How to Invest in Solar Energy: A Guide for Beginners

We will address critical factors to consider before investing, provide a step-by-step guide for beginners, outline solar panel manufacturing

Get a quote

Are Solar Panels Worth It? (And 7 Reasons Not to Buy Them)

If a solar panel system''s payback period is 12.5 years or less, going solar is worth it and will likely provide a good return on investment. In states with high electricity rates, solar panels can have

Get a quote

How to Invest in the Solar Industry

Solar industry index funds and ETFs compile a selection of stocks from various solar-related companies, such as manufacturers of solar panels, developers of solar projects

Get a quote

Is Solar Panel Investment In Alberta Worth It?

Solar Panel Investment In Alberta With Gridworks Energy Opting for solar panel installation through Gridworks Energy ensures you''re getting top-notch service

Get a quote

Are Solar Panels Worth the Investment? This Is How Long It

Solar panels can save you money in the long run, but it''ll take time before you see those savings. Solar panels are a great long-term option for lowering your electricity bills, but their...

Get a quote

Investing in Green Energy in Cyprus | Solar Parks,

Invest in green energy in Cyprus. Solar parks, farms, and photovoltaic systems. Learn about the cost and availability of solar park investments

Get a quote

How to invest in solar power: Adding clean energy to your portfolio

Government incentives are helping to promote the use of solar energy. Here''s what you need to know on how to add solar to your portfolio.

Get a quote

Solar Panel ROI: What To Know Before Installing –

Solar panels are relatively costly, so knowing whether you''ll make money back may help you decide if the investment is right for you. Many

Get a quote

How to Invest in Solar Energy: A Guide for Beginners

We will address critical factors to consider before investing, provide a step-by-step guide for beginners, outline solar panel manufacturing processes, and present strategies for

Get a quote

Solar Panel ROI Guide (2025) | ConsumerAffairs®

The return on investment of a solar panel installation depends on its location, performance, efficiency and size, but 10% is average.

Get a quote

How to Invest in the Solar Energy Sector

Investors usually invest in solar through traditional products like stocks, mutual funds, and exchange-traded funds (ETFs). Another common type of solar investing is the

Get a quote

Are Solar Panels Worth It? – Forbes Home

Considering solar panels for your home, but need more information to decide if they''re worth it? Usually yes, but this complete guide will help you

Get a quote

Solar Energy Investing: Pros and Cons

For those who expect renewable energy to become more popular in the coming years, the idea of solar investing might be appealing. After all, it''s widely considered one of the

Get a quote

Solar Energy Return on Investment (ROI) Calculator

Some examples of using a Solar Energy Return on Investment (ROI) Calculator include calculating the ROI for a residential solar panel

Get a quote

Investing in Solar Panels: A Comprehensive Guide

Explore solar panels as a smart investment! ☀️ Dive into ROI, maintenance, tech progress, and incentives for a sustainable future 🌱.

Get a quote

Solar Power: Is It Worth It and How to Calculate ROI

That''s right—installing a portable power station not only benefits the environment and reduces electricity bills, but it can also generate long-term profit! Here''s

Get a quote

Solar Panel ROI: What To Know Before Installing – Forbes Home

Solar panels are relatively costly, so knowing whether you''ll make money back may help you decide if the investment is right for you. Many homeowners see an ROI on solar

Get a quote

How to invest in solar power: Adding clean energy to

Government incentives are helping to promote the use of solar energy. Here''s what you need to know on how to add solar to your portfolio.

Get a quote

Solar ROI Calculator: Are Solar Panels Worth It?

When you go solar, the power generated by your solar panels replaces the electricity you buy from the utility company, reducing or completely eliminating that bill. Though solar is a big

Get a quote

Investor''s Guide to Solar IRR: Calculating Returns for

Learn how to calculate IRR for solar PV projects. Discover key elements to calculate to make informed investment decisions in the renewable

Get a quote

Solar ROI Calculator: Are Solar Panels Worth It?

