Ghana energy storage power station project

Huawei Digital Power Technologies, a unit of Chinese multinational tech giant Huawei, has signed a deal with Ghana-based solar project developer Meinergy Technology to build a 1GW solar

Get a quote

Ghana''s Energy, Extractives & Infrastructure Outlook 2025

Further, Ghana''s infrastructure sector saw the procurement of new trains for Ghana''s railway transportation system; commissioning of the 97-kilometre standard gauge

Get a quote

Govt Submits Legislative Instrument to Boost Competitive Power

Ghana has taken a key step toward reforming its energy sector by submitting a Legislative Instrument (LI) to Parliament that will enable competitive procurement of power

Get a quote

Top 18 Energy Storage Companies in Ghana (2025) | ensun

The Energy Storage industry in Ghana is gaining traction due to the country''s increasing energy demands and the push for renewable energy sources. One key consideration is the regulatory

Get a quote

Table of Contents

Electricity exports have provided an important source of foreign exchange earnings for the country as Ghana exports power to the neighbouring countries including Togo, Benin, and Burkina

Get a quote

Ghana

Opportunities Continuing year-on-year growth in energy needs. Interest in the new Ghanaian Energy Ministry in additional solar power generation capacity, especially in Ghana''s

Get a quote

Ghana''s Power Sector Report (03.11.22).pdf

Electricity Generation Ghana''s energy generation mix has primarily consisted of hydro and thermal sources. In 2021, hydro accounted for around 34.1% of total power, with thermal

Get a quote

BYD and others were shortlisted for the procurement tender of

Polaris Energy Storage Network learned that on April 26, the list of winning candidates for the energy storage system equipment procurement of the China Resources

Get a quote

Ghana Green Manufacturing and Policy Guide | Sustainable Energy

To aid the private sector, investors, and other stakeholders in navigating the manufacturing policy and regulatory landscape in Ghana, this guide offers insights on two key

Get a quote

Cabinet Approves Private Sector Procurement of Power Plants

"Cabinet has already approved private sector participation, and we have submitted the Legislative Instrument to Parliament to enable competitive procurement for power plants,"

Get a quote

Ghana Moves to Enforce Competitive Bidding in Power Contracts

As Ghana continues to battle structural challenges in the energy sector, including ballooning legacy debts and surplus capacity charges, the move to enforce competitive

Get a quote

Genser Energy Ghana Limited|Powering the Mining Industry

EVEN WITH STABLE GRID CONNECTION, MINING COMPANIES IN GHANA STILL FACE ISSUES WITH POWER SUPPLY Price Even with contracts with the national IPP, pricing can

Get a quote

Ghana PPA Study_FINAL

Ghana currently has 32 identifiable contracts, or Power Purchase Agreements (PPAs), in force for the provision of electricity generation. Both Volta River Authority (VRA) and the Electricity

Get a quote

Ghana Moves to Reform Energy Sector Through Competitive

Finance Minister Dr. Cassiel Ato Forson has announced significant steps to address Ghana''s energy sector challenges, including submitting a Legislative Instrument to

Get a quote

Govt Submits Legislative Instrument to Boost Competitive Power Procurement

Ghana has taken a key step toward reforming its energy sector by submitting a Legislative Instrument (LI) to Parliament that will enable competitive procurement of power

Get a quote

Ghana PPA Study_FINAL

To date, the country has relied almost entirely on unsolicited proposals to source new energy projects and negotiate PPAs, which limits competition and risks higher prices.

Get a quote

Ghana energy storage power station project

station project Huawei Digital Power Technologies, a unit of Chinese multinational tech giant Huawei, has signed a deal with Ghana-based solar project developer Meinergy Technology to

Get a quote

ECG Signs Power Purchase Agreement with AKSA

The 240-month agreement was signed on Thursday, 6th April 2023, as part of the strategy to stabilize and enhance power reliability in the

Get a quote

Gov''t Tables Legislative Instrument to Enforce Competitive

In a decisive move to curb inefficiencies in Ghana''s energy sector, government has laid before Parliament a Legislative Instrument (LI) that mandates competitive bidding for all

Get a quote

Ghana power Tenders, Bids and RFP

Latest Ghana power Tenders, Government Bids, RFP and other public procurement notices related to power from Ghana. Users can register and get updated

Get a quote

Reort Template Blue

The 2023 Ghana Integrated Power Sector Master Plan (IPSMP) is an output of months of work by the Energy Commission and various energy sector agencies in Ghana, with financial support

Get a quote

ECG Signs Power Purchase Agreement with AKSA Energy

The 240-month agreement was signed on Thursday, 6th April 2023, as part of the strategy to stabilize and enhance power reliability in the middle belt of Ghana, as well as

Get a quote

Ghana Moves to Reform Energy Sector Through Competitive Power Procurement

Finance Minister Dr. Cassiel Ato Forson has announced significant steps to address Ghana''s energy sector challenges, including submitting a Legislative Instrument to

Get a quote

Home | Ministry of Energy

Welcome to our website! We hope our website will provide all the information you require about Ghana''s Energy Sector. As a Ministry responsible for energy policy formulation,

Get a quote

Harbour ghana energy storage power station

The inauguration of the Akosombo hydroelectric power station in 1966 by the then independent Ghana Government marked a significant turning point in Ghana''s electricity sector. This large

Get a quote

Ghana Power Generation Company – Commited to reliable power

Ghana Power Generation Company (GPGC) aims to improve the security of power supply in Ghana with solutions that complement the Government of Ghana''s efforts to increase

Get a quote

6 FAQs about [Ghana Energy Storage Power Station Procurement]

Why do we need a power purchase agreement in Ghana?

