5G macro base station power supply design strategy and

For macro base stations, Cheng Wentao of Infineon gave some suggestions on the optimization of primary and secondary power supplies. "In terms of primary power supply, we

Get a quote

Key Technologies and Solutions for 5G Base Station Power Supply

Millimeter-wave beamforming and massive MIMO configurations create dynamic load spikes that conventional rectifiers can''t handle. Imagine a base station switching between 64

Get a quote

Study on Power Feeding System for 5G Network

High Voltage Direct Current (HVDC) power supply HVDC systems are mainly used in telecommunication rooms and data centers, not in the Base station. With the increase of

Get a quote

Selecting the Right Supplies for Powering 5G Base Stations

A single RoHS compliant BGA package integrates a switching controller, power switches, an inductor, and all the supporting components. In some cases, to maximize power supply

Get a quote

5G infrastructure power supply design considerations (Part I)

Building better power supplies for 5G base stations Authored by: Alessandro Pevere, and Francesco Di Domenico, both at Infineon Technologies Infineon Technologies - Technical

Get a quote

Research and Implementation of 5G Base Station Location

The application requirements of 5G have reached a new height, and the location of base stations is an important factor affecting the signal. Based on factors such as base station

Get a quote

5G macro base station power supply design strategy and

"In terms of primary power supply, we see a very obvious trend of requiring high efficiency and high power density. Now the efficiency of power supply should reach 97%, or

Get a quote

Study on Power Feeding System for 5G Network

HVDC systems are mainly used in telecommunication rooms and data centers, not in the Base station. With the increase of power density and voltage drops on the power transmission line in

Get a quote

5G communication challenge to switching power

For the popular networking mode of 5G base station: 3 sectorAAU + 1 BBU, assuming that the AAU efficiency is 20%, the output power of the

Get a quote

Powering 5G

Up to the radio power amplifier and receiver stage, the electronics in a base station is typical of a data processing system comprising CPUs, FPGAs, SoCs, ADCs, DACs and a

Get a quote

Power Supply Solution for 5G Telecom and Outdoor Wireless Applications

New 5G networks bring new challenges for powering base stations. MPS has developed a powerful, efficient new power supply solution for 5G telecom applications using several

Get a quote

The Long Road to Sobriety: Estimating the Operational

These alarming figures advocate for proactive digital sobriety policies. Index Terms—Mobile Network, 5G, Base Station, Power Con- sumption, Digital Sobriety, France. I.

Get a quote

5G infrastructure power supply design considerations (Part I)

Discover the factors that telecoms organizations need to consider for 5G infrastructure power design in the network periphery.

Get a quote

Murata-Base-station-app-guide

Moving up the mast In the era of 4G, network installations typically relied upon heavy duty infrastructure such as large power masts and passive cables and antennas, with much of the

Get a quote

Power Consumption Modeling of 5G Multi-Carrier Base

However, there is still a need to understand the power consumption behavior of state-of-the-art base station architectures, such as multi-carrier active antenna units (AAUs), as well as the

Get a quote

5G Base Station Power Supply System: NextG Power''s Cutting

Discover NextG Power''s 5G micro base station power solutions! Our IP65-rated 2000W/3000W modules and 48V 20Ah/50Ah LFP batteries ensure reliable connectivity.

Get a quote

5G Communication Base Stations Participating in Demand

In the operation process, through scientific means to dispatch and manage the power supply and power consumption equipment in 5G base station, the interactive response

Get a quote

A super base station based centralized network architecture for 5G

In future 5G mobile communication systems, a number of promising techniques have been proposed to support a three orders of magnitude higher network load compared to what

Get a quote

Optimal energy-saving operation strategy of 5G base station with

To further explore the energy-saving potential of 5 G base stations, this paper proposes an energy-saving operation model for 5 G base stations that incorporates communication caching

