Evaluating the Technical and Economic Performance of PV

Calculating Energy Revenue: Dispatch – DC-Coupled Storage (constraints due to shared inverter) In other periods (July 1 shown here), storage plant cannot be fully utilized because of the

Get a quote

In-depth explainer on energy storage revenue and

The following article provides a high-level overview of the revenue models for non-residential energy storage projects and how financing parties

Get a quote

In-depth explainer on energy storage revenue and

The following article provides a high-level overview of the revenue models for non-residential energy storage projects and how financing parties evaluate the various sources of

Get a quote

Optimal revenue sharing model of a wind–solar-storage hybrid energy

Therefore, it is necessary to study a scheduling strategy coordinated by an energy storage power station for participating in multiple power markets at the same time and

Get a quote

Integrated Wind, Solar, and Energy Storage: Designing Plants with

An integrated wind, solar, and energy storage (IWSES) plant has a far better generation profile than standalone wind or solar plants. It results in better use of the

Get a quote

Energy storage power station revenue is more than several billion

Energy storage power stations are becoming pivotal in our quest for sustainable energy solutions, with revenue surpassing several billion dollars. 1. These facilities enable the

Get a quote

New Report: Clean Energy Industry is Generating Billions for

AUSTIN, TX — Existing and expected utility-scale solar, wind, and battery storage projects will contribute over $20 billion in total tax revenue — and pay Texas landowners $29.5

Get a quote

In-depth explainer on energy storage revenue and

In many locations, owners of batteries, including storage facilities that are co-located with solar or wind projects, derive revenue under multiple

Get a quote

Wind-driven storage to see solid revenues in MISO thanks to tight

In the Midcontinent ISO, supportive capacity revenue and, to a lesser extent, arbitrage revenue will make battery energy storage systems financially viable for contracted resources, but they

Get a quote

Business Models and Profitability of Energy Storage

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream

Get a quote

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get a quote

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get a quote

U.S. developers report half of new electric generating capacity will

If those plans are realized, solar would account for more than half of the 64 GW that developers plan to bring online this year. Battery storage, wind, and natural gas power

Get a quote

New Energy Storage Technologies Empower Energy

Independent energy storage stations can meet the needs for energy storage by generators and for peak shaving and frequency regulation by power grids, expanding their channels for

Get a quote

Solar Market Insight Report Q3 2025

4 days ago· 1. Key Figures The US solar industry installed 7.5 gigawatts direct current (GW dc) of capacity in Q2 2025, a 24% decline from Q2 2024 and a 28% decrease since Q1 2025. Solar

Get a quote

The Energy Storage Market in Germany

Renewable energy sources currently produce around 36 per-cent of all electricity consumed in the country. In line with the goals of the German government, this share is to be increased to at

Get a quote

DOE Announces $289.7 Million Loan Guarantee to

DOE Announces $289.7 Million Loan Guarantee to Sunwealth to Deploy Solar PV and Battery Energy Storage, Creating Wide-Scale Virtual Power Plant Project Polo will deploy

Get a quote

Risk assessment of offshore wave-wind-solar-compressed air energy

As a promising offshore multi-energy complementary system, wave-wind-solar-compressed air energy storage (WW-S-CAES) can not only solve the shortcomings of

Get a quote

Energy Storage Market Is Expected To Reach Revenue Of USD

Energy storage systems are critical in more supply and demand operations, contributing to enhanced distribution grid stability and the connection of renewable energy.

Get a quote

Capacity planning for wind, solar, thermal and energy storage in power

This article proposes a coupled electricity-carbon market and wind-solar-storage complementary hybrid power generation system model, aiming to maximize energy

Get a quote

Modelling and capacity allocation optimization of a combined

Subsequently, the wind turbine model and the PV model are simulated to derive the wind-PV complementary characteristic curves, and it is found that the load demand cannot

Get a quote

Solar power in Germany – output, business & perspectives

Solar power accounted for around 43 percent of the 23.6 TWh of electricity generated from renewables in that month, according to data from the economy ministry (BMWK).

