Nigeria

3 days ago· Nigeria is the largest economy in sub-Saharan Africa. Despite its privatisation in 2013, the Nigerian electricity supply industry delivers power that is significantly less than what

Get a quote

These are the entities that control Nigeria''s power

Nigeria''s power sector operates through a complex network of key players responsible for electricity generation, transmission, and distribution.

Get a quote

A Guide to the Nigerian Power Sector

1.1 History The first utility company, the Nigerian Electricity Supply Company, was established in Nigeria in 1929. However, electricity generation in Nigeria had started over 30 years before the

Get a quote

APM Terminals report highlights Nigeria''s potential for electrified

According to a white paper by terminal operator APM Terminals and international systems change consultancy Systemiq, Nigeria has a unique opportunity to electrify its

Get a quote

Nigeria Solar Energy Container | Mobile Solar Power Container

The new container generation from Karmod is now responsible for solar energy storage in Nigeria. In the solar energy storage plant of the country''s central power company in Lagos, solar

Get a quote

APGC | ASSOCIATION OF POWER GENERATION

As an association for power generation companies, our coverage encompasses generating capacity from thermal, hydro and other sources, which include:

Get a quote

Nigeria Electricity Generation Mix 2024 | Low-Carbon

History Throughout Nigeria''s history of low-carbon electricity generation, hydropower has played a significant role. The early years saw moderate

Get a quote

Nigeria: Solar energy to provide electricity at container terminal

The West Africa Container Terminal (WACT) has signed a solar lease agreement with a pan-African clean energy company to provide at least 1.2GW hours of electricity each

Get a quote

Power Sector Industry Overview 2024

The year 2024 was transformative for the Nigerian Power Sector, marked by several significant developments including the handover of the 700MW Zungeru hydropower

Get a quote

Containers – Karmod Nigeria

Karmod Nigeria is the leading manufacturer of modular buildings and containers in Nigeria. We Premium modular portable containers for all purposes. Our accumulated experience stems

Get a quote

Importation Guide

The distinguishing factor by the NCS between Headings 8501 and 8541 is that the former relates to solar panels having bypass-diodes permitting for use in power generation purposes, and the

Get a quote

APMT''s West Africa Container Terminal replaces

WACT is the first greenfield container terminal built under a Public-Private Partnership model in Nigeria. Strategically located within the Oil

Get a quote

APMT''s West Africa Container Terminal replaces diesel generation

WACT is the first greenfield container terminal built under a Public-Private Partnership model in Nigeria. Strategically located within the Oil and Gas Free Zone in Onne

Get a quote

Nigeria: power production share by source 2023| Statista

Nigeria''s electricity production relies heavily on natural gas, which accounted for over ** percent of the country''s power generation in 2023.

Get a quote

Nigeria can lead change on electrified container trade

Nigeria has a unique opportunity to electrify its containerised trade at scale – leapfrogging fossil-powered infrastructure and aligning with the global shift toward low

Get a quote

Nigeria: 1,2 GWh per year of photovoltaic electricity for the new

WACT, owned by APM Terminals, is the first greenfield container terminal built under a public-private partnership in Nigeria. Its decarbonisation strategy is in line with the

Get a quote

Electrifying Container Transport in Nigeria

If Nigerian stakeholders act now, the country can reap the benefits that electrification can bring to Nigeria and West Africa. This white paper, a practical roadmap developed by APM Terminals

Get a quote

Nigerian Maritime Industry: 2024 In Review

It is the first inland container port to export containers from the hinterland to seaports in Nigeria. The FGN has also officially launched a freight train service from APM

Get a quote

Nigeria Container | Nigeria living container Nigeria

The new container generation from Karmod is now responsible for solar energy storage in Nigeria. In the solar energy storage plant of the country''s central

Get a quote

Huaquan Electric Container Gas Generator Sent to Nigeria

Huaquan Power Container Gas Generator Unit can flexibly adapt to different load demands, and can be used for small-scale independent power generation systems or as part of large power

Get a quote

Nigeria Container | Nigeria living container Nigeria Modular

The new container generation from Karmod is now responsible for solar energy storage in Nigeria. In the solar energy storage plant of the country''s central power company in Lagos, solar

Get a quote

Nigeria Solar Energy Container | Mobile Solar Power

The new container generation from Karmod is now responsible for solar energy storage in Nigeria. In the solar energy storage plant of the country''s central

Get a quote

The Opportunity to Electrify Container Transport in Nigeria

This whitepaper lays out the opportunity for Nigeria to electrify its container transport sector, including the major economic, social, and climate benefits that could be unlocked if action is

Get a quote

Guess what you want to know

-

Nigeria 5g base station photovoltaic power generation system communication cabinet

Nigeria 5g base station photovoltaic power generation system communication cabinet

