Overview of Earth Station Licensing and License

Introduction What is an Earth Station License and why is one needed: Federal regulations require that a valid authorization be obtained

Get a quote

How Solar Energy Systems are Revolutionizing Communication

Energy consumption is a big issue in the operation of communication base stations, especially in remote areas that are difficult to connect with the traditional power grid,

Get a quote

Overview of key Commission rules related to earth

Part 25 Subpart C of the Commission''s rules contains the technical parameters and rules that all operators and applicants must follow. Below is a

Get a quote

How Uruguay Relies Almost Completely on Renewable Energy

Held up as a case study for successfully transitioning away from fossil fuels, Uruguay now generates up to 98% of its electricity from renewable energy. The country offers

Get a quote

huawei base station

A base station, also known as an eNodeB (for 4G LTE) or gNodeB (for 5G NR) in Huawei''s terminology, is a piece of equipment that facilitates wireless communication between

Get a quote

Communication Base Station Energy Solutions

Many remote areas lack access to traditional power grids, yet base stations require 24/7 uninterrupted power supply to maintain stable communication services.

Get a quote

Aerial base station

An Aerial base station (ABS), also known as unmanned aerial vehicle (UAV)-mounted base station (BS), is a flying antenna system that works as a hub between the backhaul network

Get a quote

Uruguay''s Base Station Market Report 2024

The Uruguayan base station market soared to $X in 2022, growing by X% against the previous year. This figure reflects the total revenues of producers and importers (excluding

Get a quote

Uruguay and Argentina''s Energy Storage Power Stations: South

Uruguay''s wind turbines spinning like gauchos'' lassos while Argentina''s solar panels soak up sun like mate tea drinkers at a Buenos Aires café. These two neighbors aren''t

Get a quote

Measurements and Modelling of Base Station Power Consumption under Real

Abstract Base stations represent the main contributor to the energy consumption of a mobile cellular network. Since traffic load in mobile networks significantly varies during a working or

Get a quote

Communication Base Station Energy Solutions

Many remote areas lack access to traditional power grids, yet base stations require 24/7 uninterrupted power supply to maintain stable communication

Get a quote

Uruguay communication energy storage battery

The integration of batteries to the national grid in Uruguay has recently been authorised. A key intent of the project is to provide a learning experience for the state power utility UTE, paving

Get a quote

Analyze the Types of Communication Stations | SpringerLink

There are main two types of communication networks: cellular networks and wired networks. Each type contains different sector which discussed in this chapter, also

Get a quote

How Solar Energy Systems are Revolutionizing Communication Base Stations?

Energy consumption is a big issue in the operation of communication base stations, especially in remote areas that are difficult to connect with the traditional power grid,

Get a quote

Uruguay: Energy Country Profile

Many of us want an overview of how much energy our country consumes, where it comes from, and if we''re making progress on decarbonizing our energy mix.