Get a quote

Building better power supplies for 5G base stations

Building better power supplies for 5G base stations Authored by: Alessandro Pevere, and Francesco Di Domenico, both at Infineon Technologies Infineon Technologies - Technical

Get a quote

Energy Management of Base Station in 5G and B5G: Revisited

Due to infrastructural limitations, non-standalone mode deployment of 5G is preferred as compared to standalone mode. To achieve low latency, higher throughput, larger capacity,

Get a quote

The power supply design considerations for 5G base

Infrastructure OEMs and their suppliers see "pulse power" as a potential solution. This technique reduces opex by putting a base station into a

Get a quote

Selecting the Right Supplies for Powering 5G Base Stations

A single RoHS compliant BGA package integrates a switching controller, power switches, an inductor, and all the supporting components. In some cases, to maximize power supply

Get a quote

The power supply design considerations for 5G base stations

Infrastructure OEMs and their suppliers see "pulse power" as a potential solution. This technique reduces opex by putting a base station into a "sleep mode," with only the

Get a quote

Building a Better –48 VDC Power Supply for 5G and

Figure 3. A power supply for a 5G macro base station block diagram. Highlighted ICs The MAX15258 is a high voltage multiphase boost controller with an I 2 C

Get a quote

6 FAQs about [A brief description of the 5G communication base station power supply construction process]

What is a 5G power supply?

The equipment ensures that devices across the infrastructure stack receive reliable power from the mains network, wherever they happen to reside. With it, individuals and organizations can continue to render services to both themselves and their customers. Overviews The 5G network architecture uses multiple types of power supplies.

How will 5G affect power supply design?

Higher bandwidths and compression techniques will let 5G networks shuttle more data through systems in a given period, leaving more power-saving idle time. In light of this, the move to 5G infrastructure is necessitating new power supply design considerations.

How does a 5G base station reduce OPEX?

This technique reduces opex by putting a base station into a “sleep mode,” with only the essentials remaining powered on. Pulse power leverages 5G base stations’ ability to analyze traffic loads. In 4G, radios are always on, even when traffic levels don’t warrant it, such as transmitting reference signals to detect users in the middle of the night.

Will 5G use micro-cells?

Therefore, in 5G networks, high-frequency resources will no longer use macro base stations, micro-cells become the mainstream, and the small base stations will be used as the basic unit for ultra-intensive networking, that is, small base stations dense deployment.

What is a 5G backhaul power supply?

The backhaul part of the 5G network connects the access interface - including masts, eNodeB, and cell site gateway - to the mobile core and internet beyond. And just like the access equipment, it too has specific power supply requirements. Backhaul power supplies must cater to aggregation routers and core routers.

Do 5G equipment power supply units need to be compact?

Small cells will need to be able to fit in compact environments, such as traffic lights, utility poles, and rooftops. So power supply units will need to be compact, able to fit comfortably alongside the equipment they power. There are also considerable heat dissipation issues that 5G equipment power supply units will need to accommodate.

Guess what you want to know

-

Base station communication power supply construction process

Base station communication power supply construction process

-

Malawi 5G communication base station power supply number

Malawi 5G communication base station power supply number

-

Company producing 5g base station communication power supply

Company producing 5g base station communication power supply

-

Communication base station power supply construction project cost

Communication base station power supply construction project cost

-

Communication and 5G base station hybrid power supply

Communication and 5G base station hybrid power supply

-

Kazakhstan communication base station power supply construction project

Kazakhstan communication base station power supply construction project

-

Photovoltaic area of the Maldives 5G communication base station power supply project

Photovoltaic area of the Maldives 5G communication base station power supply project

-

5W ultra-low power 5G base station power supply

5W ultra-low power 5G base station power supply

-

Communication base station external power construction plan

Communication base station external power construction plan

-

5g base station power supply change

5g base station power supply change

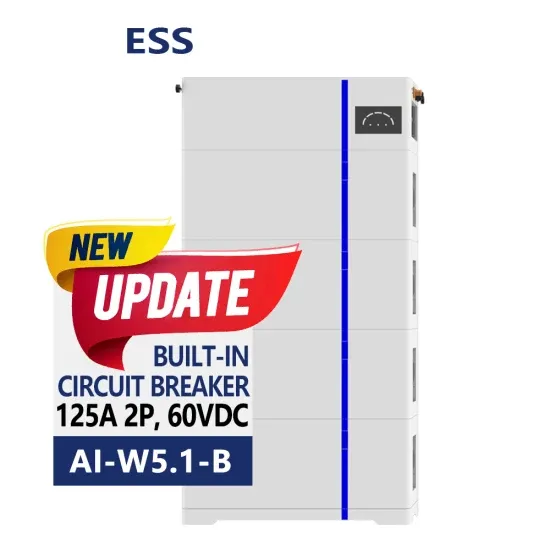

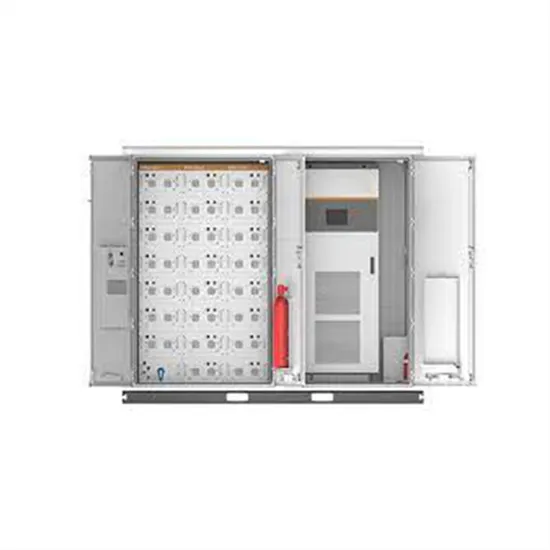

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

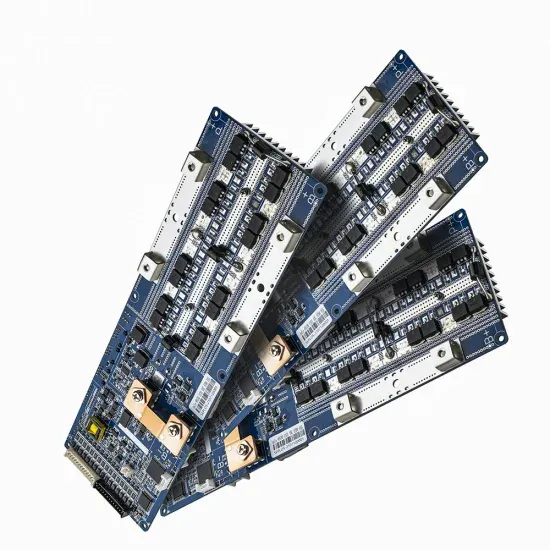

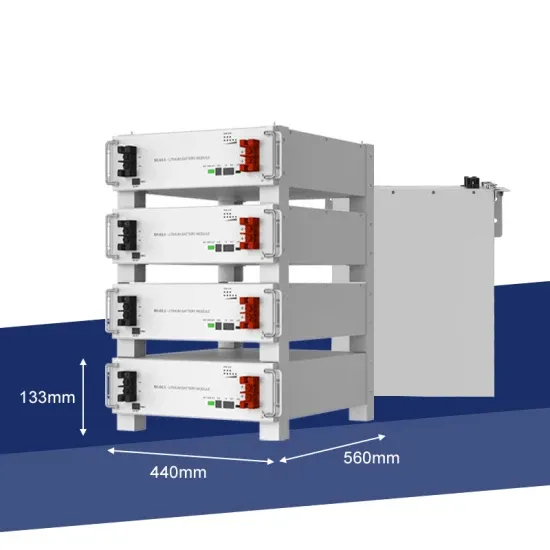

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.