Wind power in Taiwan

A wind farm in Qingshui District, Taichung. Wind power is a major industry in Taiwan. Taiwan has abundant wind resources however a lack of space on land means that most major

Get a quote

Green power for mobile networks

To power base stations that are not on the grid, diesel fuel has often been chosen for electricity generators. However, the price of diesel has risen substantially in

Get a quote

How to make wind solar hybrid systems for telecom stations?

To provide a scientific power supply solution for telecommunications base stations, it is recommended to choose solar and wind energy. This will provide a stable 24-hour

Get a quote

Taipower touts local wind power progress

Total wind power generation hit a record 1.63 gigawatt-hours (GWh) on Tuesday, Taipower said. Offshore wind power generated 1.38GWh on Friday, the first time that total

Get a quote

(PDF) Design of an off-grid hybrid PV/wind power system for

The study [4] has discussed the energy efficiency of telco base stations with renewable sources integration and the possibility of base stations switching off during low

Get a quote

Taiwan Power Company-News-The First Locally-Developed Offshore Wind

It''s hoped that after today''s ground breaking ceremony, Taipower''s Offshore Wind Farm Phase II project can be carried out smoothly to achieve the goals of stable power supply, energy

Get a quote

Battery for Communication Base Stations Market

Batteries for communication base stations play a pivotal role in storing energy generated from renewable sources like solar and wind, ensuring a consistent power supply even when primary

Get a quote

Wind Solar Hybrid Power System for the Communication Base

In conclusion, it''s more eco-friendly and economic to construct a wind solar hybrid power system for the communication base station cause solar and wind is sufficient here.

Get a quote

MiuK brochure template

It presents a detailed assessment of the strengths and weaknesses in Taiwan''s offshore wind supply chain, serving as a source for UK suppliers to identify potential business sectors and

Get a quote

How Solar Energy Systems are Revolutionizing Communication Base Stations?

Why Solar Energy for Communication Base Stations? Being a clean and renewable energy source, solar energy emits much less greenhouse gas compared to the

Get a quote

Far EasTone installs base stations at Taiwan offshore wind farm

To improve operational efficiency, Far EasTone installed 4G and 5G bases at the wind farm''s offshore substation. By switching from satellite to mobile network technology, the

Get a quote

(PDF) Small windturbines for telecom base stations

The presentation will give attention to the requirements on using windenergy as an energy source for powering mobile phone base stations.

Get a quote

Taiwan''s offshore wind projects to move to deeper waters,

3 days ago· Taiwan''s bid to propel its billowing offshore wind power market will entail huge government support for prospective suppliers to achieve capacity goals as projects move to

Get a quote

Taiwan Power Company-News-The First Locally-Developed

It''s hoped that after today''s ground breaking ceremony, Taipower''s Offshore Wind Farm Phase II project can be carried out smoothly to achieve the goals of stable power supply, energy

Get a quote

Green and Sustainable Cellular Base Stations: An

This study presents an overview of sustainable and green cellular base stations (BSs), which account for most of the energy consumed in

Get a quote

(PDF) Small windturbines for telecom base stations

The presentation will give attention to the requirements on using windenergy as an energy source for powering mobile phone base stations.

Get a quote

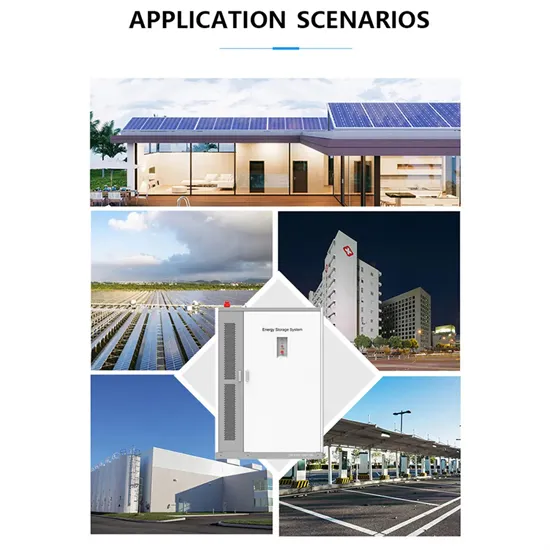

Communication Base Station Energy Solutions

The Importance of Energy Storage Systems for Communication Base Station With the expansion of global communication networks, especially the

Get a quote

Taiwan''s new offshore wind farms deliver power for

Two onshore substations and one offshore substation have been energized, and undersea cable laying is continuing on schedule, it added.

