Tesla''s 2024 energy storage revenue surpasses $10

Records are tumbling for Tesla''s battery energy storage business with revenues growing 67% and deployments surging 114% year-on-year.

Get a quote

Zinc-Iodide Battery Tech Disrupts $293B Energy Storage Market

4 days ago· Renewable energy and stationary storage at scale: Joley Michaelson''s woman-owned public benefit corporation deploys zinc-iodide flow batteries and microgrids.

Get a quote

Meet the Company Making Ice the Future of Energy Storage: Ice Energy

2 days ago· Based in Southern California, Ice Energy is a leading innovator in thermal energy storage technology. The company''s flagship product, the Ice Bear, transforms traditional air

Get a quote

Uniper recommissions Happurg pumped-storage plant for around

By storing energy, the pumped storage power plant will contribute to greater security of supply in southern Germany. This investment is part of our previously announced strategy to invest in

Get a quote

Uniper recommissions Happurg pumped-storage plant

By storing energy, the pumped storage power plant will contribute to greater security of supply in southern Germany. This investment is part of our

Get a quote

A comprehensive review of large-scale energy storage

2 days ago· ABSTRACT Addressing high-proportion renewable energy leads to insufficient grid regulation ability and frequency instability, a perfect electricity market clearing mechanism with

Get a quote

Tesla earnings rise on energy storage surge | CFO Dive

Dive Brief: Electric vehicle maker Tesla reported stronger-than-expected earnings for its third quarter largely driven by a surge in its energy generation and storage business,

Get a quote

Optimizing Energy Storage Profits: A New Metric for

Abstract: Storage profit maximization is based on buying energy at the lowest prices and selling it at the highest prices. The best strategy must thus be based on both accurately predicting the

Get a quote

Energy Arbitrage and Battery Storage: Revolutionizing

Introduction With the rise of renewable energy and falling battery storage prices, energy arbitrage is becoming an increasingly popular way for

Get a quote

The new economics of energy storage | McKinsey

In this article, we describe how to find profitable possibilities for energy storage. We also highlight some policy limitations and how these might be addressed to accelerate

Get a quote

Analytics Can Help Energy Storage Operators Find More Revenue

6 days ago· Using modeling through analytics, battery energy storage system operators can determine exactly what size system they need for their site with advanced predictive software.

Get a quote

Maximizing Energy Storage Profits

Discover the potential of energy storage arbitrage and learn how to optimize your energy storage systems for maximum profitability in the energy market.

Get a quote

The new economics of energy storage | McKinsey

In this article, we describe how to find profitable possibilities for energy storage. We also highlight some policy limitations and how these might

Get a quote

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get a quote

Energy Storage Grand Challenge Energy Storage Market

This report covers the following energy storage technologies: lithium-ion batteries, lead–acid batteries, pumped-storage hydropower, compressed-air energy storage, redox flow batteries,

Get a quote

China Aims to More Than Double Energy Storage Capacity by 2027

7 hours ago· China plans to more than double its energy storage capacity in the next two years to further accelerate the deployment of renewables.

Get a quote

Business Models and Profitability of Energy Storage

This paper presents a conceptual framework to describe business models of energy storage. Using the framework, we identify 28 distinct business models applicable to

Get a quote

How is the profit of new energy storage | NenPower

The future potential for profits in energy storage appears promising due to various factors. As global energy demand continues to rise alongside the transition to renewable

Get a quote

Still too early to see Trump tariffs'' impact on

1 day ago· It''s still to early to see the financial impact on energy storage suppliers in the wake of Trump''s tariffs and legislation, writes Solar Media analyst Charlotte Gisbourne, analysing their

Get a quote

Revamping Energy Storage: How Dynamic Grid Tariffs

Dynamic electricity tariffs are transforming the landscape of energy storage systems, setting the stage for a paradigm shift in how storage dispatch is optimized. With energy

Get a quote

Tesla deployed 31GWh of storage in 2024, segment

In other words, storage is doing the heavy lifting for the segment''s fortunes, and a gross profit margin of 26.2% for the generation and storage

Get a quote

Meet the Company Making Ice the Future of Energy Storage: Ice

2 days ago· Based in Southern California, Ice Energy is a leading innovator in thermal energy storage technology. The company''s flagship product, the Ice Bear, transforms traditional air

Get a quote

Tesla Energy Revenue And Energy Profit Margin

Tesla''s energy generation and storage sales revenue is derived from sales of solar energy systems and energy storage products to residential,

Get a quote

Hierarchical game optimization of independent shared energy storage

However, challenges such as limited revenue streams hinder their widespread adoption. In this study, a joint optimization scheme for multiple profit models of independent

Get a quote

New Energy Storage: How Energy Saving Fuels Profitability in 2024

Energy storage isn''t just about saving watts – it''s about printing dollars. From commercial buildings using thermal storage (ice batteries, anyone?) to microgrids powering entire islands,

Get a quote

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get a quote

6 FAQs about [New Energy Profits Energy Storage]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Is it profitable to provide energy-storage solutions to commercial customers?

The model shows that it is already profitable to provide energy-storage solutions to a subset of commercial customers in each of the four most important applications—demand-charge management, grid-scale renewable power, small-scale solar-plus storage, and frequency regulation.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

What are the benefits of energy storage?

There are four major benefits to energy storage. First, it can be used to smooth the flow of power, which can increase or decrease in unpredictable ways. Second, storage can be integrated into electricity systems so that if a main source of power fails, it provides a backup service, improving reliability.

Guess what you want to know

-

Andorra New Energy Storage Planning Company

Andorra New Energy Storage Planning Company

-

Fire protection management for new energy storage projects

Fire protection management for new energy storage projects

-

Tanzania s new energy installations with energy storage

Tanzania s new energy installations with energy storage

-

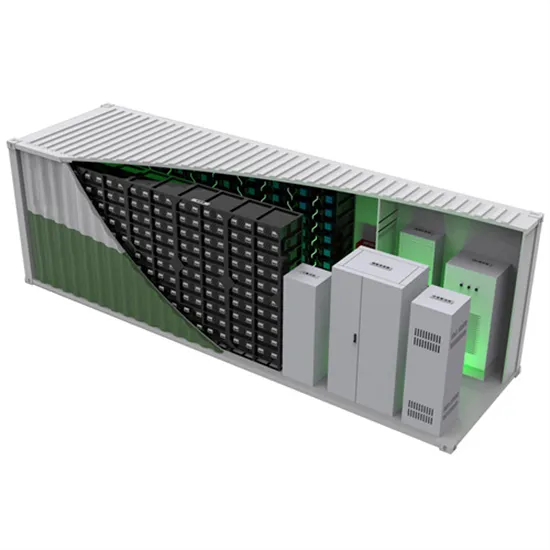

New energy storage battery container transfer

New energy storage battery container transfer

-

Swedish new energy storage cabinet manufacturer

Swedish new energy storage cabinet manufacturer

-

Cost of new energy storage equipment in Niger

Cost of new energy storage equipment in Niger

-

Kyrgyzstan Huijue New Energy Storage

Kyrgyzstan Huijue New Energy Storage

-

The cost of home use of new energy storage cabinet system has been increasing

The cost of home use of new energy storage cabinet system has been increasing

-

Libya s new energy storage subsidy period

Libya s new energy storage subsidy period

-

New lithium battery energy storage module group

New lithium battery energy storage module group

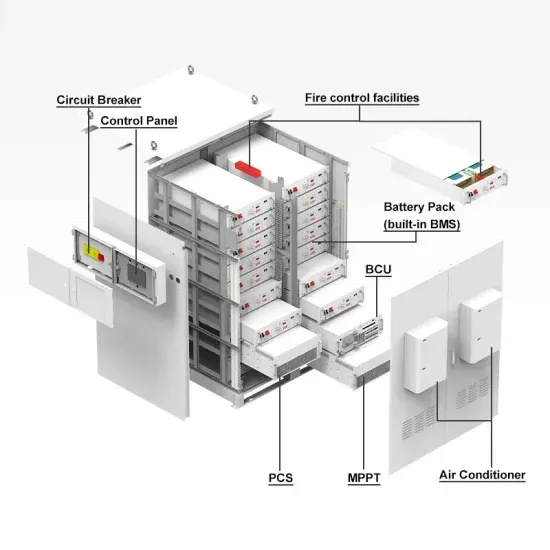

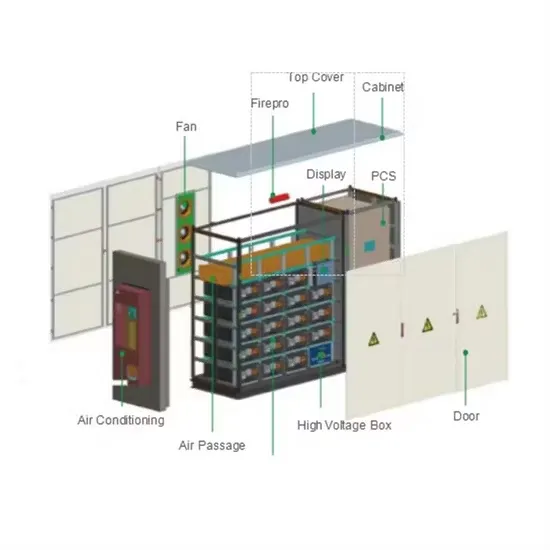

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.