Global Solar Atlas

Specifically for Middle East and North Africa, country factsheet has been elaborated, including the information on solar resource and PV power potential country statistics, seasonal electricity

Get a quote

Unlocking the Potential of the Solar Photovoltaic (PV) Market

Connect with global industry leaders and explore solutions across the full energy value chain, including renewable & clean energy, smart solutions, transmission & distribution, critical and

Get a quote

The Middle East Is Bracing for a Solar Energy Boom

Solar PV is expected to contribute over half of the Middle East''s power supply by 2050, from just 2 percent in 2023. Renewable energy sources are expected to contribute

Get a quote

Middle East and North Africa

The region''s energy mix Natural gas overtook oil as the biggest single-source of electricity generation in the Middle East in 1989 and, since then, it has only grown in importance.

Get a quote

Solar Energy in the Middle East

Even if Middle Eastern nations manage to produce large quantities of solar energy, exporting it would be incredible challenging, due to the issues with modern-day batteries (described

Get a quote

Current Trends in the Middle Eastern Solar PV Market

Receiving over 2,000 kWh/m² annually in solar irradiation and benefiting from an 89% drop in solar generation costs since 2010, the region could leverage this abundant natural

Get a quote

Power surge: Solar PV to help meet soaring Middle East power

With nearly 40% of its power consumed by a growing residential sector, the Middle East faces surging power demand. This, coupled with the need for economic

Get a quote

Middle East embraces solar energy revolution

Of the top 10 countries for practical PV power potential, four are in the Middle East, with Jordan ranking third in the world. A crucial factor to this is the region''s steady year-round solar PV

Get a quote

Executive summary – Renewables 2023 – Analysis

Renewable energy expansion also starts accelerating in other regions of the world, notably the Middle East and North Africa, owing mostly to policy

Get a quote

The Top 10 Solar Power Plants in the Middle East

An additional 1,800MW from PV technology is under construction. The Solar Park aligns with the Dubai Clean Energy Strategy 2050 and the

Get a quote

Current Trends in the Middle Eastern Solar PV Market

Receiving over 2,000 kWh/m² annually in solar irradiation and benefiting from an 89% drop in solar generation costs since 2010, the region

Get a quote

Economic viability of rooftop photovoltaic systems in the middle east

The findings of the study can help policymakers understand the application of rooftop PV systems in the Middle East and Northern African countries. The study, the first of its

Get a quote

Solar PV Analysis of Dubai, United Arab Emirates

Maximise annual solar PV output in Dubai, United Arab Emirates, by tilting solar panels 23degrees South. The location in Dubai, United Arab

Get a quote

Accelerating Solar Power Deployment in the Arab Gulf

There is currently a discrepancy between the strategic objectives and enabling conditions for solar power in the Gulf and the level of actual

Get a quote

Middle East – the new point of growth at the solar

The high average annual number of clear days in the region, and the reduction of technological costs over the recent decade are the main

Get a quote

MENA region''s solar energy capacity to exceed 180 GW by 2030:

The share of solar energy in the Middle East and North Africa''s (MENA) energy mix has grown significantly in recent years. Solar capacity in the region rose 23 percent in 2023 to

Get a quote

Middle East – the new point of growth at the solar energy map

The high average annual number of clear days in the region, and the reduction of technological costs over the recent decade are the main factors contributing to solar

Get a quote

WFES 2024

KSA is expected to outperform all other countries in the Middle East region for installed solar PV capacity at an anticipated CAGR of 63.4%. Note: The anticipated growth will have a strong

Get a quote

Power generation by utilization of different renewable energy

Moreover, the challenges for development of renewable energy technologies for electricity development in these countries are represented and investigated. Among the

Get a quote

Solar energy projects pick up steam in the GCC

With a capacity of 2,060 MW, the solar plant will be the largest of its kind in the Middle East and North Africa, according to MESIA. In the Riyadh

Get a quote

Middle East Power: Outlook 2035

The Middle East is a growing region for power generation and will require additional capacity to meet its economic ambitions and the needs of its people. There is no doubt that renewable

Get a quote

Middle East & Africa Solar Photovoltaic (PV) Market

The solar energy capacity in the country is expected to be fourfold by the end of 2025 as compared to the current installed capacity. In 2020

Get a quote

Egypt, Morocco Lead Solar Energy Expansion in

Countries in the Middle East and North Africa (MENA) region have ramped up their solar energy output by 23% year-over-year in 2023, with

Get a quote

Middle-East Solar Power Companies

This report lists the top Middle-East Solar Power companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted

Get a quote

Power surge: Solar PV to help meet soaring Middle

With nearly 40% of its power consumed by a growing residential sector, the Middle East faces surging power demand. This, coupled with the

Get a quote

Middle East & Africa Solar Photovoltaic (PV) Market

The solar energy capacity in the country is expected to be fourfold by the end of 2025 as compared to the current installed capacity. In 2020 renewable energy capacity of the

Get a quote

Use of Solar Energy in the Middle East

Current Use Solar energy is currently utilized in the following ways in the Middle East. PV Systems: This involves the generation of electricity by the use of semiconductor materials

Get a quote

Guess what you want to know

-

Annual power generation of 1kW photovoltaic panels in Kosovo

Annual power generation of 1kW photovoltaic panels in Kosovo

-

Annual photovoltaic power generation of light-transmitting solar panels

Annual photovoltaic power generation of light-transmitting solar panels

-

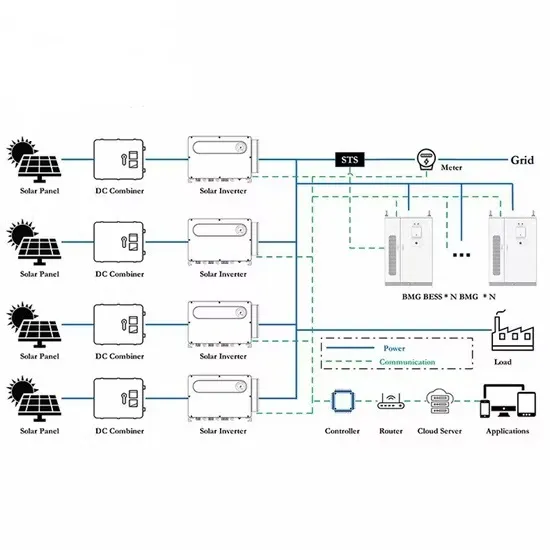

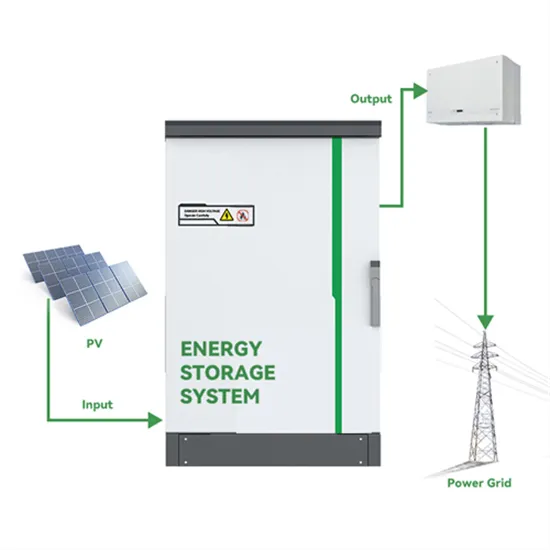

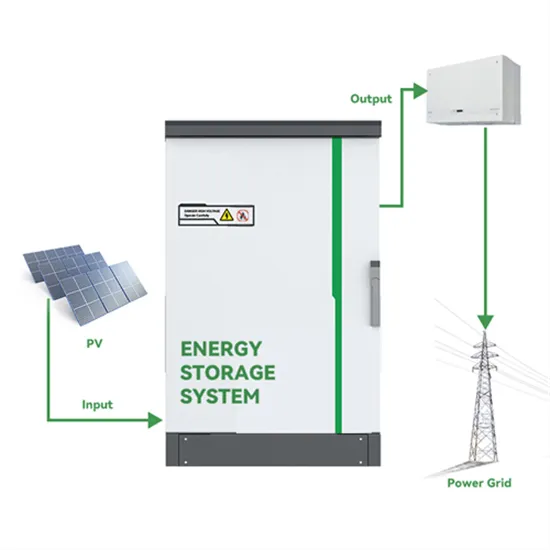

Photovoltaic energy storage power generation in the Middle East

Photovoltaic energy storage power generation in the Middle East

-

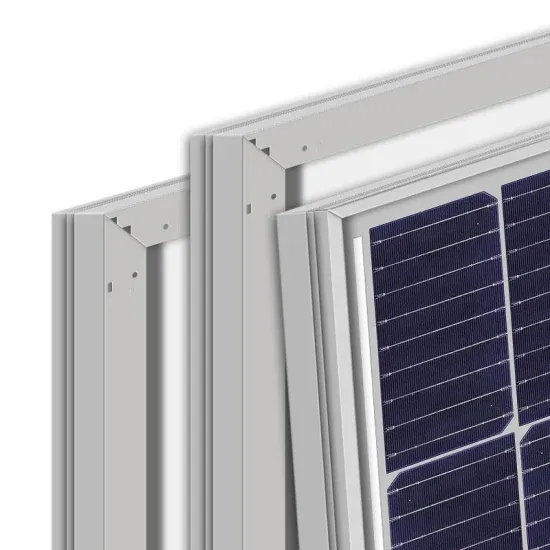

Individual installation of photovoltaic panels for power generation

Individual installation of photovoltaic panels for power generation

-

Is photovoltaic power generation from solar panels mature now

Is photovoltaic power generation from solar panels mature now

-

Solar power generation increases photovoltaic panels

Solar power generation increases photovoltaic panels

-

Photovoltaic panels power generation in Norway

Photovoltaic panels power generation in Norway

-

Jordan polycrystalline photovoltaic panels power generation

Jordan polycrystalline photovoltaic panels power generation

-

Photovoltaic panels single-sided and double-sided power generation

Photovoltaic panels single-sided and double-sided power generation

-

Photovoltaic power generation rotates solar panels

Photovoltaic power generation rotates solar panels

Industrial & Commercial Energy Storage Market Growth

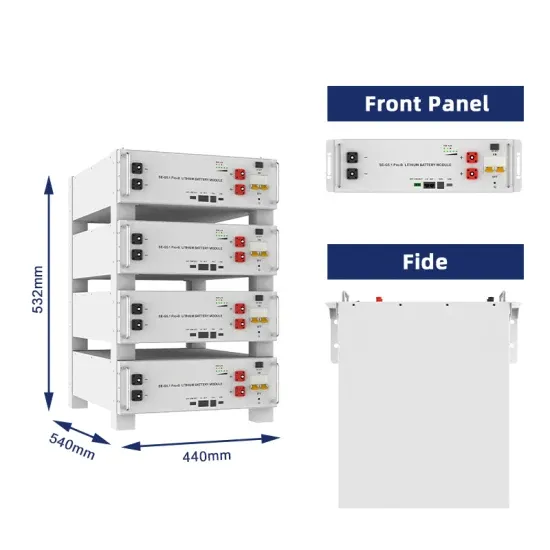

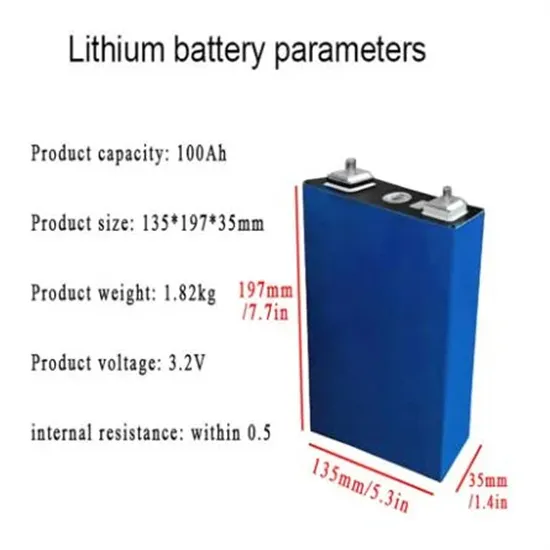

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.