Can 3,500 Percent Tariffs Protect the U.S. Solar

The U.S. imposed sky-high tariffs on solar imports from four countries, but it''s unclear if they will be enough to fight back Chinese competitors.

Get a quote

Southeast Asian Solar Manufacturers Look Elsewhere To Escape

To support green energy, President Biden waived tariffs for solar panels produced in Vietnam, Cambodia, Malaysia, and Thailand for two years starting in 2022. But that

Get a quote

What next for Southeast Asia''s China-backed solar boom?

The arrival of factories backed by Chinese solar heavyweights such as Trina, Longi, JA Solar and Jinko Solar, among nearly 20 other competitors, has transformed

Get a quote

What next for Southeast Asia''s China-backed solar

The arrival of factories backed by Chinese solar heavyweights such as Trina, Longi, JA Solar and Jinko Solar, among nearly 20 other

Get a quote

U.S. Slaps Steep Tariffs on Southeast Asian Solar Imports

SINGAPORE--The U.S. broadened its trade dispute with China by imposing steep tariffs on solar imports from four Southeast Asian countries where mainland manufacturers

Get a quote

Asia Solar Co.,Ltd – Brighten Your Living

Asia Solar Co., Ltd is "The Best Solar Energy and Lighting Solution Provider" for you. Aiming to be the best in the league, we offer fair value product and will

Get a quote

US Duties on Southeast Asian Solar Panel Exports: Where the

Beginning in mid-June 2025, US buyers are paying higher duties on solar panel imports from four Southeast Asian countries, namely, Cambodia, Malaysia, Thailand, and

Get a quote

US sets tariffs of up to 3,521% on South East Asia solar panels

The US Commerce Department has announced plans to impose tariffs of up to 3,521% on imports of solar panels from four South East Asian countries.

Get a quote

US sets tariffs for solar panels from South-east Asian nations

WASHINGTON-US trade officials announced on Nov 29 a new round of tariffs on solar panel imports from four South-east Asian nations after American manufacturers

Get a quote

Final U.S. Tariffs on Solar Imports from Southeast

Discover how new 2025 U.S. tariffs on solar panels from Malaysia, Thailand, Vietnam, and Cambodia could impact importers and developers.

Get a quote

US Imposes Massive Tariffs on Southeast Asian Solar Panels

US slaps massive tariffs on Asian solar imports, with Cambodia hit hardest at 3,521%, as trade tensions rise over alleged Chinese subsidies.

Get a quote

US sets antidumping duties for Southeast Asian solar

DOC issued a list of companies it says are exporting solar cells to the US below production costs, a practice known as "price dumping".

Get a quote

As Trump''s tariffs loom, Southeast Asia''s solar

US officials say Chinese producers have used Southeast Asian countries to skirt tariffs on China and "dump" cheap solar panels in the US

Get a quote

Top 10 Asian Solar Companies 2025: Global Rankings

Discover the innovators driving 82% of global solar deployment with breakthrough technologies and record installations. In 2025, Asian manufacturers have solidified their position as global

Get a quote

US sets tariffs of up to 3,521% on South East Asia

The US Commerce Department has announced plans to impose tariffs of up to 3,521% on imports of solar panels from four South East Asian

Get a quote

Will Tariffs on Solar Cell Imports Invigorate the U.S.

The U.S. Department of Commerce determined last week solar cell imports from four Southeast Asian countries should see tariffs of up to 3,521

Get a quote

As Trump''s tariffs loom, Southeast Asia''s solar industry faces

US officials say Chinese producers have used Southeast Asian countries to skirt tariffs on China and "dump" cheap solar panels in the US market, harming their businesses.

Get a quote

As Trump''s tariffs loom, Southeast Asia''s solar

As Trump''s tariffs loom, Southeast Asia''s solar industry faces devastation US tariffs cast pall over green energy industry in Thailand,

Get a quote

2024 Trends in the Asian Solar Market

China aside, Asia''s solar market remains widely untapped. This is a huge missed opportunity, considering that the region faces unique circumstances. On the one hand, it is

Get a quote

First Solar surges as U.S. finalizes tariffs on Southeast Asian solar

First Solar finished +10.5% after the U.S. Department of Commerce announced steep anti-dumping and anti-subsidy tariffs against solar cell imports from four Southeast Asian

Get a quote

© Asian Solar Co., Ltd. – Asian Solar Co., Ltd.

We are involved in design and installation of solar systems, as well as distributing solar panels from manufacturers in Thailand, China, and throughout Asia. Learn more about what we do.

