China''s 5G dominance: 3.19 million base stations

Base stations offering high-speed fifth-generation (5G) mobile networks have now exceeded 3.19 million, the Ministry of Industry and

Get a quote

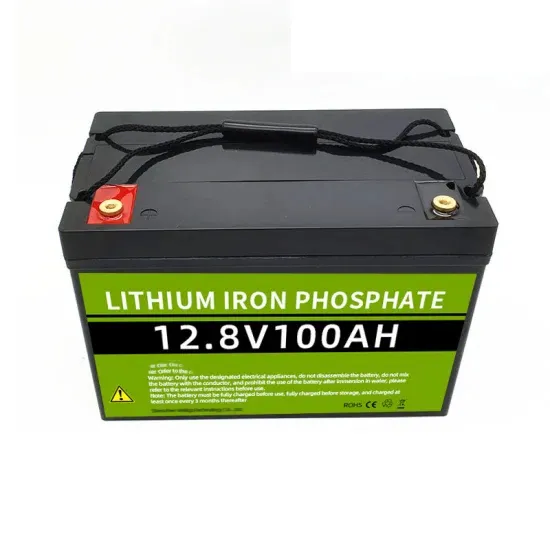

5G base station application of lithium iron phosphate battery

Jan 19, 2021 5G base station application of lithium iron phosphate battery advantages rolling lead-acid batteries With the pilot and commercial use of 5G systems, the large power consumption

Get a quote

Lead-acid batteries

Lead-acid batteries Due to the increase in demand for alternative back-up electricity supplies and stand-alone power systems (SAPS), energy storage batteries are becoming more frequently

Get a quote

Lithium ion battery for telecom industry/towers/backup

The construction of mobile communication base stations is an important part of social security. The stability of communication base stations is related to

Get a quote

What Batteries Power China Telecom''s Network Infrastructure?

China Telecom relies on lithium-ion, valve-regulated lead-acid (VRLA), and nickel-based batteries to ensure uninterrupted power for its vast network infrastructure. These

Get a quote

Intelligent Telecom Energy Storage White Paper

Replacement of lead-acid batteries Basic control & Management Multiple technologies Integration New dual-network Architecture Energy internet technology and new energy

Get a quote

Electric vehicle battery

Electric vehicle battery Nissan Leaf cutaway showing part of the battery in 2009 An electric vehicle battery is a rechargeable battery used to power the electric

Get a quote

Telecom Power Supply Solution for China Mobile''s

To date, the supplier has provided 100,000 CL 2V Series batteries and 60,000 Long-Life FM Series batteries. These batteries are used in the power systems

Get a quote

Types of Batteries Used in Telecom Systems: A Guide

That''s where batteries come into play. They ensure that communication lines remain open, even during outages or emergencies. But not all batteries are created equal.

Get a quote

Lead-Acid Batteries for Reliable Telecom Power

Among the various energy storage options, lead-acid batteries have been a reliable and cost-effective choice for providing backup power in

Get a quote

Vision_Smart_Batteries_Backup_Power | Telecom Power Supply

To date, Vision has supplied China Mobile with?100,000 CL 2V Series batteries and 60,000 Long-Life FM Series batteries, which are used in the power systems of newly constructed base

Get a quote

China''s 5G construction turns to lithium-ion batteries for energy

According to the plans of the four major operators of China Mobile, China Unicom, China Telecom, and China Radio and Television, 600,000 5G base stations will be opened by the

Get a quote

5G base station rollout in the U.S. and China 2021

The United States (U.S.) and China are both rolling out ** infrastructure at a rapid rate, growing approximately *** times in size from

Get a quote

Lead Battery Facts and Sources | Battery Council International

Learn more about lead battery facts and information presented on Essential Energy Everyday derived from the sources provided.

Get a quote

What to Look for in a Telecom Battery? Updated

Both lead-acid and lithium-ion batteries are incredibly common, so you need to make sure you''re getting batteries designed for use in telecom systems.

Get a quote

China Tower Stopped Purchasing Lead-acid batteries And

By the end of 2018, about 120,000 base stations in 31 provinces and cities across the country had used 1.5 GWh of ladder batteries, replacing about 45,000 tons of lead-acid

Get a quote

Telecom Power Supply Solution for China Mobile''s Base Stations

To date, the supplier has provided 100,000 CL 2V Series batteries and 60,000 Long-Life FM Series batteries. These batteries are used in the power systems of newly constructed base

Get a quote

Global Battery for Communication Base Stations Market 2025 by

China is the largest producer of Battery For Communication Base Stations, followed by South Korea and Japan. In terms of product type, Lead-acid Battery is the largest segment, occupied

Get a quote

Optimization of Communication Base Station Battery

In the communication power supply field, base station interruptions may occur due to sudden natural disasters or unstable power supplies. This work studies the optimization of

Get a quote

China Tower Stopped Purchasing Lead-acid batteries

By the end of 2018, about 120,000 base stations in 31 provinces and cities across the country had used 1.5 GWh of ladder batteries, replacing

Get a quote

The Future of Telecom Relies on Lithium Batteries: Why and How?