-

Tunisian power generation container manufacturer

Tunisian power generation container manufacturer

-

Good power generation container manufacturer

Good power generation container manufacturer

-

Nepal container photovoltaic power generation

Nepal container photovoltaic power generation

-

Vietnam container power generation BESS

Vietnam container power generation BESS

-

Morocco container power generation manufacturer

Morocco container power generation manufacturer

-

Namibia power generation container

Namibia power generation container

-

Container Power Generation in the United States

Container Power Generation in the United States

-

Energy Storage Container Group Solar Power Generation

Energy Storage Container Group Solar Power Generation

-

Power generation from large container ships

Power generation from large container ships

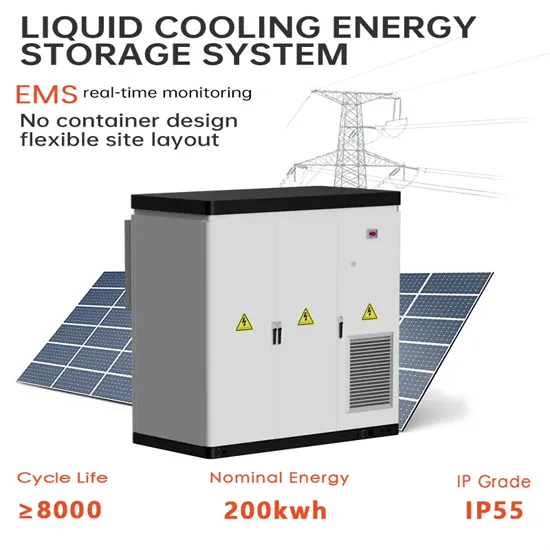

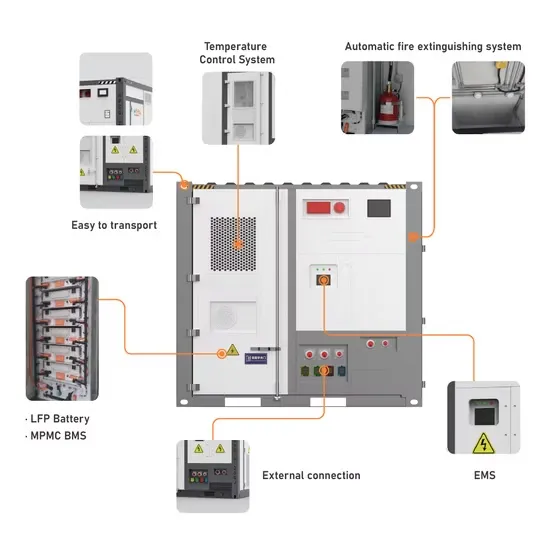

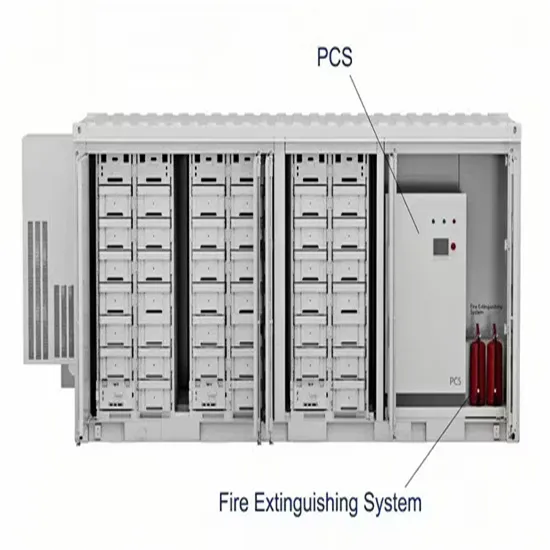

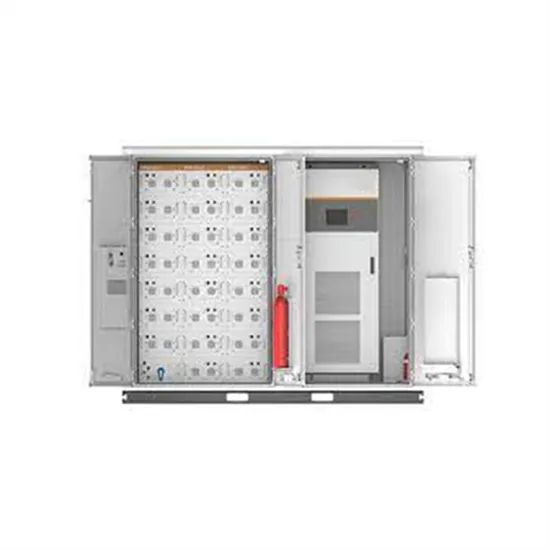

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.