Get a quote

Taiwan''s Green Shift – prospects and challenges

Three years ago, we published an article in Asia Pacific Journal: Japan Focus on Taiwan''s energy debates and an accompanying article in

Get a quote

How to make wind solar hybrid systems for telecom

To provide a scientific power supply solution for telecommunications base stations, it is recommended to choose solar and wind energy. This will provide

Get a quote

Offshore Wind Development in Chinese Taipei

Green energy is the core of energy transition. 20.6 GW by 2035, and 40~55 GW by 2050. The first demonstration wind farm commercialized, leading to a new milestone. At least 1.5 GW

Get a quote

Toward the Early Realization of Flying Base Stations "HAPS"

Ideally, they depend solely on solar power for their energy sources. In addition, HAPS that are mounted with communications equipment are positioned as one of "Non-Terrestrial Networks

Get a quote

What is a Base Station in Telecommunications?

What is a Base Station? A base station is a critical component in a telecommunications network. A fixed transceiver that acts as the central

Get a quote

Taiwan''s new offshore wind farms deliver power for the first time

Two onshore substations and one offshore substation have been energized, and undersea cable laying is continuing on schedule, it added.

Get a quote

Exploiting Wind-Turbine-Mounted Base Stations to Enhance

The authors investigate the use of wind-turbine-mounted base stations as a cost-efective solution for regions with high wind energy potential, since it could replace or even outperform current

Get a quote

Solar Powered Cellular Base Stations: Current

Cellular base stations powered by renewable energy sources such as solar power have emerged as one of the promising solutions to these issues.

Get a quote

6 FAQs about [What are the wind power sources for Taipei communication base stations ]

What is Taiwan's offshore wind strategy?

As the world shifts towards renewable energy, the Taiwan government has developed a national strategy to guide offshore wind development, seeking to install 5.6GW offshore wind capacity by 2025 through three phases, namely the Demonstration Incentive Program, Potential Sites, and Zonal Development.

Which ports in Taiwan support offshore wind?

In Taiwan, the Taipei Port, Taichung Port and Kaohsiung Xingda Port are positioned as major base ports for offshore wind. However, to accommodate the rapid expansion of offshore wind, the Kaohsiung Port and Anping Port in Tainan have also expanded their business to support the offshore wind industry.

Does Taiwan have a nascent offshore wind industry?

Existing marine engineering vendors in Taiwan lack relevant experience in offshore wind, and only two wind farms—Swancor Renewable Energy’s Formosa 1 and Taipower’s Changhua Demonstration Project Phase 1—have entered the O&M period, suggesting a nascent O&M sector with limited expertise.

Who are the leading WTG suppliers in Taiwan offshore wind industry?

Siemens Gamesa Renewable Energy (SGRE) and Vestas are leading WTG suppliers in Taiwan offshore wind industry. Below content focuses on their business activities in Taiwan and the capabilities of their local partners regarding the components.

Do Taiwanese companies need offshore wind support vessels?

SOVs: almost no Taiwanese companies has invested in construction or installation support vessels. Therefore, in the event of major component replacement, SOVs still need to be chartered from overseas sources. Taiwan is currently in Phase 2, Potential Sites, with 5.2GW of offshore wind capacity yet to be installed.

Where is the first offshore wind farm in Taiwan?

In 2019, the first offshore wind farm in Taiwan, Formosa I, was inaugurated off the coast of Miaoli, with an installation capacity of 120MW.

Guess what you want to know

-

What are the wind power sources for Vanuatu s offshore communication base stations

What are the wind power sources for Vanuatu s offshore communication base stations

-

What are the wind power sources for Iceland s communication base stations

What are the wind power sources for Iceland s communication base stations

-

What kind of wind power is best for Marshall Islands communication base stations

What kind of wind power is best for Marshall Islands communication base stations

-

What is wind power for network communication base stations

What is wind power for network communication base stations

-

About the height of wind power construction for communication base stations

About the height of wind power construction for communication base stations

-

Replacement Solution for Wind Power Energy Storage Cabinets in Communication Base Stations

Replacement Solution for Wind Power Energy Storage Cabinets in Communication Base Stations

-

Embedded wind power supply for communication base stations

Embedded wind power supply for communication base stations

-

Wind power development for communication base stations

Wind power development for communication base stations

-

Consequences of wind power generation at communication base stations

Consequences of wind power generation at communication base stations

-

Where are the wind power plants for Yemeni communication base stations

Where are the wind power plants for Yemeni communication base stations

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.