The power sector’s acute problems call for a new, more transparent approach in order to reduce costs, pay down debt, improve electricity supply, and rebuild public confidence. Ghana currently has 32 identifiable contracts, or Power Purchase Agreements (PPAs), in force for the provision of electricity generation.

How many PPAs are in force for electricity generation in Ghana?

This case study, written in collaboration with the Institute of Economic Affairs (IEA Ghana), identified 32 PPAs currently in force for the provision of electricity generation. We have summarized the implications of these contracts, and compiled all available public information into a downloadable Annex.

Why does Ghana need a more transparent electricity contracting system?

Ghana’s electricity sector faces an urgent crisis of immense financial strain that calls for a new, more transparent approach for contracting power in the future. Public information on current contracts is highly limited, which has contributed to overcapacity, weakened sector planning, mounting debt, and rising concerns over public accountability.

Does Ghana pay for electricity if no electricity is consumed?

In addition, most of these contracts were agreed on a take-or-pay basis, which means that the government of Ghana must pay for the generation capacity even if no electricity is consumed. The only publicly-disclosed aspects of these PPAs are the names of the project, contract type, technology/fuel, location, and total project cost.

Does Ghana have a PPA?

Both Volta River Authority (VRA) and the Electricity Company of Ghana (ECG) have PPAs in place with private Independent Power Projects (IPPs). The Ministry of Energy has also contracted PPAs with Emergency Power Producers (EPPs).

How many renewable generation licenses are there in Ghana?

Issuance of renewable generation licenses has halted since October 2018, and only 3 of the existing 124 licenses have been developed. Ghana does not have a comprehensive legal document regarding PPAs. However, the Constitution, along with several other regulations provides some legal framework for PPAs.

Guess what you want to know

-

Ghana photovoltaic power station energy storage installation

Ghana photovoltaic power station energy storage installation

-

Energy Storage Power Station Construction and Procurement

Energy Storage Power Station Construction and Procurement

-

Centralized energy storage power station put into operation in Ghana

Centralized energy storage power station put into operation in Ghana

-

Thailand energy storage power station project

Thailand energy storage power station project

-

The safest battery large energy storage power station

The safest battery large energy storage power station

-

How many plants are there in the Pretoria Energy Storage Power Station

How many plants are there in the Pretoria Energy Storage Power Station

-

Liquid-cooled energy storage lithium battery station cabinet base station power system

Liquid-cooled energy storage lithium battery station cabinet base station power system

-

South Korea New Energy Storage Power Station Project

South Korea New Energy Storage Power Station Project

-

Battery energy storage power station market price

Battery energy storage power station market price

-

Which energy storage container power station is best in Brazil

Which energy storage container power station is best in Brazil

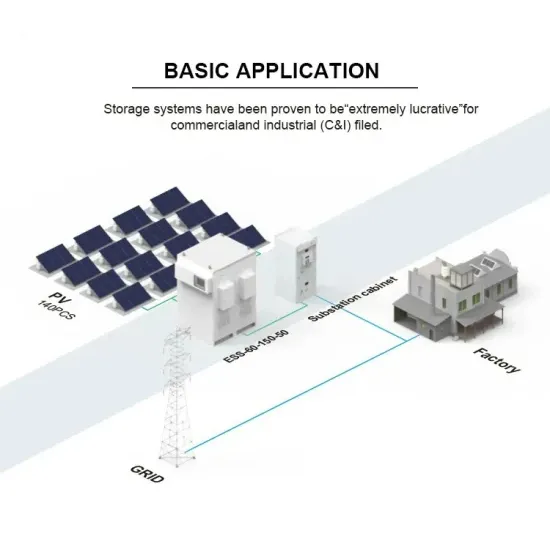

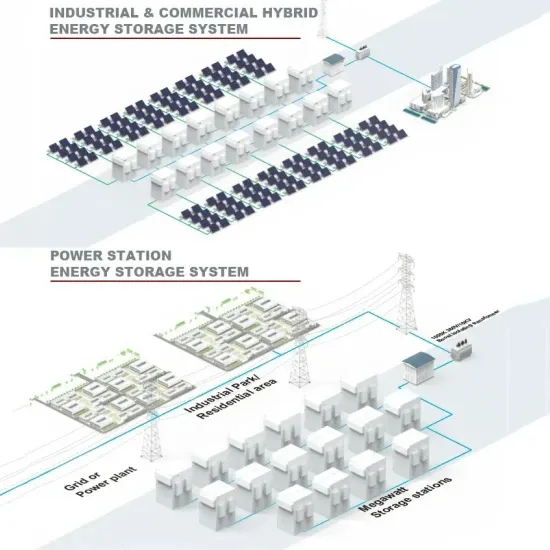

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.