Exploring Micro PV Inverters Market Evolution 2025-2033

The microinverter market, currently experiencing robust growth, is projected to expand significantly over the next decade. Driven by increasing demand for residential solar

Get a quote

Middle East And Africa Solar PV Inverter Market Growth, Size,

Middle East And Africa Solar PV Inverter Market Introduction and Overview. According to SPER Market Research, the Middle East And Africa Solar PV Inverter Market is estimated to reach

Get a quote

Middle East & Africa Solar Microinverter Market Size & Outlook

This continent databook contains high-level insights into Middle East & Africa solar microinverter market from 2018 to 2030, including revenue numbers, major trends, and company profiles.

Get a quote

Middle East Solar Microinverter Market (2025

Middle East Solar Microinverter Industry Life Cycle Historical Data and Forecast of Middle East Solar Microinverter Market Revenues & Volume By Type for the Period 2021 - 2031

Get a quote

Middle East and Africa Solar PV Inverters Market Analysis

The Middle East region benefits from abundant sunlight, making solar PV inverters an ideal choice for electricity generation. In Africa, countries such as South Africa, Egypt, Morocco, and Kenya

Get a quote

Solar Microinverter Market Size, Trends & Forecast 2025 to 2035

Starting with the base year 2024 and going up to the present year 2025, the report examined how the industry growth trajectory changes from the first half of the year, i.e.

Get a quote

MicroInverter Market Expansion: Growth Outlook 2025-2033

The microinverter market is experiencing robust growth, driven by increasing demand for residential and commercial solar installations globally. The rising adoption of

Get a quote

Solar Microinverter Market Size, Trends & Forecast 2025 to 2035

The micro inverter market in the Middle East and Africa is gradually expanding, driven by rising interest in decentralized solar solutions to overcome grid unreliability and expand energy access.

Get a quote

Micro Inverter Market Size, Share, Trends & Industry Growth

The Micro Inverter Market is expected to reach USD 4.17 billion in 2025 and grow at a CAGR of 18.23% to reach USD 10.21 billion by 2030. Enphase Energy Inc., Siemens AG,

Get a quote

Microinverter Comparison Chart

Microinverter Comparison Chart Below is our detailed comparison of the most popular microinverters available in the Australian, European, Asian and US markets. Enphase Energy

Get a quote

Middle East & Africa Solar Inverters Market

Strategic insights for the Middle East & Africa Solar Inverters provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances.

Get a quote

Solar Microinverter Market Set for Robust Growth

Expansion in Emerging Markets – Rapid solar energy deployment in Asia-Pacific, Latin America, and the Middle East presents untapped

Get a quote

Micro Inverter Market Size, Share, Trends & Industry Growth

Micro Inverter Market is Segmented by Phase Type (Single-Phase, Three-Phase), Communication Technology (Wired, Wireless), Component (Hardware, Software and

Get a quote

PV Inverter Market Size, Share & Forecast 2025 to 2035

PV Inverter Market Forecast and Outlook from 2025 to 2035 The PV inverter generators industry is valued at USD 1.7 billion in 2025. As per FMI''s analysis, the PV inverter

Get a quote

Market Deep Dive: Exploring Photovoltaic Microinverter Trends

The photovoltaic (PV) microinverter market is experiencing robust growth, driven by increasing demand for residential and commercial solar installations. The market''s

Get a quote

Middle East and Africa Solar PV Inverters Market

The Middle East region benefits from abundant sunlight, making solar PV inverters an ideal choice for electricity generation. In Africa, countries such as

Get a quote

Grid-Forming Micro-Inverter Market Size, Share | Report [2032]

The global grid-forming micro-inverter market size is projected to grow from $20.25 million in 2025 to $32.22 million by 2032, exhibiting a CAGR of 6.86%

Get a quote

Middle East And Africa Solar PV Inverter Market

Middle East And Africa Solar PV Inverter Market Introduction and Overview. According to SPER Market Research, the Middle East And Africa Solar PV

Get a quote

Microinverter Market Size, Share, Trends | Global Report [2032]

Microinverters are small, compact devices that convert direct current (DC) electricity generated by individual solar panels into alternating current (AC) electricity, which

Get a quote

Solar Microinverter Market Size & Share [2033]

The Middle East & Africa region holds a smaller but growing 9.7% share in the global Solar Microinverter market. Countries like the UAE and Saudi Arabia are deploying

Get a quote

MENA Solar and Renewable Energy Report

Introduction Renewable energy usage has been growing significantly over the past 12 months. This trend will continue to increase as solar power prices reach grid parity. In 2019, the global

Get a quote

Middle East And Africa Grid-Connected Solar Microinverter

This market segmentation analysis explores the diverse consumer landscape within Middle East And Africa''s Middle East And Africa Grid-Connected Solar Microinverter Market

Get a quote

Commercial Micro Inverters Market

Middle Eastern commercial projects prioritize microinverters'' heat resilience – Dubai''s Mohammed bin Rashid Solar Park recorded 22% higher yield from microinverter

Get a quote

Micro Inverter Market Size & Share | Industry Report, 2030

The micro inverter market in the Middle East and Africa is gradually expanding, driven by rising interest in decentralized solar solutions to overcome grid unreliability and expand energy access.

Get a quote

Solar Micro Inverter Market Set for Explosive Growth to

Rest of the World: Includes regions like Latin America and the Middle East, where solar adoption is steadily increasing. The Solar Micro

Get a quote

6 FAQs about [Microinverter prices in the Middle East]

Who are the leading companies in the micro inverter market?

Some key players operating in the market are Enphase, Darfon Electronics Corporation, Deye Inverter, Sparq Systems, Fimer Group, Solis Solar, Tata Power Solar, and others. The following are the leading companies in the micro inverter market. These companies collectively hold the largest market share and dictate industry trends.

What is the global micro inverter market size?

The global micro inverter market size was estimated at USD 4.67 billion in 2024 and is projected to reach USD 17.34 billion by 2030, at a CAGR of 24.58% from 2025 to 2030. The market is experiencing steady growth, driven by the rising adoption of rooftop solar systems and the increasing emphasis on maximizing energy efficiency.

Which country is leading the solar microinverter market?

North America contributes in for the solar microinverter market, where USA is leading way for the market. The USA market has experienced significant growth driven by a rise in demand for renewable energy, government support, and heightened awareness of the ecological advantages of solar power.

Why is the micro inverter market growing?

The market is experiencing steady growth, driven by the rising adoption of rooftop solar systems and the increasing emphasis on maximizing energy efficiency. North America held the largest revenue share of 37.74% in the global micro inverter market. The micro inverter market in the U.S. is experiencing strong momentum.

Where is the microinverter market segmented?

The global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is estimated to have all the dominant microinverter market share during the study period.

Is Germany a good market for solar microinverters?

Germany remains one of the leading markets for solar microinverters in Europe. Thanks to a robust renewable energy framework and solid governmental backing, the nation has steadily expanded its solar energy capabilities.

Guess what you want to know

-

Middle East inverter prices

Middle East inverter prices

-

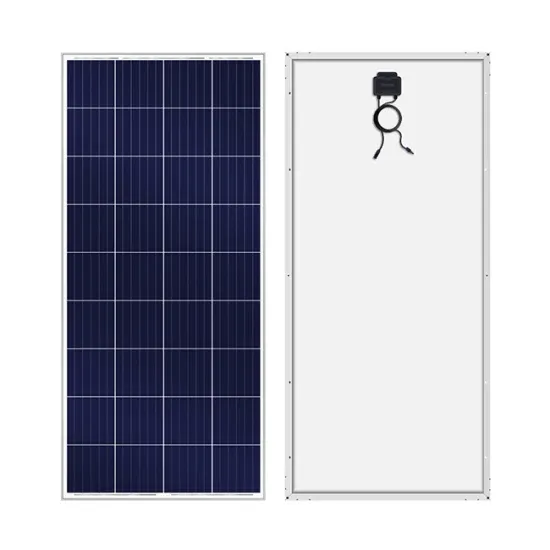

Middle East 265 photovoltaic panel prices

Middle East 265 photovoltaic panel prices

-

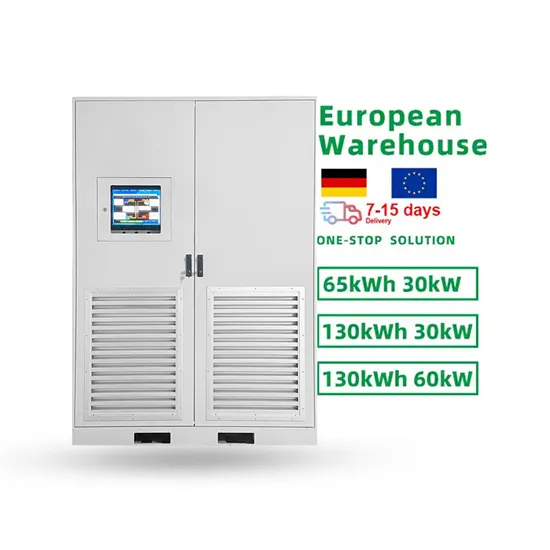

Where is the best containerized energy storage cabinet in the Middle East

Where is the best containerized energy storage cabinet in the Middle East

-

Middle East Power Storage Vehicle

Middle East Power Storage Vehicle

-

Middle East Power Storage Vehicle Customization

Middle East Power Storage Vehicle Customization

-

Middle East Electric 12v 79000 Inverter

Middle East Electric 12v 79000 Inverter

-

Middle East sun room photovoltaic panel manufacturer

Middle East sun room photovoltaic panel manufacturer

-

Middle East Solar PV Inverters

Middle East Solar PV Inverters

-

Middle East energy storage lithium batteries are safe and reliable

Middle East energy storage lithium batteries are safe and reliable

-

Huawei Middle East energy storage battery customization

Huawei Middle East energy storage battery customization

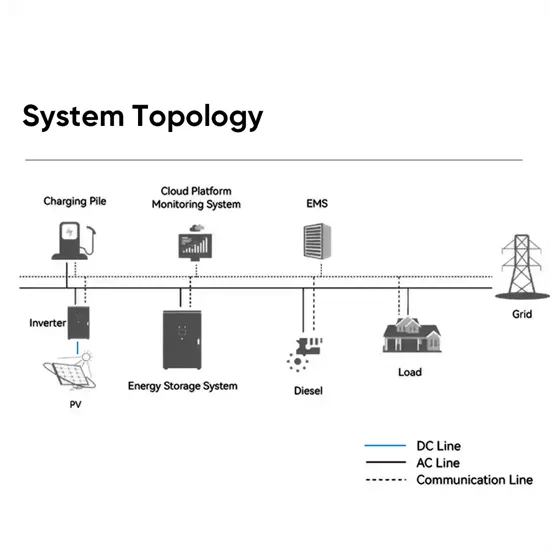

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.