Maroc Telecom Boosts Mauritania''s Digital

Maroc Telecom, a leading telecommunications group in Morocco and a major player across Africa, has strengthened its presence in Mauritania

Get a quote

Mauritania – WATRA | ARTAO

The sector employs about 10,000 people and provides services to over 5 million subscribers. Regulatory Journey and Evolution of the Industry: Mauritania''s telecommunications industry

Get a quote

The Base Station in Wireless Communications: The

Base station, also known as BTS (Base Transceiver Station), is a key device in wireless communication systems such as GSM. Equipped with

Get a quote

Analysis of Hybrid Energy Systems for Telecommunications

1. Introduction Telecom network operators are installing a higher number of base stations (BSs) to meet the demand of ever-increasing data rate and the number of mobile subscribers across

Get a quote

List of Mobile Operators in Mauritania

Mobile operators in Mauritania play a pivotal role in providing telecommunications services to the country''s population. Mauritania, a West African nation with a diverse

Get a quote

Mobile communication base stations

Mobile communication base stations Since 2012, we have completed over 1,000 mobile operator (SIA LMT, SIA Tele2, SIA Bite Latvia) base station reconstruction projects and more than 300

Get a quote

Telecom companies in Mauritania

Search our database and find Telecom companies in Mauritania based on your preferred criteria. Get key company details, track changes, and gain actionable insights to

Get a quote

HVAC | Telecommunication Infrastructure Fabrication

HVAC provides custom solutions to the telecommunications industry. We are capable of designing, manufacturing and maintaining mobile base stations,

Get a quote

Telecommunications in Mauritania

Mauritania has three operators, the original monopoly, Mauritel (now owned by Vivendi''s Maroc Telecom), Mattel (owned by Tunisie Telecom) and Chinguitel, which started operating in

Get a quote

Mauritania Communications 2024, CIA World Factbook

NOTE: The information regarding Mauritania on this page is re-published from the 2024 World Fact Book of the United States Central Intelligence Agency and other sources.

Get a quote

Mauritania | Powertec Information Portal

The company was founded in 2006 as a subsidiary of Sudatel, a major telecom provider headquartered in Sudan. Sudatel owns a majority stake in Chinguitel Sudatel, marking its

Get a quote

Reliable energy storage solutions for telecommunications

Reliable energy storage solutions for telecommunications and industrial application Telecommunications companies, which must maintain the infrastructure (base stations) in

Get a quote

Mauritania Telecom Infrastructure Market Trends, Statistics, and

Mauritania has a huge national telecommunications network. A strong increase in telecom subscribers base has necessitated network expansion covering a wider area, thereby creating

Get a quote

Mauritania LTE Base Station Market (2024-2030) | Segmentation,

Historical Data and Forecast of Mauritania LTE Base Station Market Revenues & Volume By Residential and Small Office or Home Office (SOHO) for the Period 2020- 2030

Get a quote

Top 10 Companies in Mauritania

Industry: Telecommunications Market Influence: Mauritel is the leading telecommunications provider in Mauritania, offering mobile, fixed-line, and internet services. Notable Achievements:

Get a quote

New WISP operator in West Africa

With no limit in number of users, the BS is capable of handling more than 200 subscribers with excellent performance. Unlike other technologies designed for short

Get a quote

What is a base station and how are 4G/5G base

A base station is referred to a stationary trans-receiver used in telecommunications that serves as the primary hub for connectivity of wireless

Get a quote

Telecommunications in Mauritania

Mauritania has three operators, the original monopoly, Mauritel (now owned by Vivendi''s Maroc Telecom), Mattel (owned by Tunisie Telecom) and Chinguitel, which started operating in December 2006. The country only has around 1000 DSL subscribers, and 300,0000 internet subscribers in total, out of a population of 4.5 million. Monthly DSL charges were high, around US$30 per month, bu

Get a quote

Mauritania Base Station Energy Project

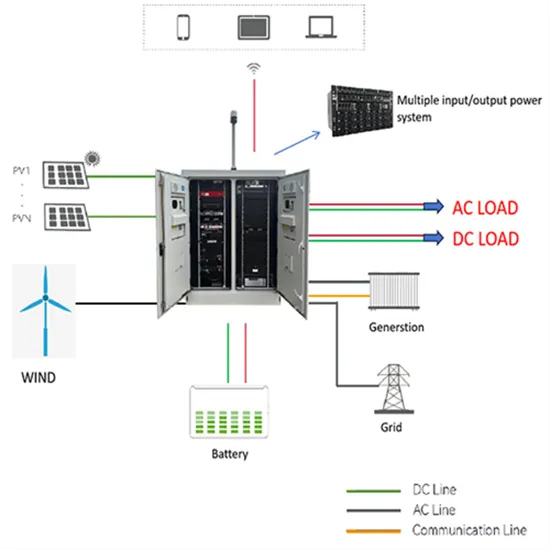

This project addresses power supply challenges for telecommunication base stations in Mauritania. It delivers a flexible, reliable energy solution in off-grid environments by integrating

Get a quote

Building 370 wireless base stations in Mauritania and providing

Building 370 wireless base stations in Mauritania and providing services to some 800,000 people, the Chinese telecom giant ZTE has made communications easier for

Get a quote

Telecommunications Companies in Mauritania

Find detailed information on Telecommunications companies in Mauritania, including financial statements, sales and marketing contacts, top competitors, and firmographic insights.

Get a quote

Top 5G Base Station gNodeB Manufacturers & Vendors

Explore the leading manufacturers of 5G gNodeB base stations, including Nokia, Ericsson, Huawei, Samsung, and ZTE, and their contributions to the telecom industry.

Get a quote

Guess what you want to know

-

Telecommunications company base station project

Telecommunications company base station project

-

Telecommunications company installation base station process

Telecommunications company installation base station process

-

Telecommunications company base station fees

Telecommunications company base station fees

-

Nicaragua Communications Company s base station inverter

Nicaragua Communications Company s base station inverter

-

Chinese telecommunications operators 5G base station brands

Chinese telecommunications operators 5G base station brands

-

Ugandan telecommunications operator 5g base station

Ugandan telecommunications operator 5g base station

-

Which Portuguese Telecommunications Company Has More Base Stations

Which Portuguese Telecommunications Company Has More Base Stations

-

EMS Building for Ireland Telecommunications Base Station

EMS Building for Ireland Telecommunications Base Station

-

Guinea-Bissau Telecommunications Photovoltaic Base Station Cabinet Installation

Guinea-Bissau Telecommunications Photovoltaic Base Station Cabinet Installation

-

North Korea s telecommunications photovoltaic base station hybrid power supply

North Korea s telecommunications photovoltaic base station hybrid power supply

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.