Size, weight, power, and heat affect 5G base station

Energy use will increase dramatically with 5G because a typical gNodeB uses at least twice as much electricity as its 4G counterpart, MTN

Get a quote

Base Station Microgrid Energy Management in 5G Networks

The number of 5G base stations (BSs) has soared in recent years due to the exponential growth in demand for high data rate mobile communication traffic from various

Get a quote

Why does 5g base station consume so much power and how to

According to industry insiders'' estimates, 100000 5G base stations require at least 2 billion yuan in electricity bills per year, so 8 million 5G base stations require at least 160 billion

Get a quote

What is the Power Consumption of a 5G Base Station?

These 5G base stations consume about three times the power of the 4G stations. The main reason for this spike in power consumption is the addition of massive MIMO and

Get a quote

Optimal configuration of 5G base station energy storage

it, in the case of a power failure. As the number of 5G base stations, and their power consumption increase significantly compared with that of 4G base stations, the demand for backup batteries

Get a quote

The Future of Energy-Efficient 5G Base Station Design

The economic advantages of investing in energy-efficient 5G base stations extend beyond mere cost savings on electricity bills. By optimizing energy use, telecommunications

Get a quote

Why does 5g base station consume so much power

According to industry insiders'' estimates, 100000 5G base stations require at least 2 billion yuan in electricity bills per year, so 8 million 5G base

Get a quote

5G base stations use a lot more energy than 4G base stations: MTN

In November 2019, China Mobile EVP Li Zhengmao said that its electricity costs were rising fast with 5G. China Mobile has tried using lower cost deployments of MIMO

Get a quote

5G Infrastructure Costs: What Telcos Are Paying | PatentPC

Setting up a 5G base station is expensive, with costs ranging from $100,000 to $200,000 per site. This price includes hardware, installation, site rental, and maintenance.

Get a quote

5G Base Station Power Supply Market

The global 5G base station power supply market is shaped by companies specializing in high-efficiency energy solutions, backed by technological innovation, vertical integration, and

Get a quote

Renewable energy powered sustainable 5G network

Renewable energy is considered a viable and practical approach to power the small cell base station in an ultra-dense 5G network infrastructure to reduce the energy provisions

Get a quote

Final draft of deliverable D.WG3-02-Smart Energy Saving of

Change Log This document contains Version 1.0 of the ITU-T Technical Report on "Smart Energy Saving of 5G Base Station: Based on AI and other emerging technologies to forecast and

Get a quote

5G base station saves energy and reduces consumption

In 5G communications, base stations are large power consumers, and about 80% of energy consumption comes from widely dispersed base stations. It is predicted that by

Get a quote

How much power does 5G consume?

When base stations, data centers and devices are added together, telecommunications will consume more than 20% of the world''s electricity by 2025, says Huawei analyst Dr. Anders

Get a quote

How much does it cost to build a 5G base station? The total

The price of micro base stations is definitely not as high as that of macro base stations, but in densely populated areas in cities, the rent and entrance fees are often more expensive, and

Get a quote

How Much Power Does 5G Base Station Consume?

Have you ever wondered how much energy our hyper-connected world is consuming? 5G base stations, the backbone of next-gen connectivity, now draw 3-4 times more power than their 4G

Get a quote

Energy Efficiency for 5G and Beyond 5G: Potential, Limitations,

Energy efficiency assumes it is of paramount importance for both User Equipment (UE) to achieve battery prologue and base stations to achieve savings in power and operation

Get a quote

5G Energy Consumption Prediction

This repository contains my project for the 5G Energy Consumption modeling challenge organized by the International Telecommunication Union (ITU) in 2023. The challenge aims to estimate

Get a quote

Comparison of Power Consumption Models for 5G Cellular Network Base

This paper conducts a literature survey of relevant power consumption models for 5G cellular network base stations and provides a comparison of the models. It highlights

Get a quote

A technical look at 5G energy consumption and performance

When base stations, data centers and devices are added together, telecommunications will consume more than 20% of the world''s electricity by

Get a quote

Optimal capacity planning and operation of shared energy

A bi-level optimization framework of capacity planning and operation costs of shared energy storage system and large-scale integrated 5G base stations is proposed to

Get a quote

Size, weight, power, and heat affect 5G base station designs

Energy use will increase dramatically with 5G because a typical gNodeB uses at least twice as much electricity as its 4G counterpart, MTN says. Higher opex makes it difficult

Get a quote

A technical look at 5G energy consumption and performance

To understand this, we need to look closer at the base station power consumption characteristics (Figure 3). The model shows that there is significant energy consumption in the

Get a quote

Research on Performance of Power Saving Technology for 5G Base Station

Compared with the fourth generation (4G) technology, the fifth generation (5G) network possesses higher transmission rate, larger system capacity and lower transmission

Get a quote

5G Base Stations: The Energy Consumption Challenge

Early deployments indicate that 5G base stations require 2.5-3.5 times more power compared to a 4G one. Moreover, C-band, i.e., 3.4 GHz to 4.2 GHz, is deemed as the most popular 5G

Get a quote

6 FAQs about [5g energy base station electricity fee]

How much does a 5G base station cost?

Click Here To Download It For Free! Setting up a 5G base station is expensive, with costs ranging from $100,000 to $200,000 per site. This price includes hardware, installation, site rental, and maintenance. Urban areas often have higher costs due to land prices and infrastructure challenges.

Are 5G base stations causing more energy consumption?

However, Li says 5G base stations are carrying five times the traffic as when equipped with only 4G, pushing up power consumption. The carrier is seeking subsidies from the Chinese government to help with the increased energy usage.

How much power does a 5G base station consume?

That’s almost a threefold increase compared to 4G (5). One 5G base station is estimated to consume about as much power as 73 households (6), and 3x as much as the previous generation of base stations (5), (7).

Does China Mobile have a 5G base station?

China Mobile has tried using lower cost deployments of MIMO antennas, specifically 32T32R and sometimes 8T8R rather than 64T64R, according to MTN. However, Li says 5G base stations are carrying five times the traffic as when equipped with only 4G, pushing up power consumption.

How much does 5G cost?

Fixed wireless access (FWA) using mid-band 5G can also be a cost-effective solution, allowing companies to offer broadband services without the need for extensive fiber rollouts. 19. Private 5G networks for enterprises cost between $250,000 and $1 million per deployment

How much does 5G infrastructure cost?

The total cost of 5G infrastructure is staggering, with projections estimating that telecom companies will spend over $2 trillion globally by 2030. This includes investments in spectrum, network densification, fiber backhaul, energy-efficient infrastructure, and emerging technologies such as AI and automation.

Guess what you want to know

-

Malawi 5G base station electricity fee policy

Malawi 5G base station electricity fee policy

-

Czech hybrid energy 5G base station installation

Czech hybrid energy 5G base station installation

-

5g communication base station energy storage system cost

5g communication base station energy storage system cost

-

Ecuador 5G base station installation electricity price

Ecuador 5G base station installation electricity price

-

Electricity Policy 5G Base Station

Electricity Policy 5G Base Station

-

Does Gambia have a 5G base station with hybrid energy

Does Gambia have a 5G base station with hybrid energy

-

Huawei 5g base station power solar energy

Huawei 5g base station power solar energy

-

How much electricity does a 5G base station in Switzerland use

How much electricity does a 5G base station in Switzerland use

-

Cost price of 5G hybrid energy base station in Hungary

Cost price of 5G hybrid energy base station in Hungary

-

China s hybrid energy 5G base station planning

China s hybrid energy 5G base station planning

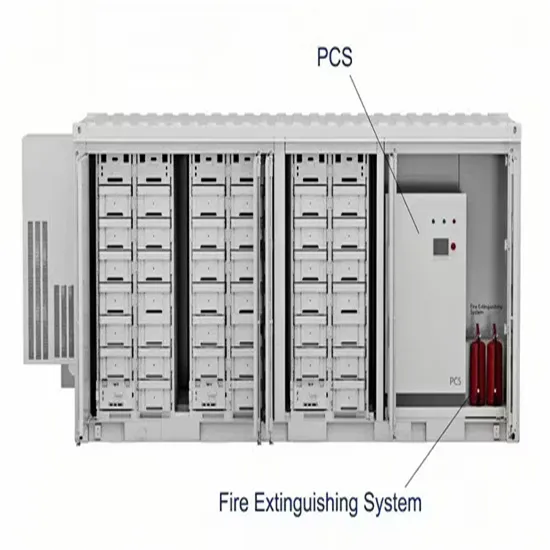

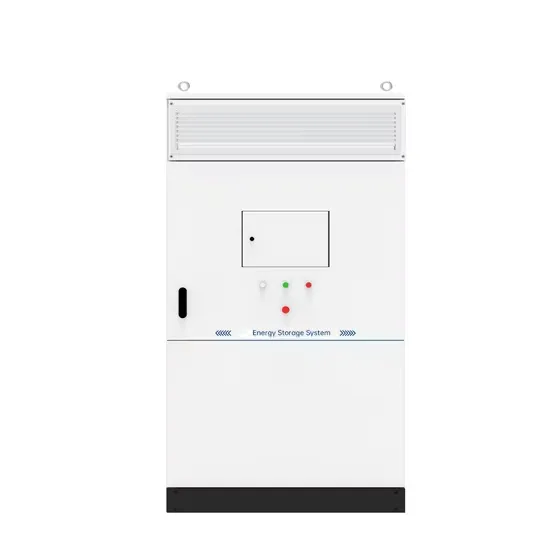

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.