Investors usually invest in solar through traditional products like stocks, mutual funds, and exchange-traded funds (ETFs). Another common

Get a quote

How to Calculate Solar Return On Investment

How solar return on investment works, how to calculate the ROI for your solar panels, factors that influence solar panel ROI, and solar lease ROI.

Get a quote

6 FAQs about [Investment in solar photovoltaic panels]

Who can invest in solar energy?

Individuals and institutions can invest in solar energy. This can include solar panel manufacturers, installers, or companies operating solar energy facilities. Investors usually invest in solar through traditional products like stocks, mutual funds, and exchange-traded funds (ETFs). Another common type of solar investing is the installation of solar panels on a home or business.

What are some common types of solar investing?

Another common type of solar investing is the installation of solar panels on a home or business. Investors usually invest in solar through traditional products like stocks, mutual funds, and exchange-traded funds (ETFs). This can include solar panel manufacturers, installers, or companies operating solar energy facilities.

What is solar investing?

Solar investing encompasses investments in various aspects of the solar energy supply chain. Perhaps you invest in companies like First Solar (ticker: FSLR) that produce large-scale solar panels. It might even mean investing in a popular company like Tesla (TSLA) that hopes to create smaller solar products for homes.

Is solar a good investment?

When you go solar, the power generated by your solar panels replaces the electricity you buy from the utility company, reducing or completely eliminating that bill. Though solar is a big purchase up front, that investment quickly pays for itself in energy savings over the life of ownership.

Which companies are investing in solar energy?

Sunrun (NASDAQ: RUN) has been expanding its services and product offerings into states beyond its California headquarters. Tesla, while famous for its electric cars, is also investing heavily in solar energy—from the manufacturing of solar panels to installation and energy storage with its Powerwall batteries.

How will solar power help the solar industry?

That’s a significant boost for the solar industry and may provide support for companies and consumers alike. One of its clean energy initiatives is to have 950 million solar panels installed by 2030. More solar panels could translate into more power generation for electrolysis to produce hydrogen, another clean source of energy.

Guess what you want to know

-

Do photovoltaic solar panels generate electricity

Do photovoltaic solar panels generate electricity

-

Photovoltaic solar panels in rural areas of the UK

Photovoltaic solar panels in rural areas of the UK

-

Guyana installs solar photovoltaic panels

Guyana installs solar photovoltaic panels

-

Flexible solar panels for photovoltaic power generation

Flexible solar panels for photovoltaic power generation

-

Comoros installs solar photovoltaic panels

Comoros installs solar photovoltaic panels

-

What is the voltage and current of solar photovoltaic panels

What is the voltage and current of solar photovoltaic panels

-

Photovoltaic panels How many layers of solar panels

Photovoltaic panels How many layers of solar panels

-

Solar photovoltaic panels on US construction sites

Solar photovoltaic panels on US construction sites

-

Photovoltaic solar panels in Tunisia

Photovoltaic solar panels in Tunisia

-

Photovoltaic solar panels produced in Indonesia

Photovoltaic solar panels produced in Indonesia

Industrial & Commercial Energy Storage Market Growth

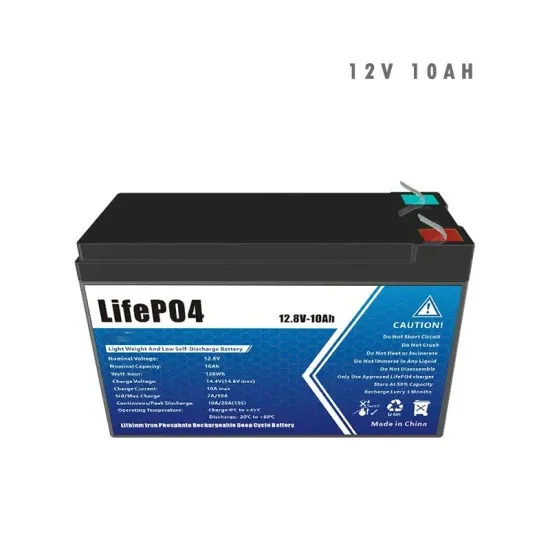

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.