Here''s the Top 10 List of Flow Battery Companies

What is a flow battery made of? Who makes flow batteries? Check out our blog to learn more about our top 10 picks for flow battery companies.

Get a quote

Batteries and ev charging stations manufacturers in Benin

With over 150 years of history, the company is the oldest metal packaging company in the world. In addition to Germany, production takes place in Denmark, Poland and Russia.

Get a quote

LIST OF COMPANIES OF BENIN

Next generation battery technology companies are at the forefront of developing advanced batteries that are more efficient, cost-effective, and environmentally friendly.

Get a quote

Afrikta Benin Business Directory: A Comprehensive Listing of Companies

Afrikta Benin business directory is the ideal platform for companies based Benin looking for growth. Either locally or in other African countries. Through Afrikta, the leading business listing

Get a quote

Powering the Future: Benin''s Energy Storage Project Lights the

The Benin energy storage project, launched in 2023, isn''t just about keeping the lights on. It''s a masterclass in how developing economies can leapfrog traditional power

Get a quote

ENGIE Energy Access'' First Mini-Grid in Benin

Our heartfelt thanks to the ENGIE Energy Access team for selecting SustainSolar''s turnkey power system to help electrify Dohoue community in the Zogbodomey (Benin).

Get a quote

Benin ess salt battery

The Iron Redox Flow Battery (IRFB), also known as Iron Salt Battery (ISB), stores and releases energy through the electrochemical reaction of iron salt. ESS Inc. is an American company

Get a quote

Benin ess salt battery

The Iron Redox Flow Battery (IRFB), also known as Iron Salt Battery (ISB), stores and releases energy through the electrochemical reaction of iron salt. This type of battery belongs to the

Get a quote

Benin ess salt battery

ESS Inc gets 1MW/8MWh iron flow battery order from ESS Inc manufactures commercial and grid-scale BESS using its proprietary iron and salt based battery chemistry. Image: ESS Inc.

Get a quote

Here''s the Top 10 List of Flow Battery Companies

Next generation battery technology companies are at the forefront of developing advanced batteries that are more efficient, cost-effective, and environmentally friendly.

Get a quote

Top Battery Companies in Benin 2024

These batteries are designed for use in a variety of applications, including UPS systems, emergency lighting, and security systems. These batteries are specifically suitable for

Get a quote

Benin Battery Energy Storage System Market (2024-2030)

Forecast of Benin Battery Energy Storage System Market, 2030 Historical Data and Forecast of Benin Battery Energy Storage System Revenues & Volume for the Period 2020-2030

Get a quote

Benin Flow Battery Market (2024-2030) | Trends, Outlook

Benin Flow Battery Market (2024-2030) | Growth, Share, Revenue, Outlook, Trends, Analysis, Size, Segmentation, Value, Industry, Companies & Forecast

Get a quote

6 FAQs about [Companies using flow batteries in Benin]

What is the merged company of Avalon Battery and redT energy?

North America’s Avalon Battery and British company redT energy merged to form Invinity Energy Systems—a leading global vanadium flow battery company that specializes in utility-grade energy storage for commercial & industrial (C&I), grid-scale, and micro-grid applications.

What are the current commercial flow battery chemistries?

Current commercial flow batteries are based on vanadium- and zinc-based flow battery chemistries. Typical flow battery chemistries include all vanadium, iron-chromium, zinc-bromine, zinc-cerium, and zinc-ion.

What is a flow battery?

A flow battery is an electrochemical cell that converts chemical energy into electrical energy through ion exchange across an ion-selective membrane. It separates two liquid electrolytes stored in separate tanks. Typical flow battery chemistries include all vanadium, iron-chromium, zinc-bromine, zinc-cerium, and zinc-ion.

Are flow batteries the future of energy storage?

Flow batteries, with their ability to create a more stable grid and reduce grid congestion, are considered a promising technology for energy storage. Their adoption is closely linked with the surging energy storage market and can help fill renewable energy production shortfalls.

How will the flow battery market grow?

The flow battery market is expected to grow significantly as the share of renewables increases in the primary energy mix. Despite their higher CapEx cost compared to lithium-ion batteries, flow batteries are expected to be used extensively for both front-of-the-meter and behind-the-meter applications in the next several years.

What are the benefits of using flow batteries in LDES?

Flow batteries are increasingly being used in LDES deployments due to their relatively lower levelized cost of storage (LCOS), safety and reliability, among other benefits. Also known as redox (reduction-oxidation) batteries, they are made of various components and are produced by several companies.

Guess what you want to know

-

Current companies making flow batteries

Current companies making flow batteries

-

Comparison of Iron and Vanadium Flow Batteries

Comparison of Iron and Vanadium Flow Batteries

-

The impact of vanadium prices on flow batteries

The impact of vanadium prices on flow batteries

-

Using energy storage batteries

Using energy storage batteries

-

About the advantages of liquid flow batteries

About the advantages of liquid flow batteries

-

Different types of flow batteries

Different types of flow batteries

-

Sodium batteries and vanadium flow batteries

Sodium batteries and vanadium flow batteries

-

Are there Chinese flow batteries for communication base stations in France

Are there Chinese flow batteries for communication base stations in France

-

Wholesale prices of flow batteries in Iraq

Wholesale prices of flow batteries in Iraq

-

Companies that use lead-carbon batteries for energy storage

Companies that use lead-carbon batteries for energy storage

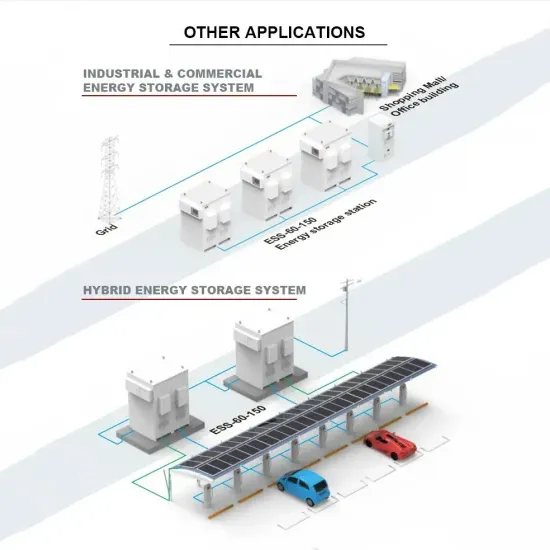

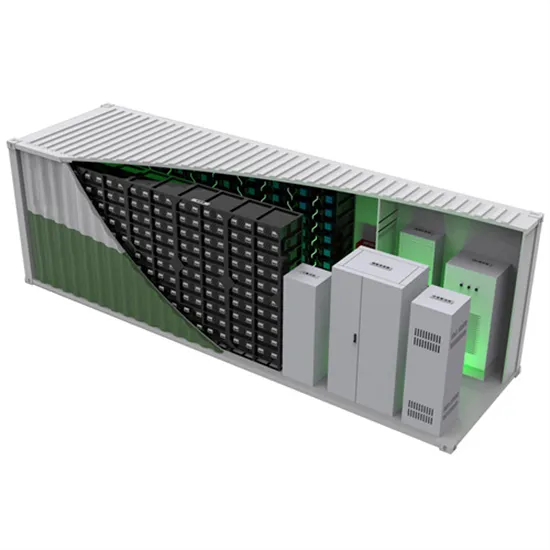

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.