Crystalline silicon

Crystalline silicon is the dominant semiconducting material used in photovoltaic technology for the production of solar cells. These cells are assembled into solar panels as part of a photovoltaic

Get a quote

Benchmark costs for five solar PV module technologies

Specifically, the report calculates that price by using bottom-up manufacturing cost analysis and applying a gross margin of 15%. This report

Get a quote

Crystalline Silicon Photovoltaics Research

The U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) supports crystalline silicon photovoltaic (PV) research and development efforts

Get a quote

2024 PV Module Price Index

The PV Module Price Index tracks wholesale pricing and supply of crystalline-silicon modules that have fallen out of traditional distribution channels, and as a result are listed for

Get a quote

(PDF) Crystalline Silicon Solar Cells: State-of-the-Art

The cost distribution of a crystalline silicon PV module is clearly dominated by material costs, especially by the costs of the silicon wafer.

Get a quote

Photovoltaic Module Prices 2025: Updated Data

Prices for photovoltaic modules in 2024 continue to fall. According to the monthly index published by Germany''s pvXchange Trading, the downward trend persists, driven

Get a quote

Solar Manufacturing Cost Analysis | Solar Market Research & Analysis | NREL

These manufacturing cost analyses focus on specific PV and energy storage technologies—including crystalline silicon, cadmium telluride, copper indium gallium

Get a quote

Polysilicon Solar PV Price

1 day ago· All solar PV (Photovoltaic) real-time price update, such as Panle/Module, Inverter, Wafer, Cell, and poly / Silicon, and research reports.

Get a quote

Advances in crystalline silicon solar cell technology for industrial

Crystalline silicon PV cells are the most popular solar cells on the market and also provide the highest energy conversion efficiencies of all commercial solar cells and modules.

Get a quote

Solar Technology Cost Analysis | Solar Market

Solar Technology Cost Analysis NREL''s solar technology cost analysis examines the technology costs and supply chain issues for solar

Get a quote

Crystalline Silicon Photovoltaic Module Manufacturing Costs

We employ NREL''s bottom-up cost modeling methods and accepted accounting frameworks to estimate costs and minimum sustainable prices (MSPs) for each step in the c-Si supply chain:

Get a quote

Crystalline Silicon Solar PV Module Market Size & Growth

This report is based on historical analysis and forecast calculation that aims to help readers get a comprehensive understanding of the global Crystalline Silicon Solar PV Module

Get a quote

Recycling Si in waste crystalline silicon photovoltaic panels after

The photovoltaic (PV) market started in 2000, and the first batch of crystalline silicon (c-Si) PV panels with a lifespan of 20–30 years are about to be retired. Recycling Si in

Get a quote

Polysilicon Price: Chart, Forecast, History

Price data providers: A short guide for users Three Taiwanese market research firms provide weekly spot prices of the products in the solar

Get a quote

Quantifying the costs of diversifying silicon PV module assembly

In the shift toward a zero-carbon future, many GW of solar PV modules will be required, and supply-chain resilience is becoming increasingly important. This study assesses

Get a quote

How much does crystalline silicon solar energy cost | NenPower

The prices of crystalline silicon solar panels have consistently decreased, owing to technological advancements and increased manufacturing efficiencies. Different types of

Get a quote

PV Module Price Index | EnergyBin

The PV module price index presented by EnergyBin tracks and reports on crystalline-silicon (c-Si) module trade within the secondary market. Results are based on data collected from over 500

Get a quote

Solar Photovoltaic Prices, PV modules, PV glass, PV

SMM brings you current solar photovoltaic equipment or material prices and historical price charts such as polysilicon prices, silicon wafer prices, battery

Get a quote

The difference between monocrystalline silicon and polycrystalline

The magical silicon wafer that converts solar energy into electrical energy is the core of photovoltaic technology. Today, let''s take a closer look at the differences between

Get a quote

Solar Photovoltaic Prices, PV modules, PV glass, PV cells, PV

SMM brings you current solar photovoltaic equipment or material prices and historical price charts such as polysilicon prices, silicon wafer prices, battery cell prices, module prices, silicon

Get a quote

Research and development priorities for silicon photovoltaic module

The increasing deployment of photovoltaic modules poses the challenge of waste management. Heath et al. review the status of end-of of-life management of silicon solar

Get a quote

Benchmark costs for five solar PV module technologies

Specifically, the report calculates that price by using bottom-up manufacturing cost analysis and applying a gross margin of 15%. This report benchmarks three established, mass

Get a quote

Photovoltaic (PV) Module Technologies: 2020 Benchmark Costs

This report benchmarks 2020 PV module minimum sustainable price (MSP) via bottom-up manufacturing cost analysis, for established PV technologies in mass production, including

Get a quote

What''s the Difference Between Silicon Solar Panels

Crystalline-silicon solar panels are efficient, reliable, and dominate the solar-panel market. However, new third-gen solar technology could do

Get a quote

6 FAQs about [Price of crystalline silicon photovoltaic modules]

How much does a photovoltaic module cost?