Get a quote

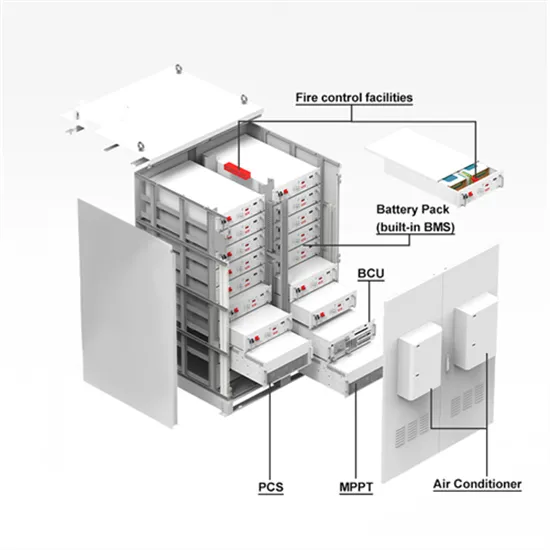

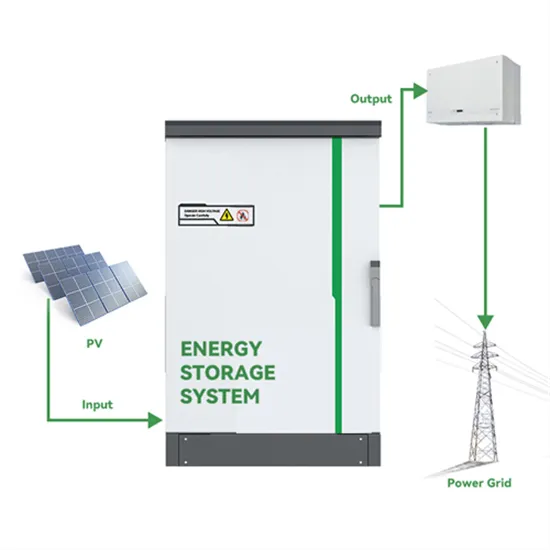

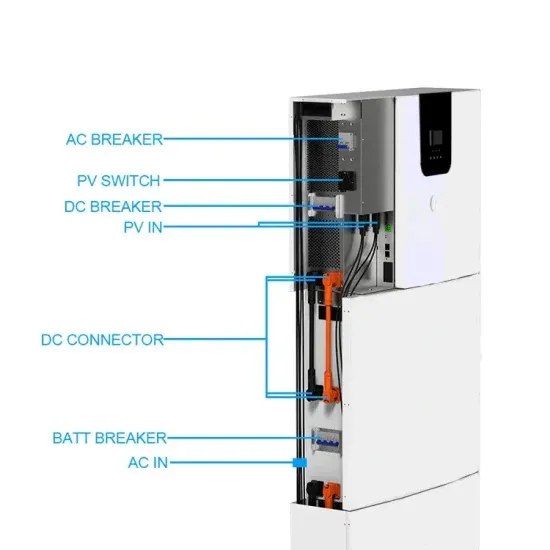

Energy Storage for Communication Base

The one-stop energy storage system for communication base stations is specially designed for base station energy storage. Users can use the energy storage

Get a quote

solar power for Base station

Solar Power for Base Station: Eco-Friendly & Cost-Efficient Off-Grid Energy Solution These solar systems enable communication base stations to: Reduce energy costs

Get a quote

Energy in Uruguay

Energy in Uruguay describes energy and electricity production, consumption and import in Uruguay. As part of climate mitigation measures and an energy transformation, Uruguay has

Get a quote

Uruguay: Energy Country Profile

Many of us want an overview of how much energy our country consumes, where it comes from, and if we''re making progress on decarbonizing our energy mix. This page provides the data for

Get a quote

Predictive Modelling of Base Station Energy

The increasing demand for wireless communication services has led to a significant growth in the number of base stations, resulting in a substantial increase in energy consumption.

Get a quote

Final draft of deliverable D.WG3-02-Smart Energy Saving of

Smart energy saving of 5G base stations: Based on AI and other emerging technologies to forecast and optimize the management of 5G wireless network energy consumption Working

Get a quote

Electricity sector in Uruguay

The objective this project is to increase the demand for and competitive supply of energy efficiency goods and services, contributing to improved efficiency of energy use, reduced

Get a quote

Uruguay communication energy storage battery

Renewable sources—hydroelectric power, wind, biomass, and solar energy—now cover up to 98% of Uruguay''''s energy needs in a normal year and still over 90% in a very dry one,

Get a quote

Coordinated scheduling of 5G base station energy

With the rapid development of 5G base station construction, significant energy storage is installed to ensure stable communication.

Get a quote

What are the communication base station energy

These energy storage systems are pivotal in providing backup power to base stations and ensuring minimal service interruptions. Integrating

Get a quote

6 FAQs about [Uruguay Communications Energy Base Station]

What are the different types of energy sources in Uruguay?

