MTN leads telecom ESG reporting in Uganda

MTN Foundation allocated Shs 4.6 billion to education, digital literacy, and community outreach. Kampala, Uganda | JULIUS BUSINGE | MTN Uganda has become the

Get a quote

How many 5G Cell Towers & Base Stations Worldwide?

European 5G observatory reported that China intends to have 600,000 5G base stations by the end of 2020. According to RCR wireless, Chinese telcos have already

Get a quote

On-site Energy Utilization Evaluation of Telecommunication Base Station

Due to the widespread installation of Base Stations, the power consumption of cellular communication is increasing rapidly (BSs). Power consumption rises as traffic does, however

Get a quote

The Best Telecommunication Companies in Uganda (2025 Edition)

Uganda''s telecommunications industry has grown rapidly over the past two decades, offering mobile services, internet access, mobile money, and data solutions to

Get a quote

MTN Uganda, Airtel move on 5G rollout

Last month, Uganda Communications Commission awarded spectrum to two of the country''s mobile operators, MTN and Airtel, in the crucial 700 MHz, 800 MHz, 2.3 GHz, 2.6

Get a quote

MTN Uganda Becomes the First Telco to Launch 5G

MTN Uganda launches the first 5G Network in the country, bringing faster data speeds and unparalleled digital experiences to its massive

Get a quote

MTN Uganda Becomes the First Telco to Launch 5G in the Country

MTN Uganda launches the first 5G Network in the country, bringing faster data speeds and unparalleled digital experiences to its massive subscriber base.

Get a quote

MTN Uganda lays more fibre, widens 5G reach and eyes the last

MTN''s digital infrastructure arm, Bayobab Uganda, recently laid a 260km line from Kampala to Malaba, piggybacking on the Uganda Railway corridor. The $4m route connects

Get a quote

5G Network Transformation Adopted by MTN Uganda

MTN Uganda has announced a five-year strategic partnership with Huawei Technologies, a global ICT solutions provider, to transform and modernize its network into a

Get a quote

Indian operators expand 5G to 469k base stations,

The Indian government has reckons 5G coverage now extends to all states and 99.6 percent of districts nationwide. India had 469,000 5G base

Get a quote

High costs of Data, Devices and Services is holding

Airtel Uganda, owned by India-based Bharti Airtel, is the biggest rival of MTN with 38% of customers, since it acquired the no.3 network in

Get a quote

Overview of Uganda Telecom Market – Danmari Nexus

Average Revenue Per User (ARPU) Mobile: Total ARPU ARPU by: prepaid vs. contract ARPU segmentation by service: voice, data, messaging ARPU segmentation by technology: 2G, 3G,

Get a quote

How a 5G cell tower works | Deutschland spricht über 5G

Network operators are converting existing mobile communications sites – masts, for example – for 5G, as well as building new ones. Without this, citizens will

Get a quote

Uganda Telecom MNO Market Size, Share & 2030 Growth

Uganda Telecom MNO Market Analysis by Mordor Intelligence The Uganda Telecom MNO Market size is estimated at USD 1.52 billion in 2025, and is expected to reach

Get a quote

Kyocera Develops AI-powered 5G Virtualized Base

3. Base Station Sharing Functionality Kyocera''s innovation allows multiple telecommunications operators to share a single base station (CU/DU

Get a quote

Mobile base station

A mobile base station, also called a base transceiver station (BTS), is a fixed radio transceiver in any mobile communication network or wide area network (WAN). The base station connects

Get a quote

MTN Uganda launches commercial 5G network in Kampala,

The telecom giant aims to upgrade base stations in all major Ugandan cities to support 5G spectrum over the next two years. Rival operator Airtel Uganda is also set to begin

Get a quote

The 5G Revolution: MTN Uganda''s bold step towards connectivity

MTN Uganda, a leading player in the country''s telecommunications sector, made history by becoming the first telecom operator to launch 5G connectivity in July this year. In

Get a quote

MTN Uganda rolls out 5G Network

Telecom firm MTN Uganda, a unit of South Africa''s MTN Group, on Friday launched the first 5G network in the east African country. MTN has Uganda''s largest subscriber base at

Get a quote

Uganda Telcos'' 5G dilemma

To promote its 5G service, MTN partnered with Huawei to launch 5G experience centres in Lugogo Area and UCC headquarters in Bugolobi and surrounding areas in Kampala

Get a quote

A list of 35 areas where MTN Uganda has so far rolled out its 5G

MTN Uganda recently became the first telecom firm to launch 5G connectivity in July this year, since then they have rolled out over 35 sites starting in Kampala.

Get a quote

Uganda suddenly has two 5G networks

Airtel and MTN''s Ugandan subsidiaries secured 5G spectrum in a government auction earlier this month and the frequencies have now been released by the regulator, the

Get a quote

5G Network Transformation Adopted by MTN Uganda

MTN Uganda has announced a five-year strategic partnership with Huawei Technologies, a global ICT solutions provider, to transform and

Get a quote

Long Term Evolution Base Station Market

1 day ago· Telecom operators are deploying additional LTE base stations to strengthen network coverage, improve speed, and reduce congestion. Investment in rural and semi-urban network

Get a quote

Guess what you want to know

-

Chinese telecommunications operators 5G base station brands

Chinese telecommunications operators 5G base station brands

-

Rwanda Telecom Operator 5G Base Station

Rwanda Telecom Operator 5G Base Station

-

ASEAN Huijue Communication 5G Base Station

ASEAN Huijue Communication 5G Base Station

-

5g base station installation contact

5g base station installation contact

-

Tanzania Communications 5G Base Station Efficiency

Tanzania Communications 5G Base Station Efficiency

-

Malawi Communications 5G Base Station Upgrade

Malawi Communications 5G Base Station Upgrade

-

Mexico 5G base station photovoltaic power generation system energy storage

Mexico 5G base station photovoltaic power generation system energy storage

-

Does 5G communication base station wind and solar complementarity have advantages

Does 5G communication base station wind and solar complementarity have advantages

-

5g network circuit base station photovoltaic power generation system

5g network circuit base station photovoltaic power generation system

-

The integrated 5G base station is not powered on

The integrated 5G base station is not powered on

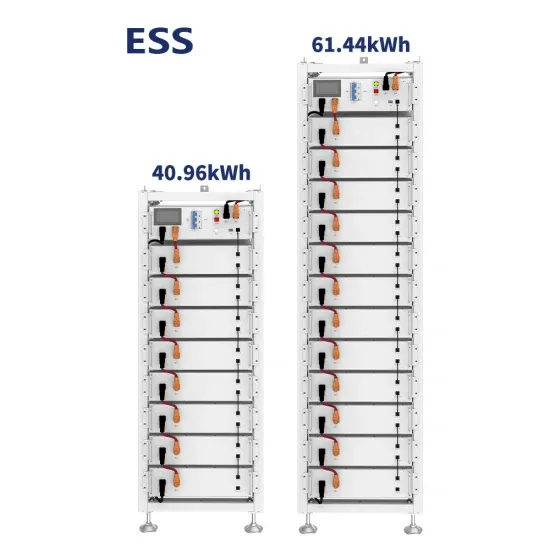

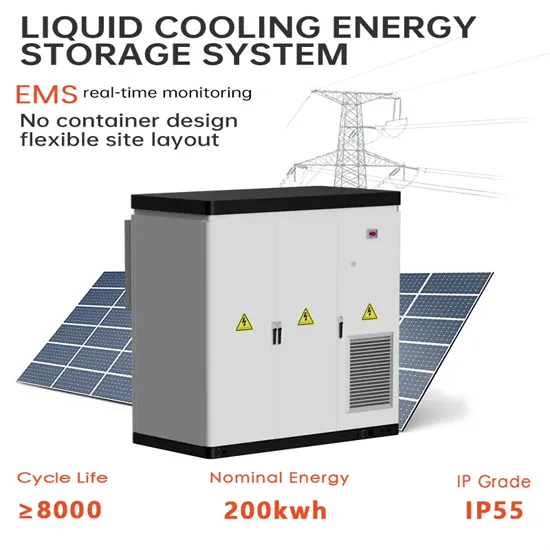

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

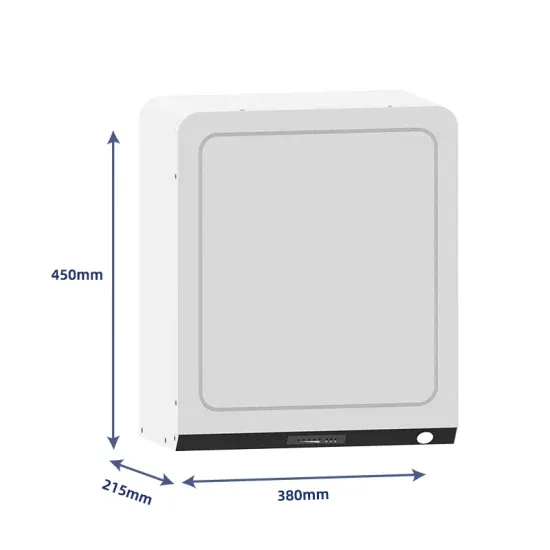

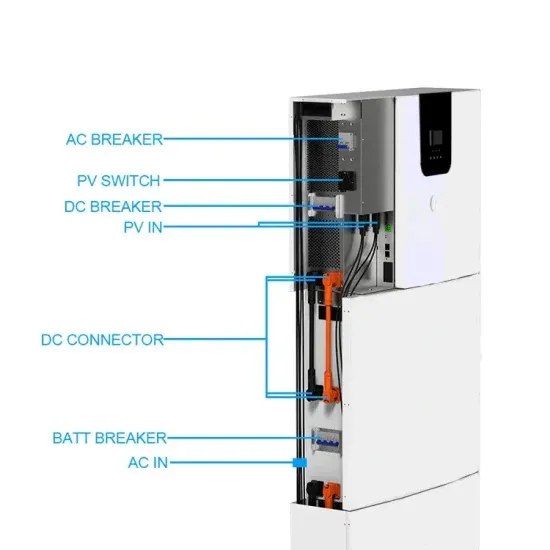

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.