Lithium-ion Battery Energy Storage Safety Standards

IEC62619 regulates the common test items and minimum safety requirements of secondary lithium batteries in industrial use, and iec positions

Get a quote

Lithium Battery For Communication Base Stations Market By

The Lithium Battery for Communication Base Stations Markethas encountered significant development over the recent years and is anticipated to grow tremendously over the forecast

Get a quote

Lithium-ion Battery For Communication Energy Storage System

It is expected that the next few years will be the peak of 5G base station construction, and by 2025, the battery demand for new and renovated 5G base stations in

Get a quote

Understanding Backup Battery Requirements for Telecom Base Stations

Telecom base stations require reliable backup power to ensure uninterrupted communication services. Selecting the right backup battery is crucial for network stability and

Get a quote

Battery For Communication Base Stations Market Size,Forecast

Battery for Communication Base Stations Market Size and Forecast Battery For Communication Base Stations Market size was valued at USD 7.1 Billion in 2024 and is projected to reach

Get a quote

Can telecom lithium batteries be used in 5G telecom base stations?

Integrating lithium batteries into existing 5G base station power systems may require some modifications. Operators need to ensure that the battery''s voltage, capacity, and

Get a quote

Common Safety Standards for Lithium Batteries in the

Performance standards for energy storage battery systems, the standards mainly cover various types of energy storage batteries used for

Get a quote

Optimization of Communication Base Station Battery

In the communication power supply field, base station interruptions may occur due to sudden natural disasters or unstable power supplies. This

Get a quote

Battery technology for communication base stations

In order to ensure the reliability of communication, 5G base stations are usually equipped with lithium iron phosphate cascade batteries with high energy density and high charge and

Get a quote

Lithium Iron Phosphate Batteries in Wireless Communication

These advancements made LFP batteries increasingly attractive for use in remote base stations and portable communication devices. A significant milestone in LFP battery

Get a quote

Telecom Base Station Backup Power Solution: Design

The battery pack should comply with international safety standards such as UL, CE, and IEC to ensure safe use in telecom base stations.

Get a quote

What Are the Key Considerations for Telecom Batteries in Base Stations?

Telecom batteries for base stations are backup power systems that ensure uninterrupted connectivity during grid outages. Typically using valve-regulated lead-acid

Get a quote

Communication Base Station Energy Storage Lithium Battery

Technological Advancements in Battery Technology: Continuous improvements in lithium battery energy density, lifespan, safety features, and cost-effectiveness enhance their attractiveness

Get a quote

Global Lithium Battery for Communication Base Stations Supply,

This report is a detailed and comprehensive analysis of the world market for Lithium Battery for Communication Base Stations, and provides market size (US$ million) and Year-over-Year

Get a quote

What Are the Key Considerations for Telecom Batteries in Base

Telecom batteries for base stations are backup power systems that ensure uninterrupted connectivity during grid outages. Typically using valve-regulated lead-acid

Get a quote

Battery for Communication Base Stations Market

Vodafone''s Turkish network uses lithium batteries with 95% round-trip efficiency for solar storage, compared to 80% for lead-acid alternatives. The International Energy Agency estimates solar

Get a quote

Lithium-ion Battery For Communication Energy Storage System

These network power applications require higher battery standards: higher energy density, more compact size, longer service times, easier maintenance, higher high

Get a quote

White Paper on Lithium Batteries for Telecom Sites

To cope with the safety risks of lithium batteries in telecom sites, ITU conducts extensive research, has strengthened the formulation and amendment of lithium battery safety standards.

Get a quote

Types of Batteries Used in Telecom Systems: A Guide

They''re often used alongside traditional batteries to enhance performance during peak loads or sudden power demands. These diverse options allow telecom operators to tailor

Get a quote

Global Lithium Battery for Communication Base Stations Market

On Aug 15, the latest report "Global Lithium Battery for Communication Base Stations Market 2025 by Manufacturers, Regions, Types and Applications, Forecast to 2031" from Global Info

Get a quote

Lithium battery solution for power supply guarantee system of

The power supply guarantee system for base stations, with its new energy lithium batteries featuring high energy density, light weight, long cycle life and environmental

Get a quote

Use of Batteries in the Telecommunications Industry

ATIS Standards and guidelines address 5G, cybersecurity, network reliability, interoperability, sustainability, emergency services and more...

Get a quote

Types of Batteries Used in Telecom Systems: A Guide

They''re often used alongside traditional batteries to enhance performance during peak loads or sudden power demands. These diverse

Get a quote

Understanding Backup Battery Requirements for

Telecom base stations require reliable backup power to ensure uninterrupted communication services. Selecting the right backup battery is

Get a quote

Communication network cabinet base station lithium battery

The use of lithium batteries in communication base stations is governed by industry-specific standards and regulations, including safety and transportation standards for lithium batteries.

Get a quote

Telecom Base Station Backup Power Solution: Design Guide for

The battery pack should comply with international safety standards such as UL, CE, and IEC to ensure safe use in telecom base stations. Additionally, it should meet

Get a quote

6 FAQs about [Standards for lithium batteries used in communication base stations]

Are lithium-ion batteries a good choice for a telecom system?

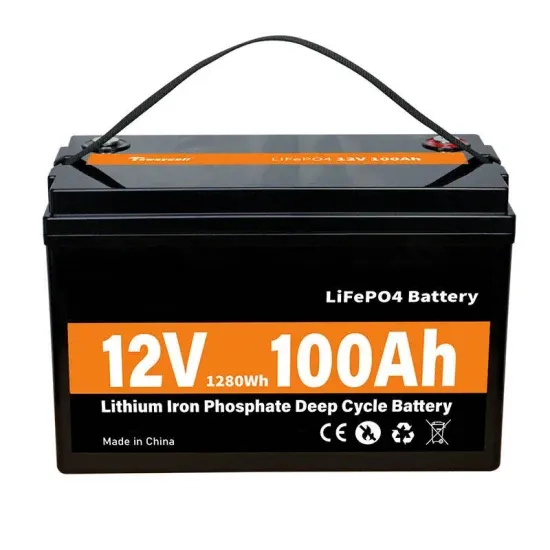

Lithium-ion batteries have rapidly gained popularity in telecom systems. Their efficiency is unmatched, providing higher energy density compared to traditional options. This means they can store more power in a smaller footprint.

Which battery is best for telecom base station backup power?

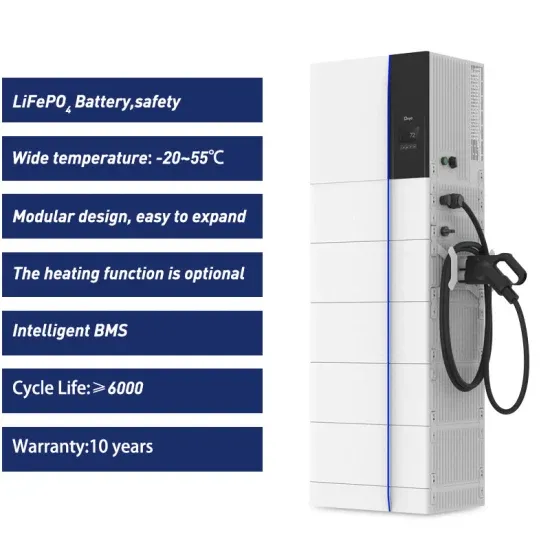

Among various battery technologies, Lithium Iron Phosphate (LiFePO4) batteries stand out as the ideal choice for telecom base station backup power due to their high safety, long lifespan, and excellent thermal stability.

What makes a telecom battery pack compatible with a base station?

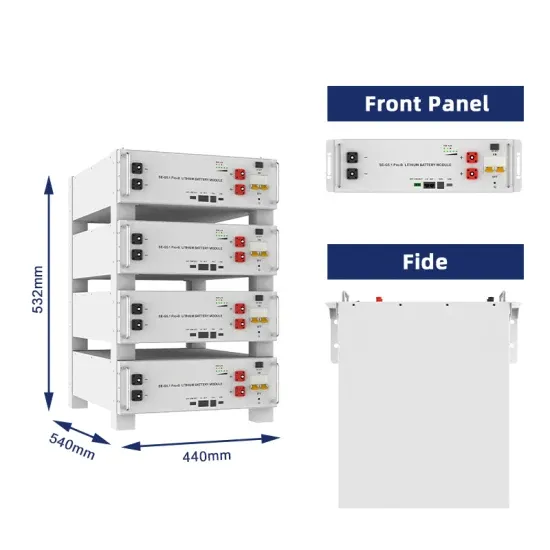

Compatibility and Installation Voltage Compatibility: 48V is the standard voltage for telecom base stations, so the battery pack’s output voltage must align with base station equipment requirements. Modular Design: A modular structure simplifies installation, maintenance, and scalability.

Are lithium-ion batteries the future of telecommunication?

With advancements continually being made in battery technology, lithium-ion remains at the forefront of innovative solutions for telecommunication needs. Nickel-cadmium (NiCd) batteries have carved out a niche in telecom systems due to their durability and reliability.

What type of battery does a telecom system need?

Beyond the commonly discussed battery types, telecom systems occasionally leverage other varieties to meet specific needs. One such option is the flow battery. These batteries excel in energy storage, making them ideal for larger installations that require consistent power over extended periods.

How do I choose the right battery for my telecom system?

Choosing the right battery for your telecom system involves several critical factors. Start by assessing the energy requirements of your equipment. Different devices will have different power needs, which can influence battery capacity. Next, consider the operating environment. Is it indoors or outdoors?

Guess what you want to know

-

Lithium titanate batteries for communication base stations

Lithium titanate batteries for communication base stations

-

Communication base stations have lithium iron phosphate batteries

Communication base stations have lithium iron phosphate batteries

-

How many sets of batteries are suitable for communication base stations

How many sets of batteries are suitable for communication base stations

-

Main equipment cost of lead-acid batteries for communication base stations

Main equipment cost of lead-acid batteries for communication base stations

-

Where are the lead-acid batteries for communication base stations in Uzbekistan

Where are the lead-acid batteries for communication base stations in Uzbekistan

-

Construction cost of lead-acid batteries for communication base stations in the UAE

Construction cost of lead-acid batteries for communication base stations in the UAE

-

Alkaline new energy batteries for communication base stations

Alkaline new energy batteries for communication base stations

-

Requirements for lead-acid batteries installed in communication base stations in Liberia

Requirements for lead-acid batteries installed in communication base stations in Liberia

-

The cost of installing batteries for communication base stations in Sao Tome and Principe

The cost of installing batteries for communication base stations in Sao Tome and Principe

-

How to build liquid flow batteries for small communication base stations in Bangladesh

How to build liquid flow batteries for small communication base stations in Bangladesh

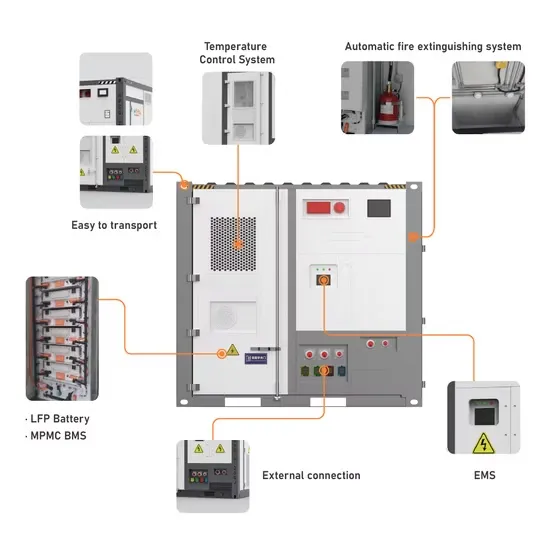

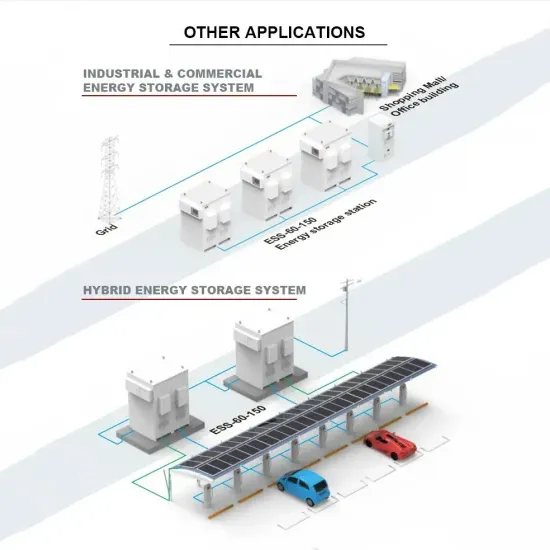

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.