5G Base Station Backup Power Supply Growth Forecast and

The global market for 5G base station backup power supplies is experiencing robust growth, driven by the rapid expansion of 5G networks worldwide. The increasing demand for

Get a quote

Power Supply for Base Station Unlocking Growth Potential:

The global power supply market for base stations is experiencing robust growth, projected to reach $10.2 billion in 2025 and maintain a Compound Annual Growth Rate

Get a quote

5G Network Equipment Manufacturers: Modem, Base Station,

Explore leading 5G equipment manufacturers for modems, base stations, RAN, and core networks. Discover vendors enhancing network speed and efficiency.

Get a quote

Ranking of the top 10 manufacturers in the global 5G base station

In the mobile network exhibition area, 5G AIO (innovative integrated 5G indoor and outdoor base station), AirScale Levante high-performance baseband, and ASOF''s new

Get a quote

Selecting the Right Supplies for Powering 5G Base Stations

Consequently, a company like ADI, which specializes in all aspects of the base station RF chain and has thorough knowledge of power management tools required for powering these

Get a quote

Global 5G Base Station Power Supply Market 2025 by

Chapter 2, to profile the top manufacturers of 5G Base Station Power Supply, with price, sales quantity, revenue, and global market share of 5G Base Station Power Supply from 2020 to 2025.

Get a quote

5G Base Station Power Supply Market

The global 5G base station power supply market is shaped by companies specializing in high-efficiency energy solutions, backed by technological innovation, vertical integration, and

Get a quote

5G Base Station Companies

This report lists the top 5G Base Station companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research and identified these

