Buy Wholesale flow meter south korea At Affordable Prices

Make sure to find wholesale flow meters extensive collections of flow meter south korea at Alibaba and uncover all the in-demand flow meter south korea available for your shopping

Get a quote

The key to making all-solid-state secondary batteries

South Korean researchers have found the key to producing ultra-thin, high-performance solid-state batteries. Standard lithium-ion batteries use

Get a quote

South Korea Zinc-Iron Liquid Flow Battery Market Overview

The South Korea zinc-iron liquid flow battery market is experiencing steady growth driven by increasing demand for efficient and sustainable energy storage solutions.

Get a quote

What Are Liquid Flow Batteries And Their Advantages?

The discharge process is the opposite. Unlike general solid-state batteries, the positive and (or) negative electrolyte solutions of liquid flow batteries are stored in tanks

Get a quote

The manufacturer of the largest liquid flow battery project in the

H2 Inc, a South Korean based manufacturer of vanadium flow battery energy storage systems, has recently completed a Series B financing of $18 million. The company stated last week that

Get a quote

List of Battery companies in South Korea

We are very specialized the business of car battery (SMF/MF), deep cycle battery, forklift battery (traction cell) and motorcycle battery as a manufacturer exporter.

Get a quote

South Korea''s Emerging Role in the Global Battery Supply Chain

Increased raw material requirements have led South Korean companies to buy stakes and indulge in strategic partnerships with mining and refining companies, to invest in

Get a quote

Top Battery Companies In South Korea In 2025

South Korea is a major player in the global battery industry, with several companies leading the way in innovation and production. These companies

Get a quote

South Korean flow battery maker H2 building 330MWh

The company has developed Enerflow, a vanadium redox flow battery (VRFB) based on proprietary technology, claiming that a high level of

Get a quote

Liquid Flow Battery Market Size and Trends 2025-2033:

The liquid flow battery market is experiencing robust growth, driven by increasing demand for energy storage solutions across diverse sectors. The market''s expansion is fueled

Get a quote

South Korean flow battery maker H2 building 330MWh factory

The company has developed Enerflow, a vanadium redox flow battery (VRFB) based on proprietary technology, claiming that a high level of vertical integration will make its

Get a quote

Liquid Flow Controllers Price in South Korea

Find South Korea liquid flow controllers manufacturers on ExportHub . Buy products from suppliers of South Korea and increase your sales.

Get a quote

Liquid flow system | C&I Energy Storage System

From lithium-ion battery giants to innovative system integrators, let''s explore who''s leading this charge. [2024-11-04 23:08] energy storage systems energy storage equipment Liquid metal

Get a quote

South Korea Flow Battery Market (2024-2030) Outlook

Market Forecast By Type (Vanadium Redox Flow Battery, Zinc Bromine Flow Battery, Iron Flow Battery, Zinc Iron Flow Battery), By Storage (Compact, Large scale), By Application (Utilities,

Get a quote

South Korea''s Emerging Role in the Global Battery

Increased raw material requirements have led South Korean companies to buy stakes and indulge in strategic partnerships with mining and

Get a quote

Vanadium redox battery

Schematic design of a vanadium redox flow battery system [5] 1 MW 4 MWh containerized vanadium flow battery owned by Avista Utilities and manufactured by UniEnergy Technologies

Get a quote

South Korea Liquid Flow Testing Service Market Size 2026-2033

The South Korea Liquid Flow Testing Service industry exhibits concentrated regional activity, with key hubs such as Seoul, Incheon, and Busan leading in production,

Get a quote

Vanadium flow battery maker H2 secures funds for new Korean

South Korean vanadium flow battery (VFB) maker H2, Inc. has secured $16 million of bridge funding towards the K2 manufacturing site which is intended to almost treble its

Get a quote

South Korea Zinc Bromide Liquid Battery Market Overview: Key

The South Korea Zinc Bromide Liquid Battery market is witnessing significant growth driven by the increasing demand for energy storage solutions and sustainable energy

Get a quote

South Korea Liquid Cooled Battery Cabinet Market 2026: Size

South Korea Liquid Cooled Battery Cabinet Market size was valued at USD 0.12 Billion in 2024 and is projected to reach USD 0.35 Billion by 2033, growing at a CAGR of

Get a quote

South Korea Liquid Cooled Energy Storage Solution Market

South Korea Liquid Cooled Energy Storage Solution Market was valued at USD 400 Million in 2022 and is projected to reach USD 1.1 Billion by 2030, growing at a CAGR of 12.

Get a quote

South Korea Liquid Cooling Battery Rack System Market

South Korea Liquid Cooling Battery Rack System Market size is estimated to be USD 1.2 Billion in 2024 and is expected to reach USD 3.

Get a quote

Wholesale Korea Battery

Wholesale Korea batteries for various applications. Find reliable, high-quality lithium-ion and other battery types from South Korean suppliers. Bulk orders welcome.

