How America Can Leverage Its Battery Oversupply for Global Gains

1 day ago· US battery oversupply offers an opportunity to expand into new markets, counter Chinese dominance, and secure long-term energy competitiveness.

Get a quote

Africa: The role China is playing in continent''s energy transition

Through three detailed case studies on Kenya, Mozambique and South Africa, the report examines how China''s investments and exports align with each country''s energy

Get a quote

China Dominates Battery Supply Chain: From Mine to

In 2023, China imported 44% and exported 58% of all battery-related interregional trade. It leads in processing over 90% of graphite and

Get a quote

China Dominates Battery Supply Chain: From Mine to Market

In 2023, China imported 44% and exported 58% of all battery-related interregional trade. It leads in processing over 90% of graphite and controls major stakes in cobalt mining in

Get a quote

1Q24 Energy-storage cell shipment ranking: CATL

The world shipped 38.82 GWh of energy-storage cells in the first quarter this year, with utility-scale and C&I projects accounting for 34.75 GWh

Get a quote

Chinese shipments of energy storage batteries

Emerging markets "In addition to major regions such as China, Europe and North America, the energy storage market in emerging [markets],

Get a quote

Africa''s Competitiveness in Global Battery Supply Chains

As the US and the European Union (EU) seek to decrease reliance on China, this creates opportunities in Africa around battery material refining, components and cell production

Get a quote

China-Africa Lithium-Ion Energy Storage Battery Collaboration

This article explores how China-Africa partnerships in lithium-ion battery enterprises are reshaping energy access, industrial growth, and sustainable development across Africa.

Get a quote

Key trends in battery energy storage in China

China has been an undisputed leader in the battery energy storage system deployment by a far margin. The nation more than quadrupled its

Get a quote

Eritrea''s Energy Storage Exports: Opportunities, Trends, and Key

African Energy Storage Boom: China''s Export Playground While Eritrea''s making waves, the whole continent''s battery storage market is growing faster than baobab trees.

Get a quote

South Africa Has the Critical Minerals, But Is That

South Africa exports its battery minerals mostly to China which has well-established battery production facilities. To balance exports and domestic

Get a quote

China dominates global trade of battery minerals

China imported 20% of the world''s processed battery minerals in 2023, made up of mainly cobalt from Africa. That same year, China exported 58% of the world''s processed

Get a quote

THE CHINA BATTERY ENERGY STORAGE SYSTEM

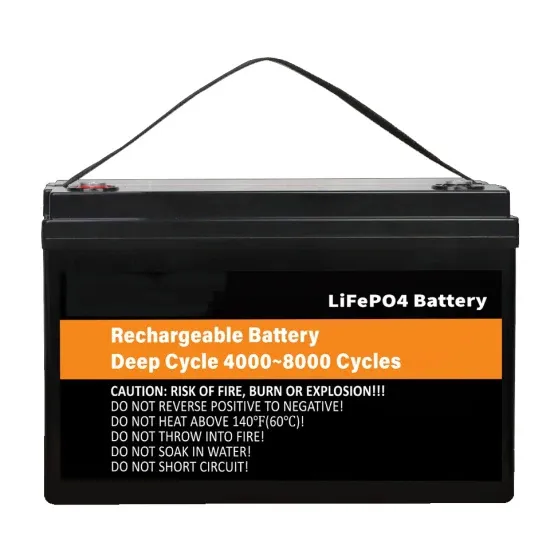

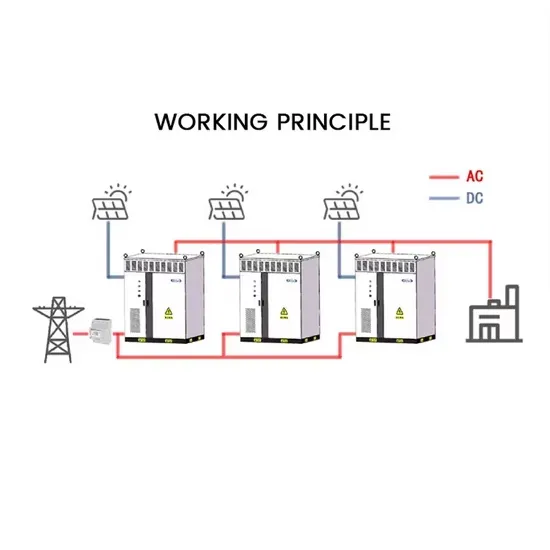

EXECUTIVE SUMMARY A Battery Energy Storage System (BESS) secures electrical energy from renewable and non-renewable sources and collects and saves it in rechargeable

Get a quote

Africa: The role China is playing in continent''s energy

Through three detailed case studies on Kenya, Mozambique and South Africa, the report examines how China''s investments and exports align

Get a quote

Overview of Lithium Ion Battery Exports by Country

The following countries achieved the highest net exports of lithium ion batteries in 2022. Net exports, as defined by Investopedia, is the value of a

Get a quote

Power Move: China Seeking Dominance over African Lithium and

China has unveiled plans to impose stricter export controls on advanced technologies related to lithium refining and battery material production, aiming to safeguard its

