The new economics of energy storage

Our model, shown in the exhibit, identifies the size and type of energy storage needed to meet goals such as mitigating demand charges, providing frequency-regulation services, shifting or

Get a quote

What are the business models of energy storage power stations?

This business model focuses on reducing the demand for electricity during peak periods by discharging stored energy. By alleviating peak load pressure, energy storage

Get a quote

Business Models for Distributed Energy Resources

Abstract This paper presents a novel, empirical analysis of the most common business models for the deployment of distributed energy resources. Specifically, this research focuses on demand

Get a quote

Four areas where energy storage incites new business models

In this 5-part series, we discuss how storage technology, especially Battery Storage, opens doors to new value creation, and what the typical business models would be. We focus on four

Get a quote

Building the Energy Storage Business Case: The Core Toolkit

Stacking of payments is the most common way to make the business model for energy storage bankable whilst optimizing services to the grid. In its simplest version it contains:

Get a quote

A two-stage business model for voltage sag sensitive industrial

The two-stage energy-storage business model considers a voltage-sag-sensitive user with independent energy storage and an IESP offering energy-storage equipment and

Get a quote

4 major business models of energy storage

At present, the financial leasing business model is the most common business model for energy storage, and it is also the business operation model with the widest

Get a quote

Tesla''s energy storage business is booming, and it''s

Tesla''s energy storage business is booming with a record year, but it''s just the beginning as we could see volume hit new records quickly. With

Get a quote

Business Models and Profitability of Energy Storage

Here we first present a conceptual framework to characterize business models of energy storage and systematically differentiate investment opportunities.

Get a quote

Exploration of Shared Energy Storage Business Model

Abstract. This article takes the shared energy storage business model as the discussion object. Based on the definition and classification of business models, it analyzes

Get a quote

Energy Storage as a Service: A New Business Model

Energy Storage as a Service (ESaaS) is changing how businesses manage energy and customer relations. This innovative model offers significant cost savings, flexibility, and

Get a quote

Sharing Economy as a new business model for energy storage systems

Energy storage systems (ESS) are the candidate solution to integrate the high amount of electric power generated by volatile renewable energy sources into the electric grid.

Get a quote

A Brief Review of Energy Storage Business Models

All energy storage projects hinge on a successful business model - and there are a growing number of them, as energy storage can provide value in different

Get a quote

Research on Energy Storage Business Model and Optimized

On this basis, an energy storage optimization operation model suitable for various business models is constructed and simulated using typical examples.

Get a quote

Bringing innovation to market: business models for battery storage

Battery storage business model innovation Though battery storage has experienced rapid growth in the last few years, its application for power storage is still at the early stage of

Get a quote

Business Model Selection for Community Energy

This paper explores business models for community energy storage (CES) and examines their potential and feasibility at the local level. By

Get a quote

Energy Storage + PPA Business Model: Secure Long

Discover how the Energy Storage + PPA Business Model helps businesses lock in long-term electricity prices, reduce market volatility, and

Get a quote

Energy Storage Business Model Analysis: Key Trends, Revenue

Let''s face it – the global energy storage market has become the rockstar of the clean energy transition. With a whopping $33 billion valuation and capacity to generate 100 gigawatt-hours

Get a quote

Business models in energy storage

With energy storage becoming an im-portant element in the energy system, each player in this field needs to prepare now and experiment and develop new business models in storage.

Get a quote

Con Edison Proposes New Energy Storage Business Model

Consolidated Edison wants to test out a new energy storage business model in a project planned with microgrid developer GI Energy at four customer sites. The New York

Get a quote

A Brief Review of Energy Storage Business Models

All energy storage projects hinge on a successful business model - and there are a growing number of them, as energy storage can provide value in different ways to different market

Get a quote

Utility Business Models in Energy Storage

As energy storage continues to grow, utilities are presented with new opportunities to innovate and diversify their revenue streams. This article explores the different business

Get a quote

European energy storage: a new multi-billion-dollar asset class

What opportunities does energy storage offer for investors? With energy storage, there''s a new and interesting asset class emerging, and the business model is fundamentally

Get a quote

6 FAQs about [Business model of new energy storage]

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

Why do energy storage companies need a business model?

Operating energy storage technologies and providing the associated services gives them a unique position in the industry once more. To succeed, however, they need to own, operate and experiment with energy storage assets and design the business models of the fu-ture.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Are energy storage projects ready for a bright future?