Renewable energy here is the sum of hydropower, wind, solar, geothermal, modern biomass and wave and tidal energy. Traditional biomass – the burning of charcoal, crop waste, and other organic matter – is not included. This can be an important energy source in lower-income settings. Uruguay: How much of the country’s energy comes from nuclear power?

How does the electricity sector work in Uruguay?

The electricity sector of Uruguay has traditionally been based on domestic hydropower along with thermal power plants, and reliant on imports from Argentina and Brazil at times of peak demand.

Is Uruguay a net importer of energy?

Once a net importer of energy, Uruguay now exports its surplus energy to neighbouring Brazil and Argentina. In less than two decades, Uruguay broke free of its dependence on oil imports and carbon emitting power generation, transitioning to renewable energy that is owned by the state but with infrastructure paid for by private investment.

Why did Uruguay reopen the Nuclear Debate?

The energy crisis in Uruguay in 2007 led to Uruguay reopening the nuclear debate under the presidency of Tabaré Vázquez, when the Executive Branch established a multiparty committee devoted to the study of the use of nuclear energy to generate electricity and the installation of a nuclear power plant.

How much electricity does Uruguay have?

Installed electricity capacity in Uruguay was around 2,500 MW (megawatts) in 2009 and around 2,900 MW in 2013. Of the installed capacity, about 63% is hydro, accounting for 1,538 MW which includes half of the capacity of the Argentina-Uruguay bi-national Salto Grande.

What is the potential for large hydroelectric projects in Uruguay?

All the potential for large hydroelectric projects in Uruguay has already been developed. Existing plants are Terra (152 MW), Baygorria (108 MW), Constitucion (333 MW) and the bi-national Salto Grande, with a total capacity of 1,890 MW. Uruguay has a favorable climate for generating electricity through wind power.

Guess what you want to know

-

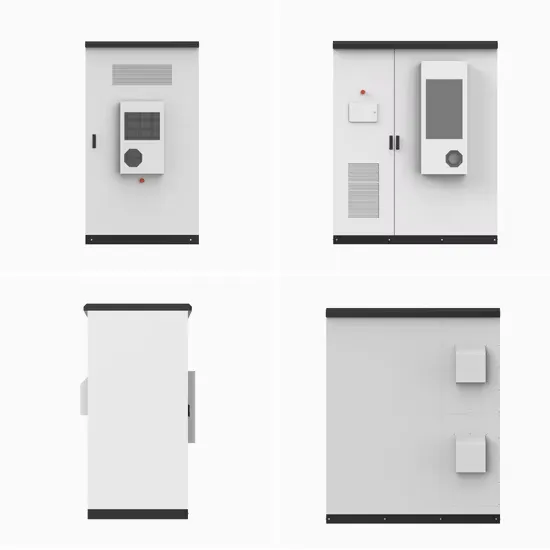

Uruguay Telecom Photovoltaic Base Station Energy Storage Cabinet

Uruguay Telecom Photovoltaic Base Station Energy Storage Cabinet

-

China Communications Base Station Energy Storage System Huawei

China Communications Base Station Energy Storage System Huawei

-

Malta Communications Energy Base Station

Malta Communications Energy Base Station

-

Humidity requirements for base station room energy management system

Humidity requirements for base station room energy management system

-

5G communication base station energy storage system spacing

5G communication base station energy storage system spacing

-

Burkina Faso communication base station energy storage system 1 2MWh

Burkina Faso communication base station energy storage system 1 2MWh

-

Guyana communication base station energy storage brand

Guyana communication base station energy storage brand

-

East African Telecommunication Base Station Energy Storage System Installation Company

East African Telecommunication Base Station Energy Storage System Installation Company

-

No electricity base station energy storage

No electricity base station energy storage

-

UAE Energy Base Station to Container

UAE Energy Base Station to Container

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.