Southeast Asia''s largest Energy Storage project deployed at

Singapore-based energy and urban development company Sembcorp Industries has officially opened the 285-MWh utility-scale energy storage system on the country''s Jurong

Get a quote

Building the ASEAN Power Grid: Opportunities and Challenges

Interconnecting power grids in the region is a key strategy in strengthening Southeast Asia''s energy security and transitioning to renewables through efficient resource

Get a quote

Largest Energy Storage System in South-East Asia to

EMA appointed Sembcorp Industries to build, own and operate Energy Storage Systems (ESS) to enhance the resilience of our energy

Get a quote

Why digital grids are pivotal to Southeast Asia''s energy

Utilities companies in the region are diversifying their asset portfolios, investing in renewable energy, energy storage, carbon capture, energy efficiency and e-mobility initiatives.

Get a quote

Energy storage systems in Southeast Asia: Four Real-World

Four original case studies of solar power inverter systems with lithium batteries deployed in Southeast Asia—design choices, performance insights, and how storage cuts

Get a quote

Southeast Asia: Emerging energy storage opportunities

There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high growth in population and energy

Get a quote

Envision Energy, SUN Terra partner for ESS in

Envision Energy has inked a strategic partnership with SUN Terra to collaborate on energy storage in Southeast Asia, India and Australia.

Get a quote

Top 10 Energy Storage Companies in Asia

Discover the current state of energy storage companies in Asia, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

Southeast Asia''s emerging energy storage opportuniti

Wärtsilä has delivered a number of projects in the region, including Singa-pore''s first-ever pilot grid-scale battery energy storage system (BESS) and several large-scale projects in the

Get a quote

Top 3 Energy Storage Suppliers in Southeast Asia

Luckily for us, most of the world''s best storage companies are in Southeast Asia. These companies store all that new renewable energy and they make sure we can get access

Get a quote

Sembcorp to expand Southeast Asia''s biggest battery storage site

Built across two sites on Jurong Island, Sembcorp''s lithium ion battery storage system will now be expanded to 311 MWh. Meanwhile, Singapore''s Energy Market Authority

Get a quote

What are the energy storage companies in Asia? | NenPower

In detail, China leads the market with numerous companies focusing on manufacturing advanced battery systems and energy management solutions, demonstrating

Get a quote

Jinko ESS to Deploy 10MWh Energy Storage System in Southeast Asia

Jinko ESS, a global leading energy storage company, has secured a 10MWh energy storage project in Southeast Asia region, and will deploy a 10MWh off-grid energy

Get a quote

One of Southeast Asia''s largest energy storage systems comes

Sembcorp Industries (Sembcorp) and Singapore''s Energy Market Authority (EMA) have officially opened what is being touted as Southeast Asia''s largest energy storage system.

Get a quote

Southeast Asia: Emerging energy storage opportunities

There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high

Get a quote

Development of Vietnam Smart Grid Roadmap for period up to

EXECUTIVE SUMMARY This Deliverable 2 - Report on Current Status of Smart Grid Development in Viet Nam has been prepared by Intelligent Energy Systems Pty Ltd (IES) and

Get a quote

Jinko ESS to deploy 10MWh off-grid energy storage system in Southeast Asia

Jinko ESS, a global leading energy storage company, has secured a 10MWh energy storage project in Southeast Asia region, and will deploy a 10MWh off-grid energy

Get a quote

ASEAN Energy in 2025

Sources: [3], [4], [5] Several energy-focused initiatives introduced at COP29 received endorsement from a few ASEAN Member States (AMS) [2]. These include the Global Energy

Get a quote

ASEAN Energy Storage Market Size & Share Analysis

The ASEAN Energy Storage Market is expected to reach USD 3.55 billion in 2025 and grow at a CAGR of 6.78% to reach USD 4.92 billion by 2030. GS Yuasa Corporation,

Get a quote

Battery energy storage systems: South-east Asia''s key to

Once the battery is full, the excess energy is sold back to the power grid. This stored energy can then be deployed during periods of low solar generation or high demand,

Get a quote

Hitachi ABB Power Grids does virtual power plant

Hitachi ABB Power Grids will supply battery energy storage and smart controls to Singapore''s first virtual power plant (VPP), on a project

Get a quote

Japan can power Southeast Asia''s clean energy future | IEEFA

By supporting renewable energy deployment and supply chain development in Southeast Asia, Japan could address three challenges: overreliance on fossil fuels, regional

Get a quote

Wired for profit: Grid is the key to unlock ASEAN energy

Wired for profit: Grid is the key to unlock ASEAN energy investment Grid is the driver to unlock solar and wind markets and provide opportunities for fossil-dependent countries to be

Get a quote

Microgrid Solutions for Southeast Asia''s Energy Challenges | Power

Discover how a microgrid can solve Southeast Asia''s energy challenges with reliable, scalable, and sustainable power.