In anticipation of a bright future, the first projects with energy storage are being set up. We have analyzed some of these cases and clustered them according to their po-sition in the energy value chain and the type of revenues associated with the business model.

What is a business model for storage?

We propose to characterize a “business model” for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue stream obtained from its operation (Massa et al., 2017).

Is energy storage a new business opportunity?

With the rise of intermittent renewables, energy storage is needed to maintain balance between demand and supply. With a changing role for storage in the ener-gy system, new business opportunities for energy stor-age will arise and players are preparing to seize these new business opportunities.

Guess what you want to know

-

Energy Storage New Energy Business Model

Energy Storage New Energy Business Model

-

Side energy storage new energy profit model

Side energy storage new energy profit model

-

Energy Storage Project Developer Business Model

Energy Storage Project Developer Business Model

-

What is the business model for energy storage power stations

What is the business model for energy storage power stations

-

Revenue model of energy storage and new energy

Revenue model of energy storage and new energy

-

Huawei Energy Storage New Energy Model

Huawei Energy Storage New Energy Model

-

What is the business model of energy storage power station

What is the business model of energy storage power station

-

Huawei Home Energy Storage Business Project

Huawei Home Energy Storage Business Project

-

West Africa New Energy and Energy Storage Equipment

West Africa New Energy and Energy Storage Equipment

-

Papua New Guinea Hybrid Energy Storage Power Station Project

Papua New Guinea Hybrid Energy Storage Power Station Project

Industrial & Commercial Energy Storage Market Growth

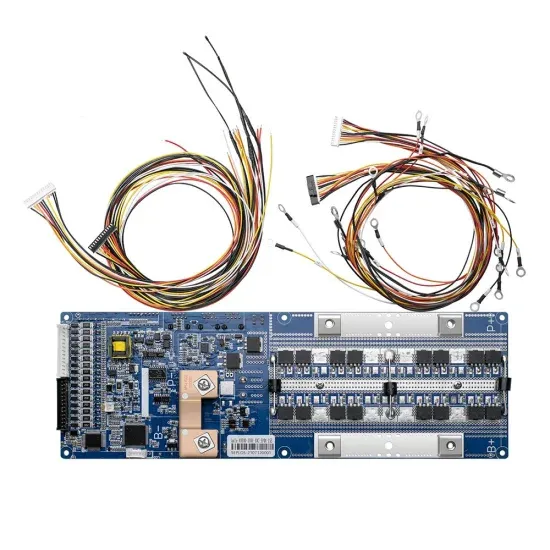

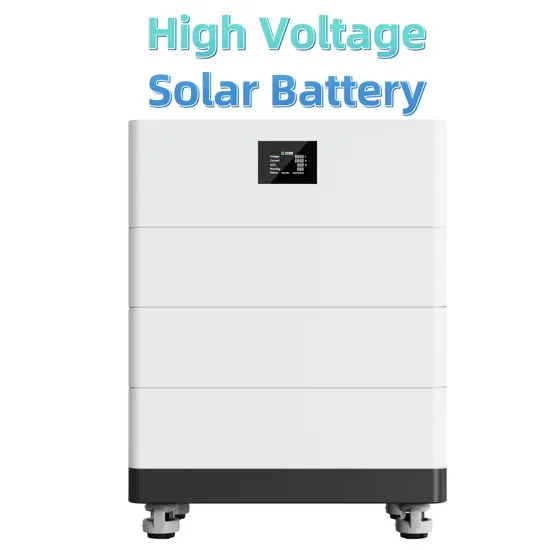

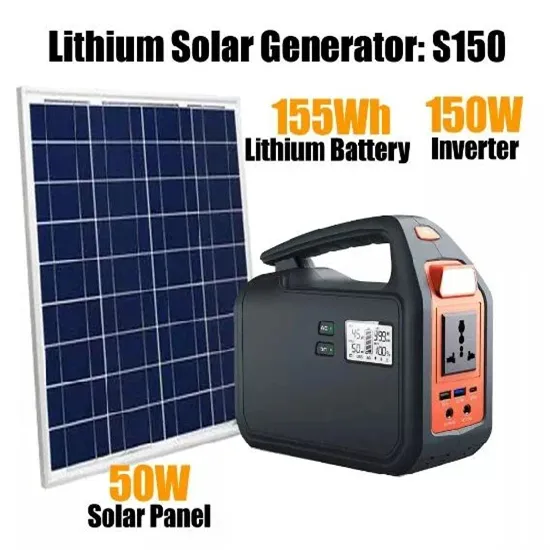

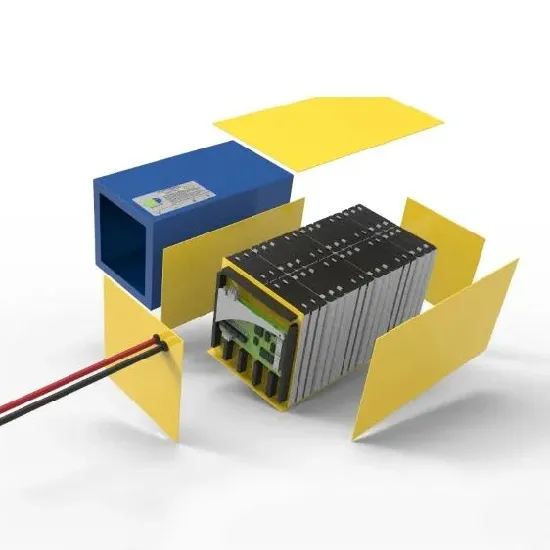

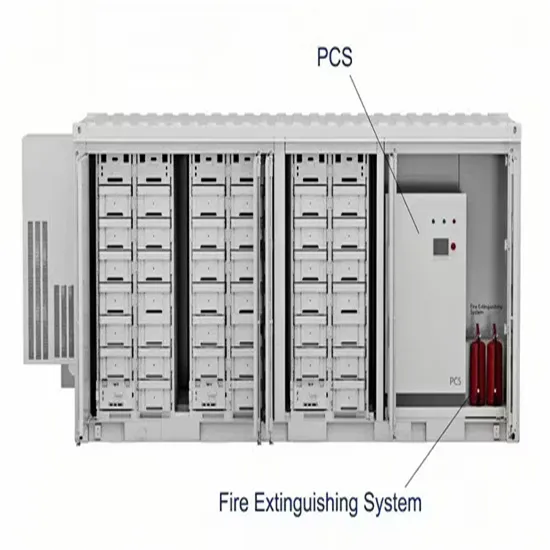

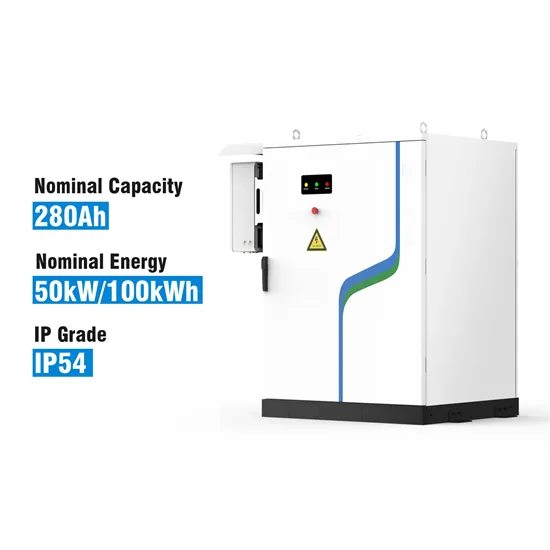

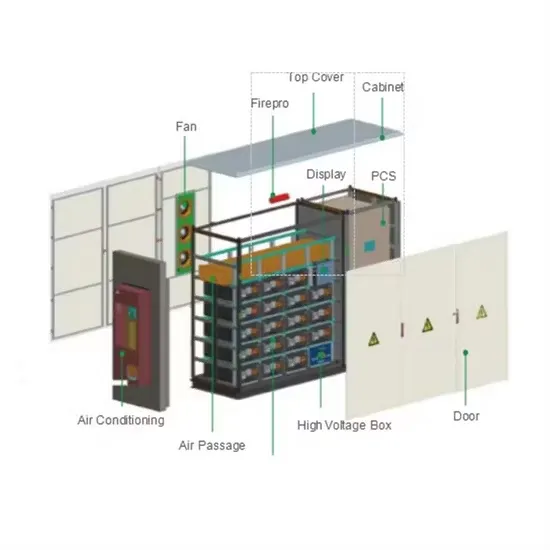

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.