How to finance battery energy storage | World

Battery energy storage systems (BESS) can help address the challenge of intermittent renewable energy. Large scale deployment of this

Get a quote

Energy Storage Financing: Project and Portfolio Valuation

This study investigates the issues and challenges surrounding energy storage project and portfolio valuation and provide insights into improving visibility into the process for developers,

Get a quote

Business Models for Utility-Scale Energy Storage in India

Business Model and Contract Analysis of US Projects Initially a lot of generation-coupled storage, to benefit from solar-ITC incentives which are being phased-out

Get a quote

Shifting Goalposts: Seven ways for independent

IPPs must adapt their business models to stay competitive in a market with changing rules Successful players are transforming from subsidy

Get a quote

Energy Storage Technologies and Business Model

By examining the current state of energy storage technologies and providing insights into the development of sustainable business models, this paper aims

Get a quote

Chhattisgarh CSPDCL Launches 380 MW BESS Tender

4 days ago· Chhattisgarh State Power Distribution Company Limited (CSPDCL) has issued a Request for Selection (RfS) for the development of a 380 MW/760 MWh standalone Battery

Get a quote

Business models in energy storage

The business models for large energy storage systems like PHS and CAES are changing. Their role is tradition-ally to support the energy system, where large amounts of baseload capacity

Get a quote

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Meeting the national renewable energy targets requires scaling up and systematic integration of variable renewable energy (VRE) systems into the power grid, which in turn necessitates

Get a quote

Energy Storage Business Model Analysis: Key Trends, Revenue

How do companies actually make money in this space? Our analysis shows three primary audiences driving demand: Take California''s duck curve phenomenon – where solar

Get a quote

Business Models and Profitability of Energy Storage

Here we first present a conceptual framework to characterize business models of energy storage and systematically differentiate investment opportunities.

Get a quote

The standalone energy storage market in India | IEEFA

Standalone Energy Storage Systems (ESS) are rapidly emerging as a key market, with 6.1 gigawatts of tenders issued in the first quarter of

Get a quote

A Brief Review of Energy Storage Business Models

This article serves as a developer primer on current energy storage business models, considering three primary factors: where the service is in the

Get a quote

Energy Storage Program | 2023

REPORT: Unlocking the Energy Transitions | Guidelines for Planning Solar-Plus-Storage Projects The report aims to streamline the adoption of solar-plus-storage projects that leverages private

Get a quote

Leading Developer Advances Michigan and Texas Projects,

AUSTIN, Texas – March 18, 2025 /PRNewswire/ – Jupiter Power LLC ("Jupiter Power"), a leading developer and operator of utility-scale battery energy storage systems (BESS), today

Get a quote

How energy storage makes solar companies more resilient

Solar companies can take steps today to bolster their business. In this economy, it''s more important than ever to reap more value from projects, enhance competitiveness, and win more

Get a quote

Energy Storage Technologies and Business Model

By examining the current state of energy storage technologies and providing insights into the development of sustainable business models, this paper aims to contribute to the

Get a quote

Energy Storage: Connecting India to Clean Power on

Executive Summary transition away from fossil fuel-based power generation. To this end, a new demand-driven capacity tender model for firm and dispatchable renewable energy (FDRE)

Get a quote

A Brief Review of Energy Storage Business Models

This article serves as a developer primer on current energy storage business models, considering three primary factors: where the service is in the electricity value chain, the benefit it provides,

Get a quote

Energy Storage Developers | Anza

A developer and operator of storage systems shifting from traditional project development to a tolling-based business model had a critical need for accurate and granular CapEx and OpEx

Get a quote

Project Developers Are Bullish On The Thermal Energy Storage

2 days ago· The emergence of thermal energy storage project developers affirms our expectations for growth in the TES industry. The main driver for manufacturers is cost savings.

