From sunlight to strategy: How the Middle East is turning solar

For many years, the Middle East''s energy narrative has been dominated by oil and gas. But today, a new chapter is unfolding, one powered by sunlight and shaped by strategy.

Get a quote

Saudi Arabia, a leading powerhouse in renewable

The Dumat al-Jandal Wind Farm, for example, has become the largest in the Middle East, with a generation capacity of 400 megawatts –

Get a quote

Battery storage allows the sun to shine in the day and at night

Its giant solar and battery combination will provide electricity day and night, summer and winter. The project was announced at Abu Dhabi Sustainability Week last week,

Get a quote

Middle East: Energy Transition Unlocks Huge Market

In particular, due to the advantages of abundant sunshine, vast land and sparse population in the Middle East, many countries have invested

Get a quote

Middle East: Energy Transition Unlocks Huge Market Potential for

In particular, due to the advantages of abundant sunshine, vast land and sparse population in the Middle East, many countries have invested in photovoltaic power generation.

Get a quote

Solar investments soar across the Middle East

If even a fraction of this project''s ambition is realised, it will have staggering implications for solar in Saudi Arabia and the Middle East as a whole. Current estimates

Get a quote

Power surge: Solar PV to help meet soaring Middle

With nearly 40% of its power consumed by a growing residential sector, the Middle East faces surging power demand. This, coupled with the

Get a quote

Increasing Solar Power Generation in the Middle East

There will be increased solar power generation if Middle Eastern government and private sector companies invest in and develop solar projects

Get a quote

Unlocking the Potential of the Solar Photovoltaic (PV) Market

Receiving over 2,000 kWh/m2 annually in solar irradiation and benefiting from an 89% drop in solar generation costs since 2010, the region could leverage this abundant natural resource to

Get a quote

A Sunny Start: The Al Kharsaah Solar Power Plant

The Middle East is the most suitable place for solar power generation, meeting the two key conditions for this form of energy production: an excellent amount

Get a quote

Gigantic solar farms of the future might impact how

In our recent study, we used a computer program to model the Earth system and simulate how hypothetical enormous solar farms covering

Get a quote

Battery storage allows the sun to shine in the day and

Its giant solar and battery combination will provide electricity day and night, summer and winter. The project was announced at Abu Dhabi

Get a quote

Renewable energy in the Middle East and North Africa

The Middle East and North Africa (MENA) region, traditionally associated with abundant fossil fuel resources, is undergoing a transformative shift towards a

Get a quote

From sunlight to strategy: How the Middle East is turning solar power

For many years, the Middle East''s energy narrative has been dominated by oil and gas. But today, a new chapter is unfolding, one powered by sunlight and shaped by strategy.

Get a quote

Sun on the Sand: Middle East and North Africa

The Middle East and North Africa (MENA) and the Gulf States are prime territories for solar power generation. As solar production increases and

Get a quote

Middle East projected to surpass 100 GW of solar

The Sakaka solar power plant in Saudi Arabia. Source: ACWA Power Renewable energy sources, including hydro, are expected to account

Get a quote

Large-scale photovoltaic solar farms in the Sahara affect solar power

Large solar farms in the Sahara Desert could redistribute solar power generation potential locally as well as globally through disturbance of large-scale atmospheric

Get a quote

Sun on the Sand: Middle East and North Africa (MENA) Turns to Solar Power

The Middle East and North Africa (MENA) and the Gulf States are prime territories for solar power generation. As solar production increases and greater applications are found across the Gulf

Get a quote

The Middle East Is Bracing for a Solar Energy Boom

Several Middle Eastern countries are investing heavily in solar power projects, aiming to significantly increase the share of renewable energy in their power generation mix.

Get a quote

RETRACTED: Middle East energy consumption and potential

Solar energy may be used in several ways, including (Jaszczur et al., 2018; Hassan et al., 2022c): Produce energy with the use of photovoltaic solar cells; produce hydrogen using

Get a quote

Power surge: Solar PV to help meet soaring Middle East power

Renewables capacity in the Middle East to soar in the coming years, with green energy sources outpacing fossil fuel usage in the power sector by 2040.

