ROI of a battery energy storage system?

In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the organization/business, and external factors that are beyond our control. External Factors that influence the ROI of a BESS

Is a project investment in energy storage a viable investment?

The project investment in all the studied energy storage systems is demonstrated viable to both project sponsors and lenders since the IRRs of the project for all systems in their last year of operation are larger than the projected WACC and the IRR of equity in their maturity year are better than the return on equity. 5. Financial analysis

What ratios are used in energy storage systems?

Debt management, profitability, liquidity, asset management and market trend are the five sets of ratios mostly utilized. In the analysis, only project finance-related ratios are covered. The operating waterfall of the investigated energy storage systems is shown in Fig. 7.

Is energy storage a good investment?

As energy storage becomes increasingly essential for modern energy management, understanding and enhancing its ROI will drive both economic benefits and sustainability. To make an accurate calculation for your case and understand the potential ROI of the system, it’s best to contact an expert.

Guess what you want to know

-

Four electric energy storage project investment companies in Somalia

Four electric energy storage project investment companies in Somalia

-

1gw chemical energy storage project investment cost

1gw chemical energy storage project investment cost

-

Energy storage project investment and operating costs

Energy storage project investment and operating costs

-

Mauritius photovoltaic energy storage project investment

Mauritius photovoltaic energy storage project investment

-

Energy Storage Project Investment Benefits

Energy Storage Project Investment Benefits

-

Energy storage project investment structure

Energy storage project investment structure

-

New Zealand Energy Storage Power Station Investment Project

New Zealand Energy Storage Power Station Investment Project

-

Key points for energy storage project investment include

Key points for energy storage project investment include

-

Saint Lucia Energy Storage Battery Investment Project

Saint Lucia Energy Storage Battery Investment Project

-

The largest energy storage project investment

The largest energy storage project investment

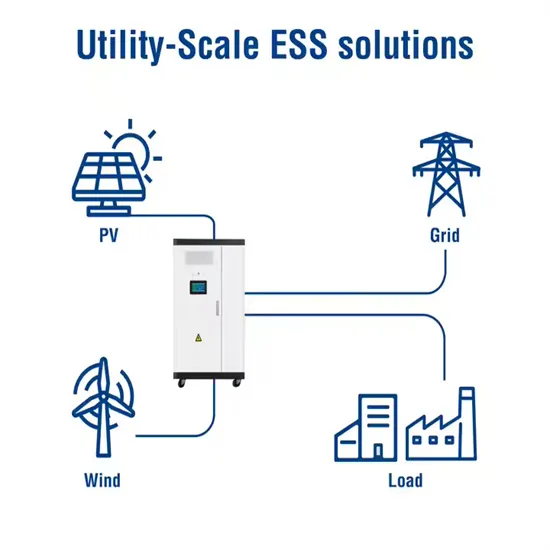

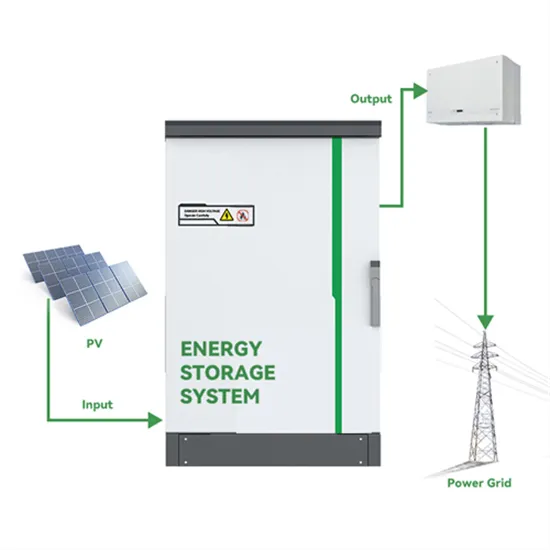

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.