Get a quote

Building the Energy Storage Business Case: The Core Toolkit

Get familiar with existing business models and collaborate closer with regulators and utilities to highlight system benefits of ES. Update planning tools to include ES and update procurement

Get a quote

What is the energy storage business model? | NenPower

The energy storage business model entails the methods and strategies employed to monetize energy storage systems, encompassing various value streams such as energy

Get a quote

Battery Storage Unlocked: Lessons Learned From Emerging

In 2023, GEAPP provided technical assistance to BRPL for project development activities, including regulatory analysis of BESS use cases, energy and system modeling, techno

Get a quote

Guess what you want to know

-

Business model of new energy storage

Business model of new energy storage

-

What is the business model of energy storage power station

What is the business model of energy storage power station

-

Model Energy Storage Project Cooperation Model

Model Energy Storage Project Cooperation Model

-

Energy Storage New Energy Business Model

Energy Storage New Energy Business Model

-

Wind power project energy storage cabinet installation standards

Wind power project energy storage cabinet installation standards

-

Energy storage project profitability

Energy storage project profitability

-

Pretoria Energy Storage Photovoltaic Project Installation

Pretoria Energy Storage Photovoltaic Project Installation

-

Mongolia energy storage battery model

Mongolia energy storage battery model

-

Energy storage project development and construction

Energy storage project development and construction

-

Huawei Turkmenistan New Energy Storage Project

Huawei Turkmenistan New Energy Storage Project

Industrial & Commercial Energy Storage Market Growth

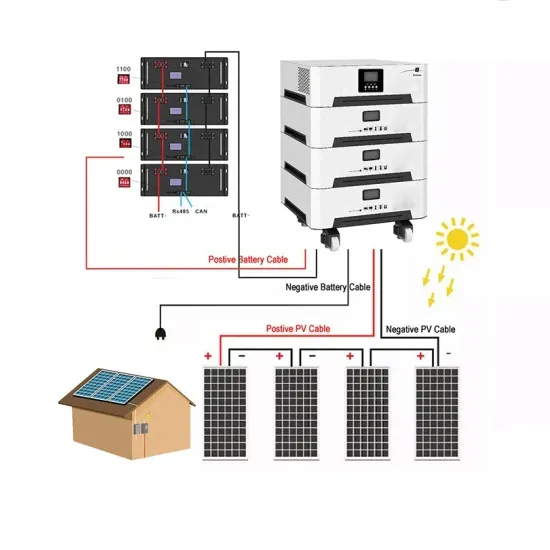

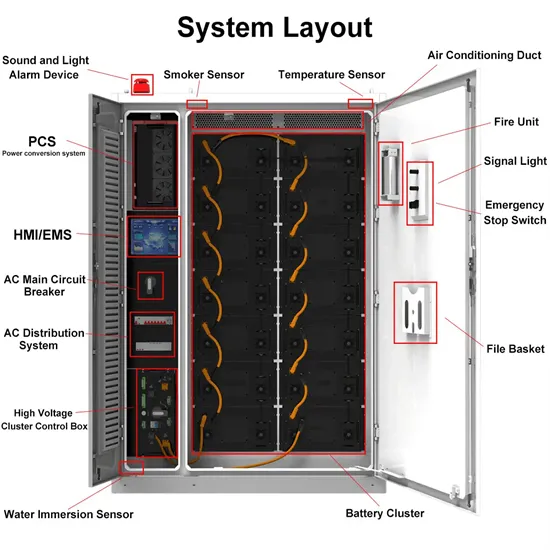

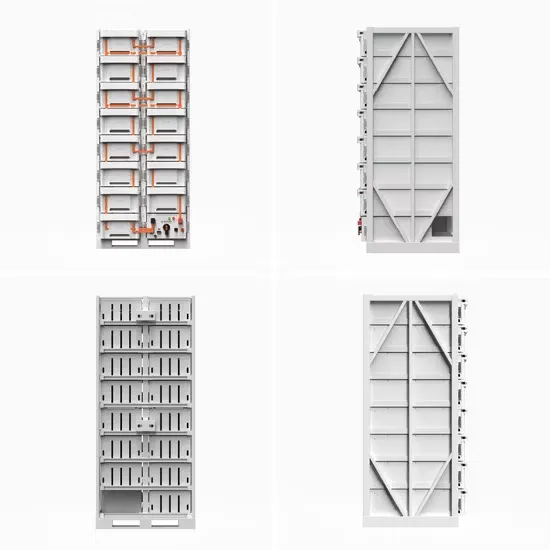

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.