China home to 3.92 million 5G base stations

The aforementioned three telecommunication operators are China Telecom, China Mobile and China Unicom. China has seen its 5G network and commercialization develop

Get a quote

China: market share of 5G base stations by company

Foreign tech in the Chinese telecom market? The 5G equipment market was dominated by domestic manufacturers, but foreign brands also get

Get a quote

5G Base Station Growth: How Many Are Active? | PatentPC

5G technology is expanding faster than anyone could have predicted. More countries, companies, and telecom providers are racing to build 5G base stations, ensuring faster speeds, lower

Get a quote

Chinese telcos operate 4.25 million 5G base stations

Chinese telecom operators have deployed a total of 4.25 million 5G base stations across the country, according to local press reports citing official data. More than 4,000 5G

Get a quote

China 5G base station count approache...

Data from China''s Ministry of Industry and Information Technology (MIIT) showed the country''s operators deployed 3.37 million 5G base stations at end-2023, with the three

Get a quote

China Unicom, Huawei to build Beijing into 5G benchmark

China Unicom, a major Chinese telecom operator, and Huawei Technologies Co jointly announced the achievements of the 5G Capital innovation project with the theme of

Get a quote

Chapter 1 Challenger multinationals in telecommunications

Huawei and ZTE, the leading telecommunications equipment providers from China, are the main focus of this chapter. Both are among the few Chinese companies that have been able to

Get a quote

China''s Ambitious 5G Base Station Plan for 2025: A Leap

China is set to establish over 4.5 million new 5G base stations by 2025, enhancing connectivity and transforming various industries. This ambitious expansion aims to bridge the

Get a quote

China 5G base station count continues...

China Mobile, the world''s largest mobile operator by subscribers, shares its 2.6GHz spectrum with China Broadnet, which launched service in 2022 and closed June with

Get a quote

Chinese operators to build over 1 million 5G base stations in 2021

Chinese operators to build over 1 million 5G base stations in 2021: Report Chinese telecom carriers are likely to build over 1 million new 5G base stations in 2021, as the cost of

Get a quote

How Many 5G and LTE Base Stations are there in China

More than 718,000 5G base stations have been put into operation, including more than 330,000 5G base stations jointly built and shared by China Telecom and China Unicom.

Get a quote

Taiwanese IC distributors target high-end market as

Chinese telecom operators have opened bids for 5G base stations. To avoid competition with China''s supply chain, Taiwanese manufacturers

Get a quote

China home to 3.92 million 5G base stations

The figure accounted for 52.4 percent of the total mobile subscribers in China''s three major telecommunication enterprises and China Broadnet, which stood at nearly 1.78

Get a quote

China 5G rush – 4.5m 5G base stations, 300 5G-A cities, 75% 5G

Mobile operators in China are ramping up 5G and 5G-A rollouts, with the former now at 4.5 million cell sites and the latter in 300 cities; a new 2027 roadmap will see 75% of

Get a quote

China: market share of 5G base stations by company 2024| Statista

Foreign tech in the Chinese telecom market? The 5G equipment market was dominated by domestic manufacturers, but foreign brands also get a piece of the pie.

Get a quote

Huawei is the world largest 5G base station equipment vendor

As of July 2021, China''s three major operators, China Mobile, China Unicom, and China Telecom, have built 916,000 5G base stations in China, accounting for 70% of the world''s total.

Get a quote

More than 70% of world''s 5G base stations built by China

More than 70 percent of the world''s 5G base stations were set up by Chinese companies, of which 36 percent were built by China Mobile, China''s largest telecoms operator,

Get a quote

China 5G rush – 4.5m 5G base stations, 300 5G-A

Mobile operators in China are ramping up 5G and 5G-A rollouts, with the former now at 4.5 million cell sites and the latter in 300 cities; a new

Get a quote

China home to 4.25m 5G base stations

BEIJING -- The number of 5G base stations in China has hit 4.25 million, with the number of gigabit broadband users surpassing 200 million, official data showed Tuesday.

Get a quote

A multi-level perspective on 5G transition: The China case

We choose China as an influential case and deploy mixed methods to analyze a variety of data sources. The results show a rich picture of technological transition, including: 1)

Get a quote

No 4 telecom operator unveils 5G brands

China Broadcasting Network Co Ltd, the country''s fourth-largest telecom operator, unveiled three 5G brands on Monday, which coincided with the third-year anniversary of the

Get a quote

Ambitious 5G base station plan for 2025

China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can

Get a quote

China: number of newly constructed 5G base stations, by type

In 2021, Chinese telecommunications companies built *** thousand macro base stations and 100 thousand micro base stations.

Get a quote

6 FAQs about [Chinese telecommunications operators 5G base station brands]

Who makes 5G in China?

A paid subscription is required for full access. As of 2023, 58 percent of all 5G base stations in China had been manufactured by Huawei. Its closest competitor was ZTE with a market share of 31 percent. Both telecom manufacturers have maintained a similar market share throughout all bidding rounds since 2020.

How many 5G base stations are there in the world?

In addition, a total of 819,000 5G base stations have been built by these three telecom giants, accounting for 70% of the world's total. As China has played a leading role in 5G technology, its 5G development has extraordinary significance for other countries.

Which mobile network operators are providing 5G mobile services in Hong Kong?

To date, four mobile network operators, including CSL, China Mobile Hong Kong (CMHK), SmarTone and 3HK, are providing 5G mobile services in the market. Consumer Search Group (CSG), a leading market research firm in Asia, recently collaborated with Toluna, a consumer panel company, on the public perception towards 5G mobile network in Hong Kong.

How many people use 5G in China?

With strong government support, the three big companies invested heavily in the construction of the country's 5G network. As a result, China had comprehensive 5G coverage that provided high-speed mobile internet to almost 600 million 5G users . Foreign tech in the Chinese telecom market?

How many 5G base stations are there in Hong Kong?

Built over 1,200 5G "golden spectrum" band base stations, covering Hong Kong Island, Kowloon, the New Territories and outlying islands. To date, 3 Hong Kong boasts the highest number of 5G golden spectrum band base stations in Hong Kong.

Why is China bringing 5G mobile internet to its customers?

The Chinese telecommunication industry was at the global forefront when it came to bringing 5G mobile internet to its customers. With strong government support, the three big companies invested heavily in the construction of the country's 5G network.

Guess what you want to know

-

Ugandan telecommunications operator 5g base station

Ugandan telecommunications operator 5g base station

-

Mexico 5G base station photovoltaic power generation system energy storage

Mexico 5G base station photovoltaic power generation system energy storage

-

The integrated 5G base station is not powered on

The integrated 5G base station is not powered on

-

ASEAN Huijue Communication 5G Base Station

ASEAN Huijue Communication 5G Base Station

-

5g base station installation contact

5g base station installation contact

-

Tanzania Communications 5G Base Station Efficiency

Tanzania Communications 5G Base Station Efficiency

-

5g small base station photovoltaic power generation system circuit

5g small base station photovoltaic power generation system circuit

-

Does 5G communication base station wind and solar complementarity have advantages

Does 5G communication base station wind and solar complementarity have advantages

-

Panama 5G base station distribution box supplier

Panama 5G base station distribution box supplier

-

Honduras 5G Communication Tower Base Station Project

Honduras 5G Communication Tower Base Station Project

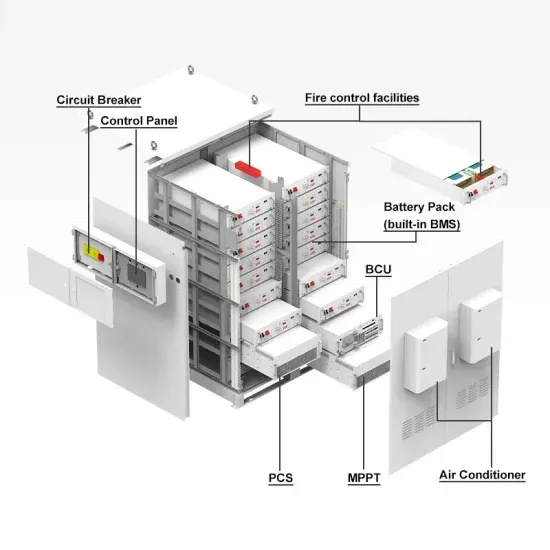

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.