A Ka-band High-OP1dB Power Amplifier in 0.15-μm GaN Process for 5G Base

(DOI: 10.23919/apmc55665.2022.9999881) In this paper, we present a Ka-band power amplifier (PA) in WIN Semiconductors 0.15-μm GaN high electron-mobility transistor (HEMT) process.

Get a quote

Selecting the Right Supplies for Powering 5G Base Stations

These tools simplify the task of selecting the right power management solutions for these devices and, thereby, provide an optimal power solution for 5G base stations components.

Get a quote

Mitsubishi Electric Achieves World''s First Performance

TOKYO, June 12, 2025 - Mitsubishi Electric Corporation (TOKYO: 6503) announced today announced today that it has developed a world''s first 1 compact 7GHz band gallium nitride

Get a quote

GaN for Power-Hungry 5G Base Stations

5G technology have a more limited range, meaning that a greater concentration of base stations will be needed to provide given areas with effective coverage. The cost of building these new

Get a quote

Design and Performance Evaluation of a 2.4 GHz High Efficiency

The intrinsic features of GaN devices, which allow for higher frequency operation and wider bandwidth, make this design ideal for 5G applications.

Get a quote

A 74W/48V Monolithic-GaN Integrated Adjustable Multilevel Supply

Efficient power management for RF power amplifiers (PAs) is emerging as a critical requirement for the development and adoption of next-generation wireless comm

Get a quote

Mitsubishi Electric Achieves World''s First Performance

Mitsubishi Electric successfully verified its new PAM''s performance in a demonstration using 5G-Advanced communication signals for the first time in the world. 1

Get a quote

Improving RF Power Amplifier Efficiency in 5G Radio Systems

The imperative here is to operate base stations that can flexibly adjust to traffic demand. Certainly, the transition to and deployment of 5G communications has an inherent requirement for

Get a quote

GaN HEMTs for 5G Base Station Applications

The state of the art GaN HEMT has penetrated into the 4G/LTE base station. The efficiency advantage, based on its material properties will also attract 5G power amplifier designers. This

Get a quote

Best Practices to Accelerate 5G Base Station

Thus, system manufacturers are migrating away from silicon LDMOS to gallium nitride (GaN) with the capability for GaN to achieve up to

Get a quote

Distribution network restoration supply method considers 5G base

In view of the impact of changes in communication volume on the emergency power supply output of base station energy storage in distribution network fault areas, this

Get a quote

Selecting the Right Supplies for Powering 5G Base Stations

These tools simplify the task of selecting the right power management solutions for these devices and, thereby, provide an optimal power solution for 5G base stations components.

Get a quote

10W Class, Wideband GaN Power Amplifier Module for 5G

In this article, we discuss the 10W class, wideband GaN power amplifier module for 5G base stations which covers almost all the bandwidths of 5G frequencies in the 3 - 4 GHz band.

Get a quote

Building Better Power Supplies For 5G Base Stations

Building Better Power Supplies For 5G Base Stations by Alessandro Pevere, and Francesco Di Domenico, Infineon Technologies, Villach, Austria according to Ofcom, the UK''s telecoms

Get a quote

GaN radiofrequency components and power amplifiers for next

In 5G communication systems, especially those functioning at millimeter-wave frequencies, Gallium Nitride high electron mobility transistors have emerged as the preferred

Get a quote

A review of GaN RF devices and power amplifiers for 5G communication

In recent years, with the development of materials and device technology, GaN-on-Si RF power devices have shown outstanding performance in fields such as aerospace, radar

Get a quote

Power Amp Wars Begin For 5G

Now device makers are developing new GaN-based power amp chips, hoping to capture the next wave of 5G base station deployments. Cree, Fujitsu, Mitsubishi, NXP, Qorvo,

Get a quote

Mitsubishi Electric to Ship Samples of GaN Power Amplifier

Mitsubishi Electric will commence sample shipments of a GaN power amplifier module for 5G mMIMO base stations that can deliver an average output power of 8W (39 dBm) over wide

Get a quote

Selecting the Right Supplies for Powering 5G Base Stations

Selecting the Right Supplies for Powering 5G Base Stations Components Cellular communications have come a long way since the introduction of analog cellular networks in

Get a quote

A GaN-based Doherty Power Amplifier for 5G Basestation

This paper presents a highly efficient and linear Doherty power amplifier targeting base station applications for the fifth-generation (5G) communication system

Get a quote

What is a GaN power amplifier?

