How power storage affects the return on energy

Authors present a theoretical framework to calculate how storage affects the energy return on energy investment (EROI) ratios of wind and solar

Get a quote

Current and Future Costs of Renewable Energy Project

We collect data from a variety of sources that have exposure to different renewable and conventional energy technology financings, both in the United States and abroad.

Get a quote

Mind the gap: Comparing the net value of geothermal, wind,

We begin with a comparison of historical price data (in $/MWh) from power purchase agreements (PPAs) for geothermal, wind, solar, and solar + storage plants in the

Get a quote

Capacity planning for wind, solar, thermal and energy storage in

This article proposes a coupled electricity-carbon market and wind-solar-storage complementary hybrid power generation system model, aiming to maximize energy

Get a quote

Grid-Scale Battery Storage: Frequently Asked Questions

What is grid-scale battery storage? Battery storage is a technology that enables power system operators and utilities to store energy for later use. A battery energy storage system (BESS) is

Get a quote

2024 Year in Review: Clean Energy Progress

Overall, solar was one of the top targets for investment in 2024 in clean technology manufacturing and deployment. Manufacturing capacity for

Get a quote

Hybrid Distributed Wind and Battery Energy Storage

Many of these technical barriers can be overcome by the hybridization of distributed wind assets, particularly with storage technologies. Electricity storage can shift wind energy from periods of

Get a quote

Comparing the net value of geothermal, wind, solar, and solar+storage

We are pleased to announce the recent publication of a new Berkeley Lab analysis— "Mind the Gap: Comparing the Net Value of Geothermal, Wind, Solar, and

Get a quote

Optimal allocation of energy storage capacity for hydro-wind-solar

Multi-energy supplemental renewable energy system with high proportion of wind-solar power generation is an effective way of "carbon neutral", but the randomness and

Get a quote

Strong US Clean Energy Growth to Continue Despite

The US is on track to see over 25% growth in annual clean energy installations this year, according to BloombergNEF''s 2H 2024 US Clean

Get a quote

Energy storage capacity optimization strategy for combined wind storage

In order to deal with the power fluctuation of the large-scale wind power grid connection, we propose an allocation strategy of energy storage capacity for combined wind

Get a quote

How much proportion should be allocated for energy storage

Thus, a substantial investment in storage technology is justified. Integrating storage solutions with these renewable energy sources not only stabilizes supply but also enhances

Get a quote

World Energy Investment 2024 – Analysis

Investment in clean energy has accelerated since 2020, and spending on renewable power, grids and storage is now higher than total spending on oil, gas, and coal.

Get a quote

Electricity Storage and Renewables: How Investments Change as

To successfully transition to more sustainable electricity grids, we need to understand how multi-hour storage and renewables interact, when and how much to invest in

Get a quote

What is the ratio of new energy to energy storage?

The ratio of new energy to energy storage highlights the intricate relationship between energy production methods and their storage

Get a quote

The Impact of Wind and Solar on the Value of Energy Storage

The purpose of this analysis is to examine how the value proposition for energy storage changes as a function of wind and solar power penetration. It uses a grid modeling

Get a quote

Assessing the value of battery energy storage in future power grids

MIT and Princeton University researchers find that the economic value of storage increases as variable renewable energy generation (from sources such as wind and solar)

Get a quote

Mind the gap: Comparing the net value of geothermal, wind, solar

We begin with a comparison of historical price data (in $/MWh) from power purchase agreements (PPAs) for geothermal, wind, solar, and solar + storage plants in the

Get a quote

Third Annual Energy Supply Investment and Banking Ratios

Executive summary The energy industry is shifting more of its investment into cleaner sources of supply. Bank financing for low-carbon energy supply technologies reached 89% of that for

Get a quote

How power storage affects the return on energy investment ratios

Authors present a theoretical framework to calculate how storage affects the energy return on energy investment (EROI) ratios of wind and solar resources.

Get a quote

Assessing the value of battery energy storage in

MIT and Princeton University researchers find that the economic value of storage increases as variable renewable energy generation (from

Get a quote

China''s role in scaling up energy storage investments

Through qualitative analysis, this opinion article presents an overview of China''s domestic and overseas energy storage policies and investment flows, followed by policy

Get a quote

The Use of Solar and Wind as a Physical Hedge against

The high solar case (High Solar) corresponds to 75% solar and 25% wind (or 3:1 ratio) generation on an annualized energy basis while the high wind case (Low Solar) corresponds to a 25%

Get a quote

Here comes the boom: Wood Mackenzie forecasts

Annual capacity will increase from approximately 500 GW of new solar and wind capacity installed in 2023, and average 560 GW annually over

Get a quote

Third Annual Energy Supply Investment and Banking Ratios

Bank financing for low-carbon energy supply technologies reached 89% of that for fossil fuels in 2023 – meaning that for every dollar that went to oil, natural gas and coal, 89

Get a quote

Capacity planning for wind, solar, thermal and energy

This article proposes a coupled electricity-carbon market and wind-solar-storage complementary hybrid power generation system model,

Get a quote

Just right: how to size solar + energy storage projects

The first question to ask yourself when sizing energy storage for a solar project is "What is the problem I am trying to solve with storage?" If you cannot answer that question, it''s

Get a quote

6 FAQs about [Investment ratio of wind solar and storage]

Does more solar and wind mean more storage value?

“Our results show that is true, and that all else equal, more solar and wind means greater storage value. That said, as wind and solar get cheaper over time, that can reduce the value storage derives from lowering renewable energy curtailment and avoiding wind and solar capacity investments.

How much energy is invested in wind & solar PV in 2023?

In 2023, each dollar invested in wind and solar PV yielded 2.5 times more energy output than a dollar spent on the same technologies a decade prior. In 2015, the ratio of clean power to unabated fossil fuel power investments was roughly 2:1. In 2024, this ratio is set to reach 10:1.

How much tax equity has been raised for solar and wind projects?

Norton Rose Fulbright (2020a) reported that approximately $12 billion in tax equity was raised in both 2018 and 2019 for solar and wind projects, representing approximately 40% and 55% of total project costs, respectively.

How much will the power sector invest in solar in 2024?

Power sector investment in solar photovoltaic (PV) technology is projected to exceed USD 500 billion in 2024, surpassing all other generation sources combined. Though growth may moderate slightly in 2024 due to falling PV module prices, solar remains central to the power sector’s transformation.

Why did the energy supply banking ratio rise in 2023?

Bank facilitated financing for fossil fuels declined. This led to a rise in 2023 for the Energy Supply Banking Ratio, or ESBR, which grew from 0.74:1 in 2022 to 0.89:1 in 2023. Changes in the way we measure finance and data gaps in China explain some of the increase in the ratio. But it also reflects an active transition in the energy system.

Is the energy industry shifting its investment into cleaner sources of supply?

By Katrina White, Senior Associate, Sustainable Finance; Ryan Loughead, Associate, Sustainable Finance; Jonas Rooze, Head of Sustainability & Climate Research, and William Young, Director of Strategic Partnerships, BloombergNEF The energy industry is shifting more of its investment into cleaner sources of supply.

Guess what you want to know

-

Investment development and operation of wind solar and energy storage

Investment development and operation of wind solar and energy storage

-

Syria s wind solar and storage ratio

Syria s wind solar and storage ratio

-

Open up investment in wind solar and energy storage power stations

Open up investment in wind solar and energy storage power stations

-

Jordan Wind Solar and Energy Storage Project

Jordan Wind Solar and Energy Storage Project

-

Bulgaria wind solar and energy storage project

Bulgaria wind solar and energy storage project

-

Wind Solar and Storage Technology

Wind Solar and Storage Technology

-

New planning for wind solar and energy storage

New planning for wind solar and energy storage

-

Is wind solar and energy storage the direction of new energy

Is wind solar and energy storage the direction of new energy

-

Wind solar and energy storage power station revenue

Wind solar and energy storage power station revenue

-

Integrated wind solar and storage improvements

Integrated wind solar and storage improvements

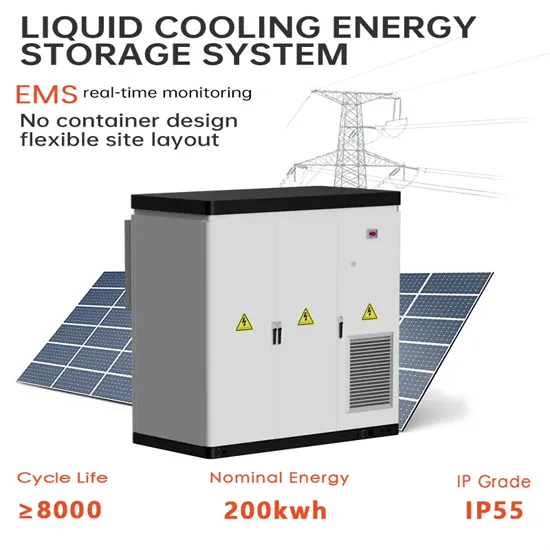

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

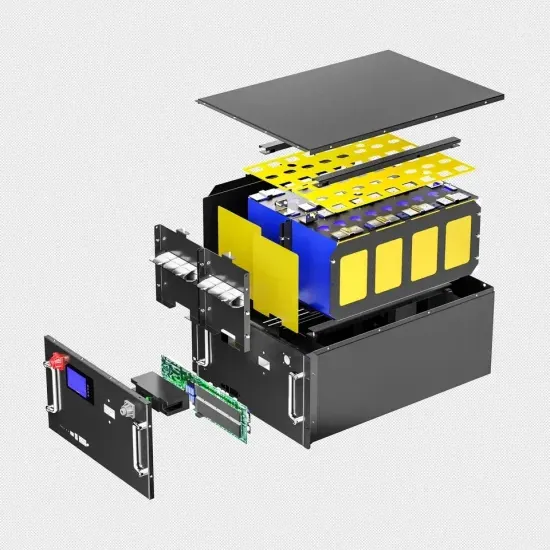

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.