Mainstream Modules: Average price of €0.11/Wp, stable compared to September but 21.4% lower than January 2024. Low-Cost Modules: Average price of €0.065/Wp, a 7.1% decrease from September and 27.8% from January 2024. These trends are exerting mounting pressure on the photovoltaic sector.

How much does a photovoltaic panel cost?

Mainstream Photovoltaic Panels: Average price of €0.10/Wp, down 9.1% month-on-month. Low-Cost Photovoltaic Modules: Average price of €0.060/Wp, a decrease of 7.7% compared to the previous month. These figures underscore the significant pressures in the photovoltaic market, as price reductions strain margins to unprecedented levels.

What is the PV module price index?

The PV Module Price Index tracks wholesale pricing and supply of crystalline-silicon modules that have fallen out of traditional distribution channels, and as a result are listed for resale on the EnergyBin exchange.

How much does a resale solar module cost?

For example, N-Type modules by REC listed for resale in May and July pushed up weighted average prices to $0.411 and $0.460 respectively. P-Type modules in September increased to $0.311 as modules by Sirius PV, Solar4America, and Panasonic were remarketed. The same price increase was present in P-Type Bifacials for the month of December.

Do PV modules lose resale value?

For historical secondary market PV module pricing from 2020 through 2023, download the 2023 PV Module Price Index from EnergyBin’s Resources portal. Overall, the price index shows that new PV modules don’t tend to lose resale value in the U.S. secondary market unless their technology is older, such as Legacy POLY modules.

Are discount prices excluded from the PV module price index?

Discounted prices for minimum quantity orders of 1+ container (s) are excluded from this price index. The 2023 PV module price index presented by EnergyBin tracks crystalline-silicon modules traded within the secondary solar market. Download the report.

Guess what you want to know

-

Introduction and price of crystalline silicon photovoltaic panels

Introduction and price of crystalline silicon photovoltaic panels

-

Price of 270wp polycrystalline silicon photovoltaic modules

Price of 270wp polycrystalline silicon photovoltaic modules

-

Practical monocrystalline silicon photovoltaic modules

Practical monocrystalline silicon photovoltaic modules

-

Tunisian crystalline silicon photovoltaic panel manufacturer

Tunisian crystalline silicon photovoltaic panel manufacturer

-

Price of monocrystalline photovoltaic modules

Price of monocrystalline photovoltaic modules

-

Turkmenistan crystalline silicon photovoltaic curtain wall

Turkmenistan crystalline silicon photovoltaic curtain wall

-

Is there an official price for photovoltaic modules

Is there an official price for photovoltaic modules

-

Middle East crystalline silicon photovoltaic module panels

Middle East crystalline silicon photovoltaic module panels

-

Monocrystalline silicon double-glass bifacial photovoltaic modules

Monocrystalline silicon double-glass bifacial photovoltaic modules

-

Marshall Islands crystalline silicon photovoltaic curtain wall installation

Marshall Islands crystalline silicon photovoltaic curtain wall installation

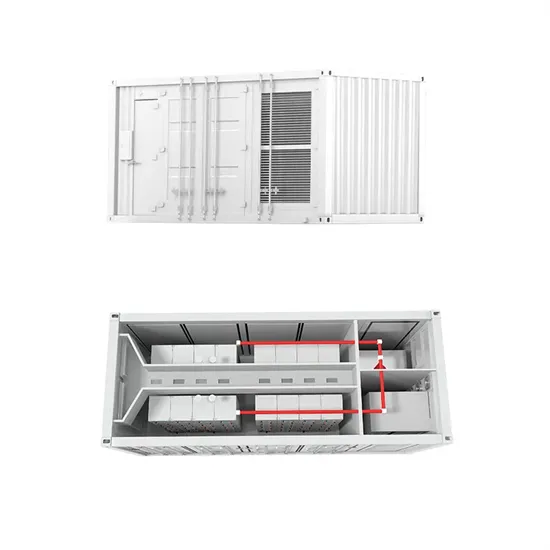

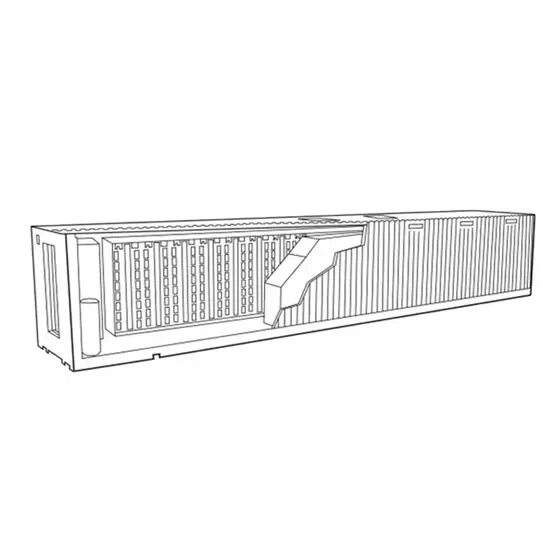

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.