European module prices continue to decline in

PV module prices dropped in Europe in December 2024, while the European PV sector remains optimistic about the industry''s long-term growth.

Get a quote

Europe Solar Inverters Industry 2025-2033 Analysis: Trends,

In summary, the solar inverters industry in Europe is well-positioned for continued growth, driven by technological progress and the continent''s dedication to enhancing its

Get a quote

European solar module price rise heralds ''new pricing

Solar module prices in Europe have risen after months of decline, driven by price increases from Chinese manufacturers and a tight supply of

Get a quote

Inverter manufacturers facing ''growing pains''

Gilligan told PV Tech Premium that PV inverter revenue is predicted to fall 20% in 2024. Image: SMA Solar Technology. The inverter market is experiencing "growing pains" as

Get a quote

Solis

Established in 2005, Ginlong (Solis) (Stock Code: 300763.SZ) stands as the world''s third-largest PV inverter manufacturer. Sponsor of the Large Scale Solar Central & Eastern Europe Summit.

Get a quote

Solar Inverter Costs 2024: Uncover the Best Prices & Save Big!

Find out the real cost of solar inverters in 2024! Learn about pricing, types, and factors affecting costs to make informed solar energy decisions.

Get a quote

European solar module price rise heralds ''new pricing balance''

Solar module prices in Europe have risen after months of decline, driven by price increases from Chinese manufacturers and a tight supply of popular modules in the European

Get a quote

South Africa Solar PV Inverter Market 2033

The South Africa solar PV inverter market size reached USD 60.69 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 105.25 Million by 2033, exhibiting a

Get a quote

Photovoltaic Price Index

PRICE INDEX | August 2025 Photovoltaic Price Index Every month we publish a current price index on the development of wholesale prices of solar modules. In doing so, we differentiate

Get a quote

European PV panel prices rise, inverter prices fall!

European PV panel prices rise, inverter prices fall! This has driven up prices for n-type monofacial solar panels and n-type bifacial solar panels as buyers continue to favor the

Get a quote

Off-Grid Solar Inverter and Battery Brands in Europe

Introduction Off-grid solar energy systems – those not connected to the utility grid – rely on inverters and batteries to supply continuous power. In Europe, where grid access is

Get a quote

Europe Solar PV Inverters Companies

This report lists the top Europe Solar PV Inverters companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted

Get a quote

Top 8 Solar Inverter Manufacturers in Europe: 2025 Guide

The European solar inverter market is set to grow from USD 2.85 billion in 2024 to USD 3.66 billion by 2029, with a growth rate of 5.06% annually. This growth is driven by government

Get a quote

OCTOBER 18, 2022 EUROPEAN REPORT 6 SOURCES

2022 Outlook Strengthens Further European string-inverter and microinverter 2022 sales/purchase growth expecta-tions have improved since July, with low supply supporting

Get a quote

Xindun Presents Solar Inverters At ENEX New Energy 2025 In

Poland ENEX New Energy 2025 is the most influential energy exhibition in Poland and Eastern Europe. The exhibition attracted 350 companies from 15 countries to showcase

Get a quote

Solar Inverter Prices in 2025: Trends & Cost Breakdown

Whether you are considering a solar power inverter price for residential or commercial use, understanding the pricing trends will help you

Get a quote

PV Solar Inverters

PVshop offers a complete range of solar inverters for your PV system. The world''s leading solar power inverters for all photovoltaic applications at the best price with worldwide delivery

Get a quote

PV Index: Price upticks in April 2025 signal supply strains

April saw nuanced but key price shifts in the European solar market, with module prices rising due to supply constraints, while inverter prices continued to decline.

Get a quote

Solar Inverter Prices in 2025: Trends & Cost Breakdown

Whether you are considering a solar power inverter price for residential or commercial use, understanding the pricing trends will help you make an informed decision.

Get a quote

Eastern European Inverter Housing Prices Trends Costs Best

Meta Description: Explore the latest pricing trends for inverter housings in Eastern Europe. Learn about cost factors, top manufacturers like EK SOLAR, and industry data to make informed

Get a quote

Prices Inverters + Storage Solutions

All prices are net and without transportation. Offer valid while stock lasts. Cancellation fee: 10% of the net value of the bill. Delivery: Incoterms 2020. Please ask for a specific quotation. We will

Get a quote

Solar Inverter Costs 2024: Uncover the Best Prices

Find out the real cost of solar inverters in 2024! Learn about pricing, types, and factors affecting costs to make informed solar energy decisions.

Get a quote

Europe Solar Inverters Market

Europe Solar Inverter analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.

Get a quote

10 most popular solar inverters in Europe in 2024

The European renewable energy market is currently shaped by two key trends: decreasing prices and intensifying competition among industry

Get a quote

6 FAQs about [New prices for solar inverters in Eastern Europe]

How big is the European solar inverter market?

The European solar inverter market is set to grow from USD 2.85 billion in 2024 to USD 3.66 billion by 2029, with a growth rate of 5.06% annually. This growth is driven by government incentives, investments in solar energy, and a focus on reducing carbon emissions. Germany is the largest market, followed by the UK and France.

Are inverters still available in Europe?

Combined with China’s pivot to domestic installations, this is squeezing module supply in Europe. Inverters, however, are still widely available, offering buyers some flexibility. Those eyeing deals on full black or older stock should move quickly on sun.store before these options vanish.” Tightening stocks led to price upticks in key segments:

Who are the key players in the European solar inverters market?

The European solar inverters market is highly fragmented. The key players (in no particular order) in the market include FIMER SpA, Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, and General Electric Company, among others. Need More Details on Market Players and Competitors?

What is the global solar inverter market size?

The Report Offers the Market Size in Value Terms in USD for all the Abovementioned Segments. The Europe Solar Inverter Market size is estimated at USD 2.99 billion in 2025, and is expected to reach USD 3.83 billion by 2030, at a CAGR of 5.06% during the forecast period (2025-2030).

Who makes the most solar PV inverters in the world?

In 2023, the global shipment of solar PV inverters reached 536 GWac, with Chinese solar inverter manufacturers responsible for half of these shipments. Companies like Huawei, Sungrow, and Ginlong Solis dominate the top ranks, securing more than 50% of the global market share.

Which countries use the most solar inverters?

Germany is the largest market, followed by the UK and France. Central inverters for large solar projects are expected to dominate, while micro inverters for homes are also growing. Hybrid inverters, which combine solar and battery storage, are gaining popularity as more people seek energy independence.

Guess what you want to know

-

New prices for photovoltaic inverters

New prices for photovoltaic inverters

-

New solar system prices in Türkiye

New solar system prices in Türkiye

-

China and Europe produce solar power home prices

China and Europe produce solar power home prices

-

Solar inverter prices in the UAE

Solar inverter prices in the UAE

-

Solar cell prices in Chile

Solar cell prices in Chile

-

Middle East Solar PV Inverters

Middle East Solar PV Inverters

-

New Zealand solar power generation and energy storage

New Zealand solar power generation and energy storage

-

Solar water pump inverter prices in South Africa

Solar water pump inverter prices in South Africa

-

Household PV containerless solar power prices

Household PV containerless solar power prices

-

New solar photovoltaic panels in the Netherlands

New solar photovoltaic panels in the Netherlands

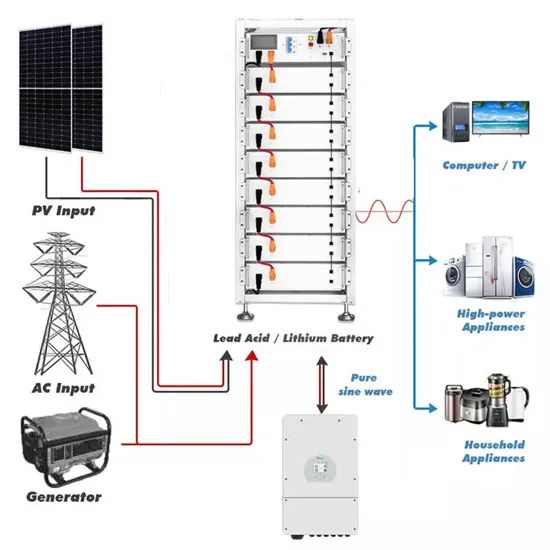

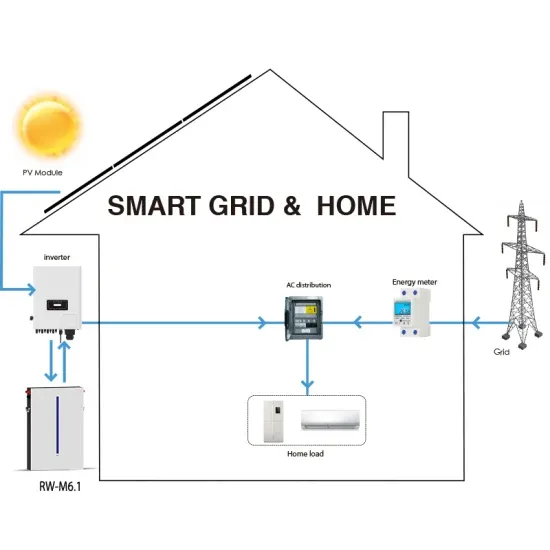

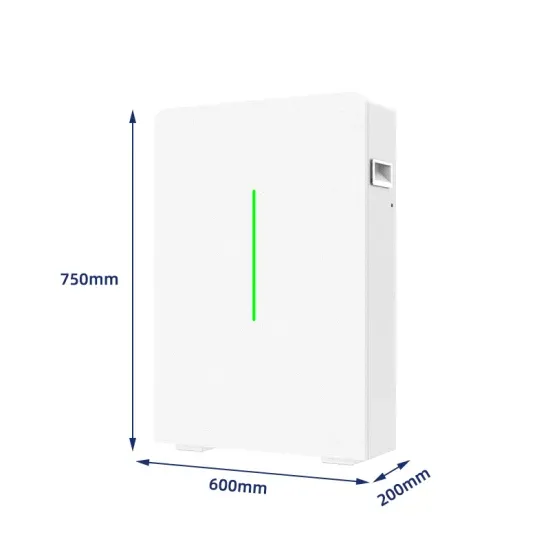

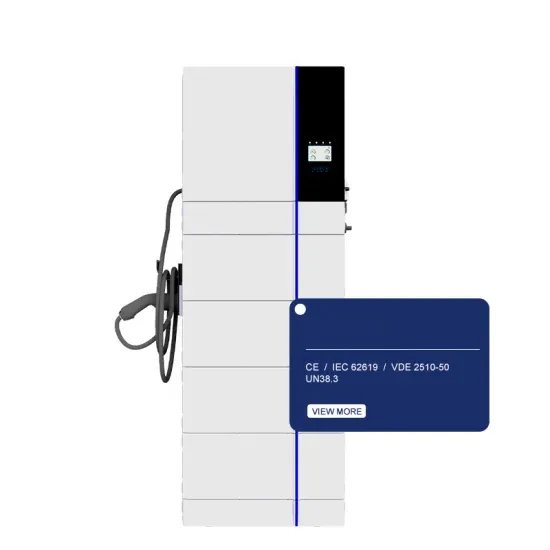

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.