A comprehensive review of large-scale energy storage

2 days ago· Subsequently, a quantitative comparative analysis of energy storage divergences between China and the U.S. is conducted from perspectives including peak-valley spread

Get a quote

Introduction of industrial and commercial energy

Introduction of industrial and commercial energy storage and analysis of income modeIndustrial and commercial energy storage business

Get a quote

Capacity Compensation Mechanism Design for Energy Storage

This study proposes a dynamic capacity compensation mechanism for shared energy storage systems to enhance their economic viability and encourage investment. By

Get a quote

Research on the Business Model and Cost Recovery Mechanism of New

Result The application scenarios, business models and cost recovery mechanism of new energy storage on the "source-grid-load" side were sorted out, and the existing problems and policy

Get a quote

Demand-side shared energy storage pricing strategy based on

In this mode, the formulation of charging and discharging prices is crucial. This paper proposed a dual-layer pricing model for shared energy storage systems based on mixed

Get a quote

Shared Energy Storage Operation Mode and Optimized

The grid side, energy storage side and user side are considered as a whole to realize the sharing of energy storage capacity and energy storage power, and a multi-objective particle swarm

Get a quote

New Energy Storage Technologies Empower Energy

KPMG China and the Electric Transportation & Energy Storage Association of the China Electricity Council (''CEC'') released the New Energy Storage Technologies Empower Energy

Get a quote

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get a quote

Research on the Business Model and Cost Recovery Mechanism

Result The application scenarios, business models and cost recovery mechanism of new energy storage on the "source-grid-load" side were sorted out, and the existing problems and policy

Get a quote

Hierarchical game optimization of independent shared energy

In this study, a joint optimization scheme for multiple profit models of independent energy storage systems is proposed by introducing a storage configuration penalty

Get a quote

Two-stage robust transaction optimization model and benefit

Two-stage robust transaction optimization model and benefit allocation strategy for new energy power stations with shared energy storage considering green certificate and

Get a quote

Profit model of grid-side energy storage

Based on the analysis of the grid side energy storage business model and operation mechanism, considering the local load and electricity price in Zhejiang, the

Get a quote

Hierarchical game optimization of independent shared energy storage

In this study, a joint optimization scheme for multiple profit models of independent energy storage systems is proposed by introducing a storage configuration penalty

Get a quote

Optimizing the operation and allocating the cost of shared energy

The concept of shared energy storage in power generation side has received significant interest due to its potential to enhance the flexibility of multiple renewable energy

Get a quote

Tesla''s Energy Storage Business Is Quietly Growing at Triple

Tesla''s energy division more than doubled its storage deployments in 2024, and triple-digit growth has continued this year. The company''s energy business is becoming a core

Get a quote

The new economics of energy storage | McKinsey

The model shows that it is already profitable to provide energy-storage solutions to a subset of commercial customers in each of the four

Get a quote

Optimal participation and cost allocation of shared energy storage

In recent years, with the increase in the proportion of new energy connected to the grid, the main goal of energy storage on the load side and energy storage users is to maximize

Get a quote

A message to energy storage colleagues: only those companies who fight during these tough times, make efforts to innovate, and a single user-side energy storage profit model, the

Get a quote

Shared Energy Storage Business and Profit Models: A Review

As a new paradigm of energy storage industry under the sharing economy, shared energy storage (SES) can effectively improve the comprehensive regulation ability

Get a quote

Profit model of new energy storage

This paper studies the optimal operation strategy of energy storage power station participating in the power market, and analyzes the feasibility of energy storage participating in the power

Get a quote

Economic Analysis of Customer-side Energy Storage

There are many scenarios and profit models for the application of energy storage on the customer side. With the maturity of energy storage technology and the decreasing cost, whether the

Get a quote

AEAUTO Grid-side Energy Storage Profitability And Application

Below, AEAUTO will conduct an in-depth analysis of the advantages, applications, and profit models of the energy storage industry on the grid side.

Get a quote

New Energy Storage Business Models and Revenue Levels

Under the current energy storage market conditions in China, analyzing the application scenarios, business models, and economic benefits of energy storage is

Get a quote

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a

Get a quote

Unlocking the Profit Model of Grid-Side Energy Storage:

But here''s the million-dollar question: "How do companies actually make money from these giant battery systems?" Buckle up as we dissect the profit models making waves in this

Get a quote

Business model and economic analysis of user-side BESS in

A business model of user-side battery energy storage system (BESS) in industrial parks is established based on the policies of energy storage in China. The business model mainly

Get a quote

6 FAQs about [Side energy storage new energy profit model]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

What is shared Energy Storage (SES)?

As a new paradigm of energy storage industry under the sharing economy, shared energy storage (SES) can effectively improve the comprehensive regulation ability and safety of the new energy power system.

Can energy storage provide multiple services?

The California Public Utilities Commission (CPUC) took a first step and published a framework of eleven rules prescribing when energy storage is allowed to provide multiple services. The framework delineates which combinations are permitted and how business models should be prioritized (American Public Power Association, 2018).

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

Guess what you want to know

-

Profit model of new energy storage

Profit model of new energy storage

-

Profit model of Latvian energy storage power station

Profit model of Latvian energy storage power station

-

Morocco energy storage power station profit model

Morocco energy storage power station profit model

-

Profit model of wind solar and energy storage power stations

Profit model of wind solar and energy storage power stations

-

Profit model and cost structure of energy storage power stations

Profit model and cost structure of energy storage power stations

-

Energy Storage New Energy Business Model

Energy Storage New Energy Business Model

-

Revenue model of energy storage and new energy

Revenue model of energy storage and new energy

-

Profit model of water pump inverter energy storage project

Profit model of water pump inverter energy storage project

-

Business model of new energy storage

Business model of new energy storage

-

Global power generation side energy storage profit model

Global power generation side energy storage profit model

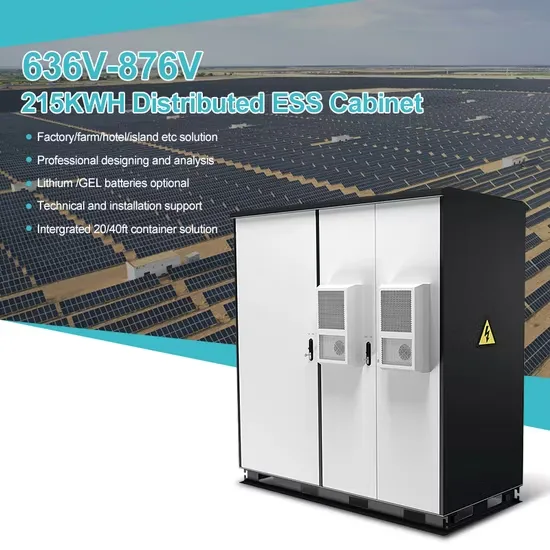

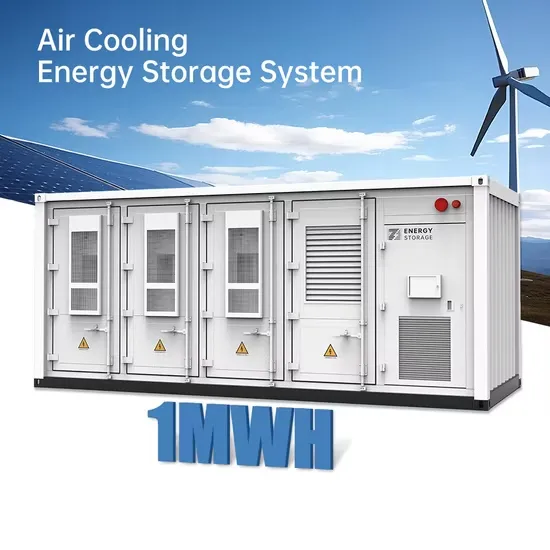

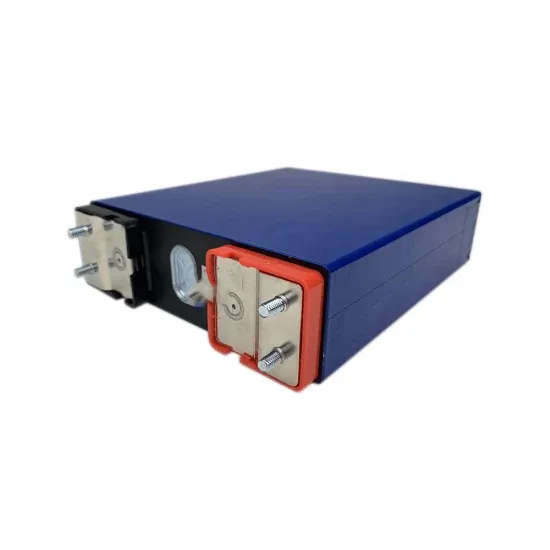

Industrial & Commercial Energy Storage Market Growth

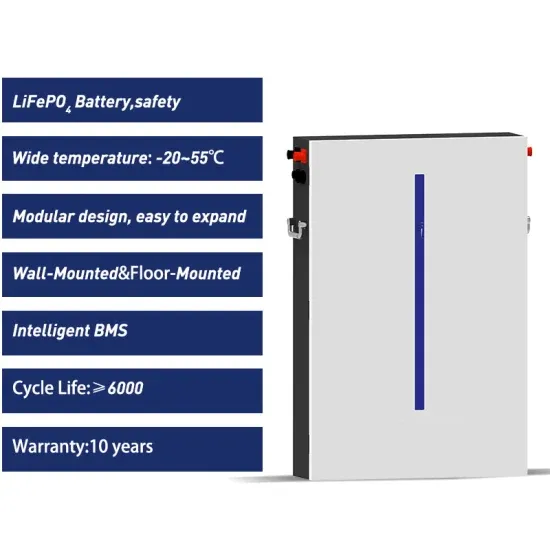

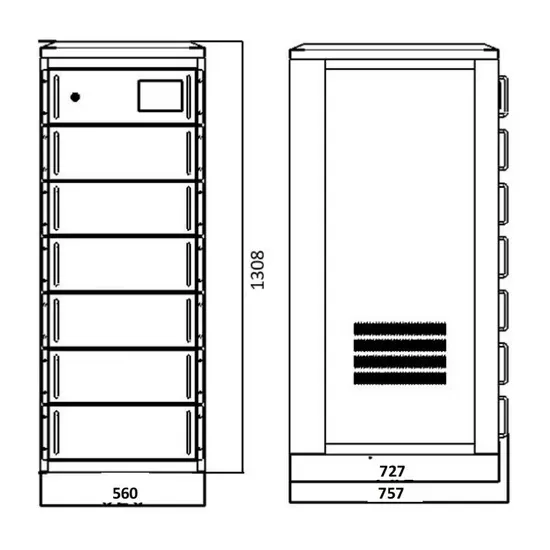

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.