Get a quote

Analysis of lithium battery export data in overseas markets in 2024

In addition to the United States, China also exports lithium-ion batteries to emerging markets such as Europe, the Middle East, Japan, South Korea and Africa, which have huge consumption

Get a quote

What US tariffs on Chinese batteries mean for

Chinese li-ion battery exports are largely bound for the European Union and North America. Source: PRC General Administration of Customs,

Get a quote

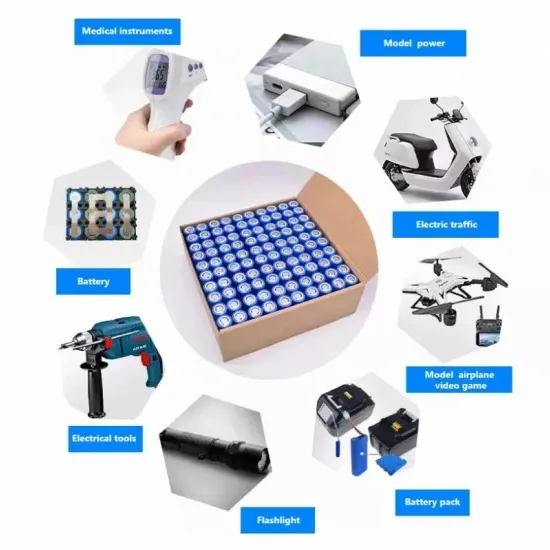

China-Africa Energy Storage Battery Production Line

In Africa, majority of demand will come from electric two/three-wheelers and stationary battery energy storage systems (BESS) with ~3 GWh and ~4GWh of additional annual demand

Get a quote

Energy storage exports to africa

Battery storage systems offer a solution by storing surplus energy generated during peak production periods and releasing it when demand is high, ensuring a consistent and reliable

Get a quote

Analysis of China-Africa energy storage market in 2024

global battery energy storage market size was valued at USD 18.20 billion in 2023 and is projected to grow from USD 25.02 billion in 2024 to USD 114.05 billion by 2032, exhibiting a

Get a quote

How to Import and Ship Lithium Batteries from China

Learn how to import and ship lithium batteries from China with this complete guide. Understand customs regulations, shipping methods, costs,

Get a quote

6 FAQs about [China-Africa energy storage battery exports]

How much battery material does China Import & Export?

China imported almost 12 million short tons of raw and processed battery minerals, accounting for 44% of interregional trade, and exported almost 11 million short tons of battery materials, packs, and components, or 58% of interregional trade in 2023, according to regional UN Comtrade data.

How can Africa support the battery value chain?

Regionalizing the value chain: The 2021 Africa Continental Free Trade Agreement (AfCFTA) offers a unique opportunity for African countries to collaborate across the value chain, localizing production and enhancing cost competitiveness. Government Support: African governments are implementing policies to support the battery value chain.

Can Africa export LFP batteries to Europe?

African countries, particularly Tanzania and Morocco, could competitively produce and export LFP batteries to Europe by 2030 at USD 68-72/kWh. This could generate USD 10-15 billion annually and create 22,000-25,000 jobs, rivaling global manufacturers like China, Indonesia, Europe, and the US.

Could African countries refine materials for lithium battery production & export?

African countries could refine materials for lithium battery production and export to the US and EU. Refining could be in countries that are currently mining raw materials required for battery cell production or have a plan to start by 2030. These include: 4. Presence of local battery demand or assembly 5. Presence of required talent 6.

Why is China a major producer of Li-ion batteries?

China is a major producer of Li-ion batteries and has streamlined supply chains, enabling efficient component procurement. Companies like CATL and BYD are prominent players in the Chinese battery market The US has seen significant growth in energy storage demand.

Can Africa produce a Gigafactory battery?

A gigafactory requires a capex of ~USD 1 bn to produce 10-15 GWh batteries per year; African countries could produce LFP battery cells and export to the EU market. Countries that could produce battery cells cost competitively (e.g., Morocco, Tanzania).