Get a quote

Top Battery Companies In South Korea In 2025

South Korea is a major player in the global battery industry, with several companies leading the way in innovation and production. These companies include LG Chem, Samsung SDI, SK

Get a quote

South Korea Flow Battery Store Energy Market: Key Trends

With increasing awareness of sustainable energy solutions and the strategic focus on energy independence, the South Korea flow battery market is poised for sustained growth

Get a quote

6 FAQs about [South Korean liquid flow battery wholesale]

What are the top battery companies in South Korea in 2025?

Here are the 28 Top Battery Companies In South Korea In 2025 and their top employee and leadership contact details: South Korea is a major player in the global battery industry, with several companies leading the way in innovation and production. These companies include LG Chem, Samsung SDI, SK Innovation, and Kokam.

Is South Korea a good place to buy EV batteries?

South Korea is the leading exporter of cathode materials to the US and European markets. South Korea is also considered the hub for the EV battery supply chain. The US Inflation Reduction Act (IRA) presents a significant opportunity for South Korea's battery supply chain as the country is listed under the free trade agreement (FTA) with the US.

Who makes the best battery in South Korea?

LG Chem is the largest battery manufacturer in South Korea, producing a wide range of lithium-ion batteries for use in electric vehicles, home energy storage systems, and other applications. Samsung SDI is also a major player in the battery industry, producing high-quality batteries for use in smartphones, tablets, and other electronic devices.

What influences the battery industry in South Korea?

The battery industry in South Korea is significantly influenced by several key considerations. Firstly, South Korea is home to major players like Samsung SDI and LG Energy Solution, which are critical in shaping the competitive landscape.

Are New South Korean companies entering the battery supply chain?

New Entrants in the Market: Beyond established giants, new South Korean companies are entering the battery supply chain, further diversifying the landscape. For instance, a South Korea-based emerging player Copra BM, announced a partnership with BASF in 2023 to build a cathode active material (CAM) plant in South Korea.

How does the US inflation Reduction Act affect South Korea's battery supply chain?

The US Inflation Reduction Act (IRA) presents a significant opportunity for South Korea's battery supply chain as the country is listed under the free trade agreement (FTA) with the US. The strict sourcing model qualifies Korean-made batteries with compliant sourcing for the US EV tax credit, making them more attractive to American consumers.

Guess what you want to know

-

Honduras all-vanadium liquid flow energy storage battery

Honduras all-vanadium liquid flow energy storage battery

-

The role of liquid flow energy storage battery

The role of liquid flow energy storage battery

-

The best enterprise of all-vanadium liquid flow battery

The best enterprise of all-vanadium liquid flow battery

-

Kiribati flow battery wholesale

Kiribati flow battery wholesale

-

Namibia flow battery wholesale

Namibia flow battery wholesale

-

Iraq Flow Battery Wholesale

Iraq Flow Battery Wholesale

-

Macedonian Liquid Flow Energy Storage Battery

Macedonian Liquid Flow Energy Storage Battery

-

Huijue Liquid Flow Battery

Huijue Liquid Flow Battery

-

Turkey s new all-vanadium liquid flow battery

Turkey s new all-vanadium liquid flow battery

-

Zinc-bromine non-fading liquid flow energy storage battery

Zinc-bromine non-fading liquid flow energy storage battery

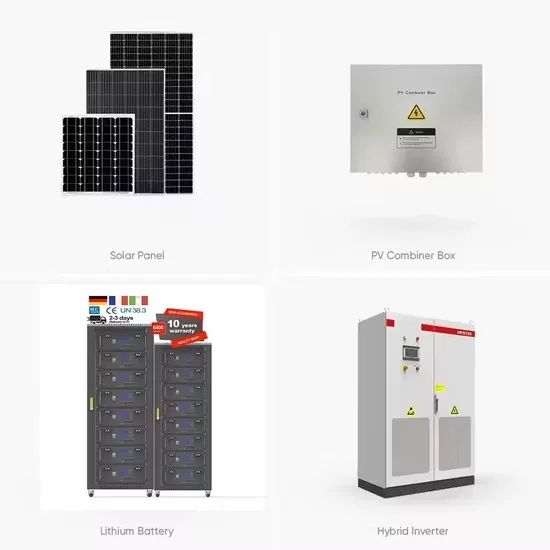

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

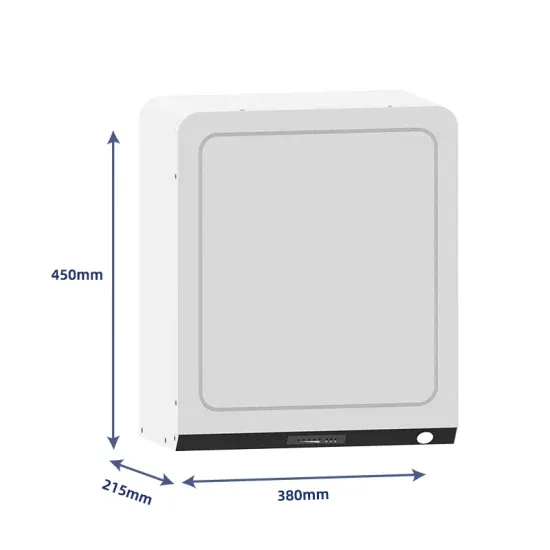

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.