Middle East And Africa Photovoltaic Recycling Technology Market

Middle East And Africa Photovoltaic Recycling Technology Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a

Get a quote

Middle East & Africa Solar Photovoltaic (PV) Market

The Middle East region, and the Gulf in particular, has been home to record low solar tariffs in recent years. Major projects are being awarded via

Get a quote

Record-Low Solar Prices Drive Middle East Projects

Abu Dhabi Power Corp. (ADPower) in late April announced what it called the lowest-ever cost-competitive tariff for a solar photovoltaic (PV) project, a few months after a project in

Get a quote

Middle East and Africa solar PV system pricing 2020

This report covers solar PV system costs for utility-scale systems in 18 major Middle East and Africa markets. It includes detailed breakdowns for system costs in Jordan

Get a quote

World''s Top Solar PV Producers Plan to Open Factories in Middle East

The solar PV factories in Middle East are set to transform the energy future of the region. Leading global solar producers have announced plans to build new manufacturing

Get a quote

Middle East and Africa Photovoltaic Market – Growth

The drop in the photovoltaic cost is one of the major factors driving the market. In 2017, photovoltaic module prices reduced by 75%, as compared to that in 2009. The fall of

Get a quote

Strong growth ahead: A solar market outlook for the Middle East

The Middle East region, and the Gulf in particular, has been home to record low solar tariffs in recent years. Major projects are being awarded via tenders, with prices

Get a quote

High-Efficiency 265w Solar Panel

Enjoy the convenience of renewable energy technologies. Browse 265w solar panel for a Solar Energy System and find 265 w solar panel at wholesale prices from Alibaba .

Get a quote

Middle East Solar PV Panels Market (2020-2026)

Middle East Solar PV panels market report thoroughly covers the market by technology, grid type, application and countries including Kuwait, UAE, Saudi Arabia, Qatar, Bahrain, Oman, Turkey,

Get a quote

Solar System Installers in Middle East | PV Companies List | ENF

List of Middle Eastern solar panel installers - showing companies in Middle East that undertake solar panel installation, including rooftop and standalone solar systems.

Get a quote

The Top 10 Solar Power Plants in the Middle East

An additional 1,800MW from PV technology is under construction. The Solar Park aligns with the Dubai Clean Energy Strategy 2050 and the Dubai Net Zero Carbon Emissions

Get a quote

Full article: PV energy penetration in Saudi Arabia: current status

Saudi Arabia is the largest country in the Middle East with huge solar energy resources but has achieved minimal adoption of photovoltaic energy systems (PV). This study

Get a quote

China''s Photovoltaic Module Exports to the Middle

The country imported approximately 1.45GW of Chinese photovoltaic modules, a 12% increase from 1.3GW in August, accounting for 60% of the total

Get a quote

Middle East & Africa Solar Photovoltaic (PV) Market

The Middle East & Africa solar photovoltaic market is being studied across various countries, which include the UAE, South Africa, Egypt, Saudi Arabia, Iraq, Oman, Ghana,

Get a quote

PV Companies List | ENF Company Directory

List of Emirati solar panel installers - showing companies in UAE that undertake solar panel installation, including rooftop and standalone solar systems.

Get a quote

Solar Panel Suppliers

Solar panels convert sunlight into electricity using photovoltaic (PV) cells. These cells absorb sunlight and generate direct current (DC) electricity, which is then

Get a quote

Record-Low Solar Prices Drive Middle East Projects

Abu Dhabi Power Corp. (ADPower) in late April announced what it called the lowest-ever cost-competitive tariff for a solar photovoltaic (PV)

Get a quote

What is going on with Middle Eastern solar prices, and what does

Our analysis contradicted that belief, demonstrating that rapidly declining hardware prices, local standard business conditions, and access to generous financing packages on

Get a quote

Unlocking the Potential of the Solar Photovoltaic (PV) Market

blessed with high solar irradiance, brims with much potential for solar energy. Receiving over 2,000 kWh/m2 annually in solar irradiation and benefiting from an 89% drop in solar

Get a quote

Solar Mounting Systems & Structures Dubai, UAE | PSI

We provide complete turn-key solutions for solar mounting systems & structures in Dubai, UAE, KSA and Middle East. We are wholly responsible for the

Get a quote

Middle East and Africa Solar PV Glass Market Price Analysis

The middle east and africa solar pv glass market report provides granular level information about the market size, regional market share, historic market (2019-2023), and forecast (2024-2030).

Get a quote

What is going on with Middle Eastern solar prices, and what does

In this study, we analyze the factors leading to the latest round of extremely low-priced contracts for solar electricity in several Persian Gulf states. We argue that the regional

Get a quote

MENA region''s solar energy capacity to exceed 180

The share of solar energy in the Middle East and North Africa''s (MENA) energy mix has grown significantly in recent years. Solar capacity in

Get a quote

Guess what you want to know

-

Middle East sun room photovoltaic panel manufacturer

Middle East sun room photovoltaic panel manufacturer

-

Middle East rooftop photovoltaic panel manufacturer

Middle East rooftop photovoltaic panel manufacturer

-

BESS photovoltaic panel prices in Sao Tome and Principe

BESS photovoltaic panel prices in Sao Tome and Principe

-

West African photovoltaic panel manufacturers prices

West African photovoltaic panel manufacturers prices

-

East Africa photovoltaic panel installation manufacturer

East Africa photovoltaic panel installation manufacturer

-

Photovoltaic panel prices in Nicaragua

Photovoltaic panel prices in Nicaragua

-

Photovoltaic panel prices for sale

Photovoltaic panel prices for sale

-

Photovoltaic panel prices in Myanmar

Photovoltaic panel prices in Myanmar

-

East Africa Photovoltaic Solar Panel Installation Manufacturer

East Africa Photovoltaic Solar Panel Installation Manufacturer

-

Photovoltaic panel prices in Romania

Photovoltaic panel prices in Romania

Industrial & Commercial Energy Storage Market Growth

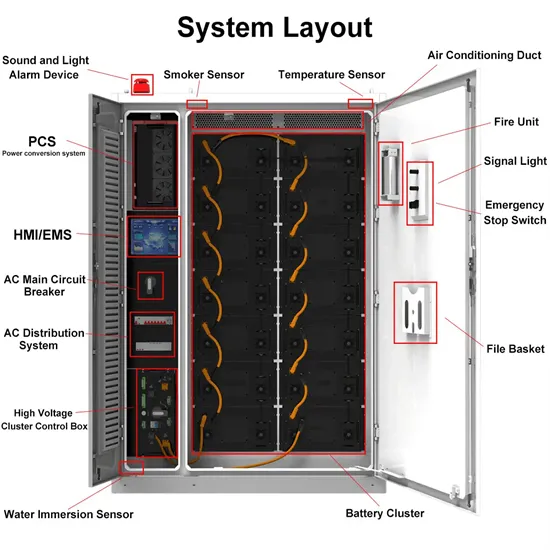

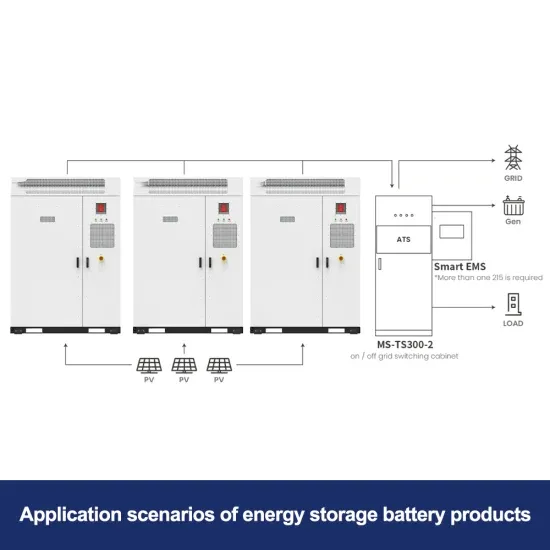

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.