Guess what you want to know

-

China-Africa stacked energy storage battery

China-Africa stacked energy storage battery

-

Home energy storage battery exports

Home energy storage battery exports

-

Netherlands energy storage battery exports

Netherlands energy storage battery exports

-

China-Africa lithium-ion energy storage battery company

China-Africa lithium-ion energy storage battery company

-

Taipei base station lithium battery energy storage 80kw inverter

Taipei base station lithium battery energy storage 80kw inverter

-

Sodium-sulfur battery energy storage application

Sodium-sulfur battery energy storage application

-

Nauru lithium titanate battery energy storage container installation

Nauru lithium titanate battery energy storage container installation

-

Base station lithium battery energy storage 30kw inverter merchant

Base station lithium battery energy storage 30kw inverter merchant

-

China Battery Energy Storage Fire Protection System

China Battery Energy Storage Fire Protection System

-

Is phase change energy storage medium a battery

Is phase change energy storage medium a battery

Industrial & Commercial Energy Storage Market Growth

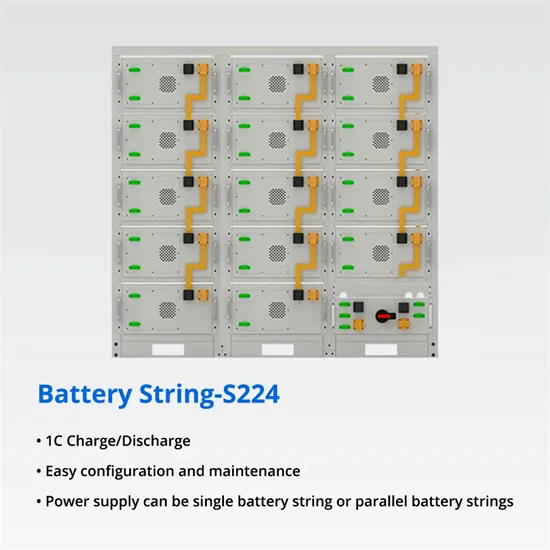

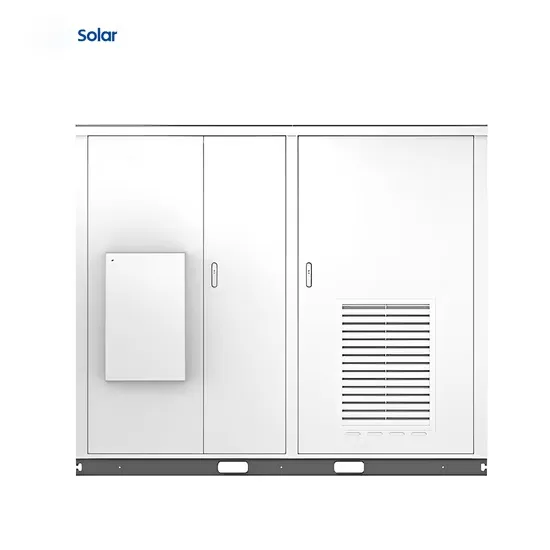

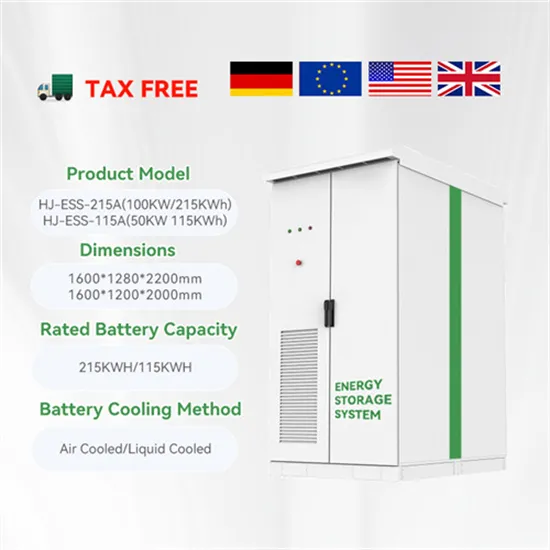

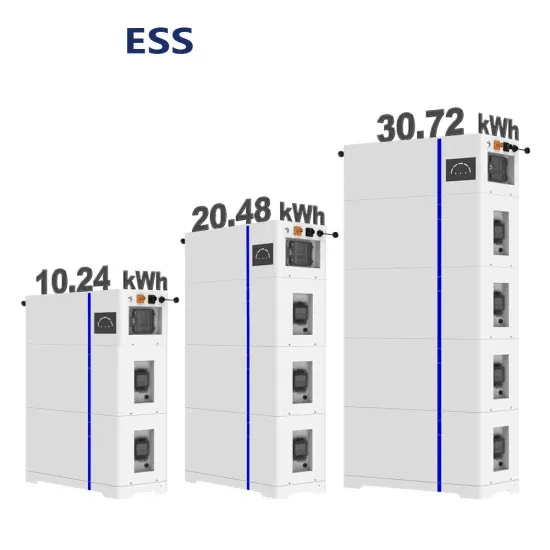

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

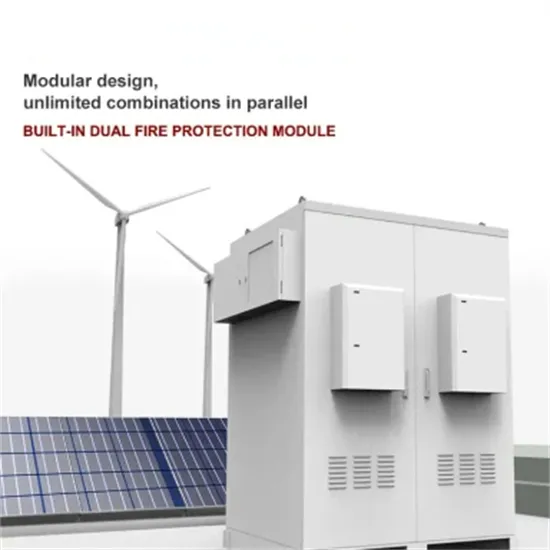

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.