Get a quote

MIDDLE EAST AND NORTH AFRICA

MIDDLE EAST AND NORTH AFRICA STATUS/CHARACTERISTICS AND NEEDS: Regional analysis covers major oil and gas exporters as well as net importers, spanning the Gulf States,

Get a quote

Use of Solar Energy in the Middle East

Solar energy can be used in several ways viz. direct heating, generating electricity by the use of concentrated solar technologies, photovoltaic panels, or water desalination among several

Get a quote

The Middle East''s Solar Revolution: Powering a New

The Middle East''s harsh climate presents unique challenges for solar power generation, particularly high temperatures and dust. In response,

Get a quote

Power surge: Solar PV to help meet soaring Middle East power

With nearly 40% of its power consumed by a growing residential sector, the Middle East faces surging power demand. This, coupled with the need for economic

Get a quote

Power generation by utilization of different renewable energy

The purpose of this article is representation of the status of power generation by use of different renewable energy systems in some Middle Eastern countries and the challenges

Get a quote

Current Trends in the Middle Eastern Solar PV Market

The highly purified form of silicon is a key component in the creation of solar cells. Be part of Middle East Energy 2025, the leading energy

Get a quote

6 FAQs about [Middle East solar power generation can be used for a whole day]

How is solar energy used in the Middle East?

Current Use Solar energy is currently utilized in the following ways in the Middle East. PV Systems:This involves the generation of electricity by the use of semiconductor materials which release electrons and get positively or negatively charged upon the incidence of sunlight.

Is Saudi Arabia advancing solar energy in the Middle East?

ader, the Middle East is embarking on various endeavors to advance solar energy. One of the most prominent is the implementation of large-scale utility projects.On this front, Saudi Arabia is leading the charge. Under its National Renewable Energy Programme, it aims to tender 20 GW annually. The country’s

How much energy does the Middle East use?

The Middle East's power generation is heavily reliant on fossil fuels, making up 93% of the total at the end of 2023. Renewables accounted for 3% and nuclear and hydro for 2% each. Natural-gas power represented almost three-quarters of the region's electricity generation, making up 40% of the overall gas demand.

Is the Middle East accelerating its solar ambitions?

ctricity, has emerged as a cornerstone of renewable energy strategies worldwide.With global solar PV capacity surpassing 1,600 GW in 2023 and projections of even greater rowth in the years to come, the Middle East is accelerating its solar ambitions. From large-scale utility projects to innovative PV technologies and smart grid i

Why is the Middle East transforming its energy sector?

The Middle East's energy sector is at a turning point. Although traditionally an oil and gas powerhouse, the region is shifting its focus to renewables as a response to rapid industrial growth, increasing population, and a global drive to reduce carbon emissions.

Will the Middle East be able to use renewables in 2040?

Renewables capacity in the Middle East is set to soar in the coming years, with green energy sources outpacing fossil fuel usage in the power sector by 2040, according to Rystad Energy's latest research.

Guess what you want to know

-

Photovoltaic energy storage power generation in the Middle East

Photovoltaic energy storage power generation in the Middle East

-

Middle East Hybrid Energy Storage Power Generation Project

Middle East Hybrid Energy Storage Power Generation Project

-

Solar power generation system for Middle Eastern households

Solar power generation system for Middle Eastern households

-

Can solar power generation be used to store electricity at home

Can solar power generation be used to store electricity at home

-

West Asia Solar Power Generation for Home Use

West Asia Solar Power Generation for Home Use

-

Solar power generation and energy storage manufacturers in the Democratic Republic of Congo

Solar power generation and energy storage manufacturers in the Democratic Republic of Congo

-

North American rooftop solar power generation systems

North American rooftop solar power generation systems

-

Irish rural solar power generation system

Irish rural solar power generation system

-

Solar power generation on-site energy installation

Solar power generation on-site energy installation

-

Mauritius electricity installation solar power generation home

Mauritius electricity installation solar power generation home

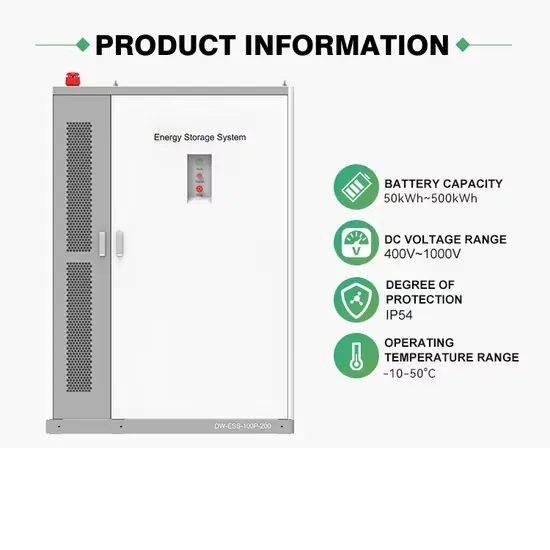

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.