Because of their wide bandgap characteristics, GaN PAs are well-suited to address many issues when implementing modern base station infrastructure for cellular

Get a quote

Consideration of Design Strategy of GaN HEMTs for Base

In recent years, gallium nitride high-electron-mobility transistor (GaN HEMT) amplifiers with high efficiency have been adopted due to the increasing demand for downsized and low-power

Get a quote

Happy GaNuary from NXP! GaN''s Continued Acceleration for the 5G

See our Versatile GaN Solution for Various Markets device. GaN already performs with greater ease than LDMOS and offers room to expand over time. In the 5G infrastructure,

Get a quote

Guess what you want to know

-

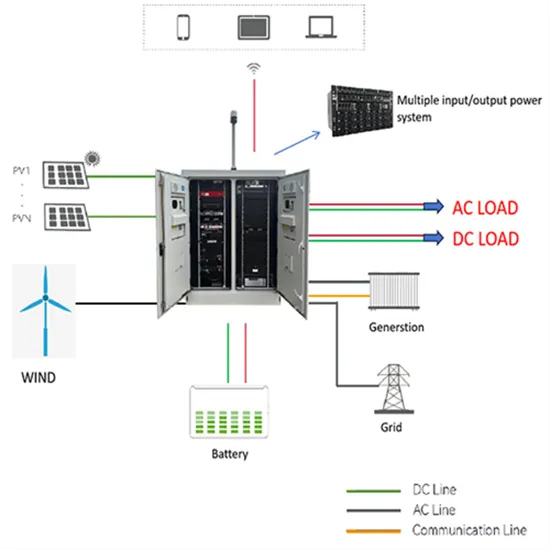

Communication and 5G base station hybrid power supply

Communication and 5G base station hybrid power supply

-

A brief description of the 5G communication base station power supply construction process

A brief description of the 5G communication base station power supply construction process

-

Company producing 5g base station communication power supply

Company producing 5g base station communication power supply

-

How much hybrid power supply does a 5G communication base station have

How much hybrid power supply does a 5G communication base station have

-

Base station communication power supply manufacturer energy

Base station communication power supply manufacturer energy

-

North Macedonia communication base station power supply cabinet bidding

North Macedonia communication base station power supply cabinet bidding

-

Which 5G base station power supply manufacturers are there

Which 5G base station power supply manufacturers are there

-

Afghanistan communication base station power supply cabinet bidding

Afghanistan communication base station power supply cabinet bidding

-

West Asia emergency communication base station power supply equipment

West Asia emergency communication base station power supply equipment

-

Semiconductor 5G base station power supply

Semiconductor 5G base station power supply

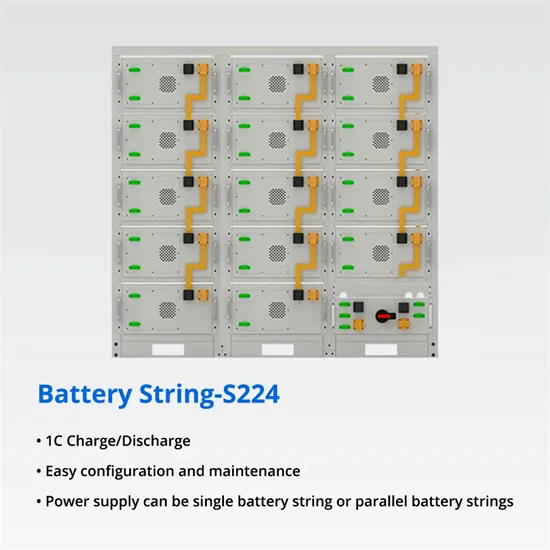

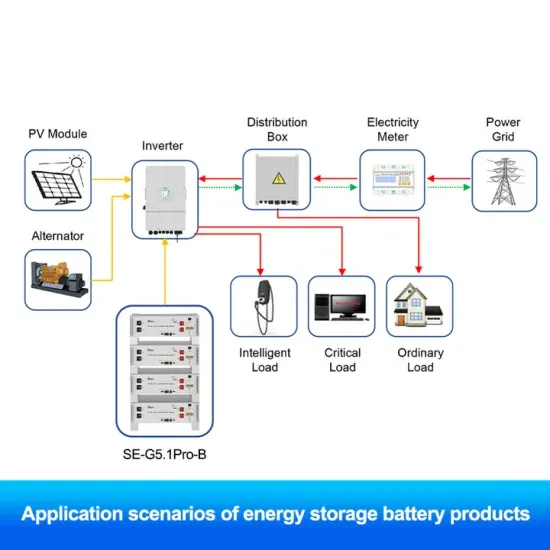

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.