Get a quote

US to unveil first of two decisions on more solar tariffs

U.S. trade officials this week may impose new tariffs on solar panels from four Southeast Asian nations that American manufacturers have

Get a quote

Trade court orders retroactive duties on solar panels imported

At the time of the investigation, solar panels from Southeast Asia made up 80% of supply in the United States, and exporters stopped bringing in more panels for fear of high

Get a quote

Final U.S. Tariffs on Solar Imports from Southeast Asia (2025

Discover how new 2025 U.S. tariffs on solar panels from Malaysia, Thailand, Vietnam, and Cambodia could impact importers and developers. Learn strategies to reduce

Get a quote

Japan''s Solar Super-Panel—More Powerful Than 20

Japan has unveiled the world''s first solar super-panel powered by next-gen perovskite technology—capable of generating power equivalent to 20 nuclear reactors.

Get a quote

Guess what you want to know

-

Nicaragua solar panel photovoltaic module seller

Nicaragua solar panel photovoltaic module seller

-

Energy storage cabinet outdoor power supply charging solar panel

Energy storage cabinet outdoor power supply charging solar panel

-

Solar PV Panel Trap

Solar PV Panel Trap

-

Solar Photovoltaic Panel Domain Proxy

Solar Photovoltaic Panel Domain Proxy

-

North America Solar Energy Storage Cabinet Control Panel Installation

North America Solar Energy Storage Cabinet Control Panel Installation

-

Kiribati Solar Panel Group

Kiribati Solar Panel Group

-

Kosovo solar photovoltaic panel project

Kosovo solar photovoltaic panel project

-

EU solar panel installation north

EU solar panel installation north

-

Farm Solar Photovoltaic Panel Benefit Linkage Mechanism

Farm Solar Photovoltaic Panel Benefit Linkage Mechanism

-

How much does solar photovoltaic silicon panel equipment cost

How much does solar photovoltaic silicon panel equipment cost

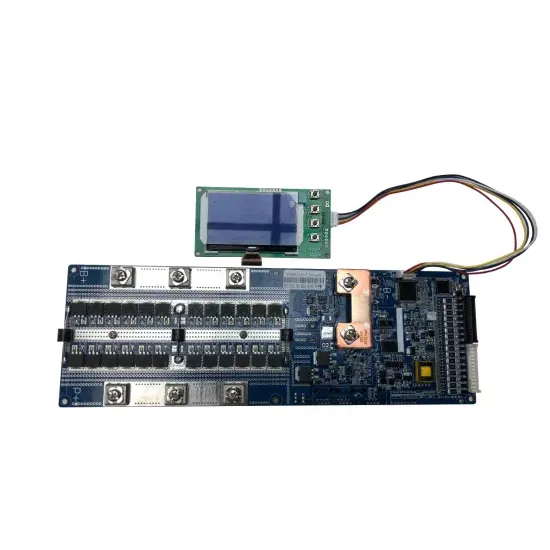

Industrial & Commercial Energy Storage Market Growth

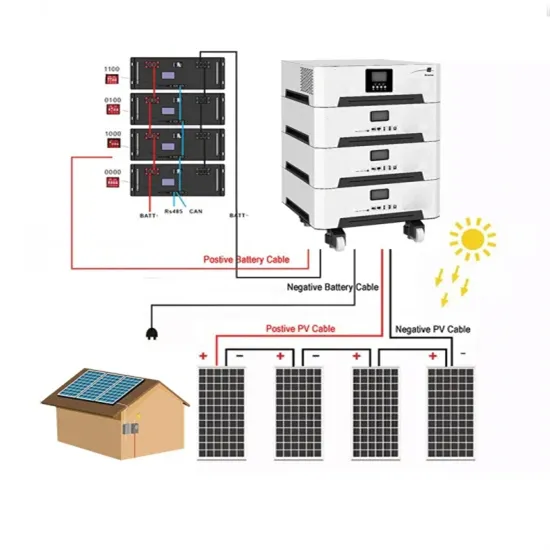

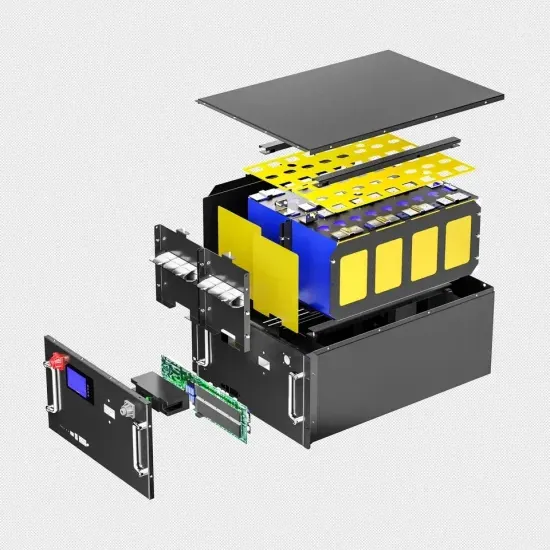

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.