Energy, utilities and resources: Insights and

A gas station chain gets its fill with near real-time data A large gas station chain tapped into PwC''s powerful analytics solution Analytics Foundation, built on

Get a quote

Energy Storage Industry In The Next Decade: Technological

Driven by the global energy transformation and carbon neutrality goals, the energy storage industry is experiencing explosive growth, but it is also facing multiple challenges such

Get a quote

Navigating the Energy Storage Supply Chain: Challenges and

The demand for battery energy storage is growing rapidly, driven by the expansion of renewable energy integration and improving grid network stability. This puts pressure on the

Get a quote

Five Dynamic Factors Reshaping the Power Sector

The shift to clean energy is triggering growing concerns about the sustainability, resilience, and integration of the power sector''s complex supply

Get a quote

What Makes the Winning Bidder for Energy Storage Power Station

But here''s the kicker: everyone wants to know why certain players keep clinching those lucrative energy storage power station contracts. Spoiler alert: It''s not just deep pockets—it''s a mix of

Get a quote

Grid Energy Storage

This analysis serves as a basis for highlighting several vulnerabilities and their causes in the grid energy storage supply chain to inform policy and decision makers in their efforts to increase

Get a quote

Navigating the Energy Storage Supply Chain:

The demand for battery energy storage is growing rapidly, driven by the expansion of renewable energy integration and improving grid network

Get a quote

Energy storage: Total supply chain | Deloitte Netherlands

In this final article, we look at the total supply chain factors that may influence the choice of investable energy storage assets, and the challenges faced by this sector when

Get a quote

How global supply chain issues affect energy storage players

However, the global supply chain struggles have created unprecedented challenges for energy storage firms. These disruptions, including material shortages,

Get a quote

Enabling renewable energy with battery energy

These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable

Get a quote

Optimizing Energy Storage Supply Chain

This article delves into the various aspects of energy storage system supply chain management. It explores methods to enhance operational efficiency, reduce costs, maintain product quality,

Get a quote

(PDF) Analysis of energy storage operation on the

This paper constructs the wind power supply chain with energy storage participation, and explores the benefit coordination of wind power

Get a quote

Supply Chain Challenges in Battery Energy Storage

However, the supply chain for these systems is facing significant challenges, driven by skyrocketing demand, increasing competition from

Get a quote

Research on Strategy Selection of Power Supply Chain Under

Against this backdrop, this study employs a Stackelberg game approach to construct a power supply chain model, with generation companies as leaders and retail

Get a quote

Supply Chain Challenges in Battery Energy Storage Systems

However, the supply chain for these systems is facing significant challenges, driven by skyrocketing demand, increasing competition from alternate technologies such as

Get a quote

How is the price of energy storage power station calculated?

The pricing of energy storage power stations can also be significantly influenced by supply chain dynamics. Late deliveries or fluctuations in material prices can lead to increased

Get a quote

A 2025 Update on Utility-Scale Energy Storage

While the energy storage market continues to rapidly expand, fueled by record-low battery costs and robust policy support, challenges still

Get a quote

Integrating virtual power plants for sustainable supply chain

ABSTRACT This paper aims to design and integrate virtual power plant (VPP) into a geographically dispersed production-distribution network for attaining environmental

Get a quote

Role of energy storage technologies in enhancing grid stability

In modern times, energy storage has become recognized as an essential part of the current energy supply chain. The primary rationales for this include the simple fact that it

Get a quote

Energy storage: Total supply chain | Deloitte Netherlands

In this final article, we look at the total supply chain factors that may influence the choice of investable energy storage assets, and the

Get a quote

Global Energy Storage Cell Shipment Ranking 1Q-3Q24

InfoLink Consulting has launched its global database of the lithium-ion battery supply chain, an essential element for the development of

Get a quote

Origin Energy invests $400M in battery at Mortlake

Origin Energy has given the go signal for the development of a significant large-scale battery at the Mortlake Power Station in southwest

Get a quote

Battery Energy Storage System (BESS) Supply Chain Analysis

Battery Energy Storage System (BESS) Supply The United States faces a significant challenge in keeping pace with the evolving and increasingly digitized grid.

Get a quote

EERE Technical Report Template

About the Supply Chain Review for the Energy Sector Industrial Base The report "America''s Strategy to Secure the Supply Chain for a Robust Clean Energy Transition" lays out the

Get a quote

A 2025 Update on Utility-Scale Energy Storage Procurements

While the energy storage market continues to rapidly expand, fueled by record-low battery costs and robust policy support, challenges still loom on the horizon—tariffs, shifting

Get a quote

Vikram Solar bags 336 MW module supply order from L&T for

Vikram Solar has received a 336 MW module supply order from L&T Construction for Gujarat''s Khavda solar project. The order will utilize Vikram Solar''s advanced Hypersol G12R modules,

Get a quote

6 FAQs about [Energy Storage Power Station Supply Chain]

Does grid energy storage have a supply chain resilience?

This report provides an overview of the supply chain resilience associated with several grid energy storage technologies. It provides a map of each technology’s supply chain, from the extraction of raw materials to the production of batteries or other storage systems, and discussion of each supply chain step.

Are energy storage manufacturing facilities online?

Even so, the strain on the supply chain remains a pressing concern. This graphic, credited to the American Clean Power Association, depicts manufacturing facilities in the United States that are currently online or have been announced. The darker green shade shows energy storage manufacturing facilities that are online.

What is a battery supply chain?

The status of the United States in each segment is highlighted. As noted earlier, five of the technologies evaluated are batteries. In general, battery supply chains encompass raw material procurement, refining, component manufacturing (electrodes, electrolytes, and separators), end-use products, and recycling.

What is America's strategy to secure the energy supply chain?

The report “America’s Strategy to Secure the Supply Chain for a Robust Clean Energy Transition” lays out the challenges and opportunities faced by the United States in the energy supply chain as well as the Federal Government plans to address these challenges and opportunities.

What is a battery energy storage system (BESS)?

As the energy industry continues to shift towards renewables, battery energy storage systems (BESS) are playing an increasingly critical role in ensuring grid stability and efficient energy management.

How much energy is stored in a battery?

Globally, over 30 gigawatt-hours (GWh) of storage is provided by battery technologies (BloombergNEF, 2020) and 160 gigawatts (GW) of long-duration energy storage (LDES) is provided by technologies such as pumped storage hydropower (PSH) (DOE 2020).

Guess what you want to know

-

Base station energy storage ESS power 1 MW base station power supply

Base station energy storage ESS power 1 MW base station power supply

-

Palau Base Station Energy Storage Power Supply

Palau Base Station Energy Storage Power Supply

-

Sudan Communication Base Station Energy Storage System Hybrid Power Supply

Sudan Communication Base Station Energy Storage System Hybrid Power Supply

-

Lu Portable Energy Storage Power Supply

Lu Portable Energy Storage Power Supply

-

Yemen Energy Storage Power Station System

Yemen Energy Storage Power Station System

-

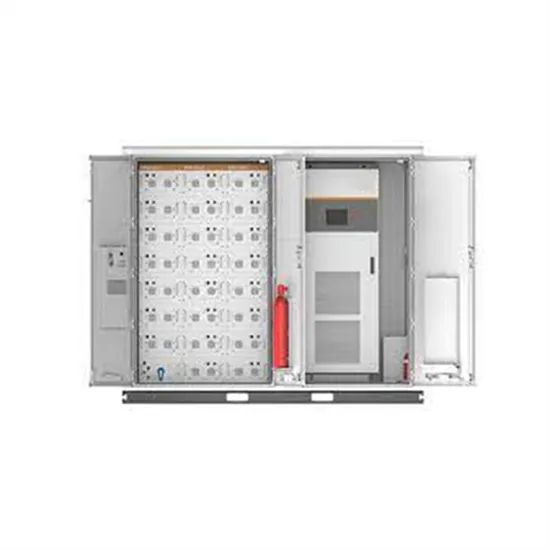

Belize Energy Storage Container Power Station System

Belize Energy Storage Container Power Station System

-

Small Energy Storage Power Supply

Small Energy Storage Power Supply

-

Huawei Netherlands Outdoor Energy Storage Power Supply

Huawei Netherlands Outdoor Energy Storage Power Supply

-

Fire protection in the energy storage cabin of a photovoltaic power station in Pakistan

Fire protection in the energy storage cabin of a photovoltaic power station in Pakistan

-

Anti-islanding protection energy storage power station

Anti-islanding protection energy storage power station

Industrial & Commercial Energy Storage Market Growth

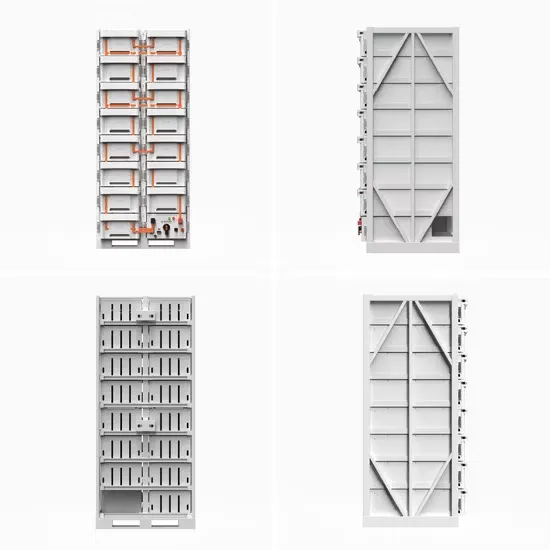

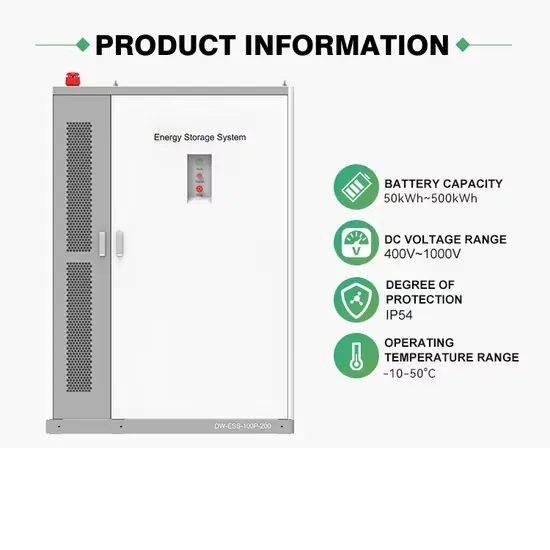

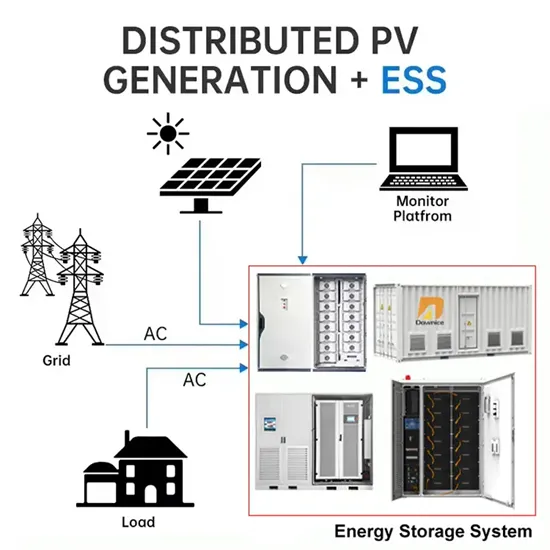

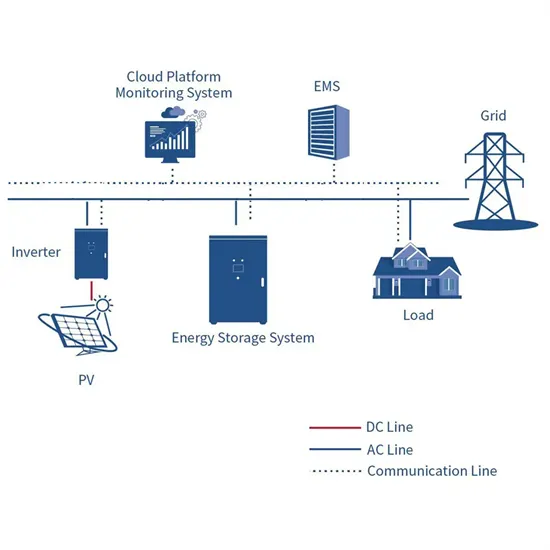

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

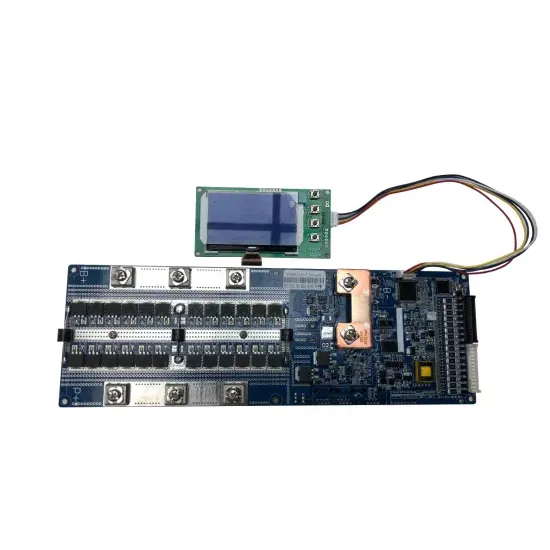

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.