Get a quote

Top 3 Energy Storage Suppliers in Southeast Asia

Luckily for us, most of the world''s best storage companies are in Southeast Asia. These companies store all that new renewable energy and

Get a quote

SOUTHEAST ASIA''S LARGEST ENERGY STORAGE

Singapore, February 2, 2023 – Sembcorp Industries (Sembcorp) and the Energy Market Authority (EMA) today officially opened the Sembcorp Energy Storage System (ESS). The Sembcorp

Get a quote

Battery energy storage systems: South-east Asia''s

Once the battery is full, the excess energy is sold back to the power grid. This stored energy can then be deployed during periods of low

Get a quote

6 FAQs about [Southeast Asian power grid energy storage companies]

Is Southeast Asia a good place to invest in energy storage?

Image: ACEN. There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high growth in population and energy demand. Andy Colthorpe speaks with companies working to establish a framework of opportunities in the region.

Why does Southeast Asia need flexible energy storage solutions?

Southeast Asia's exponential growth in electricity demand, averaging over 6% annually over the past two decades, has created an urgent need for reliable and flexible energy storage solutions. This surge in demand is primarily driven by increasing ownership of household appliances and rising consumption of goods and services across the region.

How can microgrids help Southeast Asia's power grid?

Challenges in Current Grid Infrastructure Southeast Asia's existing power grids often struggle to meet growing energy demands, leading to frequent power outages and voltage fluctuations. Microgrids can mitigate these issues by providing reliable backup power.

What is Southeast Asia's energy landscape?

Southeast Asia's energy landscape is characterised by a mix of developed and developing economies, each with unique energy challenges. The region is home to major manufacturing hubs like Vietnam and Indonesia, as well as financial centres like Singapore (Source of Asia, 2024).

Can decentralised power systems improve energy resilience in Southeast Asia?

As Southeast Asia continues to evolve its energy policies, there is potential for more favourable conditions for microgrid development. Governments are increasingly recognising the role of decentralised power systems in achieving sustainable energy goals and enhancing energy resilience.

Does ASEAN need energy storage?

The ASEAN energy storage landscape is undergoing a significant transformation driven by the region's ambitious renewable energy goals and growing energy demands. The ASEAN Centre for Energy (ACE) projects the region's total final energy consumption to increase by 146% by 2040, highlighting the urgent need for robust energy storage systems.

Guess what you want to know

-

Congo Brazzaville power grid energy storage companies

Congo Brazzaville power grid energy storage companies

-

Central Asian Power Grid Energy Storage

Central Asian Power Grid Energy Storage

-

Indonesia power grid energy storage power station construction

Indonesia power grid energy storage power station construction

-

Are there any energy storage projects in the Mozambique power grid

Are there any energy storage projects in the Mozambique power grid

-

The relationship between energy storage photovoltaic power generation and grid connection

The relationship between energy storage photovoltaic power generation and grid connection

-

Belgian Energy Storage Power Station Grid Connection Project

Belgian Energy Storage Power Station Grid Connection Project

-

American companies photovoltaic power generation and energy storage equipment

American companies photovoltaic power generation and energy storage equipment

-

The difference between the grid side and the user side of energy storage power supply

The difference between the grid side and the user side of energy storage power supply

-

How many companies are involved in the Cook Islands energy storage power station

How many companies are involved in the Cook Islands energy storage power station

-

British lithium power energy storage companies

British lithium power energy storage companies

Industrial & Commercial Energy Storage Market Growth

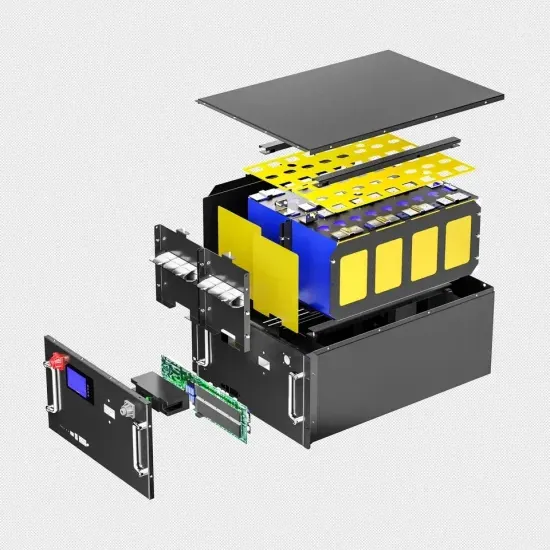

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.