They have fewer harmful components and can be reused when they wear out. How Lithium Batteries Shape Telecom''s Future: • Base Stations and Cell Towers: Lithium batteries now

Get a quote

Communication Base Station Lead-Acid Battery: Powering

In an era where lithium-ion dominates headlines, communication base station lead-acid batteries still power 68% of global telecom towers. But how long can this 150-year-old technology

Get a quote

China''s Communication Base Station Energy Storage:

By embracing these innovations, China''s communication networks can achieve true energy resilience. Not just surviving extreme weather, but thriving through it – keeping millions

Get a quote

China''s 5G construction turns to lithium-ion batteries

According to the plans of the four major operators of China Mobile, China Unicom, China Telecom, and China Radio and Television, 600,000 5G base stations

Get a quote

Environmental-economic analysis of the secondary use of electric

This study examines the environmental and economic feasibility of using repurposed spent electric vehicle (EV) lithium-ion batteries (LIBs) in the ESS of

Get a quote

Path to the sustainable development of China''s secondary lead

Lead-acid batteries (LABs) are widely used in electric bicycles, motor vehicles, communication stations, and energy storage systems because they utilize readily available

Get a quote

6 FAQs about [How many lead-acid batteries are there in China s communication base stations ]

How many lead batteries are produced each year in China?

Every year in China, approximately 300,000 lead batteries are replaced in motor vehicles and ships alone, and the annual growth rate of WLAB production is 7% (Bai et al., 2016). With the development of consumer electric bicycles, vehicles, and electronic communication devices, the number of LABs is expected to increase each year.

What are lead-acid batteries used for?

Lead-acid batteries (LABs) are widely used in electric bicycles, motor vehicles, communication stations, and energy storage systems because they utilize readily available raw materials while providing stable voltage, safety and reliability, and high resource utilization. China produces a large number of waste lead-acid batteries (WLABs).

Does China recycle lead-acid batteries?

China produces a large number of waste lead-acid batteries (WLABs). However, because of the poor state of the country's collection system, China's formal recycling rate is much lower than that of developed countries and regions, posing a serious threat to the environment and human health.

Are lithium-ion batteries a good choice for a telecom system?

Lithium-ion batteries have rapidly gained popularity in telecom systems. Their efficiency is unmatched, providing higher energy density compared to traditional options. This means they can store more power in a smaller footprint.

How much lead is used in battery production?

Status of waste lead-acid battery generation Globally, approximately 10 million tons of lead is used to produce LABs annually, accounting for over 85% of lead production (Machado Santos et al., 2019; Prengaman, 2000; Tan et al., 2019).

Are lithium-ion batteries the future of telecommunication?

With advancements continually being made in battery technology, lithium-ion remains at the forefront of innovative solutions for telecommunication needs. Nickel-cadmium (NiCd) batteries have carved out a niche in telecom systems due to their durability and reliability.

Guess what you want to know

-

How are lead-acid batteries installed in communication base stations on high-rise buildings

How are lead-acid batteries installed in communication base stations on high-rise buildings

-

How many lead-acid batteries are there in Comoros 5G communication base stations

How many lead-acid batteries are there in Comoros 5G communication base stations

-

The latest planning of lead-acid batteries for Cyprus communication base stations

The latest planning of lead-acid batteries for Cyprus communication base stations

-

How important is lead-acid battery energy storage ESS for communication base stations

How important is lead-acid battery energy storage ESS for communication base stations

-

Environmental inspection of lead-acid batteries in communication base stations

Environmental inspection of lead-acid batteries in communication base stations

-

Do communication base stations still use lead-acid batteries

Do communication base stations still use lead-acid batteries

-

How much does a set of lead-acid batteries for a communication base station cost

How much does a set of lead-acid batteries for a communication base station cost

-

China digs out companies that have discovered batteries for communication base stations

China digs out companies that have discovered batteries for communication base stations

-

How many sets of batteries are suitable for communication base stations

How many sets of batteries are suitable for communication base stations

-

Are lead-acid batteries for communication base stations large

Are lead-acid batteries for communication base stations large

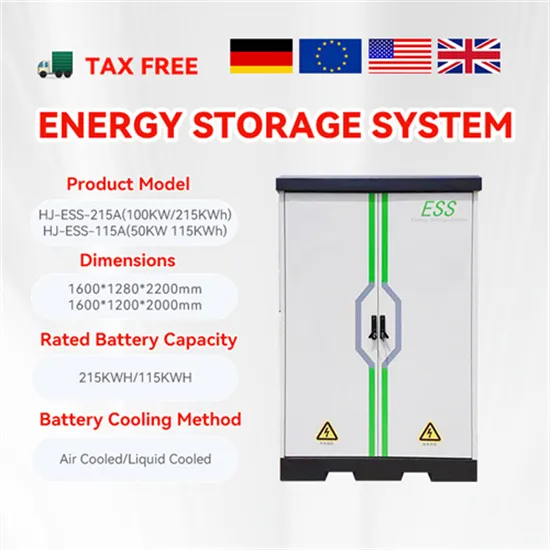

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.