Cracking the Code: Smart Profit Models in the Energy Storage Field

How to make energy storage projects actually profitable. Our target audience ranges from renewable energy investors to grid operators exploring battery storage solutions.

Get a quote

What is the profit model of independent energy storage

The demand for flexibility regulation resources in the new power system is becoming increasingly urgent, with frequency regulation being particularly prominent. Energy storage has excellent

Get a quote

Study on profit model and operation strategy optimization of energy

With the acceleration of China''s energy structure transformation, energy storage, as a new form of operation, plays a key role in improving power quality, absorption, frequency modulation and

Get a quote

6 Emerging Revenue Models for BESS: A 2025 Profitability Guide

Explore 6 practical revenue streams for C&I BESS, including peak shaving, demand response, and carbon credit strategies. Optimize your energy storage ROI now.

Get a quote

Tesla''s energy storage business ''growing like wildfire'', Musk says

Large-scale battery storage project in New South Wales, Australia, built with Tesla''s Megapacks. Image: Edify Energy. "It won''t be long" before Tesla''s stationary energy

Get a quote

The new economics of energy storage | McKinsey

In this article, we describe how to find profitable possibilities for energy storage. We also highlight some policy limitations and how these might

Get a quote

A comprehensive review of large-scale energy storage

2 days ago· Altmetric Review Article A comprehensive review of large-scale energy storage participating in electricity market transactions: Profit model and clearing mechanism

Get a quote

Optimizing Energy Storage Profits: A New Metric for Evaluating

Storage profit maximization is based on buying energy at the lowest prices and selling it at the highest prices. The best strategy must thus be based on both accurately

Get a quote

Three business models for industrial and commercial energy storage

In this article, we explore three business models for commercial and industrial energy storage: owner-owned investment, energy management contracts, and financial leasing. We''ll discuss

Get a quote

Shared Energy Storage Business and Profit Models: A Review

As a new paradigm of energy storage industry under the sharing economy, shared energy storage (SES) can effectively improve the comprehensive regulation ability and safety of the new

Get a quote

Container energy storage profit model

The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power system. With the deepening of

Get a quote

How is the profit model of energy storage power station

During periods of excess energy supply, often driven by renewables like wind or solar, energy storage stations can store the energy generated at lower prices. Conversely,

Get a quote

Profit analysis involving energy storage sector

The model shows that it is already profitableto provide energy-storage solutions to a subset of commercial customers in each of the four most important applications--demand-charge

Get a quote

Five revenue models for industrial and commercial energy

flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and

Get a quote

Energy Storage Valuation: A Review of Use Cases and Modeling

Disclaimer This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any agency thereof, nor any of

Get a quote

Australia Energy Storage Market Analysis: Profit Models,

Australia''s energy storage market began its journey in 2016, driven by key factors such as weak grid infrastructure, abundant renewable energy resources, and high electricity prices for

Get a quote

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get a quote

PARK ENERGY STORAGE PROFIT MODEL

Energy Storage and New Energy Markets: Profit Analysis and Future Trends If you''re here, chances are you''re either an investor eyeing the next big thing, a policy wonk trying to decode

Get a quote

The new economics of energy storage | McKinsey

In this article, we describe how to find profitable possibilities for energy storage. We also highlight some policy limitations and how these might be addressed to accelerate

Get a quote

Business Models and Profitability of Energy Storage

Here we first present a conceptual framework to char-acterize business models of energy storage and systematically differentiate in-vestment opportunities.

Get a quote

Business Models and Profitability of Energy Storage

Here we first present a conceptual framework to characterize business models of energy storage and systematically differentiate investment opportunities.

Get a quote

Profit Model|Home Energy Storage System|ESSCOLLEGE

In the household and community distributed energy system, the "self powered, surplus compensation" profit model achieved by users through solar energy + energy storage system

Get a quote

Shared Energy Storage Business and Profit Models: A Review

As a new paradigm of energy storage industry under the sharing economy, shared energy storage (SES) can effectively improve the comprehensive regulation ability

Get a quote

6 FAQs about [Profit model of new energy storage]

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How many business models are there for energy storage technologies?

Figure 1 depicts 28 distinct business models for energy storage technologies that we identify based on the combination of the three parameters described above. Each business model, represented by a box in Fig- ure 1, applies storage to solve a particular problem and to generate a distinct revenue stream for a specific market role.

Are business models for energy storage unprofitable or ambiguous?

The main finding is that examined business models for energy storage given in the set of technologies are largely found to be unprofitable or ambiguous.

Are energy storage products more profitable?

The model found that one company’s products were more economic than the other’s in 86 percent of the sites because of the product’s ability to charge and discharge more quickly, with an average increased profitability of almost $25 per kilowatt-hour of energy storage installed per year.

How does a storage technology affect a business model?

business model . First, the storage technology’s power capacity range must overlap with the ⤴햣 required power capacity range of the business model. In particular, the storage technology must capacity of the respective business model. At the same time, the technology’s minimal Our analysis focuses on a set of commercially available technologies.

Guess what you want to know

-

Profit model of new energy storage

Profit model of new energy storage

-

Energy Storage New Energy Business Model

Energy Storage New Energy Business Model

-

Revenue model of energy storage and new energy

Revenue model of energy storage and new energy

-

Profit model of wind solar and energy storage power stations

Profit model of wind solar and energy storage power stations

-

Profit model of water pump inverter energy storage project

Profit model of water pump inverter energy storage project

-

Business model of new energy storage

Business model of new energy storage

-

Morocco energy storage power station profit model

Morocco energy storage power station profit model

-

Profit model of Latvian energy storage power station

Profit model of Latvian energy storage power station

-

New lithium battery energy storage module group

New lithium battery energy storage module group

-

The role of Saudi Arabia s new energy storage tank

The role of Saudi Arabia s new energy storage tank

Industrial & Commercial Energy Storage Market Growth

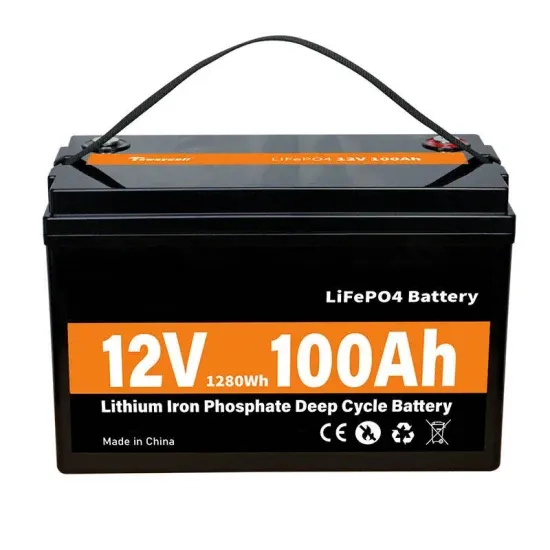

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.