Key Trends Shaping Battery Energy Storage in 2025

Demand for energy storage continues to escalate, the global battery energy storage (BESS) landscape is poised for significant installation

Get a quote

Executive summary – Batteries and Secure Energy

Strong growth occurred for utility-scale battery projects, behind-the-meter batteries, mini-grids and solar home systems for electricity access, adding a

Get a quote

Energy Storage | ACP

The energy storage industry has announced a historic commitment to invest $100 billion in building and buying American-made grid batteries, including capital for new battery

Get a quote

Comprehensive review of energy storage systems technologies,

Battery, flywheel energy storage, super capacitor, and superconducting magnetic energy storage are technically feasible for use in distribution networks. With an energy density

Get a quote

Investment trends in grid-scale battery storage

However, the IEA reported that despite the pandemic, investment in battery storage surged by almost 40% year-over-year in 2020, to USD 5.5 billion. Spending on grid-scale

Get a quote

U.S. Energy Storage Industry to Invest $100 Billion in

Today''s investment commitment aims to advance a manufacturing expansion in the United States that could enable American-made batteries to satisfy 100% of domestic energy storage project

Get a quote

Private equity targets battery energy storage, driven largely by

Private equity and venture capital investments in the battery energy storage system, energy management and energy storage sector so far in 2024 have exceeded 2023''s levels and are

Get a quote

TotalEnergies to Invest €160 Million in Six Battery

TotalEnergies has announced investment decisions for six battery storage projects in Germany, totaling 221MW of new capacity with an

Get a quote

Energy Storage Investments – Publications

Through the first three quarters of 2024, 83 energy storage financing and investment deals were reported completed for a total of $17.6 billion invested [1]. Of these

Get a quote

US energy sector set to invest $100B in battery

Members of the US energy industry has committed to investing $100 billion over the next five years to build and buy American-made batteries

Get a quote

''Big expansion'' in battery manufacturing

The amount invested in energy storage soared globally during 2023, while battery manufacturing will require the biggest share of spending

Get a quote

iShares Energy Storage & Materials ETF | IBAT

The iShares Energy Storage & Materials ETF seeks to track the investment results of an index composed of U.S. and non-U.S. companies involved in energy storage solutions

Get a quote

Energy Storage Grand Challenge Energy Storage Market

This report, supported by the U.S. Department of Energy''s Energy Storage Grand Challenge, summarizes current status and market projections for the global deployment of selected

Get a quote

Executive summary – Batteries and Secure Energy Transitions –

Strong growth occurred for utility-scale battery projects, behind-the-meter batteries, mini-grids and solar home systems for electricity access, adding a total of 42 GW of battery storage capacity

Get a quote

''Big expansion'' in battery manufacturing

The amount invested in energy storage soared globally during 2023, while battery manufacturing will require the biggest share of spending among clean energy technologies by

Get a quote

Battery Storage: Expanding Investments and Market

Arizona, Florida, and Massachusetts round out the top five in battery storage under construction, illustrating the industry''s geographic diversity. Many new battery facilities will

Get a quote

Australia Sets Record in Clean Energy Investment

Australia saw a surge in investments and rapid growth in Battery Energy Storage Systems (BESS). Find out how it supports Australia''s net-zero

Get a quote

TotalEnergies to invest in six German battery-storage

The projects to create 221 megawatts of storage will be supplied by battery maker SAFT and developed by Kyon Energy, both subsidiaries of

Get a quote

TotalEnergies Announces €160 Million Investment in Battery Storage

This investment marks a key milestone in TotalEnergies'' push for battery energy storage in Germany, strengthening its integrated energy operations in the country. The storage

Get a quote

Investment trends in grid-scale battery storage

However, the IEA reported that despite the pandemic, investment in battery storage surged by almost 40% year-over-year in 2020, to USD 5.5

Get a quote

European energy storage: a new multi-billion-dollar

"With energy storage, there''s a new and interesting asset class emerging, and the business model is fundamentally different to that of wind

Get a quote

Enabling renewable energy with battery energy

These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable

Get a quote

2021 2024 FOUR YEAR REVIEW SUPPLY CHAINS FOR

Introduction Advanced batteries are a critical technology needed for a resilient, affordable, and secure future energy system. As vital components of electric vehicles, stationary energy

Get a quote

Energy Storage Outlook

Global installed energy storage is on a steep upward trajectory. From just under 0.5 terawatts (TW) in 2024, total capacity is expected to rise ninefold to over 4 TW by 2040,

Get a quote

Battery Storage in the United States: An Update on Market

Energy storage plays a pivotal role in enabling power grids to function with more flexibility and resilience. In this report, we provide data on trends in battery storage capacity

Get a quote

US energy sector set to invest $100B in battery storage by 2030

Members of the US energy industry has committed to investing $100 billion over the next five years to build and buy American-made batteries for large, utility-scale

Get a quote

Global energy investment set to rise to $3.3 trillion in 2025 amid

Investment in clean technologies – renewables, nuclear, grids, storage, low-emissions fuels, efficiency and electrification – is on course to hit a record $2.2 trillion this

Get a quote

China''s energy storage capacity using new tech

China''s energy storage sector nearly quadrupled its capacity from new technologies such as lithium-ion batteries over the past year, after

Get a quote

6 FAQs about [Total investment in energy storage batteries]

Will US energy industry invest $100 billion in battery energy storage systems?

Members of the US energy industry has committed to investing $100 billion over the next five years to build and buy American-made batteries for large, utility-scale deployments of battery energy storage systems (BESS).

Is the world already investing in battery production?

The world is indeed already investing in battery production and investments are set to surge around 66% from 2023 to 2024 according to investment plans seen by BloombergNEF and battery gigafactories are a primary driver of this investment.

How many GW of battery storage capacity are there in the world?

Strong growth occurred for utility-scale battery projects, behind-the-meter batteries, mini-grids and solar home systems for electricity access, adding a total of 42 GW of battery storage capacity globally.

How much money will the ACP invest in battery storage?

and subscribe to the . The ACP has committed to investing $100 billion over the next five years to build and buy American-made battery storage.

How much did energy storage invest in 2023?

Meanwhile, although as a share of the total energy storage’s US$36 billion of investment commitments during 2023 seems relatively small, it was a jump of 76%. Storage investments totalled more dollars than hydrogen (US$10.4 billion) and carbon capture and storage (US$11.1 billion) together.

Should EVs and battery energy storage systems be part of a net zero World?

Of course, with EVs and battery energy storage system (BESS) both closely dependent on battery supply, and most commonly lithium-ion (Li-ion) batteries, Li-ion battery manufacturing plants would account for 70% of all clean energy supply chain spending, were they to be invested into to the full extent required for a net zero world.

Guess what you want to know

-

Batteries in energy storage power stations account for the proportion of investment

Batteries in energy storage power stations account for the proportion of investment

-

Total investment in Senegal energy storage power station

Total investment in Senegal energy storage power station

-

What kind of batteries are commonly used for energy storage now

What kind of batteries are commonly used for energy storage now

-

Where energy storage batteries are used

Where energy storage batteries are used

-

Aren t batteries considered energy storage

Aren t batteries considered energy storage

-

Nano-ion batteries are more suitable for energy storage

Nano-ion batteries are more suitable for energy storage

-

Technical features of energy storage cabinet batteries

Technical features of energy storage cabinet batteries

-

Energy storage battery consists of several batteries

Energy storage battery consists of several batteries

-

Photovoltaic energy storage supporting lithium batteries

Photovoltaic energy storage supporting lithium batteries

-

Why aren t energy storage cabinet batteries used as energy storage charging piles

Why aren t energy storage cabinet batteries used as energy storage charging piles

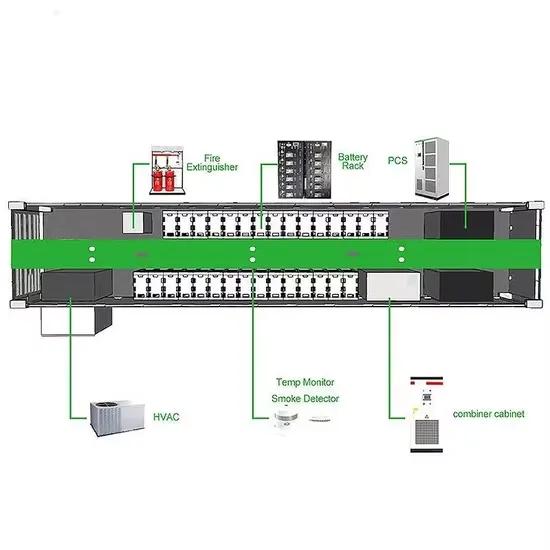

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.