Get a quote

Optimal revenue sharing model of a wind–solar

Therefore, it is necessary to study a scheduling strategy coordinated by an energy storage power station for participating in multiple

Get a quote

A comprehensive review of wind power integration and energy storage

Integrating wind power with energy storage technologies is crucial for frequency regulation in modern power systems, ensuring the reliable and cost-effective operation of

Get a quote

Solar power in Germany – output, business

Solar power accounted for around 43 percent of the 23.6 TWh of electricity generated from renewables in that month, according to data from

Get a quote

Capital Cost and Performance Characteristics for Utility

Findings Table 1 summarizes updated cost estimates for reference case utility–scale generating technologies specifically two powered by coal, five by natural gas, three by solar energy and

Get a quote

6 FAQs about [Wind solar and energy storage power station revenue]

How do solar and wind projects generate revenue?

In many locations, owners of batteries co-located with solar or wind projects derive revenue under multiple contracts and generate multiple layers of revenue or “value stack.” Developers then seek financing based on anticipated cash flows from all or a portion of the components of this value stack.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Why is energy storage important?

The global energy storage market is fostered by the growing interest in renewable power technologies like solar and wind, as well as efforts to upgrade power infrastructure. Energy storage systems are critical in more supply and demand operations, contributing to enhanced distribution grid stability and the connection of renewable energy.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Guess what you want to know

-

Cyprus Wind Solar Energy Storage Power Station

Cyprus Wind Solar Energy Storage Power Station

-

Build a wind and solar energy storage power station

Build a wind and solar energy storage power station

-

Somalia has approved a wind solar and energy storage power station

Somalia has approved a wind solar and energy storage power station

-

Albania Wind Solar Energy Storage Power Station Project

Albania Wind Solar Energy Storage Power Station Project

-

Polish wind and solar energy storage power station project

Polish wind and solar energy storage power station project

-

Papua New Guinea s largest wind solar and energy storage power station

Papua New Guinea s largest wind solar and energy storage power station

-

Solomon Islands Wind and Solar Energy Storage Power Station

Solomon Islands Wind and Solar Energy Storage Power Station

-

New Zealand Wind and Solar Energy Storage Power Station

New Zealand Wind and Solar Energy Storage Power Station

-

Technical Principle of Wind Power Energy Storage Cabinet in Communication Base Station

Technical Principle of Wind Power Energy Storage Cabinet in Communication Base Station

-

Revenue model of Côte d Ivoire energy storage power station

Revenue model of Côte d Ivoire energy storage power station

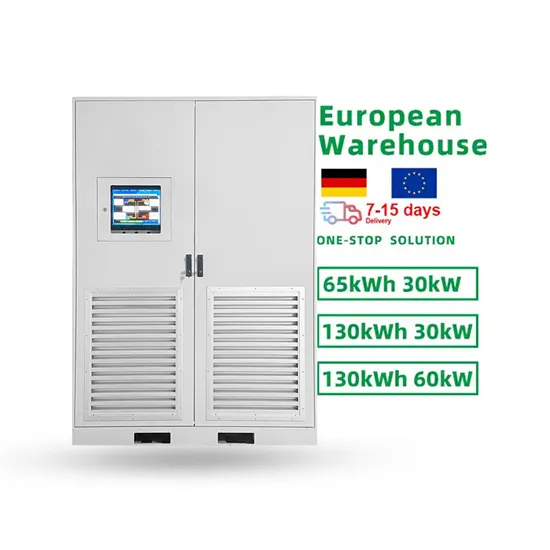

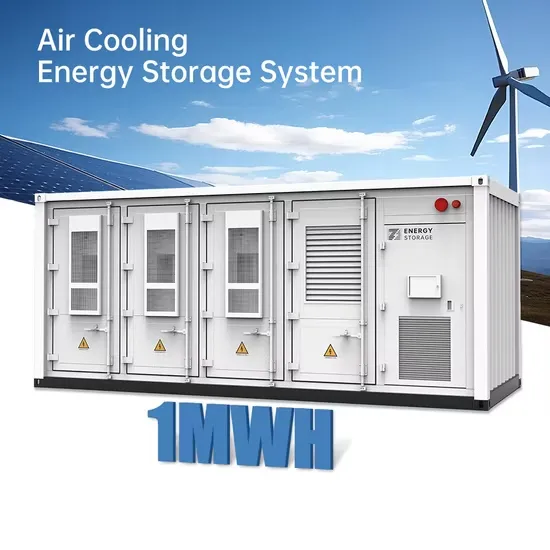

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.