Get a quote

China Power Supply System for 5G Micro Base Station Manufacturers

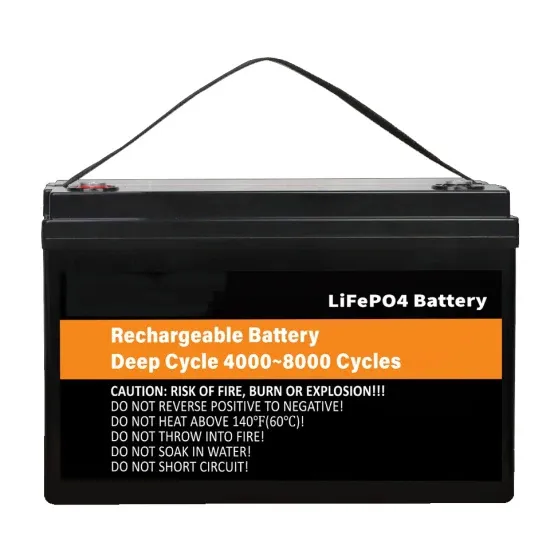

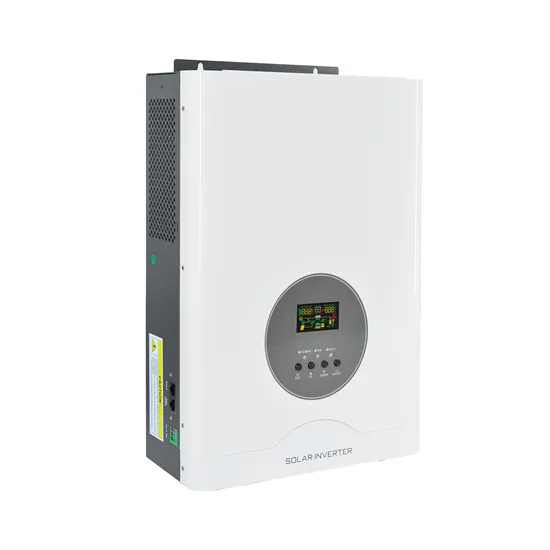

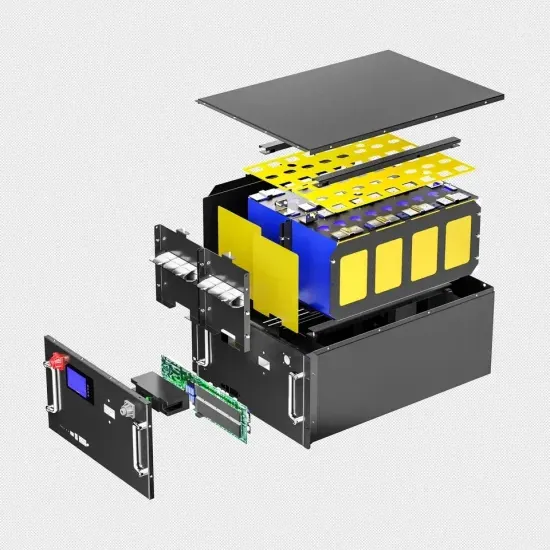

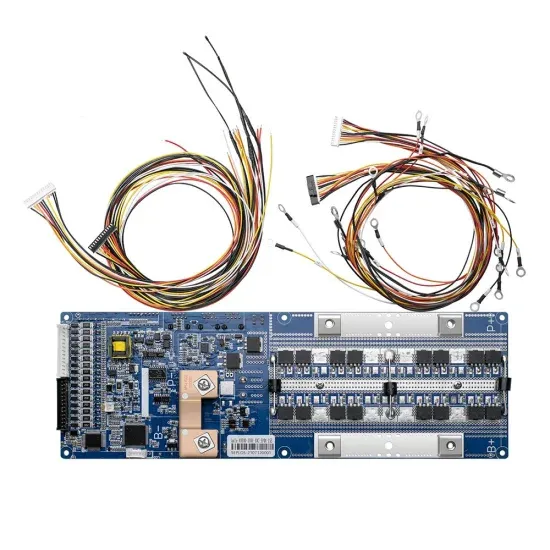

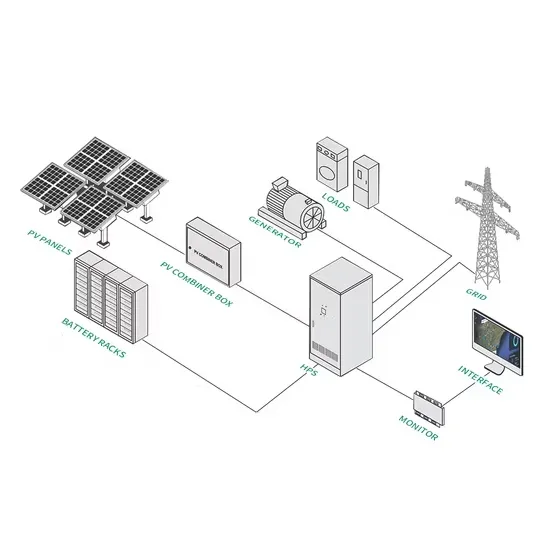

The power system of 5G micro base station mainly includes power module series (TP48V3K) and lithium battery module series (TP48V50-16S). It is an efficient, small size, light weight, easy to

Get a quote

Best Practices to Accelerate 5G Base Station

The 5G massive MIMO base station has arrived and carriers continue to ramp up deployments. The global demand for product with varying

Get a quote

Global 5G Base Station Power Supply Market 2025 by Manufacturers

5G Base station power supply is a device used to provide the power required by 5G wireless communication base stations. It usually includes components such as power adapters and

Get a quote

Global 5G Base Station Power Supply Market 2025 by Manufacturers

Chapter 2, to profile the top manufacturers of 5G Base Station Power Supply, with price, sales quantity, revenue, and global market share of 5G Base Station Power Supply from 2020 to 2025.

Get a quote

Study on Power Feeding System for 5G Network

High Voltage Direct Current (HVDC) power supply HVDC systems are mainly used in telecommunication rooms and data centers, not in the Base station. With the increase of

Get a quote

Murata-Base-station-app-guide

Moving up the mast In the era of 4G, network installations typically relied upon heavy duty infrastructure such as large power masts and passive cables and antennas, with much of the

Get a quote

Surge Protection for Cell Sites

Moreover, the base station contains secondary systems like cooling or emergency power supply, which might also need extra surge protection. For safeguarding the base

Get a quote

5G Base Station Power Supply System: NextG Power''s Cutting

Discover NextG Power''s 5G micro base station power solutions! Our IP65-rated 2000W/3000W modules and 48V 20Ah/50Ah LFP batteries ensure reliable connectivity.

Get a quote

5g Base Station Backup Power Supply Industry Forecasts:

This comprehensive report provides an in-depth analysis of the global 5G base station backup power supply market, covering the period from 2019 to 2033. The report

Get a quote

Three companies to own 74.5% of base station

TrendForce believes, with the evolution of 5G deployment towards the core and Open RAN cloud, equipment manufacturers will strengthen

Get a quote

Power Supplies for Outdoor 5G Base Station Application

As shown in Figure 3, small base stations require power supplies just like the rest of electronic devices, and because they are normally installed in outdoor environments, it is

Get a quote

Global 5G Base Station Power Supply Supply, Demand and Key

The global 5G Base Station Power Supply market size is expected to reach $ 11200 million by 2030, rising at a market growth of 7.1% CAGR during the forecast period (2024

Get a quote

Selecting the Right Supplies for Powering 5G Base Stations

Consequently, a company like ADI, which specializes in all aspects of the base station RF chain and has thorough knowledge of power management tools required for powering these

Get a quote

Global 5G Base Station Backup Power Supply Supply, Demand

This report is a detailed and comprehensive analysis of the world market for 5G Base Station Backup Power Supply, and provides market size (US$ million) and Year-over-Year (YoY)

Get a quote

Power Supplies for Outdoor 5G Base Station Application

As shown in Figure 3, small base stations require power supplies just like the rest of electronic devices, and because they are normally installed

Get a quote

5G Base Station Companies

The rollout of 5G networks is transforming the connectivity landscape, and the 5G Base Station Market is at the forefront of this revolution. 5G base stations form

Get a quote

6 FAQs about [Which 5G base station power supply manufacturers are there ]

How big is the 5G base station market?

5G Base Station Market size was valued at USD 11.20 Billion in 2021 and is projected to reach USD 194.26 Billion by 2030, growing at a CAGR of 37.3% from 2022 to 2030. Because of the increased need for high-speed data with low latency, the 5G base station market is likely to develop significantly throughout the forecast period.

How much power does a 5G base station use?

Each nation has a different 5G strategy. For 5G, China uses 3.5GHz as the frequency. Then, a 5G base station resembles a 4G system, but it’s on a much larger scale. For sub-6GHz in 5G, let’s say you have a macro base station. The power levels at the antenna range from 40 watts, 80 watts or 100 watts.

Where is the first 5G base station made?

Back in July of last year, Verizon received the first U.S. manufactured 5G base station from a facility in Texas. Pictured is Verizon's CTO Kyle Malady holding some of the hardware. Image used courtesy of Ericsson

How many 5G base stations does China have?

In November, China claimed that, despite the COVID-19 pandemic, it had built over 700,000 5G base stations in 2020, adding to the 100,000 base stations built in 2019. This means that China as a single country has more base stations than the combined total of every other nation on earth.

How 5G technology is transforming connectivity?

5G technology is revolutionizing connectivity, and the manufacturers of 5G equipment are leading this transformation. From modems and base stations to RAN, antenna arrays, and core networks, these companies are providing cutting-edge solutions. Leading vendors are offering innovative products to enhance network speed, coverage, and efficiency.

What is a 5G NR Network?

As defined in 3GPP TS 38.300, the 5G NR network consists of NG RAN (Next Generation Radio Access Network) and 5GC (5G Core Network). As shown, NG-RAN is composed of gNBs (i.e., 5G Base stations) and ng-eNBs (i.e., LTE base stations). The figure above depicts the overall architecture of a 5G NR system and its components.

Guess what you want to know

-

Which German 5G base station power supply manufacturers are there

Which German 5G base station power supply manufacturers are there

-

Which 5G base station power supply companies are there

Which 5G base station power supply companies are there

-

Ranking of domestic communication base station power supply manufacturers

Ranking of domestic communication base station power supply manufacturers

-

Saint Lucia 5G base station power supply price

Saint Lucia 5G base station power supply price

-

Guyana Communications 5G base station total hybrid power supply

Guyana Communications 5G base station total hybrid power supply

-

Malawi 5G communication base station power supply number

Malawi 5G communication base station power supply number

-

Huawei 5g system micro base station power supply

Huawei 5g system micro base station power supply

-

5G base station new wind power supply design

5G base station new wind power supply design

-

5g small base station power supply supporting company

5g small base station power supply supporting company

-

5W ultra-low power 5G base station power supply

5W ultra